The Park` N Shop

... (The Park’ N Shop) Referring to Question 1 What’s the elasticity of Demand for fresh pork? As the fresh pork in the wet market and those in the supermarket are close substitutes. Buyer could easily turn to buy the pork from another market when either market is setting a higher price for the pork. So ...

... (The Park’ N Shop) Referring to Question 1 What’s the elasticity of Demand for fresh pork? As the fresh pork in the wet market and those in the supermarket are close substitutes. Buyer could easily turn to buy the pork from another market when either market is setting a higher price for the pork. So ...

The Latest Amendments to Japan`s Securities and Exchange Law

... considerable administrative cost means that banks are, without exception, reluctant to offer this service. Therefore, even if cooperative financial institutions are allowed to offer such a service, it is unlikely to result in any immediate increase in securities investment by individual investors. ...

... considerable administrative cost means that banks are, without exception, reluctant to offer this service. Therefore, even if cooperative financial institutions are allowed to offer such a service, it is unlikely to result in any immediate increase in securities investment by individual investors. ...

Trading in Financial Markets using Pattern

... characterized by fluctuations within a narrow band. Technical analysts interpret this sign as a temporary interruption of a strong upward trend, in which investors consolidate their gains before the action resume its positive sense. As confirmed in Figure 1, we have a matrix of 10 x 10 which I shall ...

... characterized by fluctuations within a narrow band. Technical analysts interpret this sign as a temporary interruption of a strong upward trend, in which investors consolidate their gains before the action resume its positive sense. As confirmed in Figure 1, we have a matrix of 10 x 10 which I shall ...

Non-collateralised Structured Products Launch

... preceding the Expiry Date (both dates inclusive), you may sell or buy the CBBCs on the Stock Exchange. No application has been made to list the CBBCs on any other stock exchange. The CBBCs may only be transferred in a Board Lot (or integral multiples thereof). Where a transfer of CBBCs takes place o ...

... preceding the Expiry Date (both dates inclusive), you may sell or buy the CBBCs on the Stock Exchange. No application has been made to list the CBBCs on any other stock exchange. The CBBCs may only be transferred in a Board Lot (or integral multiples thereof). Where a transfer of CBBCs takes place o ...

Self Regulation - Superfinanciera

... Securities exchanges are both business ventures and regulatory bodies; may not enforce rules if detrimental to business ...

... Securities exchanges are both business ventures and regulatory bodies; may not enforce rules if detrimental to business ...

Free Sample - Exam Test Bank Store

... c. A short position is closed when the short seller purchases the security and returns it to the lender. d. If the price does decline, the short seller profits because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but wit ...

... c. A short position is closed when the short seller purchases the security and returns it to the lender. d. If the price does decline, the short seller profits because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but wit ...

Alan

... effect of the change in equilibrium rM which reinforces the exogenous Shock to prices, will be spread out over a brief period, leading to positive short-term Serial correlation in aggregate market returns. Over longer horizons, however, after the market equilibrates to the new expected return, seria ...

... effect of the change in equilibrium rM which reinforces the exogenous Shock to prices, will be spread out over a brief period, leading to positive short-term Serial correlation in aggregate market returns. Over longer horizons, however, after the market equilibrates to the new expected return, seria ...

2005 WSJ Article List

... “How Day Traders Turned Squawk-Box Chatter Into Profits” (A1) – A good and detailed example of the value of information in securities markets (and the misuse of information) and the nature of large trading activity by brokers and institutional investors “U.S. Birth Rates Remain High” (A2) – Demograp ...

... “How Day Traders Turned Squawk-Box Chatter Into Profits” (A1) – A good and detailed example of the value of information in securities markets (and the misuse of information) and the nature of large trading activity by brokers and institutional investors “U.S. Birth Rates Remain High” (A2) – Demograp ...

Liquidity and Market Crashes

... cost also limits the flow of capital into the market to provide liquidity, the price deviation only recovers slowly. Although information may well play an important role in exacerbating the initial selling demand and amplifying market crashes, we identify a unique mechanism that can explain the sud ...

... cost also limits the flow of capital into the market to provide liquidity, the price deviation only recovers slowly. Although information may well play an important role in exacerbating the initial selling demand and amplifying market crashes, we identify a unique mechanism that can explain the sud ...

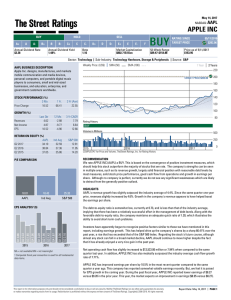

APPLE INC - TheStreet

... We rate APPLE INC (AAPL) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reas ...

... We rate APPLE INC (AAPL) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reas ...

Gideon I: the FTC equity strategy

... mutual fund with an FTC trading system. The original strategy combined two different trend-following systems which generated trading signals in a universe of over 1,000 equity mutual funds. This strategy, which can have between zero and one hundred per cent long exposure, limits the risk of falling ...

... mutual fund with an FTC trading system. The original strategy combined two different trend-following systems which generated trading signals in a universe of over 1,000 equity mutual funds. This strategy, which can have between zero and one hundred per cent long exposure, limits the risk of falling ...

