Monetary Policy Objectives and Framework

... rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The McCallum rule relies on the demand for money and the de ...

... rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The McCallum rule relies on the demand for money and the de ...

Parkin-Bade Chapter 34 - Pearson Higher Education

... rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The McCallum rule relies on the demand for money and the de ...

... rate of real GDP and medium-term changes in the velocity of circulation of the monetary base. The rule is based on the quantity theory of money. The McCallum rule does not need an estimate of either the real interest rate or the output gap. The McCallum rule relies on the demand for money and the de ...

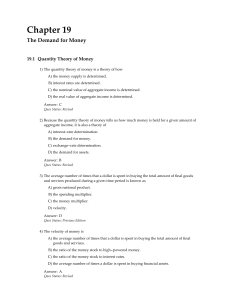

answer key - U of L Personal Web Sites

... sure to read each question carefully. Each question is worth 2 points (200 points total) and will count as 40 per cent of your final course grade. You have 120 minutes to complete this examination. NOTE: The use of calculators is prohibited. 1. Economics is the study of A) the best way of training b ...

... sure to read each question carefully. Each question is worth 2 points (200 points total) and will count as 40 per cent of your final course grade. You have 120 minutes to complete this examination. NOTE: The use of calculators is prohibited. 1. Economics is the study of A) the best way of training b ...

Macroeconomics Chapter 13W Disputes Over Macro Theory and

... financial assets, holding real assets, and buying current output. The factors that determine the amount of money the public wants to hold depend mainly on the level of nominal GDP. Example: Assume that when the level of nominal GDP is $400 billion, the public desires $100 billion of money to purchas ...

... financial assets, holding real assets, and buying current output. The factors that determine the amount of money the public wants to hold depend mainly on the level of nominal GDP. Example: Assume that when the level of nominal GDP is $400 billion, the public desires $100 billion of money to purchas ...

... Just as the yard is a certain number of wavelengths of cesium, the dollar—as originally defined by Congress—was .04838 of an ounce of gold. We teach today—in the context of modern monetary institutions—that the dollar is both a unit of value and a store of value. But the functions can be separated. ...

Reflections on the euro area fiscal stance

... stabilizers rather than discretionary actions. Monetary policy has been reacting more systematically to output and inflation; long expansions in the 1980s and 1990s demonstrate the effectiveness of such a [monetary] policy. It is unlikely that discretionary countercyclical fiscal policy could improv ...

... stabilizers rather than discretionary actions. Monetary policy has been reacting more systematically to output and inflation; long expansions in the 1980s and 1990s demonstrate the effectiveness of such a [monetary] policy. It is unlikely that discretionary countercyclical fiscal policy could improv ...

The Zero Bound on Nominal Interest Rates

... with no further negative shocks, low real interest rates may gradually return output to potential and inflation to the target, albeit more slowly than desired. Suppose, instead, that a significant negative shock to demand hits the economy, and the central bank finds itself unable to further reduce r ...

... with no further negative shocks, low real interest rates may gradually return output to potential and inflation to the target, albeit more slowly than desired. Suppose, instead, that a significant negative shock to demand hits the economy, and the central bank finds itself unable to further reduce r ...

Some Monetary Facts

... Congress is the assumption that the Fed has the ability, through its monetary policy, to control these economic variables. Does it? Clearly, it does have a measure of control over some definitions of money. But the links between money and the other economic variables have yet to be conclusively esta ...

... Congress is the assumption that the Fed has the ability, through its monetary policy, to control these economic variables. Does it? Clearly, it does have a measure of control over some definitions of money. But the links between money and the other economic variables have yet to be conclusively esta ...

The characteristics of a monetary economy: a Keynes

... modification into the way in which the economic system works. Both Keynes and Schumpeter maintain that it is not possible to describe the way in which an economy works in the presence of a fiat money by adopting the same theoretical framework used to describe a barter economy. The introduction of a ...

... modification into the way in which the economic system works. Both Keynes and Schumpeter maintain that it is not possible to describe the way in which an economy works in the presence of a fiat money by adopting the same theoretical framework used to describe a barter economy. The introduction of a ...

Macro Economics

... An economic activity is ultimately aimed at providing the desired and necessary goods and services to the population. The GDP is the most comprehensive measure of the value of economic activity in an economy. It is the measure of the market value of all goods and services produced by factors – labor ...

... An economic activity is ultimately aimed at providing the desired and necessary goods and services to the population. The GDP is the most comprehensive measure of the value of economic activity in an economy. It is the measure of the market value of all goods and services produced by factors – labor ...

Macro Economics - RuralNaukri.com

... An economic activity is ultimately aimed at providing the desired and necessary goods and services to the population. The GDP is the most comprehensive measure of the value of economic activity in an economy. It is the measure of the market value of all goods and services produced by factors – labor ...

... An economic activity is ultimately aimed at providing the desired and necessary goods and services to the population. The GDP is the most comprehensive measure of the value of economic activity in an economy. It is the measure of the market value of all goods and services produced by factors – labor ...

