The Decision Cycle for Downside Risk and Income-Focused

... 1. Know what your portfolio looks like. Understand the return distribution. 2. Understand how assets behave during different market regimes. 3. Could a portfolio exhibiting different exposures to other assets done better? 4. Identify what that investment opportunity set looks like. ...

... 1. Know what your portfolio looks like. Understand the return distribution. 2. Understand how assets behave during different market regimes. 3. Could a portfolio exhibiting different exposures to other assets done better? 4. Identify what that investment opportunity set looks like. ...

Multi-market Trading and Liquidity: Evidence from Cross

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

The Impact of Collateral

... impact markets Just as the deregulation of investment banks at the end of the last century had far-reaching effects over the two decades that followed, so today’s re-regulation of capital markets will prove to be yet another defining moment in history. Already, changing market liquidity is signallin ...

... impact markets Just as the deregulation of investment banks at the end of the last century had far-reaching effects over the two decades that followed, so today’s re-regulation of capital markets will prove to be yet another defining moment in history. Already, changing market liquidity is signallin ...

Market coupling - Houmoller Consulting ApS

... In EU, for the software calculating the spot prices, we must agree on common specifications in order to have a level playing field for the competition in The Single European Market. However, a country C outside EU may want only loose coupling to The Single European Electricity Market (at least i ...

... In EU, for the software calculating the spot prices, we must agree on common specifications in order to have a level playing field for the competition in The Single European Market. However, a country C outside EU may want only loose coupling to The Single European Electricity Market (at least i ...

Contract Law Through the Lens of Laissez-Faire

... principle of laissez-faire stood or fell with the nineteenth-century contractual synthesis of offer, acceptance and consideration.11 Lawrence Friedman found a still tighter connection between the two sets of principles. Basically, then, the "pure" law of contract is an area of what we can call abst ...

... principle of laissez-faire stood or fell with the nineteenth-century contractual synthesis of offer, acceptance and consideration.11 Lawrence Friedman found a still tighter connection between the two sets of principles. Basically, then, the "pure" law of contract is an area of what we can call abst ...

Table 1: Granger Causality Testing between Prices and Volumes

... Further support is provided by Wang (1994) on the basis of the diversity associated with the availability of information to different investors. Similar to the winner’s curse idea with IPO pricing, uninformed traders require a higher price discount when buying assets from informed traders due to the ...

... Further support is provided by Wang (1994) on the basis of the diversity associated with the availability of information to different investors. Similar to the winner’s curse idea with IPO pricing, uninformed traders require a higher price discount when buying assets from informed traders due to the ...

Can Risks Be Reduced in the Derivatives Market

... Promotion of OTC derivatives is also important in terms of balanced growth in the capital market. In U.S. financial markets, direct finance centered on the capital market is growing significantly. For balanced growth of the capital market, the securities, bonds, and derivatives markets should all gr ...

... Promotion of OTC derivatives is also important in terms of balanced growth in the capital market. In U.S. financial markets, direct finance centered on the capital market is growing significantly. For balanced growth of the capital market, the securities, bonds, and derivatives markets should all gr ...

Option traders use (very) sophisticated heuristics, never the Blackâ

... price options. Empirical regularities relating implied volatility to realized volatility, stock prices, and other implied volatilities (including the volatility skew), are qualitatively the same in both eras.” There was even active option arbitrage trading taking place between some of these markets. ...

... price options. Empirical regularities relating implied volatility to realized volatility, stock prices, and other implied volatilities (including the volatility skew), are qualitatively the same in both eras.” There was even active option arbitrage trading taking place between some of these markets. ...

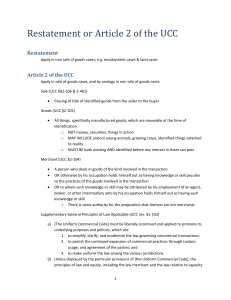

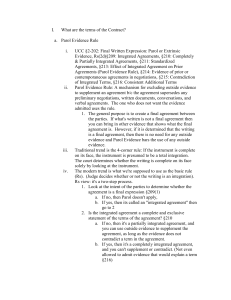

Contracts – Hull (2007-08) - St. Thomas More – Loyola Law School

... a) An offer to make a contract shall be construed as inviting acceptance in any manner and by any medium reasonable in the circumstances; b) An order or other offer to buy goods for prompt or current shipment shall be construed as inviting acceptance either by a prompt promise to ship or by the pro ...

... a) An offer to make a contract shall be construed as inviting acceptance in any manner and by any medium reasonable in the circumstances; b) An order or other offer to buy goods for prompt or current shipment shall be construed as inviting acceptance either by a prompt promise to ship or by the pro ...

Interest Rate Derivatives – Fixed Income Trading Strategies

... The Macaulay Duration was developed to analyze the change in the value – the sensitivity – of bonds and bond portfolios, for the purpose of hedging against adverse interest rate developments. As described, there is an inverse relationship between interest rates and the present value of bonds – the i ...

