Thank you for joining me. Over the next half hour

... reasons. The Fed will also evaluate measures of financial stability. The market view we’re showing here is a more collective representation of expectations based on all of these factors. As with the Taylor rule, these market forward curves suggest there will be a headwind for bonds, so investors sho ...

... reasons. The Fed will also evaluate measures of financial stability. The market view we’re showing here is a more collective representation of expectations based on all of these factors. As with the Taylor rule, these market forward curves suggest there will be a headwind for bonds, so investors sho ...

Financially Speaking

... periods of time the equity risk premium, loosely defined as the extra return investors expect from equities over bonds, has been stable. Therefore, low interest rates ultimately imply higher prices for growth assets, which ultimately flow through to lower prospective returns. It’s fairly easy to justi ...

... periods of time the equity risk premium, loosely defined as the extra return investors expect from equities over bonds, has been stable. Therefore, low interest rates ultimately imply higher prices for growth assets, which ultimately flow through to lower prospective returns. It’s fairly easy to justi ...

Chapter 8

... • Buyer of a Put: (see Exhibit 8.5) – The basic terms of this example are similar to those just illustrated with the call – The buyer of a put option, however, wants to be able to sell the underlying currency at the exercise price when the market price of that currency drops (not rises as in the cas ...

... • Buyer of a Put: (see Exhibit 8.5) – The basic terms of this example are similar to those just illustrated with the call – The buyer of a put option, however, wants to be able to sell the underlying currency at the exercise price when the market price of that currency drops (not rises as in the cas ...

answers to "do you understand" text questions

... 1. Describe the likely consequences for GDP growth when the FOMC directs the trading desk at the New York Fed to sell Treasury securities. Solution: Selling securities reduces bank reserves, money market liquidity, the bank's availability of funds, and might increase interest rates, serving the slow ...

... 1. Describe the likely consequences for GDP growth when the FOMC directs the trading desk at the New York Fed to sell Treasury securities. Solution: Selling securities reduces bank reserves, money market liquidity, the bank's availability of funds, and might increase interest rates, serving the slow ...

Finding Opportunities — Tackling today`s uncertain

... Dividends can play a central role in today’s uncertain times. To meet return goals in previous markets, many investors relied on price appreciation and/or higher fixedincome yields. However, today’s stock market volatility and historically low interest rates have discouraged these approaches. Here, ...

... Dividends can play a central role in today’s uncertain times. To meet return goals in previous markets, many investors relied on price appreciation and/or higher fixedincome yields. However, today’s stock market volatility and historically low interest rates have discouraged these approaches. Here, ...

The Impact of AI and Technology on Financial Services

... development of “FinTech”. Technological developments will provide automated personalised financial advice, more efficient clearing and settlement processes and easier payment methods for consumers. Financial institutions should view these developments (three of which we explore below) as an opportun ...

... development of “FinTech”. Technological developments will provide automated personalised financial advice, more efficient clearing and settlement processes and easier payment methods for consumers. Financial institutions should view these developments (three of which we explore below) as an opportun ...

Recovered File 1

... time (principal) when the time from contract to maturity is fixed and predetermined; presented as a percentage of the face value. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly one year. What is the interest rate? Answer: Maturity time is exactly one year, it is fixe ...

... time (principal) when the time from contract to maturity is fixed and predetermined; presented as a percentage of the face value. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly one year. What is the interest rate? Answer: Maturity time is exactly one year, it is fixe ...

October 2016 - Solent Raymond James Investment Services

... There is no assurance that any investment strategy will be successful. Investing involves risks including the possible loss of capital. Dividends are not guaranteed and will fluctuate. There is no assurance any of the trends mentioned will continue or forecasts will occur. Asset allocation and diver ...

... There is no assurance that any investment strategy will be successful. Investing involves risks including the possible loss of capital. Dividends are not guaranteed and will fluctuate. There is no assurance any of the trends mentioned will continue or forecasts will occur. Asset allocation and diver ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: The Financial Effects of Inflation

... Such items do not solve the problem of hedging against inflation for financial institutions and most investors, however. (5) Contrary to the presupposition that inflation causes a shift from fixed-dollar to real assets, household saving has increased largely in the form of financial assets, apparent ...

