Assessing Discount Rate for a Project Financed Entirely with Equity

... estimation is done through a regression of historical returns for the analyzed asset on historical returns of market index. This procedure implies some inconvenient: the period chosen for computing historical returns (a longer period offers more information, but implies more changes in the structure ...

... estimation is done through a regression of historical returns for the analyzed asset on historical returns of market index. This procedure implies some inconvenient: the period chosen for computing historical returns (a longer period offers more information, but implies more changes in the structure ...

The Decoupling of Treasury Yields and the Cost of Equity for Public

... rates of return in models like the Capital Asset Pricing Model. The calculation of the historic premium measures the difference in expected return as between the S&P 500 index and longterm US treasury bonds. For example, if on average the historic S&P 500 return were 12% annually, while long-term tr ...

... rates of return in models like the Capital Asset Pricing Model. The calculation of the historic premium measures the difference in expected return as between the S&P 500 index and longterm US treasury bonds. For example, if on average the historic S&P 500 return were 12% annually, while long-term tr ...

CHAPTER 18

... A share for share exchange occurs when a purchasing corporation acquires the shares of another corporation (from the existing shareholders) and the payment to the vendors consist entirely of shares issued by the purchasing corporation. When this occurs, and provided that certain other conditions are ...

... A share for share exchange occurs when a purchasing corporation acquires the shares of another corporation (from the existing shareholders) and the payment to the vendors consist entirely of shares issued by the purchasing corporation. When this occurs, and provided that certain other conditions are ...

to view Full text

... years. Around 80% of its business involves broking like trading of equity, commodity, currency, mutual funds, fixed income securities and tax saving products and remaining 20% of its business involves educating their customers about financial market through articles in magazines and hedge schools. I ...

... years. Around 80% of its business involves broking like trading of equity, commodity, currency, mutual funds, fixed income securities and tax saving products and remaining 20% of its business involves educating their customers about financial market through articles in magazines and hedge schools. I ...

Zest Interims 2009 PDF

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

Fair Value: Fact or Opinion

... how the market prices “similar” or ‘comparable” assets. Philosophical Basis: The intrinsic value of an asset is impossible (or close to impossible) to estimate. The value of an asset is whatever the market is willing to pay for it (based upon its characteristics) Information Needed: To do a relative ...

... how the market prices “similar” or ‘comparable” assets. Philosophical Basis: The intrinsic value of an asset is impossible (or close to impossible) to estimate. The value of an asset is whatever the market is willing to pay for it (based upon its characteristics) Information Needed: To do a relative ...

The Equity Premium Stock and Bond Returns since 1802

... option, which gave the federal government the right to redeem the principal in either gold or silver. This option may have biased the yields on federal government bonds upward.16 There is another reason why municipal bond yields should sometimes be substituted for federal government bonds. From the ...

... option, which gave the federal government the right to redeem the principal in either gold or silver. This option may have biased the yields on federal government bonds upward.16 There is another reason why municipal bond yields should sometimes be substituted for federal government bonds. From the ...

as PDF for Printing

... companies within the financial services and consumer discretionary sectors and its performance may suffer if these sectors underperform the overall stock market. Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinv ...

... companies within the financial services and consumer discretionary sectors and its performance may suffer if these sectors underperform the overall stock market. Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinv ...

Actuarial Appraisal Value - Actuarial Considerations in Insurance

... generated from a carefully crafted, internally consistent set of assumptions designed to produce best-estimate future cash flows from the seller’s perspective. Different potential investors will typically come to their own conclusions as to what constitutes best estimate assumptions. All things bein ...

... generated from a carefully crafted, internally consistent set of assumptions designed to produce best-estimate future cash flows from the seller’s perspective. Different potential investors will typically come to their own conclusions as to what constitutes best estimate assumptions. All things bein ...

1.0 Introduction The modern engineering science has perhaps led

... quite the same in principle, they tend to differ on application where each industry, or company in further micro terms, looks at business in a different manner and outlook the future through their own perspective. Orit Gadiesh and James L. Gilbert (1998) outline a simple four-step model that could ...

... quite the same in principle, they tend to differ on application where each industry, or company in further micro terms, looks at business in a different manner and outlook the future through their own perspective. Orit Gadiesh and James L. Gilbert (1998) outline a simple four-step model that could ...

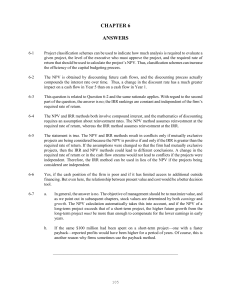

Ch 6

... The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the required rate of return, whereas use of the IRR method implies the opportunity to reinvest at the IRR. All independent projects with an NPV > $0 should be invested in by the firm. A ...

