NBER WORKING PAPER SERIES WHAT DETERMINES EUROPEAN REAL EXCHANGE RATES? Martin Berka

... GDP per capita and real exchange rates for a number of countries. For countries such as Ireland, where relative GDP per capita moved from being below the EU average to being above the EU average over the sample, the deviation of relative GDP from the EU average switched from being below the real exc ...

... GDP per capita and real exchange rates for a number of countries. For countries such as Ireland, where relative GDP per capita moved from being below the EU average to being above the EU average over the sample, the deviation of relative GDP from the EU average switched from being below the real exc ...

mmi-stein 221784 en

... to appreciate or depreciate. Hence, portfolio balance or external balance implies that real interest rates between the two countries should converge to a stationary mean. As long as there are current account deficits, the foreign debt and associated interest payments rise. If the current account def ...

... to appreciate or depreciate. Hence, portfolio balance or external balance implies that real interest rates between the two countries should converge to a stationary mean. As long as there are current account deficits, the foreign debt and associated interest payments rise. If the current account def ...

Retailer Pass-Through and its Determinants Using Scanner Data

... follow Auer and Chaney (2009) and use variation in price within specific product categoryweight-package type triplet as evidence of variation in quality. We measure the elasticity of substitution for each product category in the sample using the methodology in Broda and Weinstein (2006). While prod ...

... follow Auer and Chaney (2009) and use variation in price within specific product categoryweight-package type triplet as evidence of variation in quality. We measure the elasticity of substitution for each product category in the sample using the methodology in Broda and Weinstein (2006). While prod ...

a PDF of the full text

... the substantial volume of funds transmitted by the non-bank sector and their customers. The Board has decided not to implement the statutory provision that permitted the Board to require that model transactions illustrating exchange rates be posted on providers’ storefronts and internet sites, based ...

... the substantial volume of funds transmitted by the non-bank sector and their customers. The Board has decided not to implement the statutory provision that permitted the Board to require that model transactions illustrating exchange rates be posted on providers’ storefronts and internet sites, based ...

High-Frequency Trading in the US Treasury Market

... in financial markets during the past decade. As reported in financial media, trading records have routinely been broken in recent years, and millions of data messages are regularly sent every second to various trading venues.2 This anecdotal evidence is coupled with the hard fact that trading latenc ...

... in financial markets during the past decade. As reported in financial media, trading records have routinely been broken in recent years, and millions of data messages are regularly sent every second to various trading venues.2 This anecdotal evidence is coupled with the hard fact that trading latenc ...

Current account reversals in industrial countries: does the exchange

... not more persistent under fixed exchange rates. Indeed, in principle, fixing the nominal exchange rate does not necessarily limit the ability of the real exchange rate to adjust, given sufficient flexibility in prices and costs. However, in practice, both prices and wages are relatively sticky compa ...

... not more persistent under fixed exchange rates. Indeed, in principle, fixing the nominal exchange rate does not necessarily limit the ability of the real exchange rate to adjust, given sufficient flexibility in prices and costs. However, in practice, both prices and wages are relatively sticky compa ...

Interest Rates and the Exchange Rate: A Non

... For our sample we chose a representative mix of developed and developing countries. We focus on periods during which the exchange rate in these countries was floating, so the starting date varies from country to country. Here we report the empirical results from the subsample ending in 2001.2 We als ...

... For our sample we chose a representative mix of developed and developing countries. We focus on periods during which the exchange rate in these countries was floating, so the starting date varies from country to country. Here we report the empirical results from the subsample ending in 2001.2 We als ...

IE-UFRJ Discussion Paper - Instituto de Economia

... and thus it has to be studied according to the particular institutional and historical setting of each country. In other words, it has to be studied according to its structural components. In search for structural factors, several authors examined the causes of inflation as supply elements, or fact ...

... and thus it has to be studied according to the particular institutional and historical setting of each country. In other words, it has to be studied according to its structural components. In search for structural factors, several authors examined the causes of inflation as supply elements, or fact ...

View/Open

... et al. (1998) and Lipsey (1999) emphasizes the stability of FDI as opposed to portfolio investment. FDI is seen as less subject to capital reversals and it involves large volumes of illiquid assets that make it very difficult for FDI to fly away with the early signs of trouble. The volatility of por ...

... et al. (1998) and Lipsey (1999) emphasizes the stability of FDI as opposed to portfolio investment. FDI is seen as less subject to capital reversals and it involves large volumes of illiquid assets that make it very difficult for FDI to fly away with the early signs of trouble. The volatility of por ...

