Financial Markets

... earn a 6% taxable return or a 4% tax-free return? What is the equivalent taxable yield of the 4% tax-free yield? After-tax return on 6% bond is: ...

... earn a 6% taxable return or a 4% tax-free return? What is the equivalent taxable yield of the 4% tax-free yield? After-tax return on 6% bond is: ...

HouseStyle

... Financial Services Authority and to be admitted to trading by the London Stock Exchange plc on its main market for listed securities (together, “Admission”). Admission is expected to take place, settlement to occur and dealing in the New Ordinary Shares to commence at 8.00 a.m. on 23 March 2012. Fol ...

... Financial Services Authority and to be admitted to trading by the London Stock Exchange plc on its main market for listed securities (together, “Admission”). Admission is expected to take place, settlement to occur and dealing in the New Ordinary Shares to commence at 8.00 a.m. on 23 March 2012. Fol ...

Client Letter 2Q 2015

... the stock market decline suggests that total margin loans are likely to fall instead. Pension funds were told that they could buy but not sell shares. The CSRC even banned directors, executives and substantial shareholders from selling their shares for 6 months6. ...

... the stock market decline suggests that total margin loans are likely to fall instead. Pension funds were told that they could buy but not sell shares. The CSRC even banned directors, executives and substantial shareholders from selling their shares for 6 months6. ...

Management Buy Outs

... financing to enable current operating management to acquire at least 50% of the business they manage. In return, the private equity firm usually receives a stake in the business. ...

... financing to enable current operating management to acquire at least 50% of the business they manage. In return, the private equity firm usually receives a stake in the business. ...

Demutualizing African Stock Exchanges

... driving policy objectives of government Government policy critical in demutualization ...

... driving policy objectives of government Government policy critical in demutualization ...

Chapter 2 Securities Markets TRUE/FALSE T 1. A major function of

... 1. An investor purchased on margin Orange Computer for $30 a share. The stock's price subsequently increased to $50 a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on ...

... 1. An investor purchased on margin Orange Computer for $30 a share. The stock's price subsequently increased to $50 a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on ...

Free Sample

... 1. An investor purchased on margin Orange Computer for $30 a share. The stock's price subsequently increased to $50 a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on ...

... 1. An investor purchased on margin Orange Computer for $30 a share. The stock's price subsequently increased to $50 a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on ...

Stock Market Game Simulation Questions

... share ownership in a company with others. In a publicly traded company, an investor (that’s you) will buy stock in a company because they think the company will make money. If the stock price increases, the investor will make money. But the risk is that you could lose money if the price ...

... share ownership in a company with others. In a publicly traded company, an investor (that’s you) will buy stock in a company because they think the company will make money. If the stock price increases, the investor will make money. But the risk is that you could lose money if the price ...

The Great Depression - What Crashed and Why?

... out of business the next day! Your paycheck and savings are gone. Then, imagine going to work the next week to find the door locked. Your workplace is out of business! You have no money. You have no job, no way of earning money. How would you pay rent or buy food? This question faced many Americans ...

... out of business the next day! Your paycheck and savings are gone. Then, imagine going to work the next week to find the door locked. Your workplace is out of business! You have no money. You have no job, no way of earning money. How would you pay rent or buy food? This question faced many Americans ...

The Relationship between Share Price Gains, Corporate

... The above empirical research on company's performance, investment risk and stock return can come to the following conclusions: 1) In the stock market in China, the relationship between share price gains, investment risk and return on equity in the agricultural and the construction industries are clo ...

... The above empirical research on company's performance, investment risk and stock return can come to the following conclusions: 1) In the stock market in China, the relationship between share price gains, investment risk and return on equity in the agricultural and the construction industries are clo ...

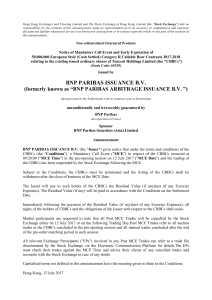

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

PPT4

... This keeps the shareholders involved and fulfills the legal requirement to recognize the rights of minority shareholders In family firms in which the extended family is large and the ownership structure has not been pruned, representative family councils may be a vehicle for educating and informing ...

... This keeps the shareholders involved and fulfills the legal requirement to recognize the rights of minority shareholders In family firms in which the extended family is large and the ownership structure has not been pruned, representative family councils may be a vehicle for educating and informing ...

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

Basic Stock Valuation

... A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq. ...

... A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq. ...

GREE Announces Expected Gain on Sale of Investment Securities

... GREE Announces Expected Gain on Sale of Investment Securities ...

... GREE Announces Expected Gain on Sale of Investment Securities ...

sight resource corp.

