Regulatory Focus on Market Structure and Trading Issues

... Sample Disciplinary Matter - In the Matter of Moore Capital Management, LP, Moore Capital Advisors, LLC, and Moore Advisors, Ltd., CFTC Docket No. 10-09 (Apr. 29, 2010): $25 million civil monetary penalty, joint and several liability; all defendants attempted to manipulate the settlement prices of ...

... Sample Disciplinary Matter - In the Matter of Moore Capital Management, LP, Moore Capital Advisors, LLC, and Moore Advisors, Ltd., CFTC Docket No. 10-09 (Apr. 29, 2010): $25 million civil monetary penalty, joint and several liability; all defendants attempted to manipulate the settlement prices of ...

Circuit Breaker Levels for the Fourth Quarter

... (“NYSE”) at the beginning of each calendar quarter, using the average closing value of the DJIA for the preceding month. Each trigger is rounded to the nearest 50 points. There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the U ...

... (“NYSE”) at the beginning of each calendar quarter, using the average closing value of the DJIA for the preceding month. Each trigger is rounded to the nearest 50 points. There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the U ...

CfP: Workshop on Commodity Trading Companies in the First

... commodities during the First Global Economy. Trading companies shaped the emergent global value chains of commodities ranging from minerals to metals and food stuffs. At this highpoint of Britain’s economic dominance, British commodity trading companies were front runners. However, rapid growth and ...

... commodities during the First Global Economy. Trading companies shaped the emergent global value chains of commodities ranging from minerals to metals and food stuffs. At this highpoint of Britain’s economic dominance, British commodity trading companies were front runners. However, rapid growth and ...

week long trading experience trade from 06:00 to 18:00 daily for five

... head Market Analyst and Client education for South Africa until December 2011. In January 2012 Warren started coaching other traders in Technical analysis, systems building and leveraged trading, whilst focusing on his own trading. He has appeared on CNBC Africa and a number of radio stations as a m ...

... head Market Analyst and Client education for South Africa until December 2011. In January 2012 Warren started coaching other traders in Technical analysis, systems building and leveraged trading, whilst focusing on his own trading. He has appeared on CNBC Africa and a number of radio stations as a m ...

Amendments to the Rules of the Exchange in relation to the

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

prezentacija ljubljanske borze

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

The course presents an introduction to financial intermediation and

... they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these issues will be conducted at three different levels: institutional, theoretical, and empir ...

... they do? 2) what are the motives for trading and how is the trading process organized? 3) how do traders (and protocols) affect market quality? The analysis of these issues will be conducted at three different levels: institutional, theoretical, and empir ...

Unauthorized/Illegal Foreign Exchange Trading Activities

... foreign exchange, depositing an initial investment in Sri Lanka rupees with a company, proprietorship concern or individual in Sri Lanka to be transferred later into an online account or, payment through credit, debit or any other electronic funds transfer card direct to an online account opened in ...

... foreign exchange, depositing an initial investment in Sri Lanka rupees with a company, proprietorship concern or individual in Sri Lanka to be transferred later into an online account or, payment through credit, debit or any other electronic funds transfer card direct to an online account opened in ...

A Day in the Life of an ETF Portfolio Manager

... The time is 11:30 a.m. Pacific Standard time and I watch stock prices dance across the screen on the Bloomberg quote machine. One is apt to be a little nervous with a billion-dollar trade on the line. I habitually check to see how smallcap stocks are trading. Today is the last trading day in June, o ...

... The time is 11:30 a.m. Pacific Standard time and I watch stock prices dance across the screen on the Bloomberg quote machine. One is apt to be a little nervous with a billion-dollar trade on the line. I habitually check to see how smallcap stocks are trading. Today is the last trading day in June, o ...

Global Macro Investment For Presentation at Yale U. October 22

... • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange rates, Wall Street fundamental forecasters do worse than the fo ...

... • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange rates, Wall Street fundamental forecasters do worse than the fo ...

FMA Doctoral Consortium Market Microstructure

... Buy-side Order Strategy • Trading is a search problem. • We need better models of the time dimension of liquidity. – Liquidity is more than bid/ask spread. ...

