THE IS-LM MODEL First developed 1937 by JR Hicks, as a way

... which together with IS determines interest rate and GDP simultaneously: ...

... which together with IS determines interest rate and GDP simultaneously: ...

The essentials of T

... • If the Government is in deficit, then the surplus fiat currency in the private sector is accumulated as cash, bank reserves, or as Treasury Bonds (deposits offered by the CB). • The taxes are scrapped (as the CB wipes off liabilities from its balance sheet). • Logically, taxes cannot finance spend ...

... • If the Government is in deficit, then the surplus fiat currency in the private sector is accumulated as cash, bank reserves, or as Treasury Bonds (deposits offered by the CB). • The taxes are scrapped (as the CB wipes off liabilities from its balance sheet). • Logically, taxes cannot finance spend ...

Mr. Mayer AP Macroeconomics

... A medium of exchange A store of value A unit of account / Standard of Value ...

... A medium of exchange A store of value A unit of account / Standard of Value ...

Money, What it was & what it has become

... people have a combined wealth of over US$1 trillion, equal to the annual income of the poorest 47% of the world's people (2.5 billion). The enormity of the wealth of the ultra-rich is a mind-boggling contrast with low incomes in the developing world. The three richest people have assets that exceed ...

... people have a combined wealth of over US$1 trillion, equal to the annual income of the poorest 47% of the world's people (2.5 billion). The enormity of the wealth of the ultra-rich is a mind-boggling contrast with low incomes in the developing world. The three richest people have assets that exceed ...

Y 1

... congressional approval, G and T require time These lags can destabilize the economy Automatic stabilizers- changes in fiscal policy that stimulate AD when economy goes into recession, without policymakers having to take any deliberate action Include tax system and government spending ...

... congressional approval, G and T require time These lags can destabilize the economy Automatic stabilizers- changes in fiscal policy that stimulate AD when economy goes into recession, without policymakers having to take any deliberate action Include tax system and government spending ...

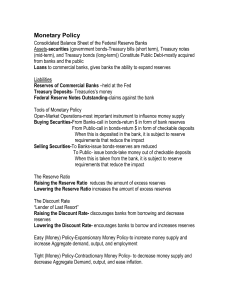

Monetary Policy

... It takes additional time to enact the appropriate policy. (This is more of a fiscal policy problem, since the FOMC can act much more quickly) ...

... It takes additional time to enact the appropriate policy. (This is more of a fiscal policy problem, since the FOMC can act much more quickly) ...

fiscal policy - Doral Academy Preparatory

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

Money, output and Prices in LR Macro_Module_32 money

... for Real GDP and Price Level with each move. Example: The money supply increases. 1. AD shifts _____. AD becomes AD1. 2. Yf moves to _____. ...

... for Real GDP and Price Level with each move. Example: The money supply increases. 1. AD shifts _____. AD becomes AD1. 2. Yf moves to _____. ...

Monetary policy

... banks are only the indirect representatives. The Czech National Bank performs banking supervision – a check whether the commercial banks respect the conditions associated with the licence issued. If the banks have a high proportion of bad credits or if there is a suspicion of fraudulent management a ...

... banks are only the indirect representatives. The Czech National Bank performs banking supervision – a check whether the commercial banks respect the conditions associated with the licence issued. If the banks have a high proportion of bad credits or if there is a suspicion of fraudulent management a ...

Monetary and Fiscal

... “In settling on Mr. Bernanke, President Bush ... chose a candidate who would satisfy others -- investors on Wall Street, lawmakers in Congress -- more than himself or his Republican base.” ''They needed somebody that everybody, including the financial markets, would react positively to.'' “But Mr. B ...

... “In settling on Mr. Bernanke, President Bush ... chose a candidate who would satisfy others -- investors on Wall Street, lawmakers in Congress -- more than himself or his Republican base.” ''They needed somebody that everybody, including the financial markets, would react positively to.'' “But Mr. B ...

5. Approaches to policy and macroeconomic context

... o Keynesian demand management in the 1970s Keynesian economics is a view that believes AD (spending) influences economic output in the short run. Keynesians also believe that the private sector sometimes leads to inefficiency, so the public sector has to intervene in order to stabilise the business ...

... o Keynesian demand management in the 1970s Keynesian economics is a view that believes AD (spending) influences economic output in the short run. Keynesians also believe that the private sector sometimes leads to inefficiency, so the public sector has to intervene in order to stabilise the business ...

- UNIMAS IR - Universiti Malaysia Sarawak

... variables, by investigating different countries at different time period with the assistance of various econometric techniques. The controversy over this issue, however, remains unsolved. The debate regarding the role of money in the economy finds its origins in the classical quantity theory of mone ...

... variables, by investigating different countries at different time period with the assistance of various econometric techniques. The controversy over this issue, however, remains unsolved. The debate regarding the role of money in the economy finds its origins in the classical quantity theory of mone ...

assignment #2

... Assuming velocity is constant and the money supply increases by 12 per cent, by how much does the nominal output rise? P*Q=M*V Since the velocity is constant, and the money supply goes up by 12%, the nominal GDP will also go up by 12%. Question 3 (10 marks) Suppose that a decrease in the demand for ...

... Assuming velocity is constant and the money supply increases by 12 per cent, by how much does the nominal output rise? P*Q=M*V Since the velocity is constant, and the money supply goes up by 12%, the nominal GDP will also go up by 12%. Question 3 (10 marks) Suppose that a decrease in the demand for ...

HW 5.1 AP Macro – Modules 31 and 32 Directions: After reading

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

Monetary and Fiscal Policy

... to the banks. Because it is easier to make gradual changes in the supply of money, open market operations are use more regularly than monetary policy. When member banks want to raise money, they can borrow from Federal Reserve Banks. Just like other loans, there is an interest rate, or a discount ra ...

... to the banks. Because it is easier to make gradual changes in the supply of money, open market operations are use more regularly than monetary policy. When member banks want to raise money, they can borrow from Federal Reserve Banks. Just like other loans, there is an interest rate, or a discount ra ...

BD104_fme_lnt_006_Ma..

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

Monetary Policy

... Strengths of Monetary Policy Speed and flexibility (even on a daily basis with actions of the FOMC) Isolation from political pressure (works more subtly, more politically palatable) Successes of 80’s and 90’s: 1. monetary policy cure for 13.5% inflation in 1980 to 3.5% in 1983 2. monetary policy mov ...

... Strengths of Monetary Policy Speed and flexibility (even on a daily basis with actions of the FOMC) Isolation from political pressure (works more subtly, more politically palatable) Successes of 80’s and 90’s: 1. monetary policy cure for 13.5% inflation in 1980 to 3.5% in 1983 2. monetary policy mov ...

5/7 Warm Up

... by the Fed – “open” b/c anyone can buy securities – When bank buys securities from the Treasury, purchase amount is deducted from the bank’s reserves • Result is the bank will have less $ to ...

... by the Fed – “open” b/c anyone can buy securities – When bank buys securities from the Treasury, purchase amount is deducted from the bank’s reserves • Result is the bank will have less $ to ...

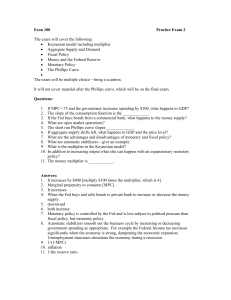

Econ 100Practice Exam 2

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. ...

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. ...