Institute of Actuaries of India Subject CT7 – Business Economics

... 1) An increase in government spending: This increases output through the multiplier effect. If mpc in the economy is 0.75 then multiplier will be 4. Thus an increase in government spending by 1 million rupees increases national income by 4 million rupees. The increase in income will increase the dem ...

... 1) An increase in government spending: This increases output through the multiplier effect. If mpc in the economy is 0.75 then multiplier will be 4. Thus an increase in government spending by 1 million rupees increases national income by 4 million rupees. The increase in income will increase the dem ...

krugman ir macro module 36(72).indd

... card. Also ask them if they ever worry that their bank will go out of business. Then ask them how the Federal Reserve actually increases the money supply. It surely does not just print money and pass it out. The answers to these questions will be revealed as you present the functions and policy tool ...

... card. Also ask them if they ever worry that their bank will go out of business. Then ask them how the Federal Reserve actually increases the money supply. It surely does not just print money and pass it out. The answers to these questions will be revealed as you present the functions and policy tool ...

Three cheers for Mr. Rosengren

... In particular, the Boston Fed President would like to see the Fed buy mortgage securities in order to lower home loan rates further. This would make it possible for more households to refinance their mortgages at lower rates, leaving them with additional money each month to purchase other goods and ...

... In particular, the Boston Fed President would like to see the Fed buy mortgage securities in order to lower home loan rates further. This would make it possible for more households to refinance their mortgages at lower rates, leaving them with additional money each month to purchase other goods and ...

3 Hours. Maximum Marks – 100 - Dwarka International School

... 7.. Increase in per capita availability of goods and services does raise the standard of living and consequently welfare. But it may not necessarily always be so. For example, manufacturing etc. does raise output but at the same time also leads to water and air pollution which reduces welfare of the ...

... 7.. Increase in per capita availability of goods and services does raise the standard of living and consequently welfare. But it may not necessarily always be so. For example, manufacturing etc. does raise output but at the same time also leads to water and air pollution which reduces welfare of the ...

Chapter 28

... By diluting the gold with other metals, the government could increase the total number of coins issued without also needing to increase the amount of gold used to make them. When the cost of each coin is lowered in this way, the government profits from an increase in seigniorage (/ˈseɪnjərɪdʒ/), th ...

... By diluting the gold with other metals, the government could increase the total number of coins issued without also needing to increase the amount of gold used to make them. When the cost of each coin is lowered in this way, the government profits from an increase in seigniorage (/ˈseɪnjərɪdʒ/), th ...

Macroeconomic Theory

... federal budget.” When the economy is booming (Y > Yp) , policy makers should aim for a governmental budget surplus. When the economy is in a recession (Y < Yp), policy makers should aim for a governmental budget deficit. Stated differently, the structural (as opposed to cyclical portion of the budge ...

... federal budget.” When the economy is booming (Y > Yp) , policy makers should aim for a governmental budget surplus. When the economy is in a recession (Y < Yp), policy makers should aim for a governmental budget deficit. Stated differently, the structural (as opposed to cyclical portion of the budge ...

MONETARY AND FISCAL POLICIES

... How is the Monetary Policy different from the Fiscal Policy? • The Monetary Policy regulates the supply of money and the cost and availability of credit in the economy. It deals with both the lending and borrowing rates of interest for commercial banks. • The Monetary Policy aims to maintain price ...

... How is the Monetary Policy different from the Fiscal Policy? • The Monetary Policy regulates the supply of money and the cost and availability of credit in the economy. It deals with both the lending and borrowing rates of interest for commercial banks. • The Monetary Policy aims to maintain price ...

Powerpoint - DebtDeflation

... • “If … wage-earners decide to keep part of their savings in the form of liquid balances … firms will get back from the market less money than they have initially injected in it… there has been a loss … firms will be unable to repay to the banks the whole of their debt.” • “An assumption is therefor ...

... • “If … wage-earners decide to keep part of their savings in the form of liquid balances … firms will get back from the market less money than they have initially injected in it… there has been a loss … firms will be unable to repay to the banks the whole of their debt.” • “An assumption is therefor ...

Managing Aggregate Demand

... – Determine short-term interest rates (FFR) – Size of U.S. money supply ...

... – Determine short-term interest rates (FFR) – Size of U.S. money supply ...

Lecture Thirty-One

... The individual deposits the check it received for the security into her bank (Bank A). Bank A’s checkable deposits increase by $1,000. Bank A presents the check to the Fed Bank for payment and its reserve deposits at the FED are credited by $1,000. ii. Bank A’s reserves have increased by $1,000: $10 ...

... The individual deposits the check it received for the security into her bank (Bank A). Bank A’s checkable deposits increase by $1,000. Bank A presents the check to the Fed Bank for payment and its reserve deposits at the FED are credited by $1,000. ii. Bank A’s reserves have increased by $1,000: $10 ...

Macroeconomics 6

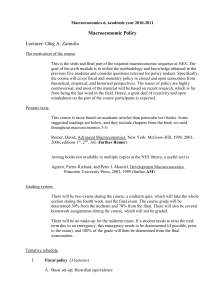

... The motivation of the course. This is the sixth and final part of the required macroeconomic sequence at NES. The goal of the sixth module is to utilize the methodology and knowledge obtained in the previous five modules and consider questions relevant for policy makers. Specifically, the course wil ...

... The motivation of the course. This is the sixth and final part of the required macroeconomic sequence at NES. The goal of the sixth module is to utilize the methodology and knowledge obtained in the previous five modules and consider questions relevant for policy makers. Specifically, the course wil ...

Inflation & Deflation - Vista Unified School District

... an increase in the price level a decrease in price level How is it determined? CPI= Consumer Price Index by comparing the CPI in different years and noting the change CPI is higher=inflation CPI is lower=deflation ...

... an increase in the price level a decrease in price level How is it determined? CPI= Consumer Price Index by comparing the CPI in different years and noting the change CPI is higher=inflation CPI is lower=deflation ...

AD shifts left.

... 1. If car prices increase, people’s nominal wealth increases (similar to if housing prices increase), thus they will consume more and AD shifts right. 2. When recession hits, more people are eligible for food stamps; government spending increases without any explicit act of Congress. 3. MPS is the p ...

... 1. If car prices increase, people’s nominal wealth increases (similar to if housing prices increase), thus they will consume more and AD shifts right. 2. When recession hits, more people are eligible for food stamps; government spending increases without any explicit act of Congress. 3. MPS is the p ...

Money

... The GDP deflator understates inflation because people tend to shift consumption from goods that have high prices or rapidly increasing prices to goods that have less rapidly increasing prices. Therefore, theoretically, prices of all goods and service could increase and the implicit price deflator co ...

... The GDP deflator understates inflation because people tend to shift consumption from goods that have high prices or rapidly increasing prices to goods that have less rapidly increasing prices. Therefore, theoretically, prices of all goods and service could increase and the implicit price deflator co ...

A rise in the price of oil imports has resulted in a decrease of short

... d. the reduced interest rate that banks charge their best customers. 24. What goes up when an economy goes into the inflationary gap in the short-run? a. output. b. unemployment. c. wages. d. both a and c. 25. What happens when there is a shortage in the labor market in the long-run? a. wages rise. ...

... d. the reduced interest rate that banks charge their best customers. 24. What goes up when an economy goes into the inflationary gap in the short-run? a. output. b. unemployment. c. wages. d. both a and c. 25. What happens when there is a shortage in the labor market in the long-run? a. wages rise. ...