18Future Contracts,Options and Swaps

... This is because when you buy an option; you have to be correct in determining not only the direction of the stock's movement, but also the magnitude and the timing of this movement. To succeed, you must correctly predict whether a stock will go up or down, and you have to be right about how much the ...

... This is because when you buy an option; you have to be correct in determining not only the direction of the stock's movement, but also the magnitude and the timing of this movement. To succeed, you must correctly predict whether a stock will go up or down, and you have to be right about how much the ...

the endowment effect: evidence of losses valued more than gains

... Several endowment effect experiments have also been carried out over repeated iterations to test for possible impacts of learning, about the trading institutions or about values. For the most part, little change in the asymmetric valuation of gains and losses has resulted from the repetitions. While ...

... Several endowment effect experiments have also been carried out over repeated iterations to test for possible impacts of learning, about the trading institutions or about values. For the most part, little change in the asymmetric valuation of gains and losses has resulted from the repetitions. While ...

Option traders use (very) sophisticated heuristics, never the Blackâ

... Option traders call the formula they use the “Black–Scholes–Merton” formula without being aware that by some irony, of all the possible options formulas that have been produced in the past century, what is called the Black–Scholes–Merton “formula” (after Black and Scholes, 1973; Merton, 1973) is the ...

... Option traders call the formula they use the “Black–Scholes–Merton” formula without being aware that by some irony, of all the possible options formulas that have been produced in the past century, what is called the Black–Scholes–Merton “formula” (after Black and Scholes, 1973; Merton, 1973) is the ...

Earnings Release

... Moreover, the announcement timing is also an explicative factor of market reactions. In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interprete ...

... Moreover, the announcement timing is also an explicative factor of market reactions. In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interprete ...

Broker-Dealer Trading Activities

... necessary to access [systems not classified as ECNs]. Nonetheless, the Commission believes that because technology is rapidly making these systems more accessible, broker-dealers must regularly evaluate whether prices or other benefits offered by these systems are reasonably available for purposes o ...

... necessary to access [systems not classified as ECNs]. Nonetheless, the Commission believes that because technology is rapidly making these systems more accessible, broker-dealers must regularly evaluate whether prices or other benefits offered by these systems are reasonably available for purposes o ...

The synchronized and long-lasting structural change on

... portfolio and reduce their risks. The publication of the seminal paper by Gorton and Rouwenhort (2006) entitled “Facts and Fantasies about Commodities” supported this diversification strategy. Using monthly returns spanning the period from July 1959 to March 2004, the authors found that commodity fu ...

... portfolio and reduce their risks. The publication of the seminal paper by Gorton and Rouwenhort (2006) entitled “Facts and Fantasies about Commodities” supported this diversification strategy. Using monthly returns spanning the period from July 1959 to March 2004, the authors found that commodity fu ...

Learning from stock prices and economic growth

... income in them. Firms’ productivity is unknown but agents can collect private signals about it at a cost. Specifically, they are endowed with one unit of free time which they can devote either to analyzing stocks or to enjoying leisure. Agents’ information is reflected in stock prices, but only part ...

... income in them. Firms’ productivity is unknown but agents can collect private signals about it at a cost. Specifically, they are endowed with one unit of free time which they can devote either to analyzing stocks or to enjoying leisure. Agents’ information is reflected in stock prices, but only part ...

Investment Banks, Scope, and Unavoidable Conflicts of Interest

... more subtle ways to circumvent the prohibitions, especially restrictions based on information flow, may arise. This later class of conflict of interest concerns may be hard to police as they do not directly involve forbidden trades or transactions, such as might occur if, for example, a bank-managed ...

... more subtle ways to circumvent the prohibitions, especially restrictions based on information flow, may arise. This later class of conflict of interest concerns may be hard to police as they do not directly involve forbidden trades or transactions, such as might occur if, for example, a bank-managed ...

the long reach of Georgia-Pacific`s Harmon Associates is beginning

... However, Forman also notes, "We haven't seen a market in a long time where it's actually hard to move material." Should market conditions change, reverse auctions could become more viable. "I believe it has a place and can be very valuable," he says of the Web-based trading component of the business ...

... However, Forman also notes, "We haven't seen a market in a long time where it's actually hard to move material." Should market conditions change, reverse auctions could become more viable. "I believe it has a place and can be very valuable," he says of the Web-based trading component of the business ...

