Reviewing Systemic Risk in the Insurance Industry

... conscious or not, lead to bias. The Wall Street versus Main Street arguments interact, as a fully functioning banking system makes it easier for citizens to transact business. A balance is required between liquidity for the international financial system and the consumer driven environment implied ...

... conscious or not, lead to bias. The Wall Street versus Main Street arguments interact, as a fully functioning banking system makes it easier for citizens to transact business. A balance is required between liquidity for the international financial system and the consumer driven environment implied ...

Intervention Guidelines for Québec-Chartered Deposit Institutions

... An institution is at the “Early Warning” stage if the AMF considers its financial condition to be acceptable, but at least one deficiency in its management practices, its policies or its procedures could put its viability or solvency at risk if the situation is not diligently remedied. Based on aggr ...

... An institution is at the “Early Warning” stage if the AMF considers its financial condition to be acceptable, but at least one deficiency in its management practices, its policies or its procedures could put its viability or solvency at risk if the situation is not diligently remedied. Based on aggr ...

federally-insured money market funds and narrow

... which enables companies to access the ultimate source of funds, the capital markets, without going through banks or other financial intermediaries.”); Bossone, supra (“it is undoubtedly the case that in the advanced economies nonbank quasi-money and financing products are taking increasing business ...

... which enables companies to access the ultimate source of funds, the capital markets, without going through banks or other financial intermediaries.”); Bossone, supra (“it is undoubtedly the case that in the advanced economies nonbank quasi-money and financing products are taking increasing business ...

Monetary Policy during Japan`s Great Recession: From Self

... There has been a great deal of debate over the years about the extent to which Japan’s economic malaise was caused by insufficient spending, as opposed to long-term structural factors. To be sure, slowing population growth and decelerating productivity account for some of the slowdown. However, the ...

... There has been a great deal of debate over the years about the extent to which Japan’s economic malaise was caused by insufficient spending, as opposed to long-term structural factors. To be sure, slowing population growth and decelerating productivity account for some of the slowdown. However, the ...

AIC guidance on the requirements of the Listing Rules August 2008

... investment policy on application to list and annually thereafter. The rules setting out these requirements have been prepared according to the FSA’s new ‘principlesbased’ approach. They represent a departure from the way in which the listing requirements have traditionally been constructed. Rather t ...

... investment policy on application to list and annually thereafter. The rules setting out these requirements have been prepared according to the FSA’s new ‘principlesbased’ approach. They represent a departure from the way in which the listing requirements have traditionally been constructed. Rather t ...

earthquake-prone buildings

... The construction of Unreinforced Masonry (URM) buildings in New Zealand peaked in the decade between 1920 and 1930 and declined thereafter. Few large buildings of any material were constructed in the period between 1935 and 1955. It is worth noting that many heritage buildings pre-date 1920. It was ...

... The construction of Unreinforced Masonry (URM) buildings in New Zealand peaked in the decade between 1920 and 1930 and declined thereafter. Few large buildings of any material were constructed in the period between 1935 and 1955. It is worth noting that many heritage buildings pre-date 1920. It was ...

Islamic Micro-Insurance * Micro-Takaful: Basic Exposition

... and economic sectors of an economy by minimizing risk of all economic activities, on the one hand and producing long-term financial resources, on the other hand. An efficient and productive insurance sector also indirectly contributes to economic growth of a country by converting savings into invest ...

... and economic sectors of an economy by minimizing risk of all economic activities, on the one hand and producing long-term financial resources, on the other hand. An efficient and productive insurance sector also indirectly contributes to economic growth of a country by converting savings into invest ...

Report

... Therefore, reinsurance failure could threaten solvency of individual insurers and create industry-wide crisis However, it is unlikely that even a major intra-industry crisis would spill over into broader financial markets ...

... Therefore, reinsurance failure could threaten solvency of individual insurers and create industry-wide crisis However, it is unlikely that even a major intra-industry crisis would spill over into broader financial markets ...

