Stocks - Bennie D. Waller, PhD Online Course Material

... that XYZ stock will rise sharply in the coming weeks after their earnings report. So you paid $200 to purchase a single $40 XYZ call option covering 100 shares. Assume the price of XYZ stock rallies to $50 after reported earnings. With this sharp rise in the underlying stock price, your call buyin ...

... that XYZ stock will rise sharply in the coming weeks after their earnings report. So you paid $200 to purchase a single $40 XYZ call option covering 100 shares. Assume the price of XYZ stock rallies to $50 after reported earnings. With this sharp rise in the underlying stock price, your call buyin ...

Options on Futures: The Exercise and Assignment

... Nothing prevents a single clearing member firm from representing both sides of an option exercise. In Exhibit 2 on page 4, for example, accounts holding long positions with Firm A seek to exercise a total of 1,000 options, while Firm A simultaneously holds account positions with short open interest ...

... Nothing prevents a single clearing member firm from representing both sides of an option exercise. In Exhibit 2 on page 4, for example, accounts holding long positions with Firm A seek to exercise a total of 1,000 options, while Firm A simultaneously holds account positions with short open interest ...

A Fully-Dynamic Closed-Form Solution for ∆-Hedging

... The optimal trading intensity θt = θ(t, Yt ) for the objective (5) is given by (8) where the nonnegative trading intensity proportion h is given by (9). Under the optimal trading strategy, YT 6= 0 a.s. That is, because of the market-impact costs, the position is not perfectly ∆-hedged, even at the ...

... The optimal trading intensity θt = θ(t, Yt ) for the objective (5) is given by (8) where the nonnegative trading intensity proportion h is given by (9). Under the optimal trading strategy, YT 6= 0 a.s. That is, because of the market-impact costs, the position is not perfectly ∆-hedged, even at the ...

Valuation of Asian Options

... These path dependent options were first introduced on the Asian market in order to avoid the manipulation of prices on expiration date. This was a common problem in European options where speculators could drive up the prices before maturity. And through out time Asian Options have become popular fo ...

... These path dependent options were first introduced on the Asian market in order to avoid the manipulation of prices on expiration date. This was a common problem in European options where speculators could drive up the prices before maturity. And through out time Asian Options have become popular fo ...

8: The Black-Scholes Model - School of Mathematics and Statistics

... Our final goal is to examine a judicious approximation of the Black-Scholes model by a sequence of CRR models. In the first step, we will first examine an approximation of the Wiener process by a sequence of symmetric random walks. In the next step, we will use this result in order to show how to ap ...

... Our final goal is to examine a judicious approximation of the Black-Scholes model by a sequence of CRR models. In the first step, we will first examine an approximation of the Wiener process by a sequence of symmetric random walks. In the next step, we will use this result in order to show how to ap ...

Uncertain Parameters, an Empirical Stochastic

... interest rate and the volatility of the underlying asset remain at predetermined and constant levels over the life of the option. Although this may be a valid simplifying assumption for short maturity options, it becomes increasingly less plausible as the maturity increases. There have been numerous ...

... interest rate and the volatility of the underlying asset remain at predetermined and constant levels over the life of the option. Although this may be a valid simplifying assumption for short maturity options, it becomes increasingly less plausible as the maturity increases. There have been numerous ...

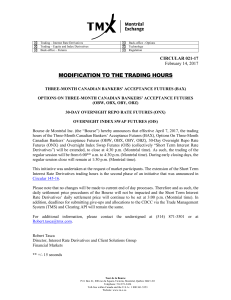

Modification to the Trading Hours

... shall equal to 100 minus the compounded daily overnight repo rate (CORRA), expressed in terms of an overnight repo rate index and calculated over the period of the contract month that beings on the first calendar day of the contract month and ends on the last calendar day of the contract month. Week ...

... shall equal to 100 minus the compounded daily overnight repo rate (CORRA), expressed in terms of an overnight repo rate index and calculated over the period of the contract month that beings on the first calendar day of the contract month and ends on the last calendar day of the contract month. Week ...

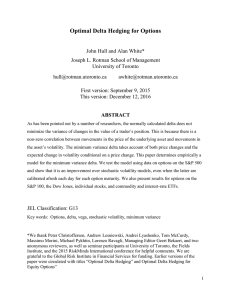

Optimal Delta Hedging for Options

... be assessed by monitoring the impact of changes in these two variables. As is well known, there is a negative relationship between an equity price and its volatility. This was first shown by Black (1976) and Christie (1982) who used physical volatility estimates. Other authors have shown that it is ...

... be assessed by monitoring the impact of changes in these two variables. As is well known, there is a negative relationship between an equity price and its volatility. This was first shown by Black (1976) and Christie (1982) who used physical volatility estimates. Other authors have shown that it is ...

Edgeworth Binomial Trees - University of California, Berkeley

... risk-neutral probabilities (rather than to the derivatives pricing formula). In particular, the paper discretizes the risk-neutral distribution of the logarithm of underlying asset returns using equallyspaced points and provides a simple method of attaching risk-neutral probabilities to these points ...