Policies and Procedures

... contrary to this agreement / rules / regulations / bye laws of the exchange or any other law for the time being in force, at such rates and in such form as it my deem fit. Further where the stock broker has to pay any fine or bear any punishment from any authority in connection with / as a conseque ...

... contrary to this agreement / rules / regulations / bye laws of the exchange or any other law for the time being in force, at such rates and in such form as it my deem fit. Further where the stock broker has to pay any fine or bear any punishment from any authority in connection with / as a conseque ...

Decimalization, trading costs, and information transmission between

... where Pit is the transaction price for stock i at time t and Mit is the midpoint of the bid and ask prices of the quotes immediately prior to the transaction. The quote is required to be at least 5 seconds before the trade.5 Because quotes of index futures are not available, quoted and effective spr ...

... where Pit is the transaction price for stock i at time t and Mit is the midpoint of the bid and ask prices of the quotes immediately prior to the transaction. The quote is required to be at least 5 seconds before the trade.5 Because quotes of index futures are not available, quoted and effective spr ...

Market coupling - Houmoller Consulting ApS

... exchange overnight This is how liquid spot exchanges were established in Belgium and the Nordic area, respectively. By having two-sided (or multiple-sided) coupling to neighbouring countries, new entrants to the price coupling can over-night have liquid spot exchanges. By having a single spot ...

... exchange overnight This is how liquid spot exchanges were established in Belgium and the Nordic area, respectively. By having two-sided (or multiple-sided) coupling to neighbouring countries, new entrants to the price coupling can over-night have liquid spot exchanges. By having a single spot ...

decentralized trade mitigates the lemons problem

... It is known that in markets for homogenous goods, decentralized trade tends to yield competitive outcomes when trading frictions are small. Because competitive equilibrium is efficient in these markets, this implies that decentralized trade generates nearly efficient outcomes. In markets with advers ...

... It is known that in markets for homogenous goods, decentralized trade tends to yield competitive outcomes when trading frictions are small. Because competitive equilibrium is efficient in these markets, this implies that decentralized trade generates nearly efficient outcomes. In markets with advers ...

Preview - American Economic Association

... be dealers, leading to a smaller intermediary sector and hence a smaller dispersion ratio and chain length. Similarly, with a higher search speed or a larger market size, intermediation is less profitable because customers can find alternative trading partners more quickly. This leads to a smaller int ...

... be dealers, leading to a smaller intermediary sector and hence a smaller dispersion ratio and chain length. Similarly, with a higher search speed or a larger market size, intermediation is less profitable because customers can find alternative trading partners more quickly. This leads to a smaller int ...

Funding Constraints, Market Liquidity, and Financial Crises

... Established in 1791, the First Bank of the United States (FBUS) was chartered for 20 years and served as the banker of the US government. The FBUS was a semi-public national bank where foreigners held a large non-voting stake in the institution. Although the FBUS did not have the explicit ability t ...

... Established in 1791, the First Bank of the United States (FBUS) was chartered for 20 years and served as the banker of the US government. The FBUS was a semi-public national bank where foreigners held a large non-voting stake in the institution. Although the FBUS did not have the explicit ability t ...

Dynamic predictor selection and order splitting in a limit order

... immediately at the best available prices. They can also place limit orders that specify the size and the limit price at which they are willing to trade, and their limit order (or a part of the order) is executed at their pre-specified or better price when other agents hit the order. There is no sto ...

... immediately at the best available prices. They can also place limit orders that specify the size and the limit price at which they are willing to trade, and their limit order (or a part of the order) is executed at their pre-specified or better price when other agents hit the order. There is no sto ...

Global Eagle Entertainment Inc. (Form: 8

... On May 19, 2017, the Company submitted to NASDAQ the Company’s plan to regain compliance with the NASDAQ Listing Rule. If it accepts the Company’s plan, NASDAQ can grant an exception of up to 180 calendar days from the due date of the Annual Report (which would be September 12, 2017) for the Company ...

... On May 19, 2017, the Company submitted to NASDAQ the Company’s plan to regain compliance with the NASDAQ Listing Rule. If it accepts the Company’s plan, NASDAQ can grant an exception of up to 180 calendar days from the due date of the Annual Report (which would be September 12, 2017) for the Company ...

