Chapter15 - University of San Diego Home Pages

... Flexible Exchange Rate System – exchange rates are determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value ...

... Flexible Exchange Rate System – exchange rates are determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value ...

Exchange Rates - Uniservity CLC

... No pre-determined official target for the exchange rate is set by the Government. The government and/or monetary authorities can set interest rates for domestic economic purposes rather than to achieve a given exchange rate target It is rare for pure free floating exchange rates to exist - most gove ...

... No pre-determined official target for the exchange rate is set by the Government. The government and/or monetary authorities can set interest rates for domestic economic purposes rather than to achieve a given exchange rate target It is rare for pure free floating exchange rates to exist - most gove ...

Federal Reserve System Federal Reserve System

... A central bank’s purchase of domestic currency and corresponding sale of foreign assets in the foreign exchange market leads to an equal decline in its international reserves and the monetary base ...

... A central bank’s purchase of domestic currency and corresponding sale of foreign assets in the foreign exchange market leads to an equal decline in its international reserves and the monetary base ...

Eurozone Accession: Benefits and Costs – the Slovak case

... – Lower transaction costs (permanent; 0.3% of GDP) – Nominal exchange rate stability – better planning; higher investment, trade and growth (difficult to calculate) – More attention to public finance stability – Since 2010: Real exchange rate undervaluation – Outright Monetary Transactions (OTM); Eu ...

... – Lower transaction costs (permanent; 0.3% of GDP) – Nominal exchange rate stability – better planning; higher investment, trade and growth (difficult to calculate) – More attention to public finance stability – Since 2010: Real exchange rate undervaluation – Outright Monetary Transactions (OTM); Eu ...

Chapter 3

... is that foreign holdings of actual currency are small relative to foreign holdings of dollardenominated interest-bearing securities and deposits. The United States earns no seigniorage return ...

... is that foreign holdings of actual currency are small relative to foreign holdings of dollardenominated interest-bearing securities and deposits. The United States earns no seigniorage return ...

Foreign Exchange Hedge Aust Procedures

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

3.E Money in the European Union High School Lesson Plan

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ ...

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ ...

Chapter 3 The International Monetary System

... the US to met its commitment to convert dollars to gold ...

... the US to met its commitment to convert dollars to gold ...

China`s Central Bank & Monetary Policy

... Policy Issue currency & maintain stable exchange rate Regulate financial markets Manage state treasury Conduct economic research & analysis Protect state foreign exchange & gold reserves Utilizes various instruments to stabilize the financial system ...

... Policy Issue currency & maintain stable exchange rate Regulate financial markets Manage state treasury Conduct economic research & analysis Protect state foreign exchange & gold reserves Utilizes various instruments to stabilize the financial system ...

Syllabus

... conditions, international monetary organizations, currency derivatives, exchange rate risk management, international financial markets, and global financing. After studying the course, students will be able to (1) evaluate foreign exchange rate systems (2) compare and contrast key economic theories ...

... conditions, international monetary organizations, currency derivatives, exchange rate risk management, international financial markets, and global financing. After studying the course, students will be able to (1) evaluate foreign exchange rate systems (2) compare and contrast key economic theories ...

3.E Money in the European Union Middle School Lesson Plan

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ Agenda ...

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ Agenda ...

Document

... sale of a currency for spot delivery and purchase of that currency for forward delivery. • Foreign exchange swaps can be used by dealers to manage the maturity structure of their currency positions. ...

... sale of a currency for spot delivery and purchase of that currency for forward delivery. • Foreign exchange swaps can be used by dealers to manage the maturity structure of their currency positions. ...

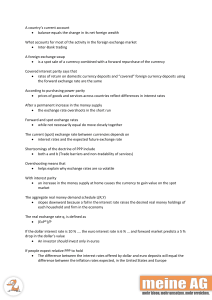

A country`s current account • balance equals the change

... A country’s current account balance equals the change in its net foreign wealth What accounts for most of the activity in the foreign exchange market Inter-Bank trading A foreign exchange swap is a spot sale of a currency combined with a forward repurchase of the currency Covered interest pari ...

... A country’s current account balance equals the change in its net foreign wealth What accounts for most of the activity in the foreign exchange market Inter-Bank trading A foreign exchange swap is a spot sale of a currency combined with a forward repurchase of the currency Covered interest pari ...

Fig. 1: Annual* Inflation and Depreciation in Israel, 1958

... Portfolios of U.S. and Foreign Mutual Funds ...

... Portfolios of U.S. and Foreign Mutual Funds ...

download soal

... reserves increase (decrease), and the money supply increases (decreases) simultaneously. To offset the effect on the money supply, the foreign exchange intervention can be sterilized; that is, the central bank can perform an open market operation that counteracts the effect on the money supply of th ...

... reserves increase (decrease), and the money supply increases (decreases) simultaneously. To offset the effect on the money supply, the foreign exchange intervention can be sterilized; that is, the central bank can perform an open market operation that counteracts the effect on the money supply of th ...

Theme 3

... • the exchange rates of three currencies don't match all ratios, and there is a gap between expectation and reality • the process of converting one currency to another, converting it again to a third currency and, finally, converting it back to the original currency within a short ...

... • the exchange rates of three currencies don't match all ratios, and there is a gap between expectation and reality • the process of converting one currency to another, converting it again to a third currency and, finally, converting it back to the original currency within a short ...

exchange rates

... The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) pegged B) measured C) excha ...

... The value of a country’s A) money B) currency C) exchange rate is extremely important to all businesses engaged in international A) commerce B) stock market C) trade – imports and exports. For over a quarter of a century after the Second World War, most currencies were A) pegged B) measured C) excha ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

“Explorations into Use of the Exchange Rate in Macroeconomic

... Economics and a Senior Research Fellow with the UPecon Foundation. She serves as Editor-in-Chief of the Journal of Asian Economics and President of the American Committee on Asian Economic Studies. She has taught at the University of Hawaii at Manoa (where she was tenured), the National University o ...

... Economics and a Senior Research Fellow with the UPecon Foundation. She serves as Editor-in-Chief of the Journal of Asian Economics and President of the American Committee on Asian Economic Studies. She has taught at the University of Hawaii at Manoa (where she was tenured), the National University o ...

Chp 1 notes - the School of Economics and Finance

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

AP Economics Mr. Bernstein Exchange Rate Policy

... Objectives - Understand each of the following: • The difference between fixed exchange rates and floating exchange rates • Considerations that lead countries to choose different exchange rate regimes ...

... Objectives - Understand each of the following: • The difference between fixed exchange rates and floating exchange rates • Considerations that lead countries to choose different exchange rate regimes ...

ECON 401 November 12, 2012 Export-led growth and the 1980s

... The policies became real effective only after the military intervention in September 1980 On September 12, 1980, the military dissolved the parliament and suspended all civilian institutions A team of high-level technocrats became responsible for preparing and implementing this new policy Turgut Öza ...

... The policies became real effective only after the military intervention in September 1980 On September 12, 1980, the military dissolved the parliament and suspended all civilian institutions A team of high-level technocrats became responsible for preparing and implementing this new policy Turgut Öza ...