Bond - InvestSmart

... Are bonds risk free? Like all investments, investing in bonds carry certain risks too. Among the risks, two of the most notable are credit and interest rate risk. • Credit risk Credit risk is when the issuer fails to pay the coupons or is unable to return your principal upon maturity. In general, bo ...

... Are bonds risk free? Like all investments, investing in bonds carry certain risks too. Among the risks, two of the most notable are credit and interest rate risk. • Credit risk Credit risk is when the issuer fails to pay the coupons or is unable to return your principal upon maturity. In general, bo ...

Capital Asset Pricing Model

... 1. Test H0: α*=0 for excess-return Market Model (t-test for one asset or F-test for a joint test for a set of assets) 2. Check if market portfolio is efficient and equal to tangency portfolio for assets in market portfolio 3. Check predictions for expected returns based on Beta and SML ...

... 1. Test H0: α*=0 for excess-return Market Model (t-test for one asset or F-test for a joint test for a set of assets) 2. Check if market portfolio is efficient and equal to tangency portfolio for assets in market portfolio 3. Check predictions for expected returns based on Beta and SML ...

Buying a Business

... The Current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities (debt and payables) with its short-term assets (cash, inventory, receivables). The Current ratio is a liquidity ratio that measures a company's ability to pay short-term obligations. The ...

... The Current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities (debt and payables) with its short-term assets (cash, inventory, receivables). The Current ratio is a liquidity ratio that measures a company's ability to pay short-term obligations. The ...

Name of Insurance Company to which Application is made (herein

... a. Is the Organization experiencing difficulty securitizing assets at this time and does it expect to encounter such difficulties within the next three to six months? _____________________________________ ____________________________________________________________________________________________ __ ...

... a. Is the Organization experiencing difficulty securitizing assets at this time and does it expect to encounter such difficulties within the next three to six months? _____________________________________ ____________________________________________________________________________________________ __ ...

Frequently Asked Questions about Commercial Paper and

... intended to implement the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), specifically section 939A, which is designed to reduce reliance on credit ratings in response to the financial crisis of 2008. The SEC re-proposed these amendments in ...

... intended to implement the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), specifically section 939A, which is designed to reduce reliance on credit ratings in response to the financial crisis of 2008. The SEC re-proposed these amendments in ...

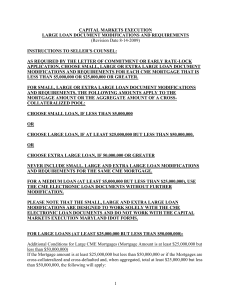

capital markets execution

... Note into one or more separate promissory notes in such denominations as Lender determines in its sole discretion, which promissory notes may be included in separate sales or Securitizations undertaken by Lender. In conjunction with any such action, Lender may redefine the interest rate and amortiza ...

... Note into one or more separate promissory notes in such denominations as Lender determines in its sole discretion, which promissory notes may be included in separate sales or Securitizations undertaken by Lender. In conjunction with any such action, Lender may redefine the interest rate and amortiza ...

Convertible Bonds

... correlation of less than one is considered a favourable correlation. All indexes in base currency. Convertible bonds are represented by Barclays Capital Global Convertibles Hedged Index (US$); Canadian bonds by FTSE TMX Canada Universe Bond Index (C$); Global bonds by Barclays Global Aggregate TR He ...

... correlation of less than one is considered a favourable correlation. All indexes in base currency. Convertible bonds are represented by Barclays Capital Global Convertibles Hedged Index (US$); Canadian bonds by FTSE TMX Canada Universe Bond Index (C$); Global bonds by Barclays Global Aggregate TR He ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... • Interest rate risk is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile – asset transformation involves an FI issuing secondary securities or liabilities to fund the purchase of primary securities or assets – if an FI’s asse ...

... • Interest rate risk is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile – asset transformation involves an FI issuing secondary securities or liabilities to fund the purchase of primary securities or assets – if an FI’s asse ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... • Interest rate risk is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile – asset transformation involves an FI issuing secondary securities or liabilities to fund the purchase of primary securities or assets – if an FI’s asse ...