Chapter 15: OLIGOPOLY: DECISION MAKING WITH

... we will lower our price and keep it low until you are driven out of the market,” then a. Rising Star would never go ahead and enter if Dell has a cost advantage over Rising Star. b. Rising Star’s decision to enter will be unaffected by the threat if the threat is not credible. c. Dell is making a st ...

... we will lower our price and keep it low until you are driven out of the market,” then a. Rising Star would never go ahead and enter if Dell has a cost advantage over Rising Star. b. Rising Star’s decision to enter will be unaffected by the threat if the threat is not credible. c. Dell is making a st ...

notice - Spice

... S&P Dow Jones Indices LLC, a part of McGraw Hill Financial, is the world’s largest, global resource for index-based concepts, data and research. Home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial AverageTM, S&P Dow Jones Indices LLC has over 115 years of ex ...

... S&P Dow Jones Indices LLC, a part of McGraw Hill Financial, is the world’s largest, global resource for index-based concepts, data and research. Home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial AverageTM, S&P Dow Jones Indices LLC has over 115 years of ex ...

on futures contracts

... • Allows frequent trading at low cost, especially useful for foreign investments ...

... • Allows frequent trading at low cost, especially useful for foreign investments ...

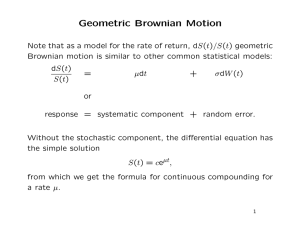

Geometric Brownian Motion

... This is the no-arbitrage principle. The expected value of the stock does not depend on the rate of return of the stock (that’s µ in some of the models we’ve used). This is true because of the cost of a forward contract. ...

... This is the no-arbitrage principle. The expected value of the stock does not depend on the rate of return of the stock (that’s µ in some of the models we’ve used). This is true because of the cost of a forward contract. ...

Stock Market Efficiency: An Autopsy

... 1989) dispelled the myth of increasing stock market volatility: it found that the monthly total rate of return on the Standard & Poor’s 500 Composite Index has not been more volatile in the 1980s than in previous periods. Indeed, the peak of stock market volatility was in the 1930s. Others (for exam ...

... 1989) dispelled the myth of increasing stock market volatility: it found that the monthly total rate of return on the Standard & Poor’s 500 Composite Index has not been more volatile in the 1980s than in previous periods. Indeed, the peak of stock market volatility was in the 1930s. Others (for exam ...

the charges document

... We are committed to providing equal access to our services for all customers with disabilities. Full details of Barclays services and facilities can be found in our brochure ‘Disabled customers – making our services available’. All of our literature can be provided in Braille, large print or audio t ...

... We are committed to providing equal access to our services for all customers with disabilities. Full details of Barclays services and facilities can be found in our brochure ‘Disabled customers – making our services available’. All of our literature can be provided in Braille, large print or audio t ...

Answers

... 3. The same three stocks as above are being considered for purchase. An investor has determined the following information: Stock A B C ...

... 3. The same three stocks as above are being considered for purchase. An investor has determined the following information: Stock A B C ...

PowerShares Dynamic US Market UCITS ETF 31 May 2017

... Persons interested in acquiring the ETF should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile: (ii) any foreign exchange controls: and (iii) tax consequences which might be relevant. This document is marketing mater ...

... Persons interested in acquiring the ETF should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile: (ii) any foreign exchange controls: and (iii) tax consequences which might be relevant. This document is marketing mater ...

Debunking some myths and misconceptions about

... to be a low-cost way to implement an investment strategy, lending a significant tailwind in producing above-average returns over the long term relative to higher-cost active strategies. For example, in Figure 2, 84% of active smallcap blend funds and 71% of active emerging-market funds underperforme ...

... to be a low-cost way to implement an investment strategy, lending a significant tailwind in producing above-average returns over the long term relative to higher-cost active strategies. For example, in Figure 2, 84% of active smallcap blend funds and 71% of active emerging-market funds underperforme ...

April 10, 2014 Summary of “The Other Side of Value: The Gross

... only updated annually and they are highly persistent. Only one-third of each side of the strategy turns over each year. Most of these benefits do not even require shorting individual unprofitable growth stocks, but can be captured by shorting the whole market or selling market futures. The profitabl ...

... only updated annually and they are highly persistent. Only one-third of each side of the strategy turns over each year. Most of these benefits do not even require shorting individual unprofitable growth stocks, but can be captured by shorting the whole market or selling market futures. The profitabl ...

Characterization of foreign exchange market using the threshold

... The market price is quoted between bid and ask prices. We assume that trading dealers have a minimum unit of yen or dollar. After a trade the seller and the buyer change places. For example, assume the i-th dealer; he is a buyer(σi = +1) and after making a purchase, becomes a seller(σi = −1). Althou ...

... The market price is quoted between bid and ask prices. We assume that trading dealers have a minimum unit of yen or dollar. After a trade the seller and the buyer change places. For example, assume the i-th dealer; he is a buyer(σi = +1) and after making a purchase, becomes a seller(σi = −1). Althou ...

PowerPoint **

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...