Utility Cost of Capital

... • This model suggests that utilities be allowed an ROE similar to the ROEs made by low-risk unregulated companies • Sounds promising – sounds like it would provide the comparable returns available in the market, BUT… • Comparable earnings provide what companies are making on their book value of equi ...

... • This model suggests that utilities be allowed an ROE similar to the ROEs made by low-risk unregulated companies • Sounds promising – sounds like it would provide the comparable returns available in the market, BUT… • Comparable earnings provide what companies are making on their book value of equi ...

accounting and market based risk measures as predictors of bank

... volatility is related to historical equity volatility or implied volatility from equity options. Agusman, Monroe, Gasbarro, Zumwalt (2008) display that the decision for the risk evaluation between market and accounting measures is based on the conditions and on its objective. Specifically, if a well ...

... volatility is related to historical equity volatility or implied volatility from equity options. Agusman, Monroe, Gasbarro, Zumwalt (2008) display that the decision for the risk evaluation between market and accounting measures is based on the conditions and on its objective. Specifically, if a well ...

The Impact of Skewness and Fat Tails on the Asset Allocation Decision

... Many assets’ return distributions are asymmetrical. In other words, the distribution is skewed to the left (or occasionally the right) of the mean (expected) value. In addition, most asset return distributions are more leptokurtic, or fatter tailed, than are normal distributions. The normal distribu ...

... Many assets’ return distributions are asymmetrical. In other words, the distribution is skewed to the left (or occasionally the right) of the mean (expected) value. In addition, most asset return distributions are more leptokurtic, or fatter tailed, than are normal distributions. The normal distribu ...

Investment Strategy Considerations for Inflation

... Market Inflation Expectations The difference between nominal bond yields and real yields on real return bonds (of similar term) is referred to as break-even inflation over the particular term of the bonds, and reflects two factors: • Expected Inflation: the level of inflation investors expect will ...

... Market Inflation Expectations The difference between nominal bond yields and real yields on real return bonds (of similar term) is referred to as break-even inflation over the particular term of the bonds, and reflects two factors: • Expected Inflation: the level of inflation investors expect will ...

How suitable is the Fama-French ve-factor model for

... According to asset pricing theory, assets earn risk premiums when they are exposed to underlying systematic risk factors. It is however still an unanswered question what these risk factors are. The research around this topic can be split into two groups. First, there are theoretical approaches tryin ...

... According to asset pricing theory, assets earn risk premiums when they are exposed to underlying systematic risk factors. It is however still an unanswered question what these risk factors are. The research around this topic can be split into two groups. First, there are theoretical approaches tryin ...

stock and mutual financial firms - American Risk and Insurance

... original high-wealth owners selling their claims to others with low wealth is reduced when the owner’s wealth is illiquid. Capital divisibility, and liquidity related capital costs, both relevant issues in this work, have not entered prior analyses. The financial institutions literature contains ma ...

... original high-wealth owners selling their claims to others with low wealth is reduced when the owner’s wealth is illiquid. Capital divisibility, and liquidity related capital costs, both relevant issues in this work, have not entered prior analyses. The financial institutions literature contains ma ...

The Link Between Job Satisfaction and Firm Value

... change in the market value between December 2001 and December 2002. Notably, unlike other performance measures, stock returns are not persistent: The change in market value between 2001 and 2002 is unrelated to the change in market value between 2000 and 2001 in an efficient market.2 If satisfaction ...

... change in the market value between December 2001 and December 2002. Notably, unlike other performance measures, stock returns are not persistent: The change in market value between 2001 and 2002 is unrelated to the change in market value between 2000 and 2001 in an efficient market.2 If satisfaction ...

Listing on the FTSE-100: Does it matter?

... with relatively low transaction costs and a high degree of publicly available information.1 This research therefore allows consideration both of the impact of index funds and the apparent relation between the value of a stock and its liquidity. Second, as noted below, research to date has focused on ...

... with relatively low transaction costs and a high degree of publicly available information.1 This research therefore allows consideration both of the impact of index funds and the apparent relation between the value of a stock and its liquidity. Second, as noted below, research to date has focused on ...