... • Interest rate risk is the risk incurred by an FI when the maturities of its assets and liabilities are mismatched and interest rates are volatile – asset transformation involves an FI issuing secondary securities or liabilities to fund the purchase of primary securities or assets – if an FI’s asse ...

The valuation of specialised operational assets

... type of equipment is replaced on a cycle that reflects the rate at which that item deteriorates over time, having regard to various factors such as intensity of use and maintenance practices. While it might be possible to calculate depreciation at a whole-of-facility level, to do so would ignore the ...

... type of equipment is replaced on a cycle that reflects the rate at which that item deteriorates over time, having regard to various factors such as intensity of use and maintenance practices. While it might be possible to calculate depreciation at a whole-of-facility level, to do so would ignore the ...

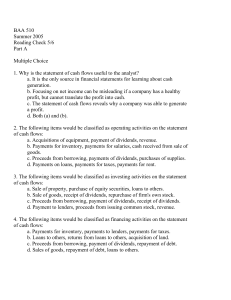

Quiz Part A

... a. It is the only source in financial statements for learning about cash generation. b. Focusing on net income can be misleading if a company has a healthy profit, but cannot translate the profit into cash. c. The statement of cash flows reveals why a company was able to generate a profit. d. Both ( ...

... a. It is the only source in financial statements for learning about cash generation. b. Focusing on net income can be misleading if a company has a healthy profit, but cannot translate the profit into cash. c. The statement of cash flows reveals why a company was able to generate a profit. d. Both ( ...

VOXX International Corp (Form: 8-K, Received: 11/03

... leader in many automotive and consumer electronics and accessories categories, as well as premium high-end audio. Today, VOXX International is a global company with an extensive distribution network that includes power retailers, mass merchandisers, 12-volt specialists and most of the world’s leadin ...

... leader in many automotive and consumer electronics and accessories categories, as well as premium high-end audio. Today, VOXX International is a global company with an extensive distribution network that includes power retailers, mass merchandisers, 12-volt specialists and most of the world’s leadin ...

FORM 8-K - corporate

... Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning the conduct of our special me ...

... Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning the conduct of our special me ...

Regulation of Alternative Investments

... non-traded REITs and non-traded BDCs. The Act provides explicit information about what must be included in the application for registration, with repeated emphasis on investor protection. Listed and unlisted publicly traded companies that are identified as reporting companies must make periodic mand ...

... non-traded REITs and non-traded BDCs. The Act provides explicit information about what must be included in the application for registration, with repeated emphasis on investor protection. Listed and unlisted publicly traded companies that are identified as reporting companies must make periodic mand ...

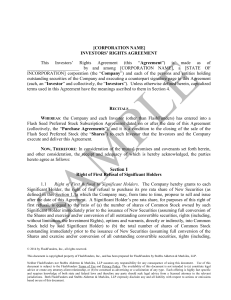

Investors Rights Agreement

... regulations of the Commission that may permit the sale of the Securities to the public without registration, the Company agrees to use its commercially reasonable efforts to: (a) Make and keep public information regarding the Company available as those terms are understood and defined in Rule 144 un ...

... regulations of the Commission that may permit the sale of the Securities to the public without registration, the Company agrees to use its commercially reasonable efforts to: (a) Make and keep public information regarding the Company available as those terms are understood and defined in Rule 144 un ...

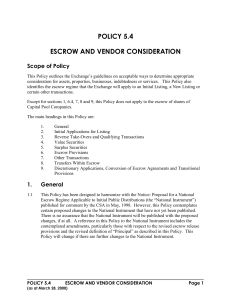

policy xx – escrow and vendor consideration

... any other New Listing refers to the Resulting Issuer (as defined in Policy 5.1 - Changes of Business and Reverse Take-Overs or Policy 2.4 - Capital Pool Companies). “Option” means an option, warrant, right of conversion or exchange, or other right to acquire an equity security of an Issuer, but does ...

... any other New Listing refers to the Resulting Issuer (as defined in Policy 5.1 - Changes of Business and Reverse Take-Overs or Policy 2.4 - Capital Pool Companies). “Option” means an option, warrant, right of conversion or exchange, or other right to acquire an equity security of an Issuer, but does ...

