No Slide Title

... 1) The money market is the interactions among institutions through which money is supplied to individuals, firms and other institutions that demand money. 2) Money Market equilibrium occurs at the interest rate at which the quantity of money demanded is equal to the quantity of money supplied. ...

... 1) The money market is the interactions among institutions through which money is supplied to individuals, firms and other institutions that demand money. 2) Money Market equilibrium occurs at the interest rate at which the quantity of money demanded is equal to the quantity of money supplied. ...

Document

... spending as a percent of total spending. Commandeering of resources could now be accomplished through the printing press. Even Keynes acknowledged this. ...

... spending as a percent of total spending. Commandeering of resources could now be accomplished through the printing press. Even Keynes acknowledged this. ...

The Curse of Cash - Arthur D. Simons Center

... rates may be seen as a direct tax on currency deposits and a violation of the depositor trust. It may also be perceived as a coercive act waged by government forcing lenders to lend, or depositors to spend. This perception could lead to a run to cash by depositors--taking their money out of the bank ...

... rates may be seen as a direct tax on currency deposits and a violation of the depositor trust. It may also be perceived as a coercive act waged by government forcing lenders to lend, or depositors to spend. This perception could lead to a run to cash by depositors--taking their money out of the bank ...

How the Federal Reserve Monetary System Destroys Liberty

... brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” ...

... brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” ...

Richard W Fisher: The limits of the powers of central banks

... open-market operations conducted by the Federal Reserve Bank of New York on behalf of all 12 Banks at the instruction of the FOMC. All 12 Bank presidents serve on the FOMC together with the seven members of the Board of Governors. This is where monetary policy for the United States is determined by ...

... open-market operations conducted by the Federal Reserve Bank of New York on behalf of all 12 Banks at the instruction of the FOMC. All 12 Bank presidents serve on the FOMC together with the seven members of the Board of Governors. This is where monetary policy for the United States is determined by ...

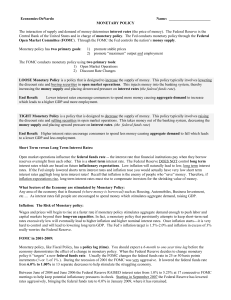

http://socrates

... etc…. As interest rates fall people are encouraged to spend money which stimulates aggregate demand, raising GDP. Inflation: The Risk of Monetary policy: Wages and prices will begin to rise at a faster rate if monetary policy stimulates aggregate demand enough to push labor and capital markets beyon ...

... etc…. As interest rates fall people are encouraged to spend money which stimulates aggregate demand, raising GDP. Inflation: The Risk of Monetary policy: Wages and prices will begin to rise at a faster rate if monetary policy stimulates aggregate demand enough to push labor and capital markets beyon ...

Section 2 - What Are the Origins of Modern Fiscal and Monetary

... depression. He also discussed how political leaders could end the Great Depression and avoid similar crises in the future. Keynes’s basic idea was simple. During a recession, overall demand for goods and services decreases because people who are out of work stop spending. In response, businesses cut ...

... depression. He also discussed how political leaders could end the Great Depression and avoid similar crises in the future. Keynes’s basic idea was simple. During a recession, overall demand for goods and services decreases because people who are out of work stop spending. In response, businesses cut ...

Final Exam - Whitman People

... 5. Consider The Economics of Money, Banking and Financial Markets, by Frederic Mishkin. On page 648 Mishkin describes the period of United States macroeconomic history from 19651973. He states “policy-makers, economists, and politicians had become committed in the mid1960’s to a target unemployment ...

... 5. Consider The Economics of Money, Banking and Financial Markets, by Frederic Mishkin. On page 648 Mishkin describes the period of United States macroeconomic history from 19651973. He states “policy-makers, economists, and politicians had become committed in the mid1960’s to a target unemployment ...

20140416 Budgeting and Macro Policy

... – If PY too large relative to trend, Federal Reserve pushes M down— and so Y (production and employment) falls and P (inflation) decelerates. – If the rest of the government does something that disturbs this relationship, the Federal Reserve can and does neutralize it • Hence fiscal policy should be ...

