Interest Rate and Credit Default Swaps

... Example (cont.): At this point, Company A would owe 6% to its original lenders and 4% (plus whatever the LIBOR rate is) to Company B. This results in its obligations being 10% + LIBOR. It will receive back from Company B 5.5%. This results in its final obligations being 10% - 5.5% = 4.5% plus LIBOR ...

... Example (cont.): At this point, Company A would owe 6% to its original lenders and 4% (plus whatever the LIBOR rate is) to Company B. This results in its obligations being 10% + LIBOR. It will receive back from Company B 5.5%. This results in its final obligations being 10% - 5.5% = 4.5% plus LIBOR ...

Grad Finale Exit Counseling PPT

... during which you are not required to make payments on subsidized and unsubsidized loans. The repayment period begins at the end of the grace period. ...

... during which you are not required to make payments on subsidized and unsubsidized loans. The repayment period begins at the end of the grace period. ...

Ch2-Sec2.5

... Here is a problem related to exponential functions: Suppose you received a penny on the first day of December, two pennies on the second day of December, four pennies on the third day, eight pennies on the fourth day and so on. How many pennies would you receive on December 31 if this pattern co ...

... Here is a problem related to exponential functions: Suppose you received a penny on the first day of December, two pennies on the second day of December, four pennies on the third day, eight pennies on the fourth day and so on. How many pennies would you receive on December 31 if this pattern co ...

4.1 - Exponential Functions

... It doesn’t take into consideration compound interest which is interest computed on your original investment PLUS any accumulated interest. Suppose a sum of money, called the principal, P, is invested at an annual percentage rate r, in decimal form, compounded once per year. Because the interest is a ...

... It doesn’t take into consideration compound interest which is interest computed on your original investment PLUS any accumulated interest. Suppose a sum of money, called the principal, P, is invested at an annual percentage rate r, in decimal form, compounded once per year. Because the interest is a ...

IB Math Studies Problem Set: Sequences/Series/Interest Name: 1

... If fees continue to rise at the same rate, calculate (to the nearest dollar) the total cost of tuition fees for the first six years of high school. ...

... If fees continue to rise at the same rate, calculate (to the nearest dollar) the total cost of tuition fees for the first six years of high school. ...

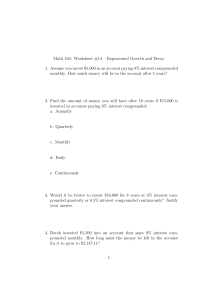

Math 165: Worksheet #14 – Exponential Growth and

... 3. Would it be better to invest $10,000 for 8 years at 8% interest compounded quarterly or 6.5% interest compounded continuously? Justify ...

... 3. Would it be better to invest $10,000 for 8 years at 8% interest compounded quarterly or 6.5% interest compounded continuously? Justify ...

7 Grade Fall Semester Exam Review

... 24. Find the unit rate for each situation below. Then circle the one that is the best deal. ________ A 6 pack for $2.40 ________ A 12 pack for $5.40 ________ A 20 pack for $7.00 ________ A 24 pack for $9.60 ...

... 24. Find the unit rate for each situation below. Then circle the one that is the best deal. ________ A 6 pack for $2.40 ________ A 12 pack for $5.40 ________ A 20 pack for $7.00 ________ A 24 pack for $9.60 ...

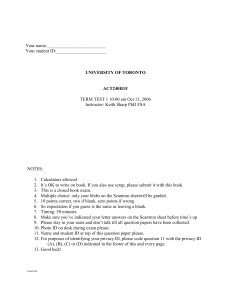

ACT 240H1F F06 Term Test 1 Privacy ID A v07

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

Math 113A – Exam Review – Consumer Math

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...

... The difference between what a person pays using an in store credit plan and what they could have paid with cash is called a ______________________________. All earnings is called _________________________. A government plan that pays people some money when they retire is called ____________________. ...

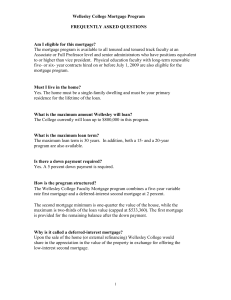

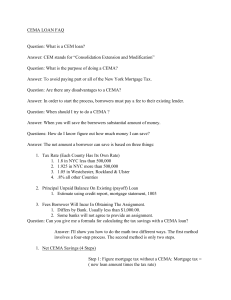

CEMA LOAN FAQ - Adams Law Group LLC

... that you have a borrower who wants to take a loan for 250,000. Imagine further that the borrower's prior mortgage was recorded in the amount of 200,000 and that they paid the full tax on that mortgage. But imagine that at the time they refinance, there is exactly 192,153.35 left on the mortgage as t ...

... that you have a borrower who wants to take a loan for 250,000. Imagine further that the borrower's prior mortgage was recorded in the amount of 200,000 and that they paid the full tax on that mortgage. But imagine that at the time they refinance, there is exactly 192,153.35 left on the mortgage as t ...

section b - Fluor

... referred to as FBP or Company and, the party identified in block 13 of Section A. hereafter referred to as Contractor. The Contractor shall furnish all personnel and services (except as may be expressly set forth in the contract) and otherwise do all things necessary for, or incidental to the perfor ...

... referred to as FBP or Company and, the party identified in block 13 of Section A. hereafter referred to as Contractor. The Contractor shall furnish all personnel and services (except as may be expressly set forth in the contract) and otherwise do all things necessary for, or incidental to the perfor ...

Taking Loans and Issuing Bonds

... for a long while) it needs Similar to an individual borrowing money ...

... for a long while) it needs Similar to an individual borrowing money ...

California Real Estate Finance, 10e - PowerPoint

... • Junior deed of trust to original loan • Seller will pay off loans from monies received from buyer • Used when – In lieu of installment sales contract – When existing loan cannot be paid off until later date – Buyer wants income tax benefits – Seller has overpriced property – Low down payment – Low ...

... • Junior deed of trust to original loan • Seller will pay off loans from monies received from buyer • Used when – In lieu of installment sales contract – When existing loan cannot be paid off until later date – Buyer wants income tax benefits – Seller has overpriced property – Low down payment – Low ...