New York Real Estate for Brokers

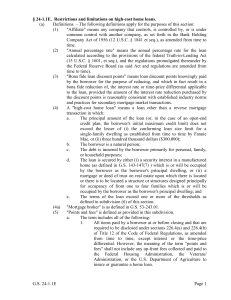

... mortgages that have an interest rate of more than 8 percent and junior mortgages that have an interest rate of more than 9 percent © 2013 All rights reserved. ...

... mortgages that have an interest rate of more than 8 percent and junior mortgages that have an interest rate of more than 9 percent © 2013 All rights reserved. ...

The ABCs of Hardships and Loans

... People are currently investing less money in their retirement plans; obviously, the economic downturn has impacted retirement plans. Almost everyone lost money in their retirement accounts, and many people either have lost jobs or are facing the possibility of losing their jobs. The IRS has found th ...

... People are currently investing less money in their retirement plans; obviously, the economic downturn has impacted retirement plans. Almost everyone lost money in their retirement accounts, and many people either have lost jobs or are facing the possibility of losing their jobs. The IRS has found th ...

continued

... A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other is based on a variable interest rate). (continued) ...

... A common type of swap is an interest rate swap where two parties agree to exchange future interest payments on a given loan amount (one set of interest payments is based on a fixed interest rate and the other is based on a variable interest rate). (continued) ...

Correlation of Risks, Integrating Risk Measurement – Risk

... CPRi,t = exp ( x(i, t)’ p )/ A and CDRi,t = exp ( x(i, t)’ d )/ A where A = 1 + exp ( x(i, t)’ p ) + exp ( x(i, t)’ d ) x(i,t) independent variables: age, seasonality, refi function, FICO score valuation model - mortgage ...

... CPRi,t = exp ( x(i, t)’ p )/ A and CDRi,t = exp ( x(i, t)’ d )/ A where A = 1 + exp ( x(i, t)’ p ) + exp ( x(i, t)’ d ) x(i,t) independent variables: age, seasonality, refi function, FICO score valuation model - mortgage ...

A Closer Look at Housing Loan Arrears Box C

... During the periods of strong housing price growth in Queensland and Western Australia, investor activity increased significantly more than owner-occupier activity (Graph C4). Between 2000 and 2007, the value of investor loan approvals grew around fivefold in these two states, whereas owner-occupier ...

... During the periods of strong housing price growth in Queensland and Western Australia, investor activity increased significantly more than owner-occupier activity (Graph C4). Between 2000 and 2007, the value of investor loan approvals grew around fivefold in these two states, whereas owner-occupier ...

PowerPoint-presentasjon

... certain future events and potential financial performance. Although SR-Boligkreditt believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ material ...

... certain future events and potential financial performance. Although SR-Boligkreditt believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ material ...

lEVEl I SCHWESER`S QuickSheet

... • Indenture. Agreement containing the terms under which money is borrowed. • Term to maturity. Length of time until loan contract or agreement expires. • Par value. Amount borrower promises to pay on or before maturity date of the issue. • Coupon rate. When multiplied by par value, gives amount ...

... • Indenture. Agreement containing the terms under which money is borrowed. • Term to maturity. Length of time until loan contract or agreement expires. • Par value. Amount borrower promises to pay on or before maturity date of the issue. • Coupon rate. When multiplied by par value, gives amount ...

Securitisation

... enabling the investors investing in these securities to buy directly parcels of specific financial assets Securities are issued to fund assets and the cash flow of the underlying assets represents the interest claims of the securities issued Increasing complexity with the emergence of financial inte ...

... enabling the investors investing in these securities to buy directly parcels of specific financial assets Securities are issued to fund assets and the cash flow of the underlying assets represents the interest claims of the securities issued Increasing complexity with the emergence of financial inte ...

Delta Workforce Investment Area

... pass the GED test. These funds will be paid from SDPDD – DWIA funds. This form should be completed by the youth subcontractor when requesting payment of the $200 cash incentive for passage of the GED test. ...

... pass the GED test. These funds will be paid from SDPDD – DWIA funds. This form should be completed by the youth subcontractor when requesting payment of the $200 cash incentive for passage of the GED test. ...

Ch - Pearson Canada

... today. It has a "par" or "face" value, which is the amount for which it can be redeemed after a certain period of time. It also has a "coupon rate," meaning that the bearer is paid an annuity, usually semi-annually, ...

... today. It has a "par" or "face" value, which is the amount for which it can be redeemed after a certain period of time. It also has a "coupon rate," meaning that the bearer is paid an annuity, usually semi-annually, ...

An Introduction To Interest Rate Hedging

... Hedges have traditionally appeared in commercial real estate transactions primarily to mitigate interest rate risks. Given the pace of new product development in the derivatives markets, Hedges may soon mitigate other risks in real estate transactions. For example, a Counterparty might issue a Hed ...

... Hedges have traditionally appeared in commercial real estate transactions primarily to mitigate interest rate risks. Given the pace of new product development in the derivatives markets, Hedges may soon mitigate other risks in real estate transactions. For example, a Counterparty might issue a Hed ...