The Impact of Market Sentiment Index on Stock

... shown that Malaysian investor sentiment index could be measured by an equation of seven market variables. Using regression analysis and controlling for firm size, market-tobook ratio, financial leverage and growth opportunity, this index is shown to be able to predict Kuala Lumpur Composite Index (K ...

... shown that Malaysian investor sentiment index could be measured by an equation of seven market variables. Using regression analysis and controlling for firm size, market-tobook ratio, financial leverage and growth opportunity, this index is shown to be able to predict Kuala Lumpur Composite Index (K ...

Our investment process - Close Brothers Asset Management

... equities, while also providing a reliable source of income although it can come at the expense of capital growth. For example, in the past government bonds have been considered less risky than equities. However, when yields are low they may not offer protection against inflation or capital losses if ...

... equities, while also providing a reliable source of income although it can come at the expense of capital growth. For example, in the past government bonds have been considered less risky than equities. However, when yields are low they may not offer protection against inflation or capital losses if ...

Predictable returns and asset allocation

... a well-defined prior over the R2 . In our empirical implementation, we consider returns on a stock index and on a long-term bond. The predictor variables are the dividend-price ratio and the yield spread between Treasuries of different maturities. We find that the evidence is sufficient to convince ...

... a well-defined prior over the R2 . In our empirical implementation, we consider returns on a stock index and on a long-term bond. The predictor variables are the dividend-price ratio and the yield spread between Treasuries of different maturities. We find that the evidence is sufficient to convince ...

Risk Management by Insurers: An Analysis of the Process

... and problematic for them to be seen divesting themselves or systematically diversifying the investments that are correlated with firm performance. Yet, such a public divestiture would be required to properly hedge management’s personal investment profile. Moreover, in the case of mutual insurers, it ...

... and problematic for them to be seen divesting themselves or systematically diversifying the investments that are correlated with firm performance. Yet, such a public divestiture would be required to properly hedge management’s personal investment profile. Moreover, in the case of mutual insurers, it ...

Going mainstream – how absolute return is moving into the

... and relative return funds. Namely: Absolute return funds display a narrow range of returns in all market conditions; a higher likelihood of delivering positive outperformance when market returns are negative and a tendency to underperform when markets are rising strongly. Conversely, relative return ...

... and relative return funds. Namely: Absolute return funds display a narrow range of returns in all market conditions; a higher likelihood of delivering positive outperformance when market returns are negative and a tendency to underperform when markets are rising strongly. Conversely, relative return ...

Expected and unexpected bond excess returns

... Either bond investors’ expectations are not rational, long interest rates overreact to short rates or a time-varying risk premium is present (see Campbell and Shiller (1991)). The high explainable power of expected excess returns rules out irrational expectations and supports the view of a business- ...

... Either bond investors’ expectations are not rational, long interest rates overreact to short rates or a time-varying risk premium is present (see Campbell and Shiller (1991)). The high explainable power of expected excess returns rules out irrational expectations and supports the view of a business- ...

Acc Plus Aut09

... business combinations. They are obviously very difficult in practice to distinguish from goodwill but the IASB are convinced that by separating them from goodwill it helps to better explain what assets the acquirer has actually bought and why the price for some acquisitions is far in excess of the f ...

... business combinations. They are obviously very difficult in practice to distinguish from goodwill but the IASB are convinced that by separating them from goodwill it helps to better explain what assets the acquirer has actually bought and why the price for some acquisitions is far in excess of the f ...

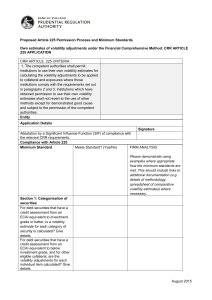

Proposed Article 225 Permission Process and

... scaled up or down to the minimum liquidation periods set out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets ...

... scaled up or down to the minimum liquidation periods set out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets ...

