Exchange rate volatility and stock market returns:

... are amplified by endogenous changes in the external finance premium. The credit channel transmission affects the real economy not only through balance sheet channel but also through the bank-lending channel. However, in a world with integrated capital markets, investors’ expectations are more likely ...

... are amplified by endogenous changes in the external finance premium. The credit channel transmission affects the real economy not only through balance sheet channel but also through the bank-lending channel. However, in a world with integrated capital markets, investors’ expectations are more likely ...

MBA 661 Debate 4

... harm in the US economy, especially with the stock market in a very fragile state. By reporting this incorrect negative information, the stock market would devalue these corporations, which may hurt stockholders across the entire market. Finally this may also cause corporations to stop issuing stock ...

... harm in the US economy, especially with the stock market in a very fragile state. By reporting this incorrect negative information, the stock market would devalue these corporations, which may hurt stockholders across the entire market. Finally this may also cause corporations to stop issuing stock ...

Retail participation in many stock markets has risen

... retail/institutional dilemma is felt most acutely. Too light a regulatory hand has been blamed for the pensions mis-selling scandal. Yet too heavy a hand could threaten London’s status as a global financial centre. The Financial Services Authority seeks to achieve a balance by, among other things, r ...

... retail/institutional dilemma is felt most acutely. Too light a regulatory hand has been blamed for the pensions mis-selling scandal. Yet too heavy a hand could threaten London’s status as a global financial centre. The Financial Services Authority seeks to achieve a balance by, among other things, r ...

What is a Depository Receipt…?

... A Depositary Receipt is a negotiable security that represents an ownership interest in securities of a foreign issuer typically trading outside its home market. Depositary Receipts are created when a broker purchases a non-U.S. company's shares on its home stock market and delivers the shares to the ...

... A Depositary Receipt is a negotiable security that represents an ownership interest in securities of a foreign issuer typically trading outside its home market. Depositary Receipts are created when a broker purchases a non-U.S. company's shares on its home stock market and delivers the shares to the ...

ch13 (1)

... are normally the stuff of adventure novels. But for employees of Facebook, these and other lavish dreams moved closer to reality when the world’s No. 1 online social network went public through an initial public offering (IPO) that may have created at least a thousand millionaires. The IPO was the l ...

... are normally the stuff of adventure novels. But for employees of Facebook, these and other lavish dreams moved closer to reality when the world’s No. 1 online social network went public through an initial public offering (IPO) that may have created at least a thousand millionaires. The IPO was the l ...

Free Sample - Exam Test Bank Store

... b. The syndicate is a selling group formed by the lead investment banker(s) to facilitate the sale of stocks and bonds (i.e., the securities being issued). c. The preliminary prospectus is registered with the SEC to inform the public of the securities and of the firm issuing the securities. It incl ...

... b. The syndicate is a selling group formed by the lead investment banker(s) to facilitate the sale of stocks and bonds (i.e., the securities being issued). c. The preliminary prospectus is registered with the SEC to inform the public of the securities and of the firm issuing the securities. It incl ...

D20 - Cro

... When you have completed and signed the form, please send with the prescribed fee to the Registrar of Companies at: ...

... When you have completed and signed the form, please send with the prescribed fee to the Registrar of Companies at: ...

pdf file - NYU Stern

... Furthermore, we assume that the market valuation of $120 will hold even with the IPO. Finally, let us assume that $20 million need to be raised. Now, if the target price is $10, which represents an underpricing of 20%, the true value of the shares would be 10/.8 = $12.5 per share. At this price, the ...

... Furthermore, we assume that the market valuation of $120 will hold even with the IPO. Finally, let us assume that $20 million need to be raised. Now, if the target price is $10, which represents an underpricing of 20%, the true value of the shares would be 10/.8 = $12.5 per share. At this price, the ...

IIROC `Tips for Traders` CSTA Whistler Friday, August 19 2016

... A client that has previously executed a short sale without being able to borrow shares, where the trade remained unsettled for 10 days following the original settlement date (T+13) cannot make any further short sales in any listed security without first arranging a pre-borrow. ...

... A client that has previously executed a short sale without being able to borrow shares, where the trade remained unsettled for 10 days following the original settlement date (T+13) cannot make any further short sales in any listed security without first arranging a pre-borrow. ...

Financial Assets vs Physical Assets Assets are commonly known as

... Futures are financial contracts giving the buyer an obligation to purchase an asset (and the seller an obligation to sell an asset) at a set price at a future point in time. How It Works/Example: Futures are also called futures contracts. The assets often traded in futures contracts include commodit ...

... Futures are financial contracts giving the buyer an obligation to purchase an asset (and the seller an obligation to sell an asset) at a set price at a future point in time. How It Works/Example: Futures are also called futures contracts. The assets often traded in futures contracts include commodit ...

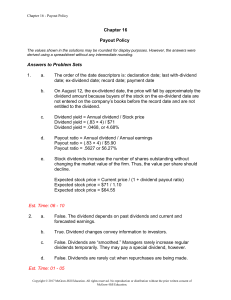

chapter 1

... cash. If the company wants to maintain its all-equity financing position, it must finance the extra cash dividend by selling more shares. This results in a transfer of value from the old to the new shareholders. Assume the company pays the dividend first and then later replaces the additional $1 mil ...

... cash. If the company wants to maintain its all-equity financing position, it must finance the extra cash dividend by selling more shares. This results in a transfer of value from the old to the new shareholders. Assume the company pays the dividend first and then later replaces the additional $1 mil ...

