Monetary Targeting and Monetary Policy

... government securities market, and estimates the demand for reserves and how the prices of government securities will change during the trading day. 9:10 A.M. The account manager studies the FOMC’s directive, or the level of the federal funds rate desired, and designs dynamic open market operations a ...

... government securities market, and estimates the demand for reserves and how the prices of government securities will change during the trading day. 9:10 A.M. The account manager studies the FOMC’s directive, or the level of the federal funds rate desired, and designs dynamic open market operations a ...

Sawyer/Sprinkle Chapter 18

... CHANGES IN MONETARY POLICY • Capital outflow causes supply of loanable funds to ...

... CHANGES IN MONETARY POLICY • Capital outflow causes supply of loanable funds to ...

PDF

... This paper develops a dynamic model of seigniorage in which economies' equilibrium paths reflect the ongoing strategic interaction between an optimizing government and a rational public. The model extends existing positive models of monetary policy and inflation by explicitly incorporating the inter ...

... This paper develops a dynamic model of seigniorage in which economies' equilibrium paths reflect the ongoing strategic interaction between an optimizing government and a rational public. The model extends existing positive models of monetary policy and inflation by explicitly incorporating the inter ...

CHAPTER 15: Macroeconomic Issues and Policy

... a. The Fed is likely to increase the interest rate during times of high output and low inflation. b. The Fed is likely to lower the interest rate during times of low output and low inflation. c. The Fed is likely to lower the interest rate during times of high output and low inflation. d. The Fed is ...

... a. The Fed is likely to increase the interest rate during times of high output and low inflation. b. The Fed is likely to lower the interest rate during times of low output and low inflation. c. The Fed is likely to lower the interest rate during times of high output and low inflation. d. The Fed is ...

Four rescue measures for stagnant eurozone

... per year for two years, concentrated in the countries with the largest output gaps, that is, in the periphery), which is permanently funded and monetised by the ECB. To make the mechanics of this helicopter money drop more transparent, the ECB could cancel the sovereign debt it purchases. This third ...

... per year for two years, concentrated in the countries with the largest output gaps, that is, in the periphery), which is permanently funded and monetised by the ECB. To make the mechanics of this helicopter money drop more transparent, the ECB could cancel the sovereign debt it purchases. This third ...

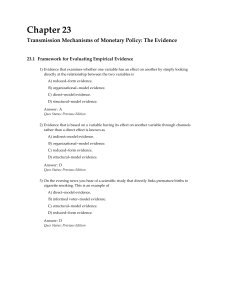

Economics of Money, Banking, and Financial Markets, 8e

... B) bank failures during the Great Depression were not the cause of the decline in the money supply. C) evidence from the Great Depression demonstrated the ineffectiveness of monetary policy. D) there is a weak link between interest rates and investment spending. Answer: A Ques Status: Revised ...

... B) bank failures during the Great Depression were not the cause of the decline in the money supply. C) evidence from the Great Depression demonstrated the ineffectiveness of monetary policy. D) there is a weak link between interest rates and investment spending. Answer: A Ques Status: Revised ...

Maradona theory of interest rates

... The source of monetary policy’s influence over output and employment lies in frictions, which mean that prices and wages do not adjust instantaneously to clear markets whenever demand and supply are out of balance. Firms change prices only irregularly in response to changes in demand; wages adjust o ...

... The source of monetary policy’s influence over output and employment lies in frictions, which mean that prices and wages do not adjust instantaneously to clear markets whenever demand and supply are out of balance. Firms change prices only irregularly in response to changes in demand; wages adjust o ...

Caution or Activism? Monetary Policy Strategies in an Open Economy

... than uninformed central banks. Optimal monetary policy strategy is activist and we replicate the closed-economy result that policy actions should be strong to promote learning. In the equilibrium without policy coordination the informational spillovers prove to be more problematic. Absent coordinat ...

... than uninformed central banks. Optimal monetary policy strategy is activist and we replicate the closed-economy result that policy actions should be strong to promote learning. In the equilibrium without policy coordination the informational spillovers prove to be more problematic. Absent coordinat ...