Optimal Deal Flow for Illiquid Assets

... Northfield models illiquids using a “bottom-up” asset-by-asset approach that is not appraisal-based Each investment is viewed as a composite asset with: • Risks based on “steady-state” cash flow assumptions for existing and expected leases/sources of cash flows • Uses lease structure, renewal, credi ...

... Northfield models illiquids using a “bottom-up” asset-by-asset approach that is not appraisal-based Each investment is viewed as a composite asset with: • Risks based on “steady-state” cash flow assumptions for existing and expected leases/sources of cash flows • Uses lease structure, renewal, credi ...

Chapter 11 Financial Reconstruction

... inventory is obsolete but the remainder could sold for book value. In addition $90,000 of the receivables is irrecoverable. 2. To be successful a scheme of reconstruction would need to raise $195,000 of cash to invest in new manufacturing processes. 3. Given the risk attached to the company any prov ...

... inventory is obsolete but the remainder could sold for book value. In addition $90,000 of the receivables is irrecoverable. 2. To be successful a scheme of reconstruction would need to raise $195,000 of cash to invest in new manufacturing processes. 3. Given the risk attached to the company any prov ...

View as DOCX (4b/2) 22 KB

... Pre-emptive rights Unlike a private company, a PLC cannot ignore pre-emptive rights in accordance with the Companies Act 2006, generally speaking this means that additional share capital or equity securities must be offered to existing shareholders before becoming available on the open market. Duty ...

... Pre-emptive rights Unlike a private company, a PLC cannot ignore pre-emptive rights in accordance with the Companies Act 2006, generally speaking this means that additional share capital or equity securities must be offered to existing shareholders before becoming available on the open market. Duty ...

Credit Management

... of the debt must be paid each month • A credit limit is set for the maximum amount to be spent • Payments are required once a month, but it doesn’t have to be the FULL payment • A finance charge is added if the total bill is not paid (total dollar amount spent plus ...

... of the debt must be paid each month • A credit limit is set for the maximum amount to be spent • Payments are required once a month, but it doesn’t have to be the FULL payment • A finance charge is added if the total bill is not paid (total dollar amount spent plus ...

GNRX VanEck Vectors Generic Drugs ETF

... Index returns are not Fund returns and do not reflect any management fees or brokerage expenses. Investors can not invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. Index returns ...

... Index returns are not Fund returns and do not reflect any management fees or brokerage expenses. Investors can not invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. Index returns ...

BRASKEM SA (Form: 6-K, Received: 08/26/2016 17

... (“Expert Firms”) to conduct an independent internal investigation into the allegations mentioned above ("Investigation"). Through said Expert Firms, Braskem voluntarily contacted the agencies regulating the capital markets in Brazil (Securities and Exchange Commission of Brazil - CVM) and the United ...

... (“Expert Firms”) to conduct an independent internal investigation into the allegations mentioned above ("Investigation"). Through said Expert Firms, Braskem voluntarily contacted the agencies regulating the capital markets in Brazil (Securities and Exchange Commission of Brazil - CVM) and the United ...

Capital Market Presentation August 2011

... This document is meant to provide a broad overview for discussion and/or information purposes. Furthermore, this document was not prepared with the intention of providing legal or tax advice. The views and opinions expressed in this document, which are subject to change, are those of Allianz Global ...

... This document is meant to provide a broad overview for discussion and/or information purposes. Furthermore, this document was not prepared with the intention of providing legal or tax advice. The views and opinions expressed in this document, which are subject to change, are those of Allianz Global ...

New York REIT, Inc. (Form: DFAN14A, Received: 10

... Partners, L.P. (“Winthrop”), have delivered to New York REIT, Inc. (NYSE: NYRT) (the “Company”) a proposal to be appointed as the replacement advisor for the Company in connection with the Company’s proposed plan of liquidation. WW Investors’ proposal is to manage the Company during its proposed liq ...

... Partners, L.P. (“Winthrop”), have delivered to New York REIT, Inc. (NYSE: NYRT) (the “Company”) a proposal to be appointed as the replacement advisor for the Company in connection with the Company’s proposed plan of liquidation. WW Investors’ proposal is to manage the Company during its proposed liq ...