10-1 Reasons for Saving and Investing

... A long-term, planned approach to making investments is called a. systematic investing b. contingency fund planning c. political risk d. hedging ...

... A long-term, planned approach to making investments is called a. systematic investing b. contingency fund planning c. political risk d. hedging ...

CM-Equity AG General Information and Risk Disclosure for

... markets (e.g. wheat, copper, oil, gold, silver, etc.) may be speculated on. Contract sizes vary depending on the market they are traded in. Contract details may be changed by the Broker. All recent changes are available on the Broker's website. General Information and Risk Disclosure for CFD Transac ...

... markets (e.g. wheat, copper, oil, gold, silver, etc.) may be speculated on. Contract sizes vary depending on the market they are traded in. Contract details may be changed by the Broker. All recent changes are available on the Broker's website. General Information and Risk Disclosure for CFD Transac ...

Test - I.I.S.S. Calamandrei

... TEST – Economic activity, Business and trade, Demand and supply 3’ B ERICA The use of a dictionary is not permitted ...

... TEST – Economic activity, Business and trade, Demand and supply 3’ B ERICA The use of a dictionary is not permitted ...

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

Trading Issues and Enhanced Regulatory Disclosures

... There must be a full business day between pricing and the bona fide purchase. If, for example, pricing occurs after market close on Wednesday, the bona fide purchase may be effected until market close on the preceding Tuesday. If, however, pricing occurs before market close on Wednesday, the bona fi ...

... There must be a full business day between pricing and the bona fide purchase. If, for example, pricing occurs after market close on Wednesday, the bona fide purchase may be effected until market close on the preceding Tuesday. If, however, pricing occurs before market close on Wednesday, the bona fi ...

DOMTrader

... symbol are displayed on each tab. The thermometer is a graphic indicator of the current market standing relative to its opening, high, and low prices. It shows the High to Last (Red), Low to Last (green), and Open (yellow triangle) for that symbol for the current day. The close or last price is indi ...

... symbol are displayed on each tab. The thermometer is a graphic indicator of the current market standing relative to its opening, high, and low prices. It shows the High to Last (Red), Low to Last (green), and Open (yellow triangle) for that symbol for the current day. The close or last price is indi ...

ECN 221 Practice Problems for Chapter 13 – Monopoly (this is not

... 13. _____ A pure monopolist can earn positive economic profits in the short-run, but not in the long-run. 14. _____ Monopoly markets are always more efficient than any other market type. 15. _____ For a monopolist, price is always greater than marginal revenue. 16. _____ A profit-maximizing monopoli ...

... 13. _____ A pure monopolist can earn positive economic profits in the short-run, but not in the long-run. 14. _____ Monopoly markets are always more efficient than any other market type. 15. _____ For a monopolist, price is always greater than marginal revenue. 16. _____ A profit-maximizing monopoli ...

Stocks and Their Valuation

... MV of equity = MV of firm – MV of debt = $416.94m - $40m = $376.94 million Value per share = MV of equity / # of shares = $376.94m / 10m ...

... MV of equity = MV of firm – MV of debt = $416.94m - $40m = $376.94 million Value per share = MV of equity / # of shares = $376.94m / 10m ...

Regional Equity Market Integration in South America

... The MILA is poised to become the third powerhouse stock exchange in South and Central America By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of ...

... The MILA is poised to become the third powerhouse stock exchange in South and Central America By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of ...

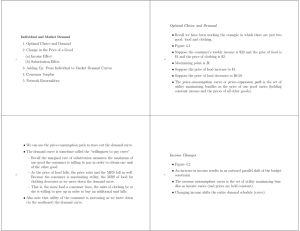

No Slide Title

... increases the price from P1 to P2 and reduces the quantity demanded from Q1 to Q2 Suppliers only need a price of P3 to produce Q2 of ...

... increases the price from P1 to P2 and reduces the quantity demanded from Q1 to Q2 Suppliers only need a price of P3 to produce Q2 of ...

Standard Risk Measures - netwealth Investments

... risk measure can lead to poor decision making. ...

... risk measure can lead to poor decision making. ...

Current Trends and Issues in Financial Planning

... – largely due to new business trusts – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...

... – largely due to new business trusts – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...