Working With Our Basic Aggregate Demand / Supply Model

... The Interest Rate Effect: A lower price level will make the nominal interest rate appear lower which will stimulate additional purchases during the current period. The Foreign Purchases Effect: Other things constant, a lower price level will make domestically produced goods less expensive relative t ...

... The Interest Rate Effect: A lower price level will make the nominal interest rate appear lower which will stimulate additional purchases during the current period. The Foreign Purchases Effect: Other things constant, a lower price level will make domestically produced goods less expensive relative t ...

M09_Gordon8014701_12_Macro_C09

... deceleration in AD, measured most directly as a sustained acceleration or deceleration in the growth of nominal GDP – A Supply Shock is caused by a sharp change in the price of an important commodity (e.g. oil) that causes the inflation rate to rise or fall in the absence of demand shocks. Copyright ...

... deceleration in AD, measured most directly as a sustained acceleration or deceleration in the growth of nominal GDP – A Supply Shock is caused by a sharp change in the price of an important commodity (e.g. oil) that causes the inflation rate to rise or fall in the absence of demand shocks. Copyright ...

chapter28

... monetary or fiscal policy would shift the aggregate supply curve from AS0 to AS1, lower output from Y0 to Y1, and raise the price level from P0 to P1. Monetary or fiscal policy could be changed enough to have the AD curve shift from AD0 to AD1. This policy would raise aggregate output Y again, but i ...

... monetary or fiscal policy would shift the aggregate supply curve from AS0 to AS1, lower output from Y0 to Y1, and raise the price level from P0 to P1. Monetary or fiscal policy could be changed enough to have the AD curve shift from AD0 to AD1. This policy would raise aggregate output Y again, but i ...

An assessment of the dynamics between the permanent and transitory components

... and labour market institutions.5 Labour demand, on the other hand, depends on technical progress and on the conditions prevailing in the goods market. In the short run, actual employment would also depend on firms’ capacity to adjust the number of hours put in by workers and their work force’s produ ...

... and labour market institutions.5 Labour demand, on the other hand, depends on technical progress and on the conditions prevailing in the goods market. In the short run, actual employment would also depend on firms’ capacity to adjust the number of hours put in by workers and their work force’s produ ...

Chapter 5 - Consumer Choice

... goods also go up which leads to inflation. That’s call cost push inflation. Simply we can say when the price of factor of production increase it increase the prices of goods and services. Factor of production (land, Labor, Capital and Enterprise). ...

... goods also go up which leads to inflation. That’s call cost push inflation. Simply we can say when the price of factor of production increase it increase the prices of goods and services. Factor of production (land, Labor, Capital and Enterprise). ...

Study questions for Macroeconomics: Let these questions direct

... another big (even bigger?) effort! Even though it is more than two weeks away, most of you need to get serious NOW about your preparations. I am going to an Economics conference in Boston on the Thursday morning before your exam and will not be available for any last minute help. However, until then ...

... another big (even bigger?) effort! Even though it is more than two weeks away, most of you need to get serious NOW about your preparations. I am going to an Economics conference in Boston on the Thursday morning before your exam and will not be available for any last minute help. However, until then ...

chapter overview

... cutting spending during recession and the opposite during booms. They support discretionary fiscal policy to combat recession or inflation even if it causes a deficit or surplus budget. C. The U.S. economy has been about one-third more stable since 1946 than in earlier periods. Discretionary fiscal ...

... cutting spending during recession and the opposite during booms. They support discretionary fiscal policy to combat recession or inflation even if it causes a deficit or surplus budget. C. The U.S. economy has been about one-third more stable since 1946 than in earlier periods. Discretionary fiscal ...

Article 10

... The paper explored the interaction of monetary and fiscal policy through game theory. In the first part of the paper it isin short presented theoretical basis of fiscal and monetary policy, and then explained the theoretical part of game theory also in short. After theoretical part, the analysis was ...

... The paper explored the interaction of monetary and fiscal policy through game theory. In the first part of the paper it isin short presented theoretical basis of fiscal and monetary policy, and then explained the theoretical part of game theory also in short. After theoretical part, the analysis was ...

Real interest rate

... debtor pays interest, and therefore, pays a lower real interest rate when there is unanticipated inflation. A fixed rate of interest helps a debtor in the long term. Paying back a loan with less purchasing power during times of inflation. ...