Zimbabwe - COMESA Monetary Institute (CMI)

... the monetary policy is expected to be minimal. It should, however, be noted that fiscal policy can affect monetary policy through its impact on interest rates and financial stability. Despite adopting a cash budgeting system in 2009, Government of Zimbabwe (GoZ) has since 2013 turned to domestic bor ...

... the monetary policy is expected to be minimal. It should, however, be noted that fiscal policy can affect monetary policy through its impact on interest rates and financial stability. Despite adopting a cash budgeting system in 2009, Government of Zimbabwe (GoZ) has since 2013 turned to domestic bor ...

NBER WORKING PAPER SERIES ARE COUNTERCYCLICAL FISCAL POLICIES COUNTERPRODUCTIVE? David B. Gordon

... run to changes in government expenditures and taxes. But in economic downturns, countercyclical policies increase government indebtedness, raising future debt service obligations. These new expenditure commitments must be financed by some mix of higher taxes, lower spending, or higher money growth i ...

... run to changes in government expenditures and taxes. But in economic downturns, countercyclical policies increase government indebtedness, raising future debt service obligations. These new expenditure commitments must be financed by some mix of higher taxes, lower spending, or higher money growth i ...

money market

... Other Determinants of Planned Investment The assumption that planned investment depends only on the interest rate is obviously a simplification, just as is the assumption that consumption depends only on income. In practice, the decision of a firm on how much to invest depends on, among other things ...

... Other Determinants of Planned Investment The assumption that planned investment depends only on the interest rate is obviously a simplification, just as is the assumption that consumption depends only on income. In practice, the decision of a firm on how much to invest depends on, among other things ...

CHAP1.WP (Word5)

... less effect on the demand for money the lower its interest responsiveness. Thus, as the interest responsiveness of the demand for money falls, a larger increase in income must occur to boost the demand for money and maintain equilibrium in the money market. Figure 4-7 illustrates the importance of t ...

... less effect on the demand for money the lower its interest responsiveness. Thus, as the interest responsiveness of the demand for money falls, a larger increase in income must occur to boost the demand for money and maintain equilibrium in the money market. Figure 4-7 illustrates the importance of t ...

NBER WORKING PAPER SERIES FISCAL LIMITS IN ADVANCED ECONOMIES Eric M. Leeper

... where z ∗ is steady-state transfers and εt is a serially uncorrelated shock with Et εt+1 = 0. Most macroeconomic models contain no uncertainty about future policy regimes, making the implausible assumption that agents know exactly what monetary and fiscal policies will be in effect at every date in th ...

... where z ∗ is steady-state transfers and εt is a serially uncorrelated shock with Et εt+1 = 0. Most macroeconomic models contain no uncertainty about future policy regimes, making the implausible assumption that agents know exactly what monetary and fiscal policies will be in effect at every date in th ...

Fiscal Stimulus and Potential Inflationary Risks

... If the debt will be paid off by higher future tax rates, the economy can be set up for a decade or more of high-tax and low-growth stagnation. If the Fed’s kitty and the Treasury’s taxing power or spending-reduction ability are gone, then we are set up for inflation.” It may be worth recognising tha ...

... If the debt will be paid off by higher future tax rates, the economy can be set up for a decade or more of high-tax and low-growth stagnation. If the Fed’s kitty and the Treasury’s taxing power or spending-reduction ability are gone, then we are set up for inflation.” It may be worth recognising tha ...

THE GLOBAL CRISIS AND UNCONVENTIONAL MONETARY POLICY

... housing bubble in the US, and then spread to the euro area – where it took the form of a sovereign debt crisis after 2010 – and to the rest of the globe. In its aftermath, the major central banks, such as the ECB and the Fed, started implementing the so-called unconventional monetary policy measures ...

... housing bubble in the US, and then spread to the euro area – where it took the form of a sovereign debt crisis after 2010 – and to the rest of the globe. In its aftermath, the major central banks, such as the ECB and the Fed, started implementing the so-called unconventional monetary policy measures ...

1) The objectives of the Federal Reserve in its conduct of monetary

... (b) Monetary base (c) Federal funds interest rate (d) Discount rate ...

... (b) Monetary base (c) Federal funds interest rate (d) Discount rate ...

