Note Guide

... 2. shares that are eligible to be sold 5. stock type with voting rights 11A. market in which shares are first sold 12. can be cumulative on non-cumulative 13. NASDAQ, for example 16. shares that have been put in to circulation 17. a bond issued by a local government (abbr) 20. the first time a compa ...

... 2. shares that are eligible to be sold 5. stock type with voting rights 11A. market in which shares are first sold 12. can be cumulative on non-cumulative 13. NASDAQ, for example 16. shares that have been put in to circulation 17. a bond issued by a local government (abbr) 20. the first time a compa ...

- Fairview High School

... Many over-the-counter securities can be bought and sold through the National Association of Securities Dealers Automated Quotations (NASDAQ®). ...

... Many over-the-counter securities can be bought and sold through the National Association of Securities Dealers Automated Quotations (NASDAQ®). ...

Investing in Stocks Chapter Sixteen

... Securities Exchanges • A marketplace where member brokers who represent investors, meet to buy and sell securities. • The securities sold at an exchange must be listed, or accepted for trading, at the exchange. • New York Stock and American Exchanges. • The Over-the-Counter (OTC) market. – Network ...

... Securities Exchanges • A marketplace where member brokers who represent investors, meet to buy and sell securities. • The securities sold at an exchange must be listed, or accepted for trading, at the exchange. • New York Stock and American Exchanges. • The Over-the-Counter (OTC) market. – Network ...

OUT FROM UNDERNEATH Investor Strategies For Capitalizing On

... year, the amount not deductible can be carried forward for use in future tax years. With income tax rates likely going up in future years, the value of these carried-forward losses will increase. One objection that people have to selling investments at a loss is that they ultimately would like to co ...

... year, the amount not deductible can be carried forward for use in future tax years. With income tax rates likely going up in future years, the value of these carried-forward losses will increase. One objection that people have to selling investments at a loss is that they ultimately would like to co ...

11-08-2016 Presidential Elections

... everyone, free utilities, or any other expense the public may believe is too expensive? Benjamin Franklin once said, “When the people find they can vote themselves money, that will herald the end of the republic.” I think all Americans believe those who are doing well and have higher incomes, should ...

... everyone, free utilities, or any other expense the public may believe is too expensive? Benjamin Franklin once said, “When the people find they can vote themselves money, that will herald the end of the republic.” I think all Americans believe those who are doing well and have higher incomes, should ...

Stocks: An Introduction

... For companies, they are one of several ways to obtain financing. Additionally, Stocks and stock markets are one of the central links between the financial world and the real economy. They indicate the value of the companies that issued the stocks and, They allocate scarce investment resources ...

... For companies, they are one of several ways to obtain financing. Additionally, Stocks and stock markets are one of the central links between the financial world and the real economy. They indicate the value of the companies that issued the stocks and, They allocate scarce investment resources ...

Financial literacy in aiwan

... – Designed and Established by TDCC – Historical records for physical Stock Certificates and development of Taiwan ...

... – Designed and Established by TDCC – Historical records for physical Stock Certificates and development of Taiwan ...

Claim for Securities

... Rule 500—General These rules will be applied in determining whether a securities transaction gives rise to a “claim for cash” or a “claim for securities” on the filing date of either a liquidation proceeding pursuant to the Securities Investor Protection Act (hereinafter referred to as “the Act”) or ...

... Rule 500—General These rules will be applied in determining whether a securities transaction gives rise to a “claim for cash” or a “claim for securities” on the filing date of either a liquidation proceeding pursuant to the Securities Investor Protection Act (hereinafter referred to as “the Act”) or ...

April 17, 2017 - Portfolio Advisory Council

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

Portfolio Advisory Council, LLC presents:

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

DATE

... Currently, investors in [insert state here] and throughout the country are compelled to sign mandatory pre-dispute arbitration clauses when they invest with broker dealers, and, in many instances, investment advisers. Mandatory pre-dispute arbitration contracts require that investors submit to arbit ...

... Currently, investors in [insert state here] and throughout the country are compelled to sign mandatory pre-dispute arbitration clauses when they invest with broker dealers, and, in many instances, investment advisers. Mandatory pre-dispute arbitration contracts require that investors submit to arbit ...