... debtor pays interest, and therefore, pays a lower real interest rate when there is unanticipated inflation. A fixed rate of interest helps a debtor in the long term. Paying back a loan with less purchasing power during times of inflation. ...

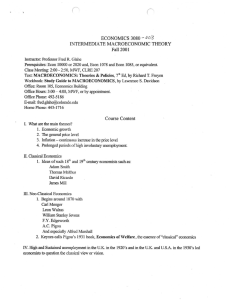

ECON 3080-003 Intermediate Macroeconomic Theory

... VI. Acceptance of Keynesianism 1. By 1964 most economists were Keynesians 2. The first Keynesian guided U.S. president was J.F. Kennedy. 3. Richard Nixon said, ''we're all Keynesians now." VII. Break down of Keynesian Monopoly on Economic Ideas 1. Starting in the 1950's Milton Friedman challenges th ...

... VI. Acceptance of Keynesianism 1. By 1964 most economists were Keynesians 2. The first Keynesian guided U.S. president was J.F. Kennedy. 3. Richard Nixon said, ''we're all Keynesians now." VII. Break down of Keynesian Monopoly on Economic Ideas 1. Starting in the 1950's Milton Friedman challenges th ...

Demand-Pull Inflation

... If aggregate demand increases by more than expected, inflation is higher than expected. Money wages do not adjust enough, and the SAS curve does not shift leftward enough to keep the economy at full employment. Real GDP exceeds potential GDP. Wages eventually rise, which leads to a decrease in the S ...

... If aggregate demand increases by more than expected, inflation is higher than expected. Money wages do not adjust enough, and the SAS curve does not shift leftward enough to keep the economy at full employment. Real GDP exceeds potential GDP. Wages eventually rise, which leads to a decrease in the S ...

UNDERLYING FACTORS OF PERSISTENT INFLATION IN ROMANIA

... rightward. If in the initial situation the economy was at its natural level, now the output will outrun its natural level; thus the unemployment will a experience a decline below the natural level generating higher wages and as a consequence the aggregate supply curve will quickly begin to shift lef ...

... rightward. If in the initial situation the economy was at its natural level, now the output will outrun its natural level; thus the unemployment will a experience a decline below the natural level generating higher wages and as a consequence the aggregate supply curve will quickly begin to shift lef ...

Deflation - Tata Mutual Fund

... in the general price level of goods and services. • How: Deflation occurs when the annual inflation rate falls below zero percent and prices continue to fall on a sustained basis • Why: Deflation is caused by a shift in the supply and demand curve for goods and interest, particularly a fall in the a ...

... in the general price level of goods and services. • How: Deflation occurs when the annual inflation rate falls below zero percent and prices continue to fall on a sustained basis • Why: Deflation is caused by a shift in the supply and demand curve for goods and interest, particularly a fall in the a ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... will be of utmost importance in overcoming the effects of the crisis. The global financial and economic crisis triggered sharp output contractions in almost all industrialized economies in 2009 for the first time in the post-Second World War era. Besides the direct impacts of this contraction in dev ...

... will be of utmost importance in overcoming the effects of the crisis. The global financial and economic crisis triggered sharp output contractions in almost all industrialized economies in 2009 for the first time in the post-Second World War era. Besides the direct impacts of this contraction in dev ...

Modules 16-21

... D. The equilibrium real GDP will rise, but still fall short of potential GDP. E. The unemployment rate will continue to rise. ____ 11. Suppose that marginal propensity to consume is equal to 0.9, and the government increases its spending by $200 billion. This new increase in spending is financed by ...

... D. The equilibrium real GDP will rise, but still fall short of potential GDP. E. The unemployment rate will continue to rise. ____ 11. Suppose that marginal propensity to consume is equal to 0.9, and the government increases its spending by $200 billion. This new increase in spending is financed by ...

Fina 353-Lecture Slide Week 8

... Changes in SAS (Shift of the SAS curve) Change in Money Prices of Other Resources • A change in money prices of other inputs/resources (such as Changes in world oil prices, Changes in the weather, Technological change) has the same effect on firms’ production plans as a change in the money wage rat ...

... Changes in SAS (Shift of the SAS curve) Change in Money Prices of Other Resources • A change in money prices of other inputs/resources (such as Changes in world oil prices, Changes in the weather, Technological change) has the same effect on firms’ production plans as a change in the money wage rat ...