BIOPHARMX CORPORATION Related Party Transactions Policy As

... Person in the transaction in sufficient detail to enable the Approval Authority to fully assess such interests, (c) a description of the purpose of the transaction, (d) all of the material facts of the proposed Related Party Transaction, including the proposed aggregate value of such transaction, or ...

... Person in the transaction in sufficient detail to enable the Approval Authority to fully assess such interests, (c) a description of the purpose of the transaction, (d) all of the material facts of the proposed Related Party Transaction, including the proposed aggregate value of such transaction, or ...

Financial Stability and Monetary Policy Erdem BAŞÇI Hakan KARA

... maturity of one week, the average maturity of deposits is almost 50 days in Turkey (Chart 7-b). If banks try to compensate the entire liquidity gap resulting from required reserve hikes by borrowing from the central bank, they will have to bear the additional interest rate risk caused by the maturi ...

... maturity of one week, the average maturity of deposits is almost 50 days in Turkey (Chart 7-b). If banks try to compensate the entire liquidity gap resulting from required reserve hikes by borrowing from the central bank, they will have to bear the additional interest rate risk caused by the maturi ...

what is management

... other vehicle, not your vehicle. 3. Full coverage means the insurance would pay for both your car and the other person’s car. 4. Uninsured motorist coverage pays for damages to your car if you are hit by someone who does not have insurance. C. Life Insurance 1. The death of one spouse can mean a sud ...

... other vehicle, not your vehicle. 3. Full coverage means the insurance would pay for both your car and the other person’s car. 4. Uninsured motorist coverage pays for damages to your car if you are hit by someone who does not have insurance. C. Life Insurance 1. The death of one spouse can mean a sud ...

Why IT Managers Don`t Go for Cyber

... security suggest that residual IT security risks are transferable to a willing party through cyber insurance. Academic research2 also corroborates the economic value of cyber insurance in managing the cyber risks integral to a firm’s operations. Cyber insurance refers to insurance contracts designed ...

... security suggest that residual IT security risks are transferable to a willing party through cyber insurance. Academic research2 also corroborates the economic value of cyber insurance in managing the cyber risks integral to a firm’s operations. Cyber insurance refers to insurance contracts designed ...

Primer on Proposed New Regulatory Capital Framework

... at June 30, 2016 would have been in the range of 153% to 156%. Under the new framework, the Company holds approximately $125 million above the OSFI Supervisory MCT Target. In addition, the Company holds $175 million of cash and investments as of June 30, 2016 and has access to a $100 million credit ...

... at June 30, 2016 would have been in the range of 153% to 156%. Under the new framework, the Company holds approximately $125 million above the OSFI Supervisory MCT Target. In addition, the Company holds $175 million of cash and investments as of June 30, 2016 and has access to a $100 million credit ...

The history of Fannie and Freddie points to risks from both populism

... In the formal models, the risks of corruption and populism are treated as exogenous variables that help determine optimal institutions. Section II of this paper discusses the forces that determine these risks. While there is significant evidence suggesting that cultural norms strongly influence cor ...

... In the formal models, the risks of corruption and populism are treated as exogenous variables that help determine optimal institutions. Section II of this paper discusses the forces that determine these risks. While there is significant evidence suggesting that cultural norms strongly influence cor ...

Q4 2016 Earnings Release - Primerica Investor Relations

... We report financial results in accordance with U.S. generally accepted accounting principles (GAAP). We also present adjusted direct premiums, other ceded premiums, operating revenues, operating income before income taxes, net operating income, adjusted stockholders’ equity and diluted operating ear ...

... We report financial results in accordance with U.S. generally accepted accounting principles (GAAP). We also present adjusted direct premiums, other ceded premiums, operating revenues, operating income before income taxes, net operating income, adjusted stockholders’ equity and diluted operating ear ...

The final version of the Department of Labor`s fiduciary rule was

... The final version of the fiduciary rule clarifies that the BICE need not be signed until an account is opened. Firms do not need to have existing customers sign a Best Interest Contract. Unlike the proposed rule, firms are allowed to send a notice to existing clients to inform them that they have as ...

