Dissertation proposal - Arizona State University

... Public debt has been a relatively underworked area in public administration, yet it is a very important issue in government finance. In essence, with the assumption that bonded borrowings can not be used for non-capital expenditure, the debt actually plays a role that helps adjust the public capital ...

... Public debt has been a relatively underworked area in public administration, yet it is a very important issue in government finance. In essence, with the assumption that bonded borrowings can not be used for non-capital expenditure, the debt actually plays a role that helps adjust the public capital ...

The fiscal impact of pension reform: economic effects and

... • Pension funds assets invested into equities stimulate investment and economic growth • It is better to turn a portion of pension liabilities into savings now than to have much greater problems with redeeming such obligations in the future ...

... • Pension funds assets invested into equities stimulate investment and economic growth • It is better to turn a portion of pension liabilities into savings now than to have much greater problems with redeeming such obligations in the future ...

NBER WORKING PAPER SERIES INDIVIDUAL VERSUS AGGREGATE COLLATERAL

... ceiling. Only when the debt constraint is binding does the shadow cost of loans adjust upwards. The second theoretical feature that is important in generating the no-overborrowing result is that when the debt limit binds, it does so for all agents at the same time. I present two theoretical examples ...

... ceiling. Only when the debt constraint is binding does the shadow cost of loans adjust upwards. The second theoretical feature that is important in generating the no-overborrowing result is that when the debt limit binds, it does so for all agents at the same time. I present two theoretical examples ...

20160118_Transcript_Debt, Demographics and the Distribution of Income new challenges for monetary policy

... that monetary policy might have distributional effects, the textbook model has it working exclusively through inter-temporal substitution of a representative agent (the consumption-saving decisions described earlier). Using a far richer framework, Auclert (2015) finds that a redistribution channel c ...

... that monetary policy might have distributional effects, the textbook model has it working exclusively through inter-temporal substitution of a representative agent (the consumption-saving decisions described earlier). Using a far richer framework, Auclert (2015) finds that a redistribution channel c ...

Operating Leverage

... The combination of debt and equity used to finance a firm Target Capital Structure The mix of debt, preferred stock, and common equity with which the firm plans to finance its investments ...

... The combination of debt and equity used to finance a firm Target Capital Structure The mix of debt, preferred stock, and common equity with which the firm plans to finance its investments ...

Weighted Average Cost of Capital (WACC)

... The Pakistan example shows that something can be done. ...

... The Pakistan example shows that something can be done. ...

Document

... • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must also be understood… – But we do at least get a better handle on the system by knowing its ch ...

... • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must also be understood… – But we do at least get a better handle on the system by knowing its ch ...

U.S. Household Debt, 1975- 2007

... loans are among the most common secured loans. In these cases, collateral is provided to the lending institution in the form of a lien on the title to the property until the loan is paid off in full, and if the borrower defaults on the loan, the lender retains the legal right to repossess the proper ...

... loans are among the most common secured loans. In these cases, collateral is provided to the lending institution in the form of a lien on the title to the property until the loan is paid off in full, and if the borrower defaults on the loan, the lender retains the legal right to repossess the proper ...

Presentación de PowerPoint

... unlawful. The securities referred to herein have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Investors must neither accept an ...

... unlawful. The securities referred to herein have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Investors must neither accept an ...

FASB Update Name of Event

... • Pushdown accounting is now optional for all acquired entities upon a change-in-control event (or may be elected in a subsequent period as a change in accounting principle) • Once pushdown accounting is applied, that election is irrevocable • A subsidiary of an acquiree is eligible to elect pushdow ...

... • Pushdown accounting is now optional for all acquired entities upon a change-in-control event (or may be elected in a subsequent period as a change in accounting principle) • Once pushdown accounting is applied, that election is irrevocable • A subsidiary of an acquiree is eligible to elect pushdow ...

Determinants of capital structure - Theoretical and Applied Economics

... 2. Literature review and macroeconomic determinants of the capital structure The empirical literature suggests a number of factors that may influence the financial structure of firms. For example, Harris and Raviv (1991) suggest that the leverage of firms tends to be affected by fixed assets, invest ...

... 2. Literature review and macroeconomic determinants of the capital structure The empirical literature suggests a number of factors that may influence the financial structure of firms. For example, Harris and Raviv (1991) suggest that the leverage of firms tends to be affected by fixed assets, invest ...

The Capital Structure Puzzle

... some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create only a potential future deduction, usable when and if the firm earns enough to work ...

... some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create only a potential future deduction, usable when and if the firm earns enough to work ...

Century Bonds: Issuance Motivations and Debt versus Equity

... concerning the stock price reactions to equity issuance announcements. For example, Mikkelson and Partch (1986) and Barclay and Litzenberger (1988) find negative stock price reactions to equity issuance announcements. However, Wruck (1989) and Hertzel and Smith (1993) find positive stock price react ...

... concerning the stock price reactions to equity issuance announcements. For example, Mikkelson and Partch (1986) and Barclay and Litzenberger (1988) find negative stock price reactions to equity issuance announcements. However, Wruck (1989) and Hertzel and Smith (1993) find positive stock price react ...

