Lecture Presentation to accompany Investment Analysis

... Sometime, you may have more money than you want to spend, at the other times, you want to buy more than you can afford. Borrow or save to maximalise long-run benefits from you income. When your income exceeds current consumption, people tend to invest income. Trade-off of present consumption for a ...

... Sometime, you may have more money than you want to spend, at the other times, you want to buy more than you can afford. Borrow or save to maximalise long-run benefits from you income. When your income exceeds current consumption, people tend to invest income. Trade-off of present consumption for a ...

as PDF for Printing

... Disclaimer: Investing in mid-cap stocks is riskier and more volatile than investing in large-cap stocks. The intrinsic value of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. A ...

... Disclaimer: Investing in mid-cap stocks is riskier and more volatile than investing in large-cap stocks. The intrinsic value of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. A ...

Forecasting Interest Rates

... Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = ...

... Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = ...

capital ideas

... to run a disciplined capital structure to enable the company to meet their dividend obligations thereby reducing agency cost. Additional exposure to ...

... to run a disciplined capital structure to enable the company to meet their dividend obligations thereby reducing agency cost. Additional exposure to ...

Merrill Finch Inc

... because the Treasury must (and will) redeem the bills at par regardless of the state of the economy. The T-bills are risk-free in the default risk sense because the 5.5% return will be realized in all possible economic states. However, remember that this return is composed of the real risk-free rate ...

... because the Treasury must (and will) redeem the bills at par regardless of the state of the economy. The T-bills are risk-free in the default risk sense because the 5.5% return will be realized in all possible economic states. However, remember that this return is composed of the real risk-free rate ...

Focused Dynamic Growth - American Century Investments

... The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index (the 3,000 largest publicly traded U.S. companies based on total market capitalization). The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher pri ...

... The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index (the 3,000 largest publicly traded U.S. companies based on total market capitalization). The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher pri ...

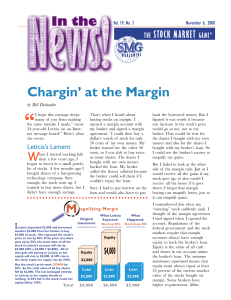

Mechanics of Trading Securities

... specific market capitalization range, i.e. largecapitalization (>$10 bn), mid-capitalization ($210bn), small-capitalization($>2bn), microcapitalization (<250mn), etc. ...

... specific market capitalization range, i.e. largecapitalization (>$10 bn), mid-capitalization ($210bn), small-capitalization($>2bn), microcapitalization (<250mn), etc. ...

4. Valuing the land – how to measure land values

... the value of the buildings, which roughly corresponds to the estimated rebuilding costs for insurance purposes, adjusted for depreciation. The remainder will be the value of the land. This is known as the ‘residual value’ method of assessment. There are a number of other methods, which can act as a ...

... the value of the buildings, which roughly corresponds to the estimated rebuilding costs for insurance purposes, adjusted for depreciation. The remainder will be the value of the land. This is known as the ‘residual value’ method of assessment. There are a number of other methods, which can act as a ...

Credit Union Merger Accounting Guidance

... assets, assume certain liabilities, or be willing to take the risk of incurring unknown liabilities. In these situations, the parties agree on the specific assets to be acquired and liabilities to be assumed. Regardless of whether the transaction is a merger, or an acquisition and assumption agreeme ...

... assets, assume certain liabilities, or be willing to take the risk of incurring unknown liabilities. In these situations, the parties agree on the specific assets to be acquired and liabilities to be assumed. Regardless of whether the transaction is a merger, or an acquisition and assumption agreeme ...

Open full article - Acta Universitatis

... financial risks. This methodological tool will support managers while monitoring the risk structure. The method is based on the capital asset pricing model (CAPM) for calculation of equity cost, namely on determination of the beta coefficient, which is the only variable, that is dependent on entreprene ...

... financial risks. This methodological tool will support managers while monitoring the risk structure. The method is based on the capital asset pricing model (CAPM) for calculation of equity cost, namely on determination of the beta coefficient, which is the only variable, that is dependent on entreprene ...

Snímek 1

... This type of loan has the same cash flow payment every throughout the life of the loan. On a fixed-rate mortgage, for example, the borrower makes the same payment to the bank every month until the maturity date, when the loan is completely ...

... This type of loan has the same cash flow payment every throughout the life of the loan. On a fixed-rate mortgage, for example, the borrower makes the same payment to the bank every month until the maturity date, when the loan is completely ...

Document

... compensating balances Involves significant fees More beneficial for small number of larger deposits Evaluation involves comparison of costs versus benefits of faster collection ...

... compensating balances Involves significant fees More beneficial for small number of larger deposits Evaluation involves comparison of costs versus benefits of faster collection ...

CNN Money

... Over periods of five years or more, stock prices closely track corporate profit growth. The longer the stretch of time, the more important earnings trends are. Indeed, since World War II, an estimated 90% of the stock market's gain has come from profit growth. As profits add up over time, the scale ...

... Over periods of five years or more, stock prices closely track corporate profit growth. The longer the stretch of time, the more important earnings trends are. Indeed, since World War II, an estimated 90% of the stock market's gain has come from profit growth. As profits add up over time, the scale ...

Top margin 1

... Fourth Company Law Directive ? The Commission has given careful consideration to the fact that the amended fair value option permits the fair valuation of own liabilities, in particular own debt instruments, whereas this is prohibited under Article 42(a) of the Fourth Company Law Directive. This pro ...

... Fourth Company Law Directive ? The Commission has given careful consideration to the fact that the amended fair value option permits the fair valuation of own liabilities, in particular own debt instruments, whereas this is prohibited under Article 42(a) of the Fourth Company Law Directive. This pro ...

- Prudential Indonesia

... a regular savings plan via dollar cost averaging. As no one can predict when a sustained rally will begin, it is tempting to lock away good value investments in a prudent, measured way. Such a strategy has many benefits. ...

... a regular savings plan via dollar cost averaging. As no one can predict when a sustained rally will begin, it is tempting to lock away good value investments in a prudent, measured way. Such a strategy has many benefits. ...

Investment Seminar

... consider active allocation methods described in “The Four Pillars”. This is technique where you overweight asset classes that have recently had significant declines. If you must invest in actively managed funds (Lack of Index options in 401K) try to keep expense ratios below 0.5%, look for long te ...

... consider active allocation methods described in “The Four Pillars”. This is technique where you overweight asset classes that have recently had significant declines. If you must invest in actively managed funds (Lack of Index options in 401K) try to keep expense ratios below 0.5%, look for long te ...