Practice final

... B) The money supply and interest rates to pursue its economic objectives. C) income tax rates and interest rates to pursue its economic objectives. D) government spending and income tax rates to pursue its economic objectives. 10. Federal Reserve Board Chairmen Paul Volker, Alan Greenspan, and Ben B ...

... B) The money supply and interest rates to pursue its economic objectives. C) income tax rates and interest rates to pursue its economic objectives. D) government spending and income tax rates to pursue its economic objectives. 10. Federal Reserve Board Chairmen Paul Volker, Alan Greenspan, and Ben B ...

1. The tax multiplier associated with a $10B reduction in taxes is

... ."An increase in national income increases aggregate demand more than the initial increase in spending." The preceding statement describes microeconomic supply and demand curves. macroeconomic supply and demand curves. the spending multiplier. the money multiplier. both c) and d) are correct. ...

... ."An increase in national income increases aggregate demand more than the initial increase in spending." The preceding statement describes microeconomic supply and demand curves. macroeconomic supply and demand curves. the spending multiplier. the money multiplier. both c) and d) are correct. ...

Syllabus - Harvard Kennedy School

... Topics covered: What is the role of monetary and fiscal policy in an open economy? What determines the balance of payments, the level of economic activity, and inflation? Should countries fix their exchange rates, or let them float? How does the globalization of financial markets affect these and ot ...

... Topics covered: What is the role of monetary and fiscal policy in an open economy? What determines the balance of payments, the level of economic activity, and inflation? Should countries fix their exchange rates, or let them float? How does the globalization of financial markets affect these and ot ...

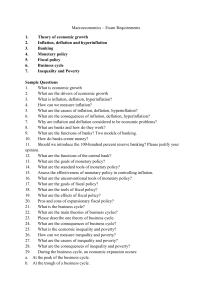

Macroeconomics – Exam Requirements 1. Theory of economic

... decrease spending d. raise the Federal Funds rate decrease spending ...

... decrease spending d. raise the Federal Funds rate decrease spending ...

The IS–LM model

... • Positive effect of Y on M d : A greater GDP means greater production of goods and services, more sales and more spending. The idea is that if people and firms are going to spend more, then other things equal they will wish to have more money on hand. • Negative effect of r on M d : Here we’re look ...

... • Positive effect of Y on M d : A greater GDP means greater production of goods and services, more sales and more spending. The idea is that if people and firms are going to spend more, then other things equal they will wish to have more money on hand. • Negative effect of r on M d : Here we’re look ...

Document

... expectations hypothesis which assumes that individuals form expectations about the future based on the information available to them, and that they act on those expectations. The founder of the rational expectations hypothesis is Robert E. Lucas of Carnegie-Mellon University. ...

... expectations hypothesis which assumes that individuals form expectations about the future based on the information available to them, and that they act on those expectations. The founder of the rational expectations hypothesis is Robert E. Lucas of Carnegie-Mellon University. ...

Introduction to Macroeconomics

... lags between the implementation of policies and their effects, the scope for monetary policy should be restricted. ...

... lags between the implementation of policies and their effects, the scope for monetary policy should be restricted. ...

Public Policy – Economic

... was the famed "trickle down" portion of Reagan's plan. The chief problem Reaganomics faced, and the reason it failed to meet its overall goals was that it was internally inconsistent. Reagan's administration professed a desire for a seriously pared down federal government, but never lived up to the ...

... was the famed "trickle down" portion of Reagan's plan. The chief problem Reaganomics faced, and the reason it failed to meet its overall goals was that it was internally inconsistent. Reagan's administration professed a desire for a seriously pared down federal government, but never lived up to the ...

Advanced Placement Annual Conference, 2011 San Francisco, CA

... To balance the federal budget, suppose that the government decides to raise income taxes while maintaining the current level of government spending. On the graph drawn in part (b), show the effect of the increase in taxes. Label the new equilibrium output and price levels Y2 and PL2, respectively. O ...

... To balance the federal budget, suppose that the government decides to raise income taxes while maintaining the current level of government spending. On the graph drawn in part (b), show the effect of the increase in taxes. Label the new equilibrium output and price levels Y2 and PL2, respectively. O ...

9 Money

... • Banks usually want to have as little reserves as they can, so they just have ρd • Therefore bank balance sheet is typically: Assets ...

... • Banks usually want to have as little reserves as they can, so they just have ρd • Therefore bank balance sheet is typically: Assets ...

When to Shift

... decisions that favor capital goods over consumer goods lead to long-run growth; however, BOTH capital and consumer goods must be produced within an economy. Short-run unemployment shows up as a point on or inside the graph. A point outside the graph represents a level of production beyond what is ac ...

... decisions that favor capital goods over consumer goods lead to long-run growth; however, BOTH capital and consumer goods must be produced within an economy. Short-run unemployment shows up as a point on or inside the graph. A point outside the graph represents a level of production beyond what is ac ...