Economic forecasts

... Policy decisions are taken in the space of a few months… – Policy decisions are taken on the basis of preliminary data which are subject to large revisions. – Revisions often appear too late to be taken into account ...

... Policy decisions are taken in the space of a few months… – Policy decisions are taken on the basis of preliminary data which are subject to large revisions. – Revisions often appear too late to be taken into account ...

staff note for the g20: state-contingent debt instruments for sovereigns

... associated with climate change are rising. Some proponents have argued that SCDIs (such as GDPlinked bonds) would make particularly good sense in a currency union as a way of achieving greater fiscal risk-sharing as well as reducing sovereigns’ funding reliance on banks. Others have reemphasized tha ...

... associated with climate change are rising. Some proponents have argued that SCDIs (such as GDPlinked bonds) would make particularly good sense in a currency union as a way of achieving greater fiscal risk-sharing as well as reducing sovereigns’ funding reliance on banks. Others have reemphasized tha ...

spending disad – 2011 adi - maria

... Decline of dollar causes worldwide economic collapse – collapses hegemony and causes a nuclear war with China Mead 2004 – Kissinger Fellow for US Foreign Policy at the Council on Foreign Relations (Walter Russell, Foreign Policy, Mar/Apr. 2004, EBSCO) Similarly, in the last 60 years, as foreigners h ...

... Decline of dollar causes worldwide economic collapse – collapses hegemony and causes a nuclear war with China Mead 2004 – Kissinger Fellow for US Foreign Policy at the Council on Foreign Relations (Walter Russell, Foreign Policy, Mar/Apr. 2004, EBSCO) Similarly, in the last 60 years, as foreigners h ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... research could extend the list of possible candidate shocks that could trigger or, more importantly, lead to sovereign default situations. Currency overvaluation/undervaluation comes to mind. One could also investigate if troubles in the Periphery were not precipitated by similar issues in the Core ...

... research could extend the list of possible candidate shocks that could trigger or, more importantly, lead to sovereign default situations. Currency overvaluation/undervaluation comes to mind. One could also investigate if troubles in the Periphery were not precipitated by similar issues in the Core ...

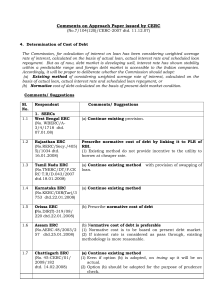

Comments on approach paper 04 - Central Electricity Regulatory

... 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market is developing well, interest rate has sho ...

... 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market is developing well, interest rate has sho ...

Financial Statement Analysis Tools

... • The total asset turnover ratio describes how efficiently the firm is using its assets to generate sales. In this case, we look at the firm's total asset investment: ...

... • The total asset turnover ratio describes how efficiently the firm is using its assets to generate sales. In this case, we look at the firm's total asset investment: ...

Cross River State Government of Nigeria

... benchmark of 35%. As such, staff numbers need to be reduced and in the absence of such action, financial flexibility will remain constrained, with fewer available funds for developmental purposes. Debt profile has remained elevated, rising by N15.1bn to a new high of N74.5bn at FYE14. As a consequ ...

... benchmark of 35%. As such, staff numbers need to be reduced and in the absence of such action, financial flexibility will remain constrained, with fewer available funds for developmental purposes. Debt profile has remained elevated, rising by N15.1bn to a new high of N74.5bn at FYE14. As a consequ ...

NBER VOLUNTARY WELFARE RESEARCH

... results from the fact that total payments in these states do not change with the level of debt; see Figure ...

... results from the fact that total payments in these states do not change with the level of debt; see Figure ...

PDF Download

... will eventually result in declines in services that the public finds unacceptable. Already some greater flexibility to reapportion the cuts implemented under the sequester has been provided in response to public pressure. Although the most likely outcome is that restraint of the magnitude embedded i ...

... will eventually result in declines in services that the public finds unacceptable. Already some greater flexibility to reapportion the cuts implemented under the sequester has been provided in response to public pressure. Although the most likely outcome is that restraint of the magnitude embedded i ...

Bankruptcy Equilibrium: Secured and Unsecured assets

... Debt is an important financial tool to transfer wealth among dates and to insurance among different states of nature. We can separate debt into two categories: Secured debt, as mortgage loan, is backed by some collateral; it played an important role during the last financial crisis [14]. Unsecured d ...

... Debt is an important financial tool to transfer wealth among dates and to insurance among different states of nature. We can separate debt into two categories: Secured debt, as mortgage loan, is backed by some collateral; it played an important role during the last financial crisis [14]. Unsecured d ...

The Use of Debt Covenants in Public Debt: The Role of

... debt. These covenants are predominantly restrictions on the payment of dividends and on new borrowing. To understand when these covenants are likely to be used we must first consider the broader agency setting in which they arise. The existence of risky debt in a firm’s capital structure motivates m ...

... debt. These covenants are predominantly restrictions on the payment of dividends and on new borrowing. To understand when these covenants are likely to be used we must first consider the broader agency setting in which they arise. The existence of risky debt in a firm’s capital structure motivates m ...