Financial Ratios and Meanings

... Meaning: Measures the degree that working capital should meet daily obligations in relation to business volume Improved by: Improve working capital or reduce unprofitable sales while maintaining working capital Working Capital: Formula: Current Assets - Current Liabilities Meaning: Principal measure ...

... Meaning: Measures the degree that working capital should meet daily obligations in relation to business volume Improved by: Improve working capital or reduce unprofitable sales while maintaining working capital Working Capital: Formula: Current Assets - Current Liabilities Meaning: Principal measure ...

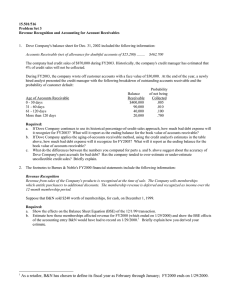

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... b. If Dove Company applies the aging-of-accounts receivable method, using the credit analyst's estimates in the table above, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? c. What do the differences between ...

... b. If Dove Company applies the aging-of-accounts receivable method, using the credit analyst's estimates in the table above, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? c. What do the differences between ...

PDF

... condition (farm income, expenses, assets, and debts, both farm and non-farm debt) and operating characteristics of farm businesses, the cost of producing agricultural commodities, and the wellbeing of farm operator households (income from farm, off-farm, and other business ventures are also collecte ...

... condition (farm income, expenses, assets, and debts, both farm and non-farm debt) and operating characteristics of farm businesses, the cost of producing agricultural commodities, and the wellbeing of farm operator households (income from farm, off-farm, and other business ventures are also collecte ...

chapter summary

... constraints that the private sector faces and hence will not go bankrupt. But growing deficits could harm our future standard of living due to the increasing cost of debt service and the possibility of long-term crowding out of private investment. 2. This chapter contains sections that deal with the ...

... constraints that the private sector faces and hence will not go bankrupt. But growing deficits could harm our future standard of living due to the increasing cost of debt service and the possibility of long-term crowding out of private investment. 2. This chapter contains sections that deal with the ...

Applications of Quantile Regression

... Debt ratio=Total liabilities/total assets (Debt ratio shows how much the company relies on debt to finance assets) Total asset turnover=Net sales/total assets (TAT is a measure of how well assets are being used to produce revenue) Current ratio=Current assets/current liability (Current ratio is an i ...

... Debt ratio=Total liabilities/total assets (Debt ratio shows how much the company relies on debt to finance assets) Total asset turnover=Net sales/total assets (TAT is a measure of how well assets are being used to produce revenue) Current ratio=Current assets/current liability (Current ratio is an i ...

PDF Download

... Fiscal policy sustainability is sometimes associated with the financial solvency of the government. In practice, however, what the empirical literature ends up testing is whether both public expenditures and government revenues will continue to display their historical growth patterns in the future. ...

... Fiscal policy sustainability is sometimes associated with the financial solvency of the government. In practice, however, what the empirical literature ends up testing is whether both public expenditures and government revenues will continue to display their historical growth patterns in the future. ...

New Zealand debt and house prices climbing rapidly

... steps have been taken to ensure that the material is presented in a clear, accurate and objective manner. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you se ...

... steps have been taken to ensure that the material is presented in a clear, accurate and objective manner. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you se ...

6 - Finance

... issue common stock. Instead, it will fund its equity needs by retaining its profits rather than paying them out as dividends. ...

... issue common stock. Instead, it will fund its equity needs by retaining its profits rather than paying them out as dividends. ...

not self-supporting debt - Texas Bond Review Board

... update, discuss pricing views and agree on a preliminary pricing scale. The agreed preliminary scale is sent out to the market (via wire) for a “pricing period,” during which orders are received Depending on orders received, the preliminary scale may be revised up or down if necessary. At the end of ...

... update, discuss pricing views and agree on a preliminary pricing scale. The agreed preliminary scale is sent out to the market (via wire) for a “pricing period,” during which orders are received Depending on orders received, the preliminary scale may be revised up or down if necessary. At the end of ...

CONNECT: Directed Numbers

... Perhaps the easiest way to think of multiplication is that you are simply repeating a deposit or withdrawal a number of times. Example, you know that 3 x 2 is 6; but think about what is happening in terms of deposits here: you are making 2 deposits of ($)3, or you could even interpret it as making 3 ...

... Perhaps the easiest way to think of multiplication is that you are simply repeating a deposit or withdrawal a number of times. Example, you know that 3 x 2 is 6; but think about what is happening in terms of deposits here: you are making 2 deposits of ($)3, or you could even interpret it as making 3 ...

MN50324 M and A game..

... • If no takeover threat, manager chooses D < R • - no financial distress. • As takeover threat increases, manager increases D towards D* => V increases => reduces takeover threat. ...