What effect does a rise in government spending have on an ISLM

... (1) If investment is perfectly interest inelastic, the IS curve is vertical. Monetary policy will not be effective in changing national income. This is because the rise in money supply does not lead to a rise in investment. (2) If the speculative demand for money is perfectly interest elastic, the L ...

... (1) If investment is perfectly interest inelastic, the IS curve is vertical. Monetary policy will not be effective in changing national income. This is because the rise in money supply does not lead to a rise in investment. (2) If the speculative demand for money is perfectly interest elastic, the L ...

Handout on the U.S. Federal Reserve and the mechanics of

... The Federal Reserve: The Mechanics of Monetary Policy To manage the money supply, the Federal Reserve uses the tools of monetary policy to influence the quantity of reserves in the banking system. Increasing (decreasing) reserves tends to expand (contract) a bank’s ability to make loans. Thus, reser ...

... The Federal Reserve: The Mechanics of Monetary Policy To manage the money supply, the Federal Reserve uses the tools of monetary policy to influence the quantity of reserves in the banking system. Increasing (decreasing) reserves tends to expand (contract) a bank’s ability to make loans. Thus, reser ...

Topic 3: Fiscal Policy

... Money Demand Made up of three pieces: Transaction Demand – money on hand for transactions (money needed for purchases) Precautionary Demand – rainy day funds (money that might be needed for purchases) Speculative Demand – e.g., hold cash to buy bonds later if you expect bond rate will rise so ...

... Money Demand Made up of three pieces: Transaction Demand – money on hand for transactions (money needed for purchases) Precautionary Demand – rainy day funds (money that might be needed for purchases) Speculative Demand – e.g., hold cash to buy bonds later if you expect bond rate will rise so ...

Demand_and_supply_Money

... •HH & BS are willing to accept currency and checkable deposits as long as they know it can be spent without a loss of purchasing power. •In inflation… the rapid loss of purchasing power will cause money to lose its function as a medium of exchange. •Money will serve its function as a store of value ...

... •HH & BS are willing to accept currency and checkable deposits as long as they know it can be spent without a loss of purchasing power. •In inflation… the rapid loss of purchasing power will cause money to lose its function as a medium of exchange. •Money will serve its function as a store of value ...

AP Economics Course Syllabus 2016-17

... We will use the Elkins Approved model for grades. There will be a minimum of three major grades and eleven daily grades per nine weeks. We will also follow the Elkins policy on late grades for AP courses. Twenty-five points will be deducted from an assignment on the first day it is late and it will ...

... We will use the Elkins Approved model for grades. There will be a minimum of three major grades and eleven daily grades per nine weeks. We will also follow the Elkins policy on late grades for AP courses. Twenty-five points will be deducted from an assignment on the first day it is late and it will ...

Practice Test – Chapters 11,12,13, Multiple Choice Identify the

... Discretionary fiscal policy refers to: A) any change in government spending or taxes that destabilizes the economy. B) the authority that the President has to change personal income tax rates. C) changes in taxes and government expenditures made by Congress to stabilize the economy. D) the changes i ...

... Discretionary fiscal policy refers to: A) any change in government spending or taxes that destabilizes the economy. B) the authority that the President has to change personal income tax rates. C) changes in taxes and government expenditures made by Congress to stabilize the economy. D) the changes i ...

Outline of Lecture 1 – Basic Economics Concepts

... The effects of monetary policy are easy to show graphically. Begin with money supply, money demand, and an equilibrium interest rate. Show how both an increase and a decrease in the money supply affect interest rates. Definition of theory of liquidity preference: Keynes’s theory that the interest ra ...

... The effects of monetary policy are easy to show graphically. Begin with money supply, money demand, and an equilibrium interest rate. Show how both an increase and a decrease in the money supply affect interest rates. Definition of theory of liquidity preference: Keynes’s theory that the interest ra ...

Name - The Keller Project

... Explain why our goal is not to achieve zero percent unemployment (_____/5) 3. (_____/15 Points) Inflation a. Fill out the following tables to practice calculating the CPI for different base years (_____/5) Year Market Basket Base Year 2006 Base Year 2007 Base Year 2008 ...

... Explain why our goal is not to achieve zero percent unemployment (_____/5) 3. (_____/15 Points) Inflation a. Fill out the following tables to practice calculating the CPI for different base years (_____/5) Year Market Basket Base Year 2006 Base Year 2007 Base Year 2008 ...

Chapter 32: Monetary Theory

... - Monetary theory deals with the effects of the demand and supply of money on income, output, and the price level. The Quantity Theory of Money - The Quantity Theory of Money states that price level changes are due to changes in the quantity of money. The Crude Quantity Theory of Money - The crude q ...

... - Monetary theory deals with the effects of the demand and supply of money on income, output, and the price level. The Quantity Theory of Money - The Quantity Theory of Money states that price level changes are due to changes in the quantity of money. The Crude Quantity Theory of Money - The crude q ...