Price Volatility, Trading Activity and Market Depth

... trading volume and price volatility for equities and futures. Considerable evidence exists a positive contemporaneous correlation between price volatility and trading volume. Karpoff (1987) extensively reviews previous theoretical and empirical research on the price-volume relation, and finds 18 stu ...

... trading volume and price volatility for equities and futures. Considerable evidence exists a positive contemporaneous correlation between price volatility and trading volume. Karpoff (1987) extensively reviews previous theoretical and empirical research on the price-volume relation, and finds 18 stu ...

Currency blocs in the 21st century

... Since the primary objective of the study is an investigation into currency bloc composition, the classification of exchange rate regimes has been confined just to the two coarse categories “peg” and “float” without further specifying the type of the regime. Borderline cases such as crawling pegs, cr ...

... Since the primary objective of the study is an investigation into currency bloc composition, the classification of exchange rate regimes has been confined just to the two coarse categories “peg” and “float” without further specifying the type of the regime. Borderline cases such as crawling pegs, cr ...

NBER WORKING PAPER SERIES THE SIMPLE GEOMETRY OF TRANSMISSION AND STABILIZATION

... in emphasis and style, a number of tightly related research agendas (from the ‘new neoclassical’synthesis to the ‘neo-Wicksellian’monetary economics to the ‘new open-economy macroeconomics’, and so on) have focused on the properties of choice-theoretic models with imperfectly competitive labor and/o ...

... in emphasis and style, a number of tightly related research agendas (from the ‘new neoclassical’synthesis to the ‘neo-Wicksellian’monetary economics to the ‘new open-economy macroeconomics’, and so on) have focused on the properties of choice-theoretic models with imperfectly competitive labor and/o ...

Economic Costs of Alternative Monetary Policy Responses During

... attack. Therefore, an analysis of the relative costs of alternative policy actions needs to be clear about the key economic channels by which monetary policy action or inaction can impact the economy during a speculative currency attack. Without being aware of the channels of impact, it is difficult ...

... attack. Therefore, an analysis of the relative costs of alternative policy actions needs to be clear about the key economic channels by which monetary policy action or inaction can impact the economy during a speculative currency attack. Without being aware of the channels of impact, it is difficult ...

The Equilibrium Value of The Euro/$ US Exchange Rate

... grouped under the heading BEER, behavioral equilibrium real exchange rate9, and the latter takes as a point of departure the NATREX model. Makrydakis, de Lima, Claessens and Kramer [ECB: M] describe the alternative approaches as follows. “The BEER, unlike the ...NATREX approaches that rely on a stru ...

... grouped under the heading BEER, behavioral equilibrium real exchange rate9, and the latter takes as a point of departure the NATREX model. Makrydakis, de Lima, Claessens and Kramer [ECB: M] describe the alternative approaches as follows. “The BEER, unlike the ...NATREX approaches that rely on a stru ...

Economic Premise - World Bank Group

... system requires the dominance of a single currency, namely the U.S. dollar. To a significant extent, U.S. dollar dominance is the result of specific policy choices by individual countries (for example, export-led growth strategies, close links to the U.S. dollar) rather than an inherent rigidity in ...

... system requires the dominance of a single currency, namely the U.S. dollar. To a significant extent, U.S. dollar dominance is the result of specific policy choices by individual countries (for example, export-led growth strategies, close links to the U.S. dollar) rather than an inherent rigidity in ...

currency crises, capital-account liberalization, and selection bias

... currency crises since 1975 despite having controls over most of this period; and so on. Dooley (1996), summarizing the literature, concludes: “Capital controls or dual exchange rate systems have been effective in generating yield differentials, covered for exchange rate risk, for short periods of ti ...

... currency crises since 1975 despite having controls over most of this period; and so on. Dooley (1996), summarizing the literature, concludes: “Capital controls or dual exchange rate systems have been effective in generating yield differentials, covered for exchange rate risk, for short periods of ti ...

FREE Sample Here - We can offer most test bank and

... 34. Commercial banks are a major source of term loans. These loans are best used for: a. financing the expansion of the business. b. financing the establishment of overseas operations. c. financing current assets like inventory and accounts receivable. d. financing the payment of dividends. ANS: C P ...

... 34. Commercial banks are a major source of term loans. These loans are best used for: a. financing the expansion of the business. b. financing the establishment of overseas operations. c. financing current assets like inventory and accounts receivable. d. financing the payment of dividends. ANS: C P ...

