Irrecoverable Debts

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...

4.7 the role of international debt

... another country or financial institution in another country as a result from loans. Debt servicing is a term used for the obligation of making regular payments of debt (loans + interest). LDCs have to borrow money from other countries or commercial institutions because… ...

... another country or financial institution in another country as a result from loans. Debt servicing is a term used for the obligation of making regular payments of debt (loans + interest). LDCs have to borrow money from other countries or commercial institutions because… ...

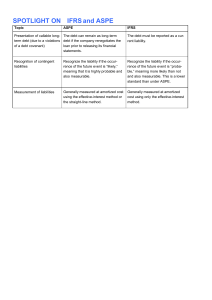

SPOTLIGHT ON*IFRS and ASPE

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

Recent changes in the debt sustainability framework

... Debt relief under HIPC and MDRI has substantially alleviated debt burdens in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

... Debt relief under HIPC and MDRI has substantially alleviated debt burdens in recipient countries and has enabled them to increase their povertyreducing expenditure by almost three and a half percentage points of GDP between 2001 and 2012 ...

Managing Banking Relationships

... companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administrators in relation to loans which they have purchased. In our experience, there is a significant variance between many of the loan acquirer’s objectives and how the ...

... companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administrators in relation to loans which they have purchased. In our experience, there is a significant variance between many of the loan acquirer’s objectives and how the ...

Lidy Nacpil - Jubilee South Asia Pacific Movement on - UN-NGLS

... and investment policies and agreements contribute significantly to huge net resource transfers from developing countries to developed countries. These form part of the roots of development financing deficit, which then serves as the backdrop, basis and justification for over-reliance on borrowing, ...

... and investment policies and agreements contribute significantly to huge net resource transfers from developing countries to developed countries. These form part of the roots of development financing deficit, which then serves as the backdrop, basis and justification for over-reliance on borrowing, ...

Chapter 12.1: Bankruptcy

... Creditors cannot sue at this point Debit/credit cards can no longer be used once a petition has been filed. ...

... Creditors cannot sue at this point Debit/credit cards can no longer be used once a petition has been filed. ...

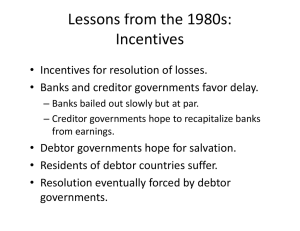

Lessons from the 1980s: Incentives • Incentives for resolution of losses.

... • Residents of debtor countries suffer. • Resolution eventually forced by debtor governments. ...

... • Residents of debtor countries suffer. • Resolution eventually forced by debtor governments. ...

PowerPoint-Präsentation

... of GDP in 2013 and decline only to 152 percent of GDP by end-2020 and to 130 percent of GDP by end-2030. … Greece would not return to the market until 2021 … cumulatively official additional financing needs (beyond what remains in the present program, and including the eventual rollover of existing ...

... of GDP in 2013 and decline only to 152 percent of GDP by end-2020 and to 130 percent of GDP by end-2030. … Greece would not return to the market until 2021 … cumulatively official additional financing needs (beyond what remains in the present program, and including the eventual rollover of existing ...

Paris Club

The Paris Club (French: Club de Paris) is an informal group of officials from creditor countries whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries. As debtor countries undertake reforms to stabilize and restore their macroeconomic and financial situation, Paris Club creditors provide an appropriate debt treatment. Paris Club creditors provide debt treatments to debtor countries in the form of rescheduling, which is debt relief by postponement or, in the case of concessional rescheduling, reduction in debt service obligations during a defined period (flow treatment) or as of a set date (stock treatment).The Paris Club was created gradually from 1956, when the first negotiation between Argentina and its public creditors took place in Paris. The Paris Club treats public claims, that is to say, those due by governments of debtor countries and by the private sector, guaranteed by the public sector to Paris Club members. A similar process occurs for public debt held by private creditors in the London Club, which was organized in 1970 on the model of the Paris Club is an informal group of commercial banks meet to renegotiate the debt they hold on sovereign debtors.Creditor countries meet ten times a year in Paris for Tour d'Horizon and negotiating sessions, chaired by the Director of the General Directorate of the Treasury of the French Ministry of Finance and Public Accounts.Since 1983 and until May 2014, the Paris Club has signed more than 430 agreements covering 90 debtor countries over 583 billion of dollars.