... – If PY too large relative to trend, Federal Reserve pushes M down— and so Y (production and employment) falls and P (inflation) decelerates. – If the rest of the government does something that disturbs this relationship, the Federal Reserve can and does neutralize it • Hence fiscal policy should be ...

Fiscal Policy and Monetary Policy

... account for the Treasury Department and processes payments such as social security checks and IRS refunds. ▫ Government Securities Auctions. Fed serves as a financial agent for the Treasury Department and other government agencies. The Fed sells, transfers, and redeems government securities. Also, t ...

... account for the Treasury Department and processes payments such as social security checks and IRS refunds. ▫ Government Securities Auctions. Fed serves as a financial agent for the Treasury Department and other government agencies. The Fed sells, transfers, and redeems government securities. Also, t ...

ECON 3080-001 Intermediate Macroeconomic Theory

... 2) "Macroeconomics : The Dynamics of Theory and Policy", by William Boyes, Southwestern Publishing Company , Cincinnati, Third Edition , ...

... 2) "Macroeconomics : The Dynamics of Theory and Policy", by William Boyes, Southwestern Publishing Company , Cincinnati, Third Edition , ...

ECON 2020-200 Principles of Macroeconomics

... This course focuses on the overall economic issues of GDP calculation, working · of ·market system in a capitalistic economy, theories of consumption and investment, multiplier analysis, Fiscal and Monetary policy making in the U.S., and monetary theories of Keynes, classical economists and monetari ...

... This course focuses on the overall economic issues of GDP calculation, working · of ·market system in a capitalistic economy, theories of consumption and investment, multiplier analysis, Fiscal and Monetary policy making in the U.S., and monetary theories of Keynes, classical economists and monetari ...

ECON 2020-500 Principles of Macroeconomics

... Kulkarni, Third Edi·tion, Kendall Hunt Publishing Company, Dubuque, Iowa, 1997 . A few other readings assignments will be distributed and referred to in the class. Course Description and Objectives: This course focuses on the overall economic issues of GDP calculation, working of market system in a ...

... Kulkarni, Third Edi·tion, Kendall Hunt Publishing Company, Dubuque, Iowa, 1997 . A few other readings assignments will be distributed and referred to in the class. Course Description and Objectives: This course focuses on the overall economic issues of GDP calculation, working of market system in a ...

ECON 3080-001 Intermediate Macroeconomic Theory

... Kulkarni, Kendall Hunt Publishing Company, Dubuque, Iowa, Third Edition, 1997. 2) "Macroeconomics: Theories and Policies", by Richard Froyen, Prentice-Hall Publishing, Sixth Edition, 1999. Objective and Contents of the Course: The list of chapters from the above books would probably give you feeling ...

... Kulkarni, Kendall Hunt Publishing Company, Dubuque, Iowa, Third Edition, 1997. 2) "Macroeconomics: Theories and Policies", by Richard Froyen, Prentice-Hall Publishing, Sixth Edition, 1999. Objective and Contents of the Course: The list of chapters from the above books would probably give you feeling ...

Review Questions Chapter 16

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

Your Chapter 15-18 Questions Chapter 15 1. Money is a. a synonym

... d. All of the above 11. The process by which financial institutions accept saving from businesses, households, and governments and savings to other businesses and savings to other businesses, households, and governments is called: a. financial intermediate b. financial intermediaries c. transactions ...

... d. All of the above 11. The process by which financial institutions accept saving from businesses, households, and governments and savings to other businesses and savings to other businesses, households, and governments is called: a. financial intermediate b. financial intermediaries c. transactions ...

Goal 9 Study Guide

... 13. If the Fed wants to stimulate the economy, what might it do to the discount rate, the reserve requirement, or open market operations? 14. If the Fed increases the money supply, what will happen to the interest rates at banks? Chapter 25.1 The Federal Budget Define the following terms: 1. budget ...

... 13. If the Fed wants to stimulate the economy, what might it do to the discount rate, the reserve requirement, or open market operations? 14. If the Fed increases the money supply, what will happen to the interest rates at banks? Chapter 25.1 The Federal Budget Define the following terms: 1. budget ...