Advertising and Issuing Credit Online

... would take the consumer to the disclosures, but the consumer need not be required to scroll completely through the disclosures; or – On the same Web page as the application without necessarily appearing on the initial screen, immediately preceding the button that the consumer will click to submit th ...

... would take the consumer to the disclosures, but the consumer need not be required to scroll completely through the disclosures; or – On the same Web page as the application without necessarily appearing on the initial screen, immediately preceding the button that the consumer will click to submit th ...

SVP-SV and Rising Interest Rates.indd

... CV ratio above 100% (a market value surplus). This ratio often receives attention because it is easily quantifiable and stable value strategies have exhibited surpluses over much of the last two decades due to the secular decline in market interest rates. While gains are not without merit, this is n ...

... CV ratio above 100% (a market value surplus). This ratio often receives attention because it is easily quantifiable and stable value strategies have exhibited surpluses over much of the last two decades due to the secular decline in market interest rates. While gains are not without merit, this is n ...

Plunder Blunder Cover Mech.indd

... There’s nothing natural or inevitable about financial bubbles. They aren’t like hurricanes or earthquakes. In fact, the stock- and housing-market bubbles of the last decade are largely the culmination of very human policy choices that began in the early 1980s. For most of the three decades before th ...

... There’s nothing natural or inevitable about financial bubbles. They aren’t like hurricanes or earthquakes. In fact, the stock- and housing-market bubbles of the last decade are largely the culmination of very human policy choices that began in the early 1980s. For most of the three decades before th ...

words

... investment securities and warrants of $26.0m2,3 Net interest income: +5.6% and +4 bps improvement to net interest margin Average total client funds1: + 3.8% Average fixed income securities: +2.7% 1. Total Client Funds refers to the sum of on-balance sheet deposits and off-balance sheet client invest ...

... investment securities and warrants of $26.0m2,3 Net interest income: +5.6% and +4 bps improvement to net interest margin Average total client funds1: + 3.8% Average fixed income securities: +2.7% 1. Total Client Funds refers to the sum of on-balance sheet deposits and off-balance sheet client invest ...

ESTIMATINg pROBABILITY Of DEfAULT AND COMpARINg IT TO

... highly countercyclical and it seems more tightly related to credit growth than to GDP growth. As shown by Bonfim (2009), Jimenez and Saurina (2006) and others, most of the credit risk is built up during periods of strong credit growth when banks apply looser credit standards. This risk materializes ...

... highly countercyclical and it seems more tightly related to credit growth than to GDP growth. As shown by Bonfim (2009), Jimenez and Saurina (2006) and others, most of the credit risk is built up during periods of strong credit growth when banks apply looser credit standards. This risk materializes ...

Minimum Revenue Provision (MRP) Strategy for 2016/2017

... charge referred to as the Minimum Revenue Provision (MRP), although it is also allowed to undertake additional voluntary payments (VRP). 3.6.4.2 Department for Communities and Local Government (CLG) Regulations have been issued which require the full Council to approve an Annual Minimum Revenue Prov ...

... charge referred to as the Minimum Revenue Provision (MRP), although it is also allowed to undertake additional voluntary payments (VRP). 3.6.4.2 Department for Communities and Local Government (CLG) Regulations have been issued which require the full Council to approve an Annual Minimum Revenue Prov ...

The Determinants of the Bank`s Excess Liquidity and the Credit Crisis

... (1971), Frost (1971) and Baltensperger (1974) 4 and the surveys of Baltensperger (1980) and Santomero (1984). Allen (1998), Nautz (1998), Dow Jr. (2001), Selgin (2001), Heller and Lengwiler (2003) and Bindseil et al. (2004) presented new applications of traditional models5. According to the reserve ...

... (1971), Frost (1971) and Baltensperger (1974) 4 and the surveys of Baltensperger (1980) and Santomero (1984). Allen (1998), Nautz (1998), Dow Jr. (2001), Selgin (2001), Heller and Lengwiler (2003) and Bindseil et al. (2004) presented new applications of traditional models5. According to the reserve ...

Why does Brazil’s banking sector need public banks?

... its objectives of financial stability and to provide funding for development and financing for innovation. Second, to the extent that the financial structure that emerged in the USA in the past 30 years failed to provide support for the development of the economy and to improve living standards, an ...

... its objectives of financial stability and to provide funding for development and financing for innovation. Second, to the extent that the financial structure that emerged in the USA in the past 30 years failed to provide support for the development of the economy and to improve living standards, an ...

The User Cost of Low-Income Homeownership

... low-income borrowers may be less financially literate and thus prone to making financial mistakes. Second, as noted by Oulton (2007), the choice of an ex ante or ex post approach to measuring the user cost of capital is best informed by what one is trying to accomplish. In historical growth accounti ...

... low-income borrowers may be less financially literate and thus prone to making financial mistakes. Second, as noted by Oulton (2007), the choice of an ex ante or ex post approach to measuring the user cost of capital is best informed by what one is trying to accomplish. In historical growth accounti ...