... risk-neutral probabilities (rather than to the derivatives pricing formula). In particular, the paper discretizes the risk-neutral distribution of the logarithm of underlying asset returns using equallyspaced points and provides a simple method of attaching risk-neutral probabilities to these points ...

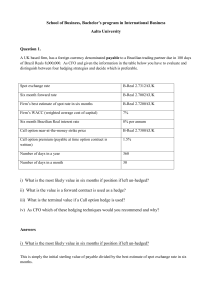

Financial Accounting and Accounting Standards

... Illustration: In September 2008 Allied Can Co. anticipates purchasing 1,000 metric tons of aluminum in January 2009. Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the oblig ...

... Illustration: In September 2008 Allied Can Co. anticipates purchasing 1,000 metric tons of aluminum in January 2009. Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the oblig ...

CHARACTERISTICS OF DERIVATIVES

... contract, the counterparties, are not required to actually deliver an asset that is associated with the underlying Derivatives ...

... contract, the counterparties, are not required to actually deliver an asset that is associated with the underlying Derivatives ...

The Option Greeks and Market Making

... shares and buying option #2 entailing 35,400 shares will do the trick. These trades will add 42,390 delta to the book, so the dealer will need to short or sell off from inventory 25,290 shares in order to delta hedge. A total of four assets were traded to delta-gamma-vega hedge. ...

... shares and buying option #2 entailing 35,400 shares will do the trick. These trades will add 42,390 delta to the book, so the dealer will need to short or sell off from inventory 25,290 shares in order to delta hedge. A total of four assets were traded to delta-gamma-vega hedge. ...

Lecture 7: Quadratic Variation

... as shown in the previous section. From a practical perspective, market operators may express views on volatility using variance swaps without having to delta hedge. Variance swaps took off as a product in the aftermath of the LTCM meltdown in late 1998 when implied stock index volatility levels ros ...

... as shown in the previous section. From a practical perspective, market operators may express views on volatility using variance swaps without having to delta hedge. Variance swaps took off as a product in the aftermath of the LTCM meltdown in late 1998 when implied stock index volatility levels ros ...

Agricultural Derivatives 101

... product should you exercise your right • the PUT option trade involves a willing buyer\willing seller at an agreed premium for a specific strike price • the buyer can exercise the right to sell maize at any time (American style options) • the buyer pays premium (negotiated on market) • seller receiv ...

... product should you exercise your right • the PUT option trade involves a willing buyer\willing seller at an agreed premium for a specific strike price • the buyer can exercise the right to sell maize at any time (American style options) • the buyer pays premium (negotiated on market) • seller receiv ...

Pricing Volatility Derivatives with General Risk Functions Alejandro Balbás University Carlos III

... Applications in Nordpool Conclusions. ...

... Applications in Nordpool Conclusions. ...

OPTIONS AND FUTURES CONTRACTS IN ELECTRICITY FOR

... Nowadays, the typical instrument of trade with electricity at wholesale level is the forward contract, so it was before and it continued being after taking place the reorganization of the sector. The forward contract is an agreement between a buyer and a seller of power to trade a given quantity of ...

... Nowadays, the typical instrument of trade with electricity at wholesale level is the forward contract, so it was before and it continued being after taking place the reorganization of the sector. The forward contract is an agreement between a buyer and a seller of power to trade a given quantity of ...

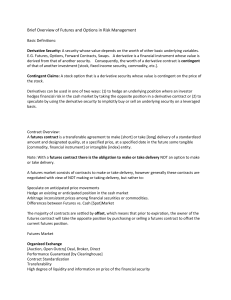

Brief Overview of Futures and Options in Risk Management

... or indexes. The intent of traders in this market is to take one of three possible positions: (1) Speculate on anticipated price movements (2) Hedge an existing or anticipated position that they may have in the cash (spot) market (3) Arbitrage inconsistent prices among financial securities and depend ...

... or indexes. The intent of traders in this market is to take one of three possible positions: (1) Speculate on anticipated price movements (2) Hedge an existing or anticipated position that they may have in the cash (spot) market (3) Arbitrage inconsistent prices among financial securities and depend ...

Download PDF

... as a stock; an index portfolio; a futures price; a currency; or some measurable state variable, such as the temperature at some location or the volatility of an index. The payoff can involve various patterns of cash flows. Payments can be spread evenly through time, occur at specific dates, or a combi ...

... as a stock; an index portfolio; a futures price; a currency; or some measurable state variable, such as the temperature at some location or the volatility of an index. The payoff can involve various patterns of cash flows. Payments can be spread evenly through time, occur at specific dates, or a combi ...

Homework - Purdue Math

... 32. Renco stock currently sells for 100 per share. Renco does not pay a dividend. A 102-strike oneyear European call sells for 8.00. The risk free interest rate is 6% compounded continuously. Calculate the premium for a 102-strike one-year European put. 33. Tariq LTD stock currently sells for 100 pe ...

... 32. Renco stock currently sells for 100 per share. Renco does not pay a dividend. A 102-strike oneyear European call sells for 8.00. The risk free interest rate is 6% compounded continuously. Calculate the premium for a 102-strike one-year European put. 33. Tariq LTD stock currently sells for 100 pe ...