13 - Finance

... ROE = EAT equity = $13,500 $90,000 = 15% EPS = EAT number of shares = $13,500 9,000,000 = $1.50 The treasurer feels debt can be traded for equity without immediately affecting the price of the stock or the rate at which the firm can borrow. Management believes it is in the best interest of t ...

... ROE = EAT equity = $13,500 $90,000 = 15% EPS = EAT number of shares = $13,500 9,000,000 = $1.50 The treasurer feels debt can be traded for equity without immediately affecting the price of the stock or the rate at which the firm can borrow. Management believes it is in the best interest of t ...

PowerPoint Ch. 16

... parent’s books using Cost Method or Equity Method (investment eliminated in Consolidation) ...

... parent’s books using Cost Method or Equity Method (investment eliminated in Consolidation) ...

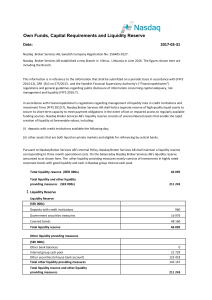

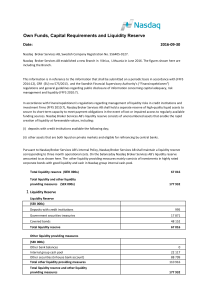

Own Funds, Capital Requirements and Liquidity Reserve

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

... funding sources. Nasdaq Broker Services AB’s liquidity reserve consists of unencumbered assets that enable the rapid creation of liquidity at foreseeable values, including: (i) deposits with credit institutions available the following day; (ii) other assets that are both liquid on private markets an ...

ch 4 financial study

... by readers who have "a reasonable knowledge of business and economic activities and accounting and who are willing to study the information."Financial statements may be used by users for different purposes: 1. Owners and managers require financial statements to make important business decisions that ...

... by readers who have "a reasonable knowledge of business and economic activities and accounting and who are willing to study the information."Financial statements may be used by users for different purposes: 1. Owners and managers require financial statements to make important business decisions that ...

Valuation of Securities

... it for three years and then sell. He thinks the price will be about $75 when he sells. What is the most Fred should be willing to pay for a share of Denhart today if he can earn 10% annually on investments of similar risk? a. $69.92 b. $61.23 c. $64.13 d. $71.20 ...

... it for three years and then sell. He thinks the price will be about $75 when he sells. What is the most Fred should be willing to pay for a share of Denhart today if he can earn 10% annually on investments of similar risk? a. $69.92 b. $61.23 c. $64.13 d. $71.20 ...

The Importance Of Using A Debtor`s Exact Name On A

... various Articles of the Uniform Commercial Code (including all secured transaction opinions) and negotiates and/or oversees the negotiation of all collateral related documents for the firm’s secured financing matters. Ms. Chernuchin participated in the Joint Task Force for the Legislative Enactment ...

... various Articles of the Uniform Commercial Code (including all secured transaction opinions) and negotiates and/or oversees the negotiation of all collateral related documents for the firm’s secured financing matters. Ms. Chernuchin participated in the Joint Task Force for the Legislative Enactment ...

Information Asymmetry within Financial Markets and Corporate

... as. It is emission inherent and could be estimated by means of financial liquidity values as long as they constitute an information asymmetry sustaining proxy. In turn, Bharath, Pasquariello and Wu (2009) have studied the influence of information asymmetry on firm-financing decisions. Actually, the ...

... as. It is emission inherent and could be estimated by means of financial liquidity values as long as they constitute an information asymmetry sustaining proxy. In turn, Bharath, Pasquariello and Wu (2009) have studied the influence of information asymmetry on firm-financing decisions. Actually, the ...

chapter 5

... the historical purchase price of the buildings and equipment that the firm owns. Even though the firm will probably buy and sell (or otherwise dispose of) many pieces of equipment, ...

... the historical purchase price of the buildings and equipment that the firm owns. Even though the firm will probably buy and sell (or otherwise dispose of) many pieces of equipment, ...

View Week 9 Presentation

... Working Capital • Current Assets – Current Liabilities • Working capital measures how much in liquid assets a company has available to build its business. The number can be positive or negative, depending on how much debt the company is carrying. In general, companies that have a lot of working cap ...

... Working Capital • Current Assets – Current Liabilities • Working capital measures how much in liquid assets a company has available to build its business. The number can be positive or negative, depending on how much debt the company is carrying. In general, companies that have a lot of working cap ...

CHAPTER 15 Corporations: Dividends, Retained Earnings, and

... • Pro rata distribution to stockholders of the corporation’s own stock – results in a decrease in retained earnings and an increase in paid-in capital – at a minimum, the par or stated value must be assigned to the dividend shares; in most cases, however, fair market value is used ...

... • Pro rata distribution to stockholders of the corporation’s own stock – results in a decrease in retained earnings and an increase in paid-in capital – at a minimum, the par or stated value must be assigned to the dividend shares; in most cases, however, fair market value is used ...

Capital structure: the Modigliani and Miller theorem, impact of taxes

... Corp. Fin. II will focus on the issues of financial contracting and corporate governance. It will discuss the ways in which financial contracts (financial structure) and control mechanisms (i.e. corporate governance) should be designed so as to mitigate the conflicts between insiders and outsiders i ...

... Corp. Fin. II will focus on the issues of financial contracting and corporate governance. It will discuss the ways in which financial contracts (financial structure) and control mechanisms (i.e. corporate governance) should be designed so as to mitigate the conflicts between insiders and outsiders i ...

Classic-Growth Stocks

... 1. In the corporate life cycle, classic-growth companies fit between: a. Aggressive-growth and speculative-growth companies. b. Slow-growth and aggressive-growth companies. c. Slow-growth and speculative-growth companies. B is Correct. The typical pattern is for a company to drift down from aggressi ...

... 1. In the corporate life cycle, classic-growth companies fit between: a. Aggressive-growth and speculative-growth companies. b. Slow-growth and aggressive-growth companies. c. Slow-growth and speculative-growth companies. B is Correct. The typical pattern is for a company to drift down from aggressi ...

key assumptions - Fisher College of Business

... The stock market's relative performance versus other investment assets is a function of stock market dividends, earnings growth, and valuation measures. Dividend and earnings growth are driven by growth in corporate earnings, which is, primarily, a function of certain macroeconomic factors. Most imp ...

... The stock market's relative performance versus other investment assets is a function of stock market dividends, earnings growth, and valuation measures. Dividend and earnings growth are driven by growth in corporate earnings, which is, primarily, a function of certain macroeconomic factors. Most imp ...