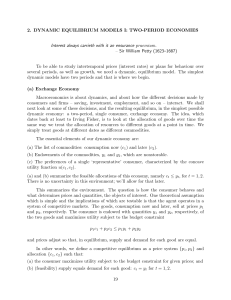

Exchange Rate Policies at the Zero Lower Bound

... raise the real domestic interest rate above the foreign one. However, when operating at the ZLB, the Central Bank can defend its exchange rate policy and maintain the domestic real rate above the foreign on. There are also limits in this case: at the ZLB, the Central Bank cannot raise the nominal in ...

... raise the real domestic interest rate above the foreign one. However, when operating at the ZLB, the Central Bank can defend its exchange rate policy and maintain the domestic real rate above the foreign on. There are also limits in this case: at the ZLB, the Central Bank cannot raise the nominal in ...

FREE Sample Here - Find the cheapest test bank for your

... 9. What factors are encouraging financial institutions to offer overlapping financial services such as banking, investment banking, brokerage, etc.? I. Regulatory changes allowing institutions to offer more services II. Technological improvements reducing the cost of providing financial services III ...

... 9. What factors are encouraging financial institutions to offer overlapping financial services such as banking, investment banking, brokerage, etc.? I. Regulatory changes allowing institutions to offer more services II. Technological improvements reducing the cost of providing financial services III ...

Here - Personal.psu.edu

... raised its short-term interest rate five times, or a total of 1.75 percentage points, to 4.75%. The Greenspan Fed had a long tradition of moving in small increments, hoping to give officials time to assess the impact on corporate borrowing or consumer spending before moving again. Changing rates too ...

... raised its short-term interest rate five times, or a total of 1.75 percentage points, to 4.75%. The Greenspan Fed had a long tradition of moving in small increments, hoping to give officials time to assess the impact on corporate borrowing or consumer spending before moving again. Changing rates too ...

stability report

... risk. Credit quality seems to vary across the sectors within the banks’ credit portfolio which may amplify the chances for a build-up of systemic risk within sectors that are highly leveraged or have a high credit concentration ratio. The insurance sector has also witnessed a substantial recovery in ...

... risk. Credit quality seems to vary across the sectors within the banks’ credit portfolio which may amplify the chances for a build-up of systemic risk within sectors that are highly leveraged or have a high credit concentration ratio. The insurance sector has also witnessed a substantial recovery in ...

Monetary Policy Statement September 2007 Contents

... from the interest rate increases undertaken earlier this year. However, in the short-term, CPI inflation is likely to rise due to the effects of a lower exchange rate and higher food prices. It is important that this temporary increase in inflation does not affect price or wage setting behaviour in ...

... from the interest rate increases undertaken earlier this year. However, in the short-term, CPI inflation is likely to rise due to the effects of a lower exchange rate and higher food prices. It is important that this temporary increase in inflation does not affect price or wage setting behaviour in ...

Financial Stability Review Contents

... revenue growth of many banks remains subdued, as credit growth is still quite weak. The return to profitability since the crisis has helped banks to strengthen their capital positions, and some have also been able to repay the public capital that was injected into them during the crisis. While this ...

... revenue growth of many banks remains subdued, as credit growth is still quite weak. The return to profitability since the crisis has helped banks to strengthen their capital positions, and some have also been able to repay the public capital that was injected into them during the crisis. While this ...

here. - DePaul University

... Creditworthy customers will pay promptly so as to get any available discounts while risky customers will find the price of trade credit to be attractive relative to other options. The supplier also discriminates in favor of the risky firm because the supplier holds an implicit equity stake in the cu ...

... Creditworthy customers will pay promptly so as to get any available discounts while risky customers will find the price of trade credit to be attractive relative to other options. The supplier also discriminates in favor of the risky firm because the supplier holds an implicit equity stake in the cu ...

Bond Premiums and the Natural Real Rate of Interest

... mix of financial conditions consistent with maximum sustainable employment and stable prices.” Similarly, a joint paper by Taylor and Federal Reserve Bank of San Francisco President Williams suggests shortterm policy rates may need to be lowered to offset increases in risk spreads following the rece ...

... mix of financial conditions consistent with maximum sustainable employment and stable prices.” Similarly, a joint paper by Taylor and Federal Reserve Bank of San Francisco President Williams suggests shortterm policy rates may need to be lowered to offset increases in risk spreads following the rece ...

exam1

... 10. (03 Points) Suppose a forward contract is used as a fair value foreign currency hedge of an asset denominated in Mexican pesos. Hedge effectiveness is judged by comparing changes in the fair value of the forward contract with changes in the fair value of the U.S. dollar vis-à-vis the peso. What ...

... 10. (03 Points) Suppose a forward contract is used as a fair value foreign currency hedge of an asset denominated in Mexican pesos. Hedge effectiveness is judged by comparing changes in the fair value of the forward contract with changes in the fair value of the U.S. dollar vis-à-vis the peso. What ...

Franck-Daphis-Presentation-AGM-2016

... Issues: Mostly relevant to commercial Institutions - In countries where microfinance flourishes secondary mortgage markets typically do not exist - Private investors have yet to see “bundled” housing loans for low ...

... Issues: Mostly relevant to commercial Institutions - In countries where microfinance flourishes secondary mortgage markets typically do not exist - Private investors have yet to see “bundled” housing loans for low ...