`Storm clouds over the EMS`, from La Libre Belgique (29-30

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

The New US-Asian Dollar Bloc

... Figures on international financial flows speak loudly to the extent of this Asian support. According to the U.S. Treasury, capital inflows into the United States over the course of 2003 totaled $633 billion, up by over $140 billion from the same period in 2002. Almost all came from official sources, ...

... Figures on international financial flows speak loudly to the extent of this Asian support. According to the U.S. Treasury, capital inflows into the United States over the course of 2003 totaled $633 billion, up by over $140 billion from the same period in 2002. Almost all came from official sources, ...

Currency Risk: To hedge or Not To Hedge—Is That The Question?

... to both of the above arguments, but it deserves special attention. Mean reversion is the idea that while currencies will fluctuate, they will return to a mean level over a long-term horizon. This argument tends to show up in the real world with phrases like: “the currency is hitting long-term highs, ...

... to both of the above arguments, but it deserves special attention. Mean reversion is the idea that while currencies will fluctuate, they will return to a mean level over a long-term horizon. This argument tends to show up in the real world with phrases like: “the currency is hitting long-term highs, ...

Answer Key - University of Colorado Boulder

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

Dr. Eran Yashiv EC303: Economic Analysis of the EU The European

... drawback is the difficulty of maintaining employment when changes in demand or other "asymmetric shocks" require a reduction in real wages in a particular region. Mundell emphasized the importance of high labor mobility in order to offset such disturbances. • He characterized an optimum currency are ...

... drawback is the difficulty of maintaining employment when changes in demand or other "asymmetric shocks" require a reduction in real wages in a particular region. Mundell emphasized the importance of high labor mobility in order to offset such disturbances. • He characterized an optimum currency are ...

Financial Statement Translation

... Automatically compute the translation gain or loss amount and report it to the Reporting Currency set of books. ...

... Automatically compute the translation gain or loss amount and report it to the Reporting Currency set of books. ...

students' powerpoint presentation sample 2

... • What was the gold-exchange standard in 1944 to 1973 and why is it important? • How globalization and world politics ...

... • What was the gold-exchange standard in 1944 to 1973 and why is it important? • How globalization and world politics ...

US$ Depreciation

... 1. Increased demand as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate 2. The price of the foreign currency in local currency ...

... 1. Increased demand as more foreign goods are demanded, more of the foreign currency is demand at each possible exchange rate 2. The price of the foreign currency in local currency ...

Document in Word format

... ever, heard of a currency crisis in the largest and the smallest monetary systems. For the smallest monetary systems, even in the unlikely event that they have a sophisticated financial infrastructure, there is often a lack of liquidity in financial markets for them to be of significant interest to ...

... ever, heard of a currency crisis in the largest and the smallest monetary systems. For the smallest monetary systems, even in the unlikely event that they have a sophisticated financial infrastructure, there is often a lack of liquidity in financial markets for them to be of significant interest to ...

Surviving a currency crisis

... As a devalued ringgit continues to struggle, Malaysia’s SMEs are discovering that foreign exchange rates are having major implications – even if they do not trade abroad ...

... As a devalued ringgit continues to struggle, Malaysia’s SMEs are discovering that foreign exchange rates are having major implications – even if they do not trade abroad ...

Chp 1 notes - the School of Economics and Finance

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

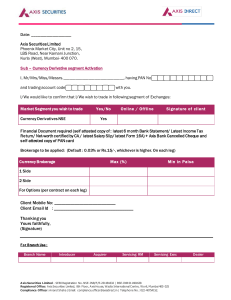

Client Email Id : Thanking you Yours faithfu

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

Lecture Slides Chapter 15

... 2) barriers to foreign savers investing in domestic assets 3) pro: government can control its balance of payments position and possibly prevent speculative attacks 4) con: weakened confidence in the government may actually cause an increase in capital outflows ...

... 2) barriers to foreign savers investing in domestic assets 3) pro: government can control its balance of payments position and possibly prevent speculative attacks 4) con: weakened confidence in the government may actually cause an increase in capital outflows ...

Currency

A currency (from Middle English: curraunt, ""in circulation"", from Latin: currens, -entis) in the most specific use of the word refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially in a nation. Under this definition, British pounds, U.S. dollars, and European euros are examples of currency. These various currencies are stores of value, and are traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are defined by governments, and each type has limited boundaries of acceptance.Other definitions of the term ""currency"" are discussed in their respective synonymous articles banknote, coin, and money. The latter definition, pertaining to the currency systems of nations, is the topic of this article. Currencies can be classified into two monetary systems: fiat money and commodity money, depending on what guarantees the value (the economy at large vs. the government's physical metal reserves). Some currencies are legal tender in certain jurisdictions, which means they cannot be refused as payment for debt. Others are simply traded for their economic value. Digital currency arose with the popularity of computers and the Internet.