6. Key Indicators

... Measure of Debt Repayment Capacity 1. Term Debt and Capital Lease Coverage Ratio: • Funds available from operations to cover scheduled payments divided by scheduled principal payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Outs ...

... Measure of Debt Repayment Capacity 1. Term Debt and Capital Lease Coverage Ratio: • Funds available from operations to cover scheduled payments divided by scheduled principal payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Outs ...

Why Are Washington Politicians Fighting?

... 3) What are the consequences of the debt buildup? 4) Does, or will, America have the ability to pay-off these debts? There are other important questions, but I will briefly address these 4 today. As to the first question: 1. WAS THE PAST DEFICIT SPENDING NECESSARY? Current and previous politicians b ...

... 3) What are the consequences of the debt buildup? 4) Does, or will, America have the ability to pay-off these debts? There are other important questions, but I will briefly address these 4 today. As to the first question: 1. WAS THE PAST DEFICIT SPENDING NECESSARY? Current and previous politicians b ...

Document

... Learning objectives 1. Distinguish different types of financial instrument, assess the broad categories into which they fall, and contrast their fundamental characteristics. 2. Discuss the continuum of financial instruments, and explain why the terms of a particular instrument will affect its posit ...

... Learning objectives 1. Distinguish different types of financial instrument, assess the broad categories into which they fall, and contrast their fundamental characteristics. 2. Discuss the continuum of financial instruments, and explain why the terms of a particular instrument will affect its posit ...

CAPITAL STRUCTURE ANALYSIS

... Long-term liabilities are reported at the present value of expected cash flows Current liabilities are not adjusted for the time value of money Contributed capital is reported at the historical proceeds received from selling stock Retained earnings are reported as a summary of all of the valuation m ...

... Long-term liabilities are reported at the present value of expected cash flows Current liabilities are not adjusted for the time value of money Contributed capital is reported at the historical proceeds received from selling stock Retained earnings are reported as a summary of all of the valuation m ...

credit_test_review_powerpoint

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

Intro to ratios

... For analysis of a company’s financial health, instead of its stock price, financial analysts use other ratios. These are derived using numbers made available through each company’s financial statements. The ratios need to be reviewed over time, in order to determine trends in financial health, and t ...

... For analysis of a company’s financial health, instead of its stock price, financial analysts use other ratios. These are derived using numbers made available through each company’s financial statements. The ratios need to be reviewed over time, in order to determine trends in financial health, and t ...

Corporation

... borrowing costs. By transferring the assets into a separate entity, the entity can issue the bonds and receive a higher rating than the unsecured debt of the corporation. • External Credit Enhancements : • Corporate guarantees, which may be provided by the corporation creating the ABS or its parent. ...

... borrowing costs. By transferring the assets into a separate entity, the entity can issue the bonds and receive a higher rating than the unsecured debt of the corporation. • External Credit Enhancements : • Corporate guarantees, which may be provided by the corporation creating the ABS or its parent. ...

DEBT - Association for Financial Professionals of Arizona

... Statements in this report are based on the opinions of UMB Capital Markets and the information available at the time this report was published. All opinions represent our judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a ...

... Statements in this report are based on the opinions of UMB Capital Markets and the information available at the time this report was published. All opinions represent our judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a ...

“Indicadores Financieros Clave en la Calificacion de Empresas por

... Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. Copyright (c) 2008 Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. ...

... Permission to reprint or distribute any content from this presentation requires the prior written approval of Standard & Poor’s. Copyright (c) 2008 Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. ...

04_CapStr_DebtLimit_Niu

... These strategies are costly because they may lower the market value of the whole firm. ...

... These strategies are costly because they may lower the market value of the whole firm. ...

use the following information for the next two problems

... FIN638 Assignment 2 Due Date: October 29 Chapter 10: 1. All else being equal, which of the following will increase a company’s current ratio? a. b. c. d. ...

... FIN638 Assignment 2 Due Date: October 29 Chapter 10: 1. All else being equal, which of the following will increase a company’s current ratio? a. b. c. d. ...

the three stages of raising money

... record, without assets, and without profits or cash flow are considered to be too risky for lending institutions, and F&F and VCs are the only alternative. Established companies generally prefer debt over equity for financing, although most corporations use a mixture of both. Debt for corporations ...

... record, without assets, and without profits or cash flow are considered to be too risky for lending institutions, and F&F and VCs are the only alternative. Established companies generally prefer debt over equity for financing, although most corporations use a mixture of both. Debt for corporations ...

All material contained in this paper is written by way of general

... All material contained in this paper is written by way of general comment. No material should be accepted as authorative advice and any reader wishing to act upon material contained in this paper should first contact Worrells for properly considered professional advice, which take into account speci ...

... All material contained in this paper is written by way of general comment. No material should be accepted as authorative advice and any reader wishing to act upon material contained in this paper should first contact Worrells for properly considered professional advice, which take into account speci ...

Rocking-Horse Winner

... created by D.H. Lawrence, nor is the horse’s answer. Billie’s rocking horse was a toy created in the 1980s and abused for two decades thereafter. Today’s chastened pony cannot cry out “borrow money,” but simply the reverse – “lend prudently.” In today’s marketplace, prudent lending must be directed ...

