Slide 1

... • A withdrawal of $45 million would have forced Milburn to borrow funds from other banks (this is done in what is called the federal funds market) to cover his reserve requirement. • Banks like the Merchants Bank may have excess reserves to lend banks that do not have enough reserves to meet their r ...

... • A withdrawal of $45 million would have forced Milburn to borrow funds from other banks (this is done in what is called the federal funds market) to cover his reserve requirement. • Banks like the Merchants Bank may have excess reserves to lend banks that do not have enough reserves to meet their r ...

I - 嘉義大學

... C. create more deposits. D. use excess reserves for loans. 27.An increase in the supply of money will lead to in equilibrium real GDP and in equilibrium price level. A. an increase; an increase B. an increase; a decrease C. a decrease; an increase D. a decrease; a decrease 28.A liquidity trap is sai ...

... C. create more deposits. D. use excess reserves for loans. 27.An increase in the supply of money will lead to in equilibrium real GDP and in equilibrium price level. A. an increase; an increase B. an increase; a decrease C. a decrease; an increase D. a decrease; a decrease 28.A liquidity trap is sai ...

Discussion section 3

... exchange for foreign currency, losing foreign reserves and reducing money supply – a simultaneous decrease in the central bank’s assets and liabilities. When there is excess demand of domestic currency: central bank sells domestic currency in exchange for foreign currency, acquiring foreign reserv ...

... exchange for foreign currency, losing foreign reserves and reducing money supply – a simultaneous decrease in the central bank’s assets and liabilities. When there is excess demand of domestic currency: central bank sells domestic currency in exchange for foreign currency, acquiring foreign reserv ...

chapter24 - YSU

... must hold less wealth in other assets – So, an individual’s quantity of money demanded is the amount of wealth individual chooses to hold as money ...

... must hold less wealth in other assets – So, an individual’s quantity of money demanded is the amount of wealth individual chooses to hold as money ...

Document

... Interest Rate: The cost to borrowers of obtaining money and the return (or yield) of money to lenders. Reserves: Assets that are held by depository institutions as either vault cash or reserve deposit accounts with the Fed. Required Reserve Ratio: Depository institutions must have reserve assets equ ...

... Interest Rate: The cost to borrowers of obtaining money and the return (or yield) of money to lenders. Reserves: Assets that are held by depository institutions as either vault cash or reserve deposit accounts with the Fed. Required Reserve Ratio: Depository institutions must have reserve assets equ ...

Macro Economic Analysis

... (c) Bonds (d) Currency notes 10. Which of the following is a primary function of money (a) Measure of value (b) Store of value (c) Standard of deferred payments (d) Basis of credit 11. The most liquid form of all assets is (a) Bonds (b). Debentures (c) Bill of exchange (d) Currency notes 12. In Indi ...

... (c) Bonds (d) Currency notes 10. Which of the following is a primary function of money (a) Measure of value (b) Store of value (c) Standard of deferred payments (d) Basis of credit 11. The most liquid form of all assets is (a) Bonds (b). Debentures (c) Bill of exchange (d) Currency notes 12. In Indi ...

Robust recovery under way - prospects for the polish economy

... representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (incl ...

... representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (incl ...

Economics Principles and Applications - YSU

... must hold less wealth in other assets – So, an individual’s quantity of money demanded is the amount of wealth individual chooses to hold as money ...

... must hold less wealth in other assets – So, an individual’s quantity of money demanded is the amount of wealth individual chooses to hold as money ...

What post-Keynesian economics has brought to an understanding of

... economist at PIMCO (one of the largest investment fund in the world), has applied this terminology to the mortgages taken by households. In his terms, hedge finance is defined by standard mortgages, amortized over standard periods of 25 or 30 years, preferably at a fixed interest rate. Speculative f ...

... economist at PIMCO (one of the largest investment fund in the world), has applied this terminology to the mortgages taken by households. In his terms, hedge finance is defined by standard mortgages, amortized over standard periods of 25 or 30 years, preferably at a fixed interest rate. Speculative f ...

loose or tight monetary policies

... federal funds market, in which banks can borrow reserves from other banks that want to lend them and pay the federal funds rate. Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

... federal funds market, in which banks can borrow reserves from other banks that want to lend them and pay the federal funds rate. Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

QUIZ 7: Macro – Winter 2011 Name

... the interest rate. Economists refer to the absence of long-run effects of money on output and the interest rate by saying that ‘money is neutral in the long-run’. However, as seen in question 3 part 1, a short-term effect of an increase in money supply is an expansion (the AD shifts out because real ...

... the interest rate. Economists refer to the absence of long-run effects of money on output and the interest rate by saying that ‘money is neutral in the long-run’. However, as seen in question 3 part 1, a short-term effect of an increase in money supply is an expansion (the AD shifts out because real ...

Ch25 - 山东大学课程中心

... 1. If the public expects the Fed to pursue a policy that is likely to raise short-term interest rates permanently to 12% but the Fed does not go through with this policy change, what will happen to long-term interest rates? Explain your answer. 2. If consumer expenditure is related to consumers' exp ...

... 1. If the public expects the Fed to pursue a policy that is likely to raise short-term interest rates permanently to 12% but the Fed does not go through with this policy change, what will happen to long-term interest rates? Explain your answer. 2. If consumer expenditure is related to consumers' exp ...

Chapters 12 and 13 Economic Indicators

... in the weather of changes in the demand for certain products. Construction is one of those industries affected, where carpenters and builders have less work during the winter than in the summer. Other workers for retail stores are in demand during the holiday season. A fifth kind of unemployment is ...

... in the weather of changes in the demand for certain products. Construction is one of those industries affected, where carpenters and builders have less work during the winter than in the summer. Other workers for retail stores are in demand during the holiday season. A fifth kind of unemployment is ...

April 19, 2001 - Questions

... Go back to the beginning of this problem. Assume the situation is as described on the Balance Sheet. Assume that the Bank of Moneyall decides to keep all the excess reserves shown on the balance sheet, but no more. David Dodge-em, Governor of the Central Bank of the land of Milk-and-Honey, decides t ...

... Go back to the beginning of this problem. Assume the situation is as described on the Balance Sheet. Assume that the Bank of Moneyall decides to keep all the excess reserves shown on the balance sheet, but no more. David Dodge-em, Governor of the Central Bank of the land of Milk-and-Honey, decides t ...

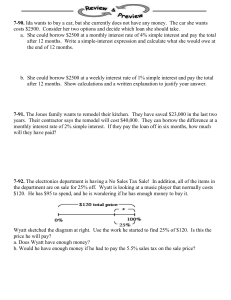

7-95.

... 7-91. The Jones family wants to remodel their kitchen. They have saved $23,000 in the last two years. Their contractor says the remodel will cost $40,000. They can borrow the difference at a monthly interest rate of 2% simple interest. If they pay the loan off in six months, how much will they have ...

... 7-91. The Jones family wants to remodel their kitchen. They have saved $23,000 in the last two years. Their contractor says the remodel will cost $40,000. They can borrow the difference at a monthly interest rate of 2% simple interest. If they pay the loan off in six months, how much will they have ...