Attention: President The Stock Exchange of Thailand Attachment

... 8. Other details necessary to support shareholder’s decision to approve the capital increase/share allotment 8.1 The reason that the Company offering of newly issued share to the Private Placement (PP) rather than offer new shares existing shareholders and the public is because the company will be a ...

... 8. Other details necessary to support shareholder’s decision to approve the capital increase/share allotment 8.1 The reason that the Company offering of newly issued share to the Private Placement (PP) rather than offer new shares existing shareholders and the public is because the company will be a ...

The Law of Ukraine On Securities and Stock Market of 23.02.2006

... securities as: bonds of enterprises, bonds of local loans, state bonds of Ukraine, treasury obligations of Ukraine, investment certificates and savings (depository) certificates. It is noted that professional activity on the stock market is an activity of legal entities on rendering financial and ot ...

... securities as: bonds of enterprises, bonds of local loans, state bonds of Ukraine, treasury obligations of Ukraine, investment certificates and savings (depository) certificates. It is noted that professional activity on the stock market is an activity of legal entities on rendering financial and ot ...

Treatment of employee stock options granted by non

... In Israel no complete statistics on the stock options exist, but data collected for balance of payment purposes show that quite large amounts appear in financial reports of foreign owned companies. Since these transactions could not be ignored, we carried out an analysis of the problem. Below a prop ...

... In Israel no complete statistics on the stock options exist, but data collected for balance of payment purposes show that quite large amounts appear in financial reports of foreign owned companies. Since these transactions could not be ignored, we carried out an analysis of the problem. Below a prop ...

Schedule 14D-9 - Piedmont Office Realty Trust, Inc.

... Subject to the provisions of the Company’s charter, shares of the Company’s Class B-1, B-2 and B-3 common stock would convert automatically into shares of the Company’s Class A common stock on a one-for-one basis 180 days following the listing, 270 days following the listing and on January 30, 2011, ...

... Subject to the provisions of the Company’s charter, shares of the Company’s Class B-1, B-2 and B-3 common stock would convert automatically into shares of the Company’s Class A common stock on a one-for-one basis 180 days following the listing, 270 days following the listing and on January 30, 2011, ...

File - get all chapter wise notes

... The capital of a company is divide into small units called share. If a company issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (II) preference share. a) ...

... The capital of a company is divide into small units called share. If a company issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (II) preference share. a) ...

(Debt/Equity Swap)? - G. William Schwert

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

Change of Control Amendment/Termination New Plan Benefits

... or reorganizations, share exchanges, divisions, sales, plans of complete liquidation or dissolution, or other dispositions of all or substantially all of the Company’s assets, which have been approved by shareholders, if the Company’s shareholders do not hold a majority of the voting power of the su ...

... or reorganizations, share exchanges, divisions, sales, plans of complete liquidation or dissolution, or other dispositions of all or substantially all of the Company’s assets, which have been approved by shareholders, if the Company’s shareholders do not hold a majority of the voting power of the su ...

Annual reports of listed issuers with financial year ended on 31st

... Northwest New Technology Industry Company (stock code: 8258) have not yet issued their annual reports for the year ended 31 December 2004; and Kinetana International Biotech Pharma Limited (stock code: 8031) has not yet issued its annual report for the year ended 28 February 2005. For details, pleas ...

... Northwest New Technology Industry Company (stock code: 8258) have not yet issued their annual reports for the year ended 31 December 2004; and Kinetana International Biotech Pharma Limited (stock code: 8031) has not yet issued its annual report for the year ended 28 February 2005. For details, pleas ...

CHAPTER 15 Corporations: Dividends, Retained Earnings, and

... account; it is not a liability because assets will NOT be used to pay the dividend. If a balance sheet is prepared before the dividend shares are issued, the distributable account is reported in paid-in capital as an addition to common stock. ...

... account; it is not a liability because assets will NOT be used to pay the dividend. If a balance sheet is prepared before the dividend shares are issued, the distributable account is reported in paid-in capital as an addition to common stock. ...

PRESS RELEASE Announcement of scrip issue price for final

... Management proposes shareholders to have the option of taking the final dividend in either cash or shares, or a combination of the two. Shareholders electing for a dividend in shares, which will be paid out of the share premium reserve and therefore not subject to dividend withholding tax, will rece ...

... Management proposes shareholders to have the option of taking the final dividend in either cash or shares, or a combination of the two. Shareholders electing for a dividend in shares, which will be paid out of the share premium reserve and therefore not subject to dividend withholding tax, will rece ...

Tips for Startups – Understanding Debt vs. Equity

... are ultimately based. Common shares can also have various rights and privileges attached to them, such as voting and participation in profits, but they tend to rank behind other securities in terms of priority. For example, a common shareholder’s right to participate would come after debt-holders an ...

... are ultimately based. Common shares can also have various rights and privileges attached to them, such as voting and participation in profits, but they tend to rank behind other securities in terms of priority. For example, a common shareholder’s right to participate would come after debt-holders an ...

DCF Tutorial Part 1

... expected future cash flows to the present • Efficient Markets Hypothesis (EMH) – Finance theory which states that all stock market prices at any given time reflect the accurate present value of the future cash flows of a business – Assumes market as a whole has rational expectations and is always ri ...

... expected future cash flows to the present • Efficient Markets Hypothesis (EMH) – Finance theory which states that all stock market prices at any given time reflect the accurate present value of the future cash flows of a business – Assumes market as a whole has rational expectations and is always ri ...