IOSCO analyzes potential of tech-driven change in the securities

... depending on the technology, certain risks are recurring across the Fintech sector, such as those arising from unlicensed cross-border activity, programing errors in the algorithms that underlie automation, breaches in cyber security, and the failure of investors to understand financial products and ...

... depending on the technology, certain risks are recurring across the Fintech sector, such as those arising from unlicensed cross-border activity, programing errors in the algorithms that underlie automation, breaches in cyber security, and the failure of investors to understand financial products and ...

Financial Market Its Types and Roles in Industry

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

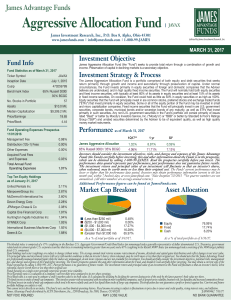

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Thursday, January 30, 2014 | Pappadeaux Seafood Kitchen

... ◦ 37% of same respondents oppose Affordable Care Act ◦ 29% of respondents approved of Obamacare ◦ 22% of respondents approved of Affordable Care Act ...

... ◦ 37% of same respondents oppose Affordable Care Act ◦ 29% of respondents approved of Obamacare ◦ 22% of respondents approved of Affordable Care Act ...

Investing

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

Individual Registration Officer Permanent | Full time Compliance and

... Reporting to the Supervisor, the Individual Registration Officer (IRO) will analyze and recommend granting, refusing or suspending the registration of dealing representatives. You will be responsible for determining initial and ongoing suitability for registration by investigating and taking into co ...

... Reporting to the Supervisor, the Individual Registration Officer (IRO) will analyze and recommend granting, refusing or suspending the registration of dealing representatives. You will be responsible for determining initial and ongoing suitability for registration by investigating and taking into co ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

Document

... – It says that the more you risk, the more you expect to be paid – It says that the most important risk investor face is the general state of the economy reflected in how markets are doing. ...

... – It says that the more you risk, the more you expect to be paid – It says that the most important risk investor face is the general state of the economy reflected in how markets are doing. ...

Chapter 011 Risk and Return

... 2. The percentage of a portfolio's value that is represented by a single security is referred to as the portfolio weight. 3. The concept of investing in a variety of diverse assets to reduce risk is diversification. 4. The efficient set of portfolios contains all portfolios: A) with maximal expected ...

... 2. The percentage of a portfolio's value that is represented by a single security is referred to as the portfolio weight. 3. The concept of investing in a variety of diverse assets to reduce risk is diversification. 4. The efficient set of portfolios contains all portfolios: A) with maximal expected ...

It`s Probably a Bad Idea to Sell Stocks Because You Fear Trump

... who put their money where their mouth was — that is, into cash instead of stocks — lost out on a 182 percent gain in the Standard & Poor’s 500 during the Obama presidency. Liberals are just as susceptible to this motivated reasoning. Barry Ritholtz of Ritholtz Wealth Management recalls hearing left- ...

... who put their money where their mouth was — that is, into cash instead of stocks — lost out on a 182 percent gain in the Standard & Poor’s 500 during the Obama presidency. Liberals are just as susceptible to this motivated reasoning. Barry Ritholtz of Ritholtz Wealth Management recalls hearing left- ...

Government Securities

... Government securities for financing the internal deficit: o Treasury Bills with maturity within one year o Treasury Bills with maturity within 5 years o Treasury Bonds with maturity of 5 years or more Government bonds for financing structural deficits in the financial sector: o ZUNK bonds (long term ...

... Government securities for financing the internal deficit: o Treasury Bills with maturity within one year o Treasury Bills with maturity within 5 years o Treasury Bonds with maturity of 5 years or more Government bonds for financing structural deficits in the financial sector: o ZUNK bonds (long term ...

Globalstrategyweekly report 20120706

... Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which ...

... Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which ...

Stock-Alerts-Risk-Guidelines

... Principle #1 -- The more money you have, the more you can afford to risk losing The more money you have, the more you can afford to risk without it hurting you too much. Someone with $5 million can afford to lose $10,000 but someone whose entire savings is $20,000 can't afford to lose that much. Ri ...

... Principle #1 -- The more money you have, the more you can afford to risk losing The more money you have, the more you can afford to risk without it hurting you too much. Someone with $5 million can afford to lose $10,000 but someone whose entire savings is $20,000 can't afford to lose that much. Ri ...