How Do Canadian Banks That Deal in Foreign Exchange Hedge

... (1996) argues that a firm, rather than focusing its corporate risk management on minimizing variance, should spend more time understanding the comparative advantage of bearing certain risks. In particular, firms should not fully hedge risks that they have a comparative advantage in bearing, because ...

... (1996) argues that a firm, rather than focusing its corporate risk management on minimizing variance, should spend more time understanding the comparative advantage of bearing certain risks. In particular, firms should not fully hedge risks that they have a comparative advantage in bearing, because ...

A monthly effect in stock returns - DSpace@MIT

... The mean return for stocks is positive only for days immediately before and during the first half of calendar months, and indistinguishable from zero for days during the last half of the month. During the 1963-1981 period all of the market's cumulative advance occurred just before and during the fir ...

... The mean return for stocks is positive only for days immediately before and during the first half of calendar months, and indistinguishable from zero for days during the last half of the month. During the 1963-1981 period all of the market's cumulative advance occurred just before and during the fir ...

Financial Market Shocks and the Macroeconomy

... Following Cooper and John (1988) and others, we assume the investment choices of the private firms are strategic complements, which mean that on average the private firms tend to underinvest relative to the social optimum. But, because these firms use the stock prices of the public firms as an indi ...

... Following Cooper and John (1988) and others, we assume the investment choices of the private firms are strategic complements, which mean that on average the private firms tend to underinvest relative to the social optimum. But, because these firms use the stock prices of the public firms as an indi ...

The Economic Impact of the Stock Market Boom and Crash of 1929

... problem of measurement. A glance at the financial pages of any major newspaper indicates that the nation’s stock exchanges are probably the most intensely monitored sector of the entire economy. Yet for all the data on the fluctuations in the prices of individual stocks or of price indices, there is ...

... problem of measurement. A glance at the financial pages of any major newspaper indicates that the nation’s stock exchanges are probably the most intensely monitored sector of the entire economy. Yet for all the data on the fluctuations in the prices of individual stocks or of price indices, there is ...

Anatomy of a Bond Futures Contract Delivery Squeeze

... episodes have occurred in bond markets,2 in commodity markets and their futures contracts,3 and also in equity markets.4 Manipulative grabs for pricing power are neither uncommon, nor even have the appearance of impropriety, in self-regulated over-the-counter markets like the government bond markets ...

... episodes have occurred in bond markets,2 in commodity markets and their futures contracts,3 and also in equity markets.4 Manipulative grabs for pricing power are neither uncommon, nor even have the appearance of impropriety, in self-regulated over-the-counter markets like the government bond markets ...

The Impact of Serial Correlation on Option Prices in a Non

... water. These modifications stand by the seminal Black-Scholes conception of an arbitrage based optionpricing model in which a perfect hedge can be formed between the option and the underlying asset. The inconsistency that has received the most attention is the so-called volatility smile. The volatil ...

... water. These modifications stand by the seminal Black-Scholes conception of an arbitrage based optionpricing model in which a perfect hedge can be formed between the option and the underlying asset. The inconsistency that has received the most attention is the so-called volatility smile. The volatil ...

Factors Determining the Price of Butter

... demand situation. Actually, this would be possible only if a substantial share of the butter supply were in the hands of relatively few firms which had essentially the same financial interest (that is, nearly all would have to benefit when the price went up or nearly all would have to benefit when t ...

... demand situation. Actually, this would be possible only if a substantial share of the butter supply were in the hands of relatively few firms which had essentially the same financial interest (that is, nearly all would have to benefit when the price went up or nearly all would have to benefit when t ...

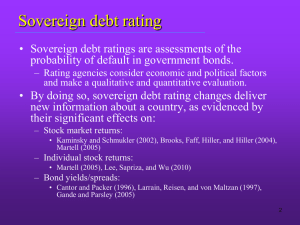

Sovereign Debt Rating and Stock Liquidity around the World

... Kaminsky and Schmukler, 2002; Borensztein, Cowan, and Valenzuela, 2007) • More information asymmetry at the time of earnings announcement (Kim and Verrecchia, 1994) ...

... Kaminsky and Schmukler, 2002; Borensztein, Cowan, and Valenzuela, 2007) • More information asymmetry at the time of earnings announcement (Kim and Verrecchia, 1994) ...