... Buy-side Order Strategy • Trading is a search problem. • We need better models of the time dimension of liquidity. – Liquidity is more than bid/ask spread. ...

trader application form

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at k.hart@qub.ac.uk Please note that the cost of holding a stall at the ma ...

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at k.hart@qub.ac.uk Please note that the cost of holding a stall at the ma ...

what is the “upstairs market?” the causes of market impact for block

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

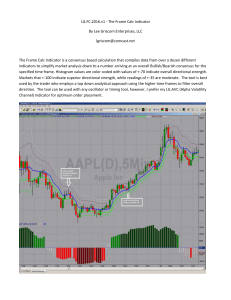

10 Min Options Strategy Handout - MarketClub

... U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with mon ...

... U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with mon ...

gbpusd - Forex Factory

... of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that may substantially affect the price and/or liquidity of a currency. The impact of seasonal a ...

... of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that may substantially affect the price and/or liquidity of a currency. The impact of seasonal a ...

CEE Trader - Wiener Börse

... be merged in one order book) ■ Drop copy support with Xetra® native interfaces Technical Key Figures ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway ...

... be merged in one order book) ■ Drop copy support with Xetra® native interfaces Technical Key Figures ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway ...

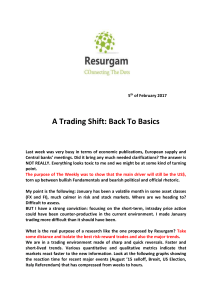

5th of February 2017 A Trading Shift: Back To Basics Last week was

... changed. Sell signals will not work in this market and the high probability set-ups are now on the long side. 3. Audnzd: 2 big trades so far this year: ...

... changed. Sell signals will not work in this market and the high probability set-ups are now on the long side. 3. Audnzd: 2 big trades so far this year: ...

Bovespa

... challenge: face the problem of low volume and, in consequence, the low scale of operations ...

... challenge: face the problem of low volume and, in consequence, the low scale of operations ...

SciDAC Poster: INCITE

... – Pre-market: 79 trades – Market trading: 33961 trades – After hours: 4091 trades ...

... – Pre-market: 79 trades – Market trading: 33961 trades – After hours: 4091 trades ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... – The study calculated that about 18 per cent of total volumes of trades were executed on broker-dealers’ own trading desks – a process known in the industry as “internalisation”. That figure included virtually all retail orders, Mr Preece said. Other block-trading venues, whether independent or ban ...

... – The study calculated that about 18 per cent of total volumes of trades were executed on broker-dealers’ own trading desks – a process known in the industry as “internalisation”. That figure included virtually all retail orders, Mr Preece said. Other block-trading venues, whether independent or ban ...

Press Release

... its product portfolio with the launch of Bitcoin trading, allowing its clients easy access to the price movement of Bitcoin without the need to open up an ewallet to purchase bitcoin in the internet. ...

... its product portfolio with the launch of Bitcoin trading, allowing its clients easy access to the price movement of Bitcoin without the need to open up an ewallet to purchase bitcoin in the internet. ...

College of Business Trading Room LCD Stock Ticker

... especially at the R.I.S.E conference, which is the premier portfolio management competition and recruiting base for financial professionals. The planned Bloomberg terminals will be of great benefit to students as they will now have access to world class information and analytical to ...

... especially at the R.I.S.E conference, which is the premier portfolio management competition and recruiting base for financial professionals. The planned Bloomberg terminals will be of great benefit to students as they will now have access to world class information and analytical to ...

assessing behaviour within an environment of uncertainty and risk

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

Belgrade Stock Exchange - New trading hours Dear clients and

... We would like to inform you of new trading hours of the Belgrade Stock Exchange, effective 2nd November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided bel ...

... We would like to inform you of new trading hours of the Belgrade Stock Exchange, effective 2nd November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided bel ...

Trading room

A trading room gathers traders operating on financial markets. The trading room is also often called the front office. The terms ""dealing room"" and ""trading floor"" are also used, the latter being inspired from that of an open outcry stock exchange. As open outcry is gradually replaced by electronic trading, the trading room gets the only living place that is emblematic of the financial market. It is also the likeliest place within the financial institution where the most recent technologies are implemented before being disseminated in its other businesses.