... The final version of the fiduciary rule clarifies that the BICE need not be signed until an account is opened. Firms do not need to have existing customers sign a Best Interest Contract. Unlike the proposed rule, firms are allowed to send a notice to existing clients to inform them that they have as ...

DETERMINANTS OF THE DEMAND FOR LIFE INSURANCE

... Namely, do economic, demographic or institutional factors affect the demand for life insurance in transition countries? The choice of CEE countries in line with Ukraine is not accidental. The CEE region is representative for Ukrainian insurance market. Not long ago these countries were the members o ...

... Namely, do economic, demographic or institutional factors affect the demand for life insurance in transition countries? The choice of CEE countries in line with Ukraine is not accidental. The CEE region is representative for Ukrainian insurance market. Not long ago these countries were the members o ...

C.S.H.B. No. 1774 85R20435 LED-F By: Bonnen of Galveston, Lucio

... that is liable for a claim under an insurance policy is not in compliance with this subchapter, the insurer is liable to pay the holder of the policy, in addition to the amount of the claim, simple interest on the amount of the claim as damages each year at the rate determined on the date of judgmen ...

... that is liable for a claim under an insurance policy is not in compliance with this subchapter, the insurer is liable to pay the holder of the policy, in addition to the amount of the claim, simple interest on the amount of the claim as damages each year at the rate determined on the date of judgmen ...

Download pdf | 371 KB |

... economy. The second is about the impact of monetary policy: since interest rates have been at such exceptionally low levels for so long there is unusual uncertainty about how the return towards more usual levels will affect the economy. The third source of uncertainty is how fast the economy grows i ...

... economy. The second is about the impact of monetary policy: since interest rates have been at such exceptionally low levels for so long there is unusual uncertainty about how the return towards more usual levels will affect the economy. The third source of uncertainty is how fast the economy grows i ...

Shaping change in insurance

... Strong 2016 result at the upper end of guidance – Reinsurance P-C remains profitable core of our business P-C – Gross premiums written ...

... Strong 2016 result at the upper end of guidance – Reinsurance P-C remains profitable core of our business P-C – Gross premiums written ...

DRAFT Investment Policy Jan 22 2016(word doc)

... PERFORMANCE STANDARDS: Investments shall only be made as allowable by law with specific reference to California Government Code Section 53600, et seq., and any other applicable provisions of law. ...

... PERFORMANCE STANDARDS: Investments shall only be made as allowable by law with specific reference to California Government Code Section 53600, et seq., and any other applicable provisions of law. ...

Use of Ratings in Insurance Industry

... No ratings exist for mortgages; therefore, factors were developed on the basis of experience on the entire mortgage portfolio. Factor based on insurer’s mortgage experience relative to industry experience (i.e., MEAF) ...

... No ratings exist for mortgages; therefore, factors were developed on the basis of experience on the entire mortgage portfolio. Factor based on insurer’s mortgage experience relative to industry experience (i.e., MEAF) ...

Market-Consistent Valuation of Long-Term

... In this paper, we contribute to the latter approach and evaluate portfolios of insurance contracts. We focus on the market-consistent embedded value (MCEV) methodology as proposed by the European Chief Financial O cer Forum (see CFO Forum, 2009). Market-consistent embedded value calculations are the ...

... In this paper, we contribute to the latter approach and evaluate portfolios of insurance contracts. We focus on the market-consistent embedded value (MCEV) methodology as proposed by the European Chief Financial O cer Forum (see CFO Forum, 2009). Market-consistent embedded value calculations are the ...

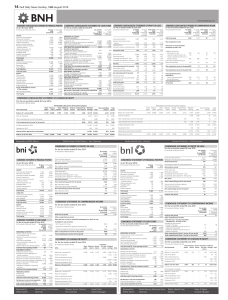

14 Gulf Daily News Sunday, 14th August 2016

... for the six months ended 30 June 2016 Six months Six months ended ended 30 June 2016 30 June 2015 (reviewed) (reviewed) ...

... for the six months ended 30 June 2016 Six months Six months ended ended 30 June 2016 30 June 2015 (reviewed) (reviewed) ...