Economics of Money, Banking, and Financial Markets, 8e

... 27) Explain the Keynesian theory of money demand. What motives did Keynes think determined money demand? What are the two reasons why Keynes thought velocity could not be treated as a constant? Answer: Keynes believed the demand for money depended on income and interest rates. Money was held to faci ...

... 27) Explain the Keynesian theory of money demand. What motives did Keynes think determined money demand? What are the two reasons why Keynes thought velocity could not be treated as a constant? Answer: Keynes believed the demand for money depended on income and interest rates. Money was held to faci ...

capr 1+) New Ke,Jne5Ian conomIcs: SticL,9 PrIces

... to clear markets will have important implications for how the economy behaves and for economic policy. The New Keynesian model studied in this chapter is essentially identical to the monetary intertemporal model in Chapter 12, except that the price level is not sufficiently flexible for the goods ma ...

... to clear markets will have important implications for how the economy behaves and for economic policy. The New Keynesian model studied in this chapter is essentially identical to the monetary intertemporal model in Chapter 12, except that the price level is not sufficiently flexible for the goods ma ...

Chapter 9: Monetary Policy

... Another long-standing debate about monetary policy has been between proponents of rules and proponents of discretion. A rule requires the central bank to abide by a formula that is announced to the public. One example is a money growth rule. If the world were as stable as our simple model in this ch ...

... Another long-standing debate about monetary policy has been between proponents of rules and proponents of discretion. A rule requires the central bank to abide by a formula that is announced to the public. One example is a money growth rule. If the world were as stable as our simple model in this ch ...

Working Paper No. 326

... ERM, i.e. the monetary stance as dictated in Frankfurt (initially at an undervalued exchange rate, followed by an untimely Lira appreciation in 1995-6, and plagued with a time-varying risk premium). By contrast, the UK left the ERM for good, pursuing its own monetary policies of quick and drastic in ...

... ERM, i.e. the monetary stance as dictated in Frankfurt (initially at an undervalued exchange rate, followed by an untimely Lira appreciation in 1995-6, and plagued with a time-varying risk premium). By contrast, the UK left the ERM for good, pursuing its own monetary policies of quick and drastic in ...

The Classical View

... the economy is in equilibrium with respect to money; the actual amount of money supplied equals the amount the public wants to hold. If velocity is stable, the equation of exchange suggests that there is a predictable relationship between the money supply and nominal GDP (= P x Q). An increase in th ...

... the economy is in equilibrium with respect to money; the actual amount of money supplied equals the amount the public wants to hold. If velocity is stable, the equation of exchange suggests that there is a predictable relationship between the money supply and nominal GDP (= P x Q). An increase in th ...

Evidence from the Classical Gold Standard

... classical gold standard. The period was characterized by two decades of secular deflation, followed by two decades of secular inflation. This early price level experience should be of great contemporary interest because most advanced countries have returned to an environment of price stability not t ...

... classical gold standard. The period was characterized by two decades of secular deflation, followed by two decades of secular inflation. This early price level experience should be of great contemporary interest because most advanced countries have returned to an environment of price stability not t ...

BALANCE OF PAYMENTS ADJUSTMENT

... Johnson 1976). Johnson (1976) argues that a causal relationship runs from changes in domestic credit to changes in net foreign assets—that is, imbalances in the domestic monetary sector lead to imbalances in a country‘s balance of payments, represented by the change in net foreign assets (Blejer 197 ...

... Johnson 1976). Johnson (1976) argues that a causal relationship runs from changes in domestic credit to changes in net foreign assets—that is, imbalances in the domestic monetary sector lead to imbalances in a country‘s balance of payments, represented by the change in net foreign assets (Blejer 197 ...

Chapter 11 All Markets Together. The AS-AD

... For values of income greater than Y⬙, the LM curve is upward sloping—just as it was in Chapter 5 when we first characterized the LM curve. For values of income less than Y⬙, it is flat at i = 0. Intuitively: The interest rate cannot go below zero. Having derived the LM curve in the presence of a liqui ...

... For values of income greater than Y⬙, the LM curve is upward sloping—just as it was in Chapter 5 when we first characterized the LM curve. For values of income less than Y⬙, it is flat at i = 0. Intuitively: The interest rate cannot go below zero. Having derived the LM curve in the presence of a liqui ...

The Interaction Between Monetary and Fiscal Policies

... as the best way that monetary policy could contribute to raising living standards. He also made it clear that, in his view, 4 per cent inflation was not price stability. It is important to review the case for low and stable inflation that the Bank has been making since 1988. The first key element in ...

... as the best way that monetary policy could contribute to raising living standards. He also made it clear that, in his view, 4 per cent inflation was not price stability. It is important to review the case for low and stable inflation that the Bank has been making since 1988. The first key element in ...

Milton Friedman`s economics and political economy

... understanding and practice despite its deep flaws. Friedman’s methodological frame rests on a distinction between “positive” and “normative” economics. The core premise is: “Positive economics is in principle independent of any particular ethical position or normative judgments…it deals with “what i ...

... understanding and practice despite its deep flaws. Friedman’s methodological frame rests on a distinction between “positive” and “normative” economics. The core premise is: “Positive economics is in principle independent of any particular ethical position or normative judgments…it deals with “what i ...