... created by D.H. Lawrence, nor is the horse’s answer. Billie’s rocking horse was a toy created in the 1980s and abused for two decades thereafter. Today’s chastened pony cannot cry out “borrow money,” but simply the reverse – “lend prudently.” In today’s marketplace, prudent lending must be directed ...

Total liabilities and equity

... Long-Term Debt • Usually decided by senior managers or board of directors – Many companies maintain debt at a relatively constant proportion of total assets. – This chapter models debt as a percentage of operating assets (later chapters show alternative debt policies). ...

... Long-Term Debt • Usually decided by senior managers or board of directors – Many companies maintain debt at a relatively constant proportion of total assets. – This chapter models debt as a percentage of operating assets (later chapters show alternative debt policies). ...

Mankiw 5/e Chapter 15: Government Debt

... tax withholding to stimulate economy. This merely delayed taxes but didn’t make consumers better off. Yet, almost half of consumers used part of this extra take-home pay for consumption. ...

... tax withholding to stimulate economy. This merely delayed taxes but didn’t make consumers better off. Yet, almost half of consumers used part of this extra take-home pay for consumption. ...

Corporate Taxation Chapter Three: Capital Structure Professors Wells Presentation:

... Tax Court: Held that the advances were equity. 6th Circuit: Held that the advances were debt for tax purposes. Debt is “an unqualified obligation to pay a sum certain at a reasonably close fixed maturity date along with a fixed percentage in interest payable regardless of the debtor’s income or lack ...

... Tax Court: Held that the advances were equity. 6th Circuit: Held that the advances were debt for tax purposes. Debt is “an unqualified obligation to pay a sum certain at a reasonably close fixed maturity date along with a fixed percentage in interest payable regardless of the debtor’s income or lack ...

Powerpoint

... debtor into paying - Any evidence of unusual collection activity may render payments outside of the ordinary course of business, even if the days to pay are identical to pre-preference invoices Never put anything in writing that you would not want a Federal Bankruptcy Judge to see Use restructuring ...

... debtor into paying - Any evidence of unusual collection activity may render payments outside of the ordinary course of business, even if the days to pay are identical to pre-preference invoices Never put anything in writing that you would not want a Federal Bankruptcy Judge to see Use restructuring ...

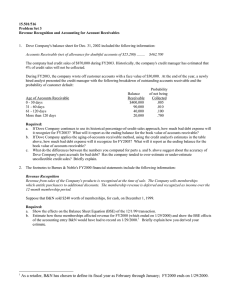

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

UNCTAD’s Seventh Debt Management Conference Towards Sovereign, Democratic, Responsible Lending

... • Make clear statements of purpose, amount, interest rates, fees and charges, grace and maturity periods, and beneficiaries of loans. • No confidential side-letters and any related host government agreements must be included in the loan documentation. • Borrowers spend funds as stipulated; lenders d ...

... • Make clear statements of purpose, amount, interest rates, fees and charges, grace and maturity periods, and beneficiaries of loans. • No confidential side-letters and any related host government agreements must be included in the loan documentation. • Borrowers spend funds as stipulated; lenders d ...

Shifting Risk and

... Any information in this presentation relating to any product: • Is a factual and objective description of the product • Does not constitute an express or implied recommendation, guidance or proposal that any particular transaction in respect the product is appropriate to your particular investment o ...

... Any information in this presentation relating to any product: • Is a factual and objective description of the product • Does not constitute an express or implied recommendation, guidance or proposal that any particular transaction in respect the product is appropriate to your particular investment o ...

A User Perspective, Sixth Canadian Edition (Hoskin, Fizzell

... Checklist of Key Figures Chapter 12: Financial Statement Analysis Problem ...

... Checklist of Key Figures Chapter 12: Financial Statement Analysis Problem ...

Debt Settlement - ClearOne Advantage

... their consumer debt. At the end of 2008, average outstanding credit card debt for U.S. households stood at an all-time high of $10,679.2 Last year, 15 percent of American adults, or nearly 34 million people, were late making credit card payments while eight percent—18 million people—missed a payment ...

... their consumer debt. At the end of 2008, average outstanding credit card debt for U.S. households stood at an all-time high of $10,679.2 Last year, 15 percent of American adults, or nearly 34 million people, were late making credit card payments while eight percent—18 million people—missed a payment ...

Roubini Global Economics - Italy Should Restructure Its Public Debt

... insurance companies that hold to maturity and don’t mark-to-market. Holdout problems can be fully dealt with through a credible commitment not to pay such holdouts if they do hold out; and if that triggers the CDS, so be it: Those who bought such protection/hedging should not be shafted—as they have ...

... insurance companies that hold to maturity and don’t mark-to-market. Holdout problems can be fully dealt with through a credible commitment not to pay such holdouts if they do hold out; and if that triggers the CDS, so be it: Those who bought such protection/hedging should not be shafted—as they have ...

eurozone_debt_crisis

... They'd be hypocritical to sanction others until they got their own houses in order. There were no teeth in any sanctions except expulsion from the eurozone, which would weaken the power of the euro itself. The EU wanted to strengthen the euro's power, putting pressure on non-eurozone EU members, lik ...

... They'd be hypocritical to sanction others until they got their own houses in order. There were no teeth in any sanctions except expulsion from the eurozone, which would weaken the power of the euro itself. The EU wanted to strengthen the euro's power, putting pressure on non-eurozone EU members, lik ...