A Resolution on UIP Puzzle The Case of Korean wonThe United

... In addition, they add the settlement lag which the vast majority of UIP literature ignores. Although Bekaert and Hodrick (1993) had already considered a settlement lag, they did not find settlement lag as a significant factor in the failure of UIP in their paper. However, according to Chaboud and Wr ...

... In addition, they add the settlement lag which the vast majority of UIP literature ignores. Although Bekaert and Hodrick (1993) had already considered a settlement lag, they did not find settlement lag as a significant factor in the failure of UIP in their paper. However, according to Chaboud and Wr ...

Current Research Journal of Economic Theory 4(4): 120-131, 2012 ISSN: 2042-485X

... Christopher N. Ekong and Kenneth U. Onye Department of Economics, Faculty of Social Sciences, University of Uyo, Nigeria Abstract: This study investigates the feasibility of proceeding with the proposed common currency in West Africa. By relying on the multivariate Structural Vector Autoregressive A ...

... Christopher N. Ekong and Kenneth U. Onye Department of Economics, Faculty of Social Sciences, University of Uyo, Nigeria Abstract: This study investigates the feasibility of proceeding with the proposed common currency in West Africa. By relying on the multivariate Structural Vector Autoregressive A ...

Peltonen-del05 1039031 en

... be successful in predicting currency crises using economic fundamentals, which will also be the focus of this study. The main result of the study is that both the probit and the ANN model were able to correctly signal crises reasonably well in-sample, and that the ANN model slightly outperformed the ...

... be successful in predicting currency crises using economic fundamentals, which will also be the focus of this study. The main result of the study is that both the probit and the ANN model were able to correctly signal crises reasonably well in-sample, and that the ANN model slightly outperformed the ...

Heat Waves, Meteor Showers, and Trading Volume: An Analysis of

... market.3 The predominant market makers are the 29 primary government securities dealers-financial firms with which the Federal Reserve Bank of New York interacts directly in the course of its open market operations. For the April-August 1994 period, the dealers traded an average of $125.5 billion of ...

... market.3 The predominant market makers are the 29 primary government securities dealers-financial firms with which the Federal Reserve Bank of New York interacts directly in the course of its open market operations. For the April-August 1994 period, the dealers traded an average of $125.5 billion of ...

Real equilibrium exchange rates for Norway

... equilibrium level when a deviation occurs. The presentation of the PPP approach is relatively brief, as we have already analysed the Norwegian nominal and real exchange rates using this approach in Akram (2000a, 2002). Section 3 employs the BEER approach and derives an empirical model of the Norwegi ...

... equilibrium level when a deviation occurs. The presentation of the PPP approach is relatively brief, as we have already analysed the Norwegian nominal and real exchange rates using this approach in Akram (2000a, 2002). Section 3 employs the BEER approach and derives an empirical model of the Norwegi ...

This PDF is a selection from an out-of-print volume from the... of Economic Research Volume Title: Exchange Rate Theory and Practice

... not intervene too actively in the foreign exchange markets. These characteristics also apply, in general, to the experience with floating exchange rates between major currencies during 1920s and 1930s and, with some modifications, to the experience of floating exchange rates between the United State ...

... not intervene too actively in the foreign exchange markets. These characteristics also apply, in general, to the experience with floating exchange rates between major currencies during 1920s and 1930s and, with some modifications, to the experience of floating exchange rates between the United State ...

The Effect of Exchange Rate Movements on Heterogeneous Plants

... a reduction in the scale of production, causing a reduction in plant productivity if the production technology exhibits increasing returns to scale. Moreover, appreciations make it more difficult for domestic plants to compete in export markets, which can reduce the scale of production for exporters ...

... a reduction in the scale of production, causing a reduction in plant productivity if the production technology exhibits increasing returns to scale. Moreover, appreciations make it more difficult for domestic plants to compete in export markets, which can reduce the scale of production for exporters ...

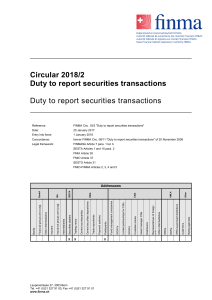

Circular 2018/2 Duty to report securities transactions Duty to

... Alternatively, a disclosure office may accept a full report in the European Union format as specified in the regulatory and technical implementing standards (RTS 22) for Article 26 of Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial ins ...

... Alternatively, a disclosure office may accept a full report in the European Union format as specified in the regulatory and technical implementing standards (RTS 22) for Article 26 of Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial ins ...