Money, Interest, and Capital Accumulation in Karl Marx`s

... introductions into Marx’s economic thinking by Mandel (1978) and Sweezy (1942) money is only considered in so far as a brief summary of Marx’s arguments in Capital, vol. I, is given where money is derived from the succession of the different forms of value and then builds the bridge to capital, the ...

... introductions into Marx’s economic thinking by Mandel (1978) and Sweezy (1942) money is only considered in so far as a brief summary of Marx’s arguments in Capital, vol. I, is given where money is derived from the succession of the different forms of value and then builds the bridge to capital, the ...

The Effectiveness of Monetary and Fiscal Policy in

... will fail to increase investments and restore full employment” (Rakic et al., 2012, p. 395). But, fiscal policy will increase the output through government expenditure augmentation, due to the fact that interest rates do not raise whatsoever and there is no crowding out of private investments to off ...

... will fail to increase investments and restore full employment” (Rakic et al., 2012, p. 395). But, fiscal policy will increase the output through government expenditure augmentation, due to the fact that interest rates do not raise whatsoever and there is no crowding out of private investments to off ...

Slide - MyWeb

... or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spending changes a great deal in response to changes in the interest rate; ...

... or a Decrease in Net Taxes (T) interest sensitivity or insensitivity of planned investment The responsiveness of planned investment spending to changes in the interest rate. Interest sensitivity means that planned investment spending changes a great deal in response to changes in the interest rate; ...

MerCAtUS reSeArCh A MArket-Driven noMinAl GDP tArGetinG reGiMe

... 5. Robert Hall—Advocated a price-level targeting scheme involving interestbearing bank reserves. Higher rates on reserves would lower demand for reserves and thus raise the price level. Hall also proposed monetary policies aimed at targeting the price of a specified basket of commodities.7 The prob ...

... 5. Robert Hall—Advocated a price-level targeting scheme involving interestbearing bank reserves. Higher rates on reserves would lower demand for reserves and thus raise the price level. Hall also proposed monetary policies aimed at targeting the price of a specified basket of commodities.7 The prob ...

Treasury Bill Rates in the 1970s and 1980s

... Wilcox (1983). The tax rate used for the October observation is an average of the rate for the Current year and the subsequent year. We use full-employment government purchases and net taxes as our fiscal policy proxies for two reasons. First, separate variables for purchases and for taxes-net-of-tr ...

... Wilcox (1983). The tax rate used for the October observation is an average of the rate for the Current year and the subsequent year. We use full-employment government purchases and net taxes as our fiscal policy proxies for two reasons. First, separate variables for purchases and for taxes-net-of-tr ...

as a PDF

... six weeks for the Federal Reserve) and attempts at fine tuning. Fiscal policy, in contrast, typically involves infrequent decisions (often annually), and could be described as ‘coarse tuning.’1 It could be argued that the ‘fine tuning’ nature of monetary policy means that it suffers more from proble ...

... six weeks for the Federal Reserve) and attempts at fine tuning. Fiscal policy, in contrast, typically involves infrequent decisions (often annually), and could be described as ‘coarse tuning.’1 It could be argued that the ‘fine tuning’ nature of monetary policy means that it suffers more from proble ...

Monetary Policy

... government securities market, and estimates the demand for reserves and how the prices of government securities will change during the trading day. 9:10 A.M. The account manager studies the FOMC’s directive, or the level of the federal funds rate desired, and designs dynamic open market operations a ...

... government securities market, and estimates the demand for reserves and how the prices of government securities will change during the trading day. 9:10 A.M. The account manager studies the FOMC’s directive, or the level of the federal funds rate desired, and designs dynamic open market operations a ...

The Contributions of Milton Friedman to Economics

... was working or not. Wallis (1980, 325–6) wrote, quoting from a 1950 letter: If a wise and seasoned ordnance expert like Schuyler were on the premises, he would see after the first few thousand or even hundred [rounds] that the experiment need not be completed. . . . [I]t would be nice if there were ...

... was working or not. Wallis (1980, 325–6) wrote, quoting from a 1950 letter: If a wise and seasoned ordnance expert like Schuyler were on the premises, he would see after the first few thousand or even hundred [rounds] that the experiment need not be completed. . . . [I]t would be nice if there were ...