... The Macaulay Duration was developed to analyze the change in the value – the sensitivity – of bonds and bond portfolios, for the purpose of hedging against adverse interest rate developments. As described, there is an inverse relationship between interest rates and the present value of bonds – the i ...

1. Assignment – contract rights are assigned for value, occasionally

... d. Contra proferentem: against its author or profferer Specific terms and separately negotiated terms are given greater weight than general language and standardized terms, respectively (§203(c-d)) Interpret terms with the aid of any relevant course of performance, course of dealing and usage of tra ...

... d. Contra proferentem: against its author or profferer Specific terms and separately negotiated terms are given greater weight than general language and standardized terms, respectively (§203(c-d)) Interpret terms with the aid of any relevant course of performance, course of dealing and usage of tra ...

Managed Futures: Portfolio Diversification Opportunities

... As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign ...

... As the world’s leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign ...

Self-Study Guide to Hedging with Livestock Futures

... Futures Terminology The futures industry uses some terms that are very unique to this market, and some that are common to other markets. A few of the more important terms are described below; related terms are listed together for comparison and better understanding. The cash market is also known as ...

... Futures Terminology The futures industry uses some terms that are very unique to this market, and some that are common to other markets. A few of the more important terms are described below; related terms are listed together for comparison and better understanding. The cash market is also known as ...

Contracts Outline - NYU School of Law

... HOLDING: "In absence of a valid agreement to make payments for the rest of their lives, clearly the agreement was one revocable at the pleasure of the Δ... We merely have a gratuitous arrangement without consideration." PAST SERVICE or already-executed consideration can not serve as consideration. S ...

... HOLDING: "In absence of a valid agreement to make payments for the rest of their lives, clearly the agreement was one revocable at the pleasure of the Δ... We merely have a gratuitous arrangement without consideration." PAST SERVICE or already-executed consideration can not serve as consideration. S ...

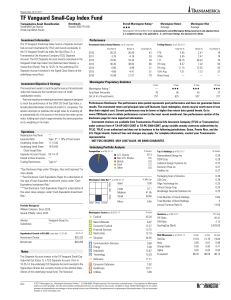

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

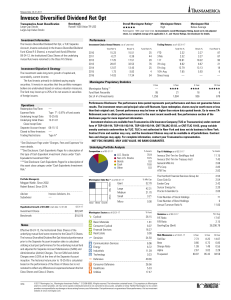

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

Financial Innovation, Collateral and Investment. Ana Fostel John Geanakoplos August 6, 2015

... Currently the outstanding notional value of CDS in the United States is far in excess of $50 trillion, more than three times the value of their underlying asset. ...

... Currently the outstanding notional value of CDS in the United States is far in excess of $50 trillion, more than three times the value of their underlying asset. ...

Pricing of Corporate Loan : Credit Risk and Liquidity cost

... than a retail loan contract. These options are designed to meet clients’ expectations and can include e.g., a prepayment option (which entitles the client, if he desires so, to pay all or a fraction of its loan earlier than the maturity), a multi-currency option, a multi-index option, etc. On the ot ...

... than a retail loan contract. These options are designed to meet clients’ expectations and can include e.g., a prepayment option (which entitles the client, if he desires so, to pay all or a fraction of its loan earlier than the maturity), a multi-currency option, a multi-index option, etc. On the ot ...

Market Makers

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

Using Financial Derivatives to Hedge Against Market

... instrument is perfectly divisible and there are no transaction costs or taxes. Assuming the availability of the required derivatives is quite common in the finance discipline, as they can either be created through financial engineering or they will be offered on the market if a demand exists. In pra ...

... instrument is perfectly divisible and there are no transaction costs or taxes. Assuming the availability of the required derivatives is quite common in the finance discipline, as they can either be created through financial engineering or they will be offered on the market if a demand exists. In pra ...

Natural and manmade disasters can be powerful leaning experiences

... such disruptions become a realistic possibility, it would be desirable for consumers to reduce consumption for a while, so that inventories can be built up as a precaution. If price is free to adjust, that is precisely what will happen. Suppliers of gasoline and other oil products know that if suppl ...

... such disruptions become a realistic possibility, it would be desirable for consumers to reduce consumption for a while, so that inventories can be built up as a precaution. If price is free to adjust, that is precisely what will happen. Suppliers of gasoline and other oil products know that if suppl ...

E-Margin is a leveraged trading facility. Positions

... off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ ...

... off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ ...

Ref No

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

Financial Market Shocks and the Macroeconomy

... In addition to including two types of firms, the model includes two types of investors, informed and uninformed, and two types of shocks. The first, a technology shock observed by the informed investors, affects the productivity of both the public and private firms. The second, which we describe as a ...

... In addition to including two types of firms, the model includes two types of investors, informed and uninformed, and two types of shocks. The first, a technology shock observed by the informed investors, affects the productivity of both the public and private firms. The second, which we describe as a ...