Rare events and investor risk aversion

... actual level. Variance of returns is calibrated as the empirical variance of historical returns in each sub-sample. Secondly, the distributional assumption of normality in returns is relaxed and replaced by the more general class of Beta densities. Given our objective of documenting the effect of se ...

... actual level. Variance of returns is calibrated as the empirical variance of historical returns in each sub-sample. Secondly, the distributional assumption of normality in returns is relaxed and replaced by the more general class of Beta densities. Given our objective of documenting the effect of se ...

The Level, Slope and Curve Factor Model for Stocks

... The method can both grow with and show robustness against the growth and inclusion of new anomaly variables. Including an additional anomaly with predictive power will help generate an even sharper estimate of the true underlying factors, but it would take a very strong new anomaly to dramatically a ...

... The method can both grow with and show robustness against the growth and inclusion of new anomaly variables. Including an additional anomaly with predictive power will help generate an even sharper estimate of the true underlying factors, but it would take a very strong new anomaly to dramatically a ...

The Effectiveness of Sell Discipline Strategies in Institutional Portfolios

... negative and positive prospects, and that individuals actually tend to seek risk when faced with negative prospects as they want to avoid a guaranteed loss. Markowitz (1952) and Tobin (1958) have noted the certainty premium, and attributed it to the idea that individuals prefer lower variability. Th ...

... negative and positive prospects, and that individuals actually tend to seek risk when faced with negative prospects as they want to avoid a guaranteed loss. Markowitz (1952) and Tobin (1958) have noted the certainty premium, and attributed it to the idea that individuals prefer lower variability. Th ...

1 CHAPTER-1 INTRODUCTION 1.0 INDIAN STOCK MARKET

... implement structural reforms. The financial sector at that time was much unstructured and its scope was limited only to bonds, equity, insurance, commodity markets, mutual and pension funds. In order to structure the security market, a regulatory authority named as SEBI (Security Exchange Board of I ...

... implement structural reforms. The financial sector at that time was much unstructured and its scope was limited only to bonds, equity, insurance, commodity markets, mutual and pension funds. In order to structure the security market, a regulatory authority named as SEBI (Security Exchange Board of I ...

"The Alpha and Omega of Hedge Fund Performance Measurement"

... on the well-known CAPM equilibrium relationship, the incremental expected return resulting from managerial superior information or skills (e.g., stock picking or market timing) can be represented as ®i = ri ¡ ¯ i (rM ¡ rf ) ¡ rf where rf is the risk-free rate. It can be estimated by a time series re ...

... on the well-known CAPM equilibrium relationship, the incremental expected return resulting from managerial superior information or skills (e.g., stock picking or market timing) can be represented as ®i = ri ¡ ¯ i (rM ¡ rf ) ¡ rf where rf is the risk-free rate. It can be estimated by a time series re ...

- Arcadis

... such as the design, age and condition of the existing building, as well as the presence or absence of constraints which may limit the extent of investment, such as planning controls and political factors. In addition, we consider the potential to improve tenant quality through asset management activ ...

... such as the design, age and condition of the existing building, as well as the presence or absence of constraints which may limit the extent of investment, such as planning controls and political factors. In addition, we consider the potential to improve tenant quality through asset management activ ...

Liquidity Pricing of Illiquid Assets

... time-on-market for residential property and key findings from this literature are considered in the chapter on time to transact. For real estate investment markets, there are fewer studies and those that exist tend to focus on measurement rather than explanation. For example, McNamara (1998) conduct ...

... time-on-market for residential property and key findings from this literature are considered in the chapter on time to transact. For real estate investment markets, there are fewer studies and those that exist tend to focus on measurement rather than explanation. For example, McNamara (1998) conduct ...

V. The Culture of Risk and Regulation

... handle the large volume of trading and the mathematical complexity of instruments. But the real commodification of risk really started with the explosion of derivative markets. Derivatives can be used to transform the underlying economic risk or exposure of a security, for example by allowing invest ...

... handle the large volume of trading and the mathematical complexity of instruments. But the real commodification of risk really started with the explosion of derivative markets. Derivatives can be used to transform the underlying economic risk or exposure of a security, for example by allowing invest ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.