... Managed Care: Managed care plans have traditionally competed to enroll members by offering coverage excluded from traditional fee-for-service health plans. Since primary eye care is one of the least expensive and most desired benefits, it is likely to become a standard feature in more health plans, ...

... Managed Care: Managed care plans have traditionally competed to enroll members by offering coverage excluded from traditional fee-for-service health plans. Since primary eye care is one of the least expensive and most desired benefits, it is likely to become a standard feature in more health plans, ...

What is a rights issue of shares?

... When company issues the shares, it has to fix the price of per share. ◦ If the face value and issue price per share will equal, then it is called that shares have been issued at par. Issue price will not always equal to the face value per share. ◦ If issue price is more than face value, then shares ...

... When company issues the shares, it has to fix the price of per share. ◦ If the face value and issue price per share will equal, then it is called that shares have been issued at par. Issue price will not always equal to the face value per share. ◦ If issue price is more than face value, then shares ...

Mini Case (p.45) A. Why is corporate finance important to all

... C. How do corporations go public and continue to grow? What are agency problems? What is corporate governance? A corporation can go public through an initial public offering (IPO) allowing anyone to purchase shares of the company on open stock exchanges. A company continues to grow by demonstrating ...

... C. How do corporations go public and continue to grow? What are agency problems? What is corporate governance? A corporation can go public through an initial public offering (IPO) allowing anyone to purchase shares of the company on open stock exchanges. A company continues to grow by demonstrating ...

teaching variability through stock market contexts

... pre-specified price during a pre-specified time interval. (But no obligation to do anything). • This opportunity costs money. • The price of the option depends on the stock price variability • More variability implies a higher option price. • Option holders want increasing variability! ...

... pre-specified price during a pre-specified time interval. (But no obligation to do anything). • This opportunity costs money. • The price of the option depends on the stock price variability • More variability implies a higher option price. • Option holders want increasing variability! ...

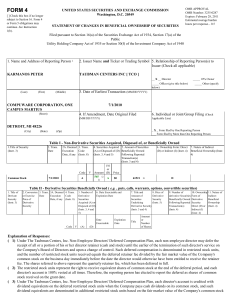

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

Chapter 19 | You Will Learn... 1. To detail recent changes in

... firm has outstanding stock options, warrants, and rights. If a firm has stock options, warrants, or rights outstanding, a determination must be made as to their potential effects on earnings per share. If the exercise price is less than the average market price for the period, the option, warran ...

... firm has outstanding stock options, warrants, and rights. If a firm has stock options, warrants, or rights outstanding, a determination must be made as to their potential effects on earnings per share. If the exercise price is less than the average market price for the period, the option, warran ...

Filed pursuant to Rule 424(b)(3) Registration File No. 333

... broker-dealers or other financial institutions, which may in turn engage in short sales of the Registered Shares in the course of hedging the positions they assume. The selling shareholders may also sell shares of our common stock short and deliver the Registered Shares to close out their short posi ...

... broker-dealers or other financial institutions, which may in turn engage in short sales of the Registered Shares in the course of hedging the positions they assume. The selling shareholders may also sell shares of our common stock short and deliver the Registered Shares to close out their short posi ...

Chapter 37 The Stock Market and Crashes

... of all creditors as a group to let a company reorganize so that it could ultimately repay its debts, a. And it certainly would be in every individual creditor's interest as well B. It would be in the interest of each individual creditor to seek immediate payment c. It would be easier for companies t ...

... of all creditors as a group to let a company reorganize so that it could ultimately repay its debts, a. And it certainly would be in every individual creditor's interest as well B. It would be in the interest of each individual creditor to seek immediate payment c. It would be easier for companies t ...

DOC - LeMaitre Vascular

... Item 5.07. Submission of Matters to a Vote of Security Holders. On June 14, 2012, the Company held its Annual Meeting. A total of 15,219,922 shares of the Company’s common stock were entitled to vote as of April 16, 2012, the record date for the Annual Meeting, of which 13,484,306 were present in pe ...

... Item 5.07. Submission of Matters to a Vote of Security Holders. On June 14, 2012, the Company held its Annual Meeting. A total of 15,219,922 shares of the Company’s common stock were entitled to vote as of April 16, 2012, the record date for the Annual Meeting, of which 13,484,306 were present in pe ...

Amazing Market Why does the stock market exist? The answer

... those times. Building a railroad, for instance, was no task for a small proprietorship or partnership with its limited funds. Instead, it required large organizations able to attract sufficient savings from the public to tackle these enormous tasks. A corporation could do just that by selling shares ...

... those times. Building a railroad, for instance, was no task for a small proprietorship or partnership with its limited funds. Instead, it required large organizations able to attract sufficient savings from the public to tackle these enormous tasks. A corporation could do just that by selling shares ...