... Such items do not solve the problem of hedging against inflation for financial institutions and most investors, however. (5) Contrary to the presupposition that inflation causes a shift from fixed-dollar to real assets, household saving has increased largely in the form of financial assets, apparent ...

FINAL EXAM—REVIEW SHEET (This sheet, while not all inclusive

... Know the uses and limitations of ratio analysis. Chapter 3 Know what a financial market is and what types of financial markets exist. Understand what a financial intermediary is and what some of the more common financial intermediaries are. Understand what an investment banker is and the ser ...

... Know the uses and limitations of ratio analysis. Chapter 3 Know what a financial market is and what types of financial markets exist. Understand what a financial intermediary is and what some of the more common financial intermediaries are. Understand what an investment banker is and the ser ...

Consumption, Savings & Investment

... Expected future income Wealth and Real interest rate ...

... Expected future income Wealth and Real interest rate ...

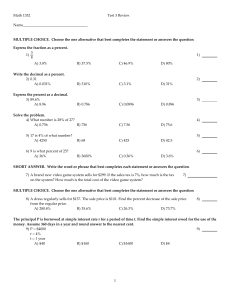

Math 1332 T3Rs11 - HCC Learning Web

... Solve the problem. Round answers to the nearest dollar. 15) The cost of a home entertainment center is $3800. We can finance this by paying $300 down and $309.17 per month for 12 months. Determine a. the amount financed; b. the total installment price; c. the finance charge. A) a. amount financed: ...

... Solve the problem. Round answers to the nearest dollar. 15) The cost of a home entertainment center is $3800. We can finance this by paying $300 down and $309.17 per month for 12 months. Determine a. the amount financed; b. the total installment price; c. the finance charge. A) a. amount financed: ...

Investing in Bond Funds - Round Table Wealth Management

... will rise at some point (although central banks continue to project supporting lower interest rates for some period of time), many investors have taken the defensive position of reducing the average maturity and duration of their fixed income portfolios in an attempt to guard against rising rates. A ...

... will rise at some point (although central banks continue to project supporting lower interest rates for some period of time), many investors have taken the defensive position of reducing the average maturity and duration of their fixed income portfolios in an attempt to guard against rising rates. A ...

Shopaholic Credit Case Study - socialsciences dadeschools net

... How do consumers effectively choose quality goods and services at an affordable cost? Why should consumers use practical reasoning when approaching spending habits? Learning Goals/Objectives Identify the opportunity cost in examples of personal decision making. Understand that spending is ex ...

... How do consumers effectively choose quality goods and services at an affordable cost? Why should consumers use practical reasoning when approaching spending habits? Learning Goals/Objectives Identify the opportunity cost in examples of personal decision making. Understand that spending is ex ...

Short-Term Income Fund - Investor Fact Sheet

... maturity of debt securities held in the fund. Weighted Average Effective Duration (sometimes called “Option-Adjusted Duration”) is a measure of a security’s price sensitivity to changes in interest rates calculated using a model that recognizes that the probability of a bond being called or remainin ...

... maturity of debt securities held in the fund. Weighted Average Effective Duration (sometimes called “Option-Adjusted Duration”) is a measure of a security’s price sensitivity to changes in interest rates calculated using a model that recognizes that the probability of a bond being called or remainin ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... Why Economists Need Credit Market Position Data ...

... Why Economists Need Credit Market Position Data ...

Five Over Five - Research and Perspectives

... …But with the Potential for Bumps Along the Way While slow but steady growth is our base case, it carries some significant risks. Will the U.S., in its seventh year of expansion, go into recession over the next five years? The longest expansion on record was 10 years―so although we don't expect a re ...

... …But with the Potential for Bumps Along the Way While slow but steady growth is our base case, it carries some significant risks. Will the U.S., in its seventh year of expansion, go into recession over the next five years? The longest expansion on record was 10 years―so although we don't expect a re ...

money - People

... • Say Fed sets the total quantity of money at Ma. • Then people will try to shift assets out of less liquid accounts into liquid money accounts as long as the rate of interest is less than Ra… • or in reverse, buy nonliquid assets (bonds) whenever the rate of interest is greater ...

... • Say Fed sets the total quantity of money at Ma. • Then people will try to shift assets out of less liquid accounts into liquid money accounts as long as the rate of interest is less than Ra… • or in reverse, buy nonliquid assets (bonds) whenever the rate of interest is greater ...