... • If no takeover threat, manager chooses D < R • - no financial distress. • As takeover threat increases, manager increases D towards D* => V increases => reduces takeover threat. ...

Instructor`s Manual Chapter 11-7e

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

BMS Finance completes its second senior debt financing of bfinance

... SMEs, today announces the completion of £2.5 million of senior debt finance to bfinance. This new debt facility follows a facility provided by BMS Finance in 2009 which enabled the current management team to buy-out bfinance from its private equity owners and has since been repaid in full. The new d ...

... SMEs, today announces the completion of £2.5 million of senior debt finance to bfinance. This new debt facility follows a facility provided by BMS Finance in 2009 which enabled the current management team to buy-out bfinance from its private equity owners and has since been repaid in full. The new d ...

Focus on emerging market corporate debt_Insights_r4

... exposure to EM corporate bonds remains compelling, based on the solid macro backdrop for emerging markets, as well as the stronger underlying credit fundamentals and higher yields of many EM corporate bond issues relative to similarly rated bonds issued by companies in developed markets. The strong ...

... exposure to EM corporate bonds remains compelling, based on the solid macro backdrop for emerging markets, as well as the stronger underlying credit fundamentals and higher yields of many EM corporate bond issues relative to similarly rated bonds issued by companies in developed markets. The strong ...

Section 5 The Financial Sector Modules 22-29

... have a risk that they will not be profitable. (what is risk?) The owner of a firm may want to build the factory, but using his/her own money is risky because the factory might not be profitable. Or the owner could raise the money by selling shares of stock in the company. When a person buys a share ...

... have a risk that they will not be profitable. (what is risk?) The owner of a firm may want to build the factory, but using his/her own money is risky because the factory might not be profitable. Or the owner could raise the money by selling shares of stock in the company. When a person buys a share ...

An Investigation into the Impact of Debt Financing

... become vibrant ones. For this reason, several governments in developing countries offer funding to small businesses either directly or by guaranteeing the payment of such loans as lack of funding is cited as one of the major challenges faced by small businesses. Due to limitation of resources by gov ...

... become vibrant ones. For this reason, several governments in developing countries offer funding to small businesses either directly or by guaranteeing the payment of such loans as lack of funding is cited as one of the major challenges faced by small businesses. Due to limitation of resources by gov ...

Role of Monetary Policy

... The corporate sector has been continuously reducing its debt burden and shifting to more long term maturity debt. ...

... The corporate sector has been continuously reducing its debt burden and shifting to more long term maturity debt. ...

Financial Check Up

... • Cash available from operations to cover scheduled payments (net income plus depreciation and interest payments less withdrawals) divided by scheduled principal and interest payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Non-f ...

... • Cash available from operations to cover scheduled payments (net income plus depreciation and interest payments less withdrawals) divided by scheduled principal and interest payments on term loans and capital leases. • After provision for taxes and withdrawals. • Should be greater than 1.0. • Non-f ...

Articles Of Confederation

... They would refer to themselves as Virginians’ or South Carolinians’, not as Americans’ ...

... They would refer to themselves as Virginians’ or South Carolinians’, not as Americans’ ...

A User Perspective, Sixth Canadian Edition (Hoskin, Fizzell

... Checklist of Key Figures Chapter 12: Financial Statement Analysis Problem ...

... Checklist of Key Figures Chapter 12: Financial Statement Analysis Problem ...

capbudgeting_leverage_old

... Using the same procedure, we compute the debt capacity at previous dates. In order for the WACC answer to be correct, we must assume that AVCO decreases its debt according to the schedule provided here. Thus, one year later, it must decrease debt by 30.62 – 23.71 or 6.91 ...

... Using the same procedure, we compute the debt capacity at previous dates. In order for the WACC answer to be correct, we must assume that AVCO decreases its debt according to the schedule provided here. Thus, one year later, it must decrease debt by 30.62 – 23.71 or 6.91 ...

austerity packages TURI Athens

... • Did the design of the package involve social dialogue, enabling the views of SPers, esp. TUs to be heard? – SD in 9 out of 17 countries; yet in 5 out of these 9 TU positions either barely taken into account or no agreement ...

... • Did the design of the package involve social dialogue, enabling the views of SPers, esp. TUs to be heard? – SD in 9 out of 17 countries; yet in 5 out of these 9 TU positions either barely taken into account or no agreement ...

Box 2 The impact of interest rate changes, inflation and exchange

... the impact would be transmitted to long-term real interest rates on indexed loans. Here it should be borne in mind that changes in yields on, for example, housing bonds, which carry fixed interest, primarily affect current homebuyers. Since homebuyers have the option of postponing transactions when ...

... the impact would be transmitted to long-term real interest rates on indexed loans. Here it should be borne in mind that changes in yields on, for example, housing bonds, which carry fixed interest, primarily affect current homebuyers. Since homebuyers have the option of postponing transactions when ...