... The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the required rate of return, whereas use of the IRR method implies the opportunity to reinvest at the IRR. All independent projects with an NPV > $0 should be invested in by the firm. A ...

Statement of Cash Flows Statement of Cash Flows

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

Wheeler Real Estate Investment Trust, Inc. (Form: 8-K

... 1934, both as amended (the “Exchange Act”), with respect to the Company's expectation for future periods. Although the Company believes that the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be ach ...

... 1934, both as amended (the “Exchange Act”), with respect to the Company's expectation for future periods. Although the Company believes that the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be ach ...

A Framework for the use of Discount Rates in Actuarial Work

... liability is approached from the viewpoint of how the liability is going to be financed and so the discount rate is often based on the expected returns from an agreed investment strategy. Matching calculations can be particularly appropriate for transactional work. This includes the calculation of l ...

... liability is approached from the viewpoint of how the liability is going to be financed and so the discount rate is often based on the expected returns from an agreed investment strategy. Matching calculations can be particularly appropriate for transactional work. This includes the calculation of l ...

Mr Madoff`s Amazing Returns: An analysis of the Split Strike

... financed in the first place from the risk free investment of the net option premiums and if that is not enough by selling enough shares of the Index. It is assumed that all available monies are invested in the Index at the start of the second month and the same option strategy is implemented. This ...

... financed in the first place from the risk free investment of the net option premiums and if that is not enough by selling enough shares of the Index. It is assumed that all available monies are invested in the Index at the start of the second month and the same option strategy is implemented. This ...

An Experienced View on Markets and Investing

... current value of liabilities because the sponsor discounts the liability stream at the assumed expected return on the risky assets held by the fund. The sponsor should be discounting the liabilities at the expected return implied by the risk of the liabilities, not the expected return on the assets. ...

... current value of liabilities because the sponsor discounts the liability stream at the assumed expected return on the risky assets held by the fund. The sponsor should be discounting the liabilities at the expected return implied by the risk of the liabilities, not the expected return on the assets. ...

Chapter 3

... Net Present Value Example Should you invest $60,000 in a project that will return $15,000 per year for five years? You have a minimum return of 8% and expect inflation to hold steady at 3% over the next five years. ...

... Net Present Value Example Should you invest $60,000 in a project that will return $15,000 per year for five years? You have a minimum return of 8% and expect inflation to hold steady at 3% over the next five years. ...

Trading Is Hazardous to Your Wealth: The Common Stock

... 11 percent as active. Sampled households were required to have an open account with the discount brokerage firm during 1991. Roughly half of the accounts in our analysis were opened prior to 1987 and half were opened between 1987 and 1991. In this research, we focus on the common stock investments o ...

... 11 percent as active. Sampled households were required to have an open account with the discount brokerage firm during 1991. Roughly half of the accounts in our analysis were opened prior to 1987 and half were opened between 1987 and 1991. In this research, we focus on the common stock investments o ...

Chapter 12: The Cost of Capital

... Example: You can issue preferred stock for a net price of $42 and the preferred stock pays a ...

... Example: You can issue preferred stock for a net price of $42 and the preferred stock pays a ...

intermediate-financial-management-10th-edition

... the real PG&E actually did. The moral of the story is that the CAPM, like other cost of capital estimating techniques, can be dangerous if used without care and judgment. One final point on all this: The utilities are regulated, and regulators estimate their cost of capital and use it as a basis for ...

... the real PG&E actually did. The moral of the story is that the CAPM, like other cost of capital estimating techniques, can be dangerous if used without care and judgment. One final point on all this: The utilities are regulated, and regulators estimate their cost of capital and use it as a basis for ...

Fund Facts

... you hold. We do not make an additional charge for asset allocation advice, or an overall portfolio charge • See the table on the next page to show the costs associated with each fund ...

... you hold. We do not make an additional charge for asset allocation advice, or an overall portfolio charge • See the table on the next page to show the costs associated with each fund ...

Markowitz and the Expanding Definition of Risk: Applications of Multi

... value of zi . Given upper bounds, the solution involves the maximum allowable holding of the most attractive security, plus the maximum allowable holding of the next most attractive until all funds have been invested. The simplest case arises when the proportion invested in each security can be no m ...

... value of zi . Given upper bounds, the solution involves the maximum allowable holding of the most attractive security, plus the maximum allowable holding of the next most attractive until all funds have been invested. The simplest case arises when the proportion invested in each security can be no m ...