The Politics of Austerity

... • Strenuous effort to minimise public austerity in a context of a new (post-Keynesian) ideological atmosphere that saw government austerity as less essential. • Cripps success in keeping the inflation rate down rested upon success in persuading the trade unions not to try to exploit labour scarcitie ...

... • Strenuous effort to minimise public austerity in a context of a new (post-Keynesian) ideological atmosphere that saw government austerity as less essential. • Cripps success in keeping the inflation rate down rested upon success in persuading the trade unions not to try to exploit labour scarcitie ...

New Consensus - Levy Economics Institute of Bard College

... "independent" Central Bank.3 Politicians would be tempted to use monetary policy for short-term gain (lower unemployment) at the expense of long term loss (higher inflation). An "independent" Central Bank would also have greater credibility in the financial markets and be seen to have a stronger com ...

... "independent" Central Bank.3 Politicians would be tempted to use monetary policy for short-term gain (lower unemployment) at the expense of long term loss (higher inflation). An "independent" Central Bank would also have greater credibility in the financial markets and be seen to have a stronger com ...

what do we know about macroeconomics that

... confusions that had plagued earlier discussions. It is worth General Theory. But, by 1950, time had passed, and Pigou clearly felt more generous. ...

... confusions that had plagued earlier discussions. It is worth General Theory. But, by 1950, time had passed, and Pigou clearly felt more generous. ...

Chap26

... demand from AD to AD'' will, in the long run, lead to a fall in the price level with no change in output If the aggregate demand curve shifts out to AD', then in the long run the equilibrium price level will increase to 140, where the same level of economy’s potential GDP is realized ...

... demand from AD to AD'' will, in the long run, lead to a fall in the price level with no change in output If the aggregate demand curve shifts out to AD', then in the long run the equilibrium price level will increase to 140, where the same level of economy’s potential GDP is realized ...

Does slack influence public and private labor market interactions?

... method to reduce the dependence of the IRF estimates on the specification of the data generating process, that is, LPs are more robust to model misspecification than other alternative methods, in particular, Smooth Transition Vector Autoregression models (STVAR henceforth). Moreover, LPs are easy to ...

... method to reduce the dependence of the IRF estimates on the specification of the data generating process, that is, LPs are more robust to model misspecification than other alternative methods, in particular, Smooth Transition Vector Autoregression models (STVAR henceforth). Moreover, LPs are easy to ...

Full employment

Full employment, in macroeconomics, is the level of employment rates where there is no cyclical or deficient-demand unemployment. It is defined by the majority of mainstream economists as being an acceptable level of unemployment somewhere above 0%. The discrepancy from 0% arises due to non-cyclical types of unemployment, such as frictional unemployment (there will always be people who have quit or have lost a seasonal job and are in the process of getting a new job) and structural unemployment (mismatch between worker skills and job requirements). Unemployment above 0% is seen as necessary to control inflation in capitalist economies, to keep inflation from accelerating, i.e., from rising from year to year. This view is based on a theory centering on the concept of the Non-Accelerating Inflation Rate of Unemployment (NAIRU); in the current era, the majority of mainstream economists mean NAIRU when speaking of ""full"" employment. The NAIRU has also been described by Milton Friedman, among others, as the ""natural"" rate of unemployment. Having many names, it has also been called the structural unemployment rate.The 20th century British economist William Beveridge stated that an unemployment rate of 3% was full employment. Other economists have provided estimates between 2% and 13%, depending on the country, time period, and their political biases. For the United States, economist William T. Dickens found that full-employment unemployment rate varied a lot over time but equaled about 5.5 percent of the civilian labor force during the 2000s. Recently, economists have emphasized the idea that full employment represents a ""range"" of possible unemployment rates. For example, in 1999, in the United States, the Organisation for Economic Co-operation and Development (OECD) gives an estimate of the ""full-employment unemployment rate"" of 4 to 6.4%. This is the estimated unemployment rate at full employment, plus & minus the standard error of the estimate.The concept of full employment of labor corresponds to the concept of potential output or potential real GDP and the long run aggregate supply (LRAS) curve. In neoclassical macroeconomics, the highest sustainable level of aggregate real GDP or ""potential"" is seen as corresponding to a vertical LRAS curve: any increase in the demand for real GDP can only lead to rising prices in the long run, while any increase in output is temporary.