DETERMINANTS OF NATIONAL AND CROSS BORDER BANK

... value and number as compared to other sectors. Often, the cross-border acquisitions involved the acquisition of minority shareholdings. Moreover, domestic deals are significantly larger than cross-border deals leading to "domestic champions" (European Commission, 2005). The economic arguments in fa ...

... value and number as compared to other sectors. Often, the cross-border acquisitions involved the acquisition of minority shareholdings. Moreover, domestic deals are significantly larger than cross-border deals leading to "domestic champions" (European Commission, 2005). The economic arguments in fa ...

Changing patterns of financial intermediation

... As a consequence of the significant economic and financial crisis suffered in 20012002, Argentina has experienced a particular path with respect to patterns of financial intermediation. Following the abandonment of the Convertibility Plan in December 2001, it suffered a huge financial and economic c ...

... As a consequence of the significant economic and financial crisis suffered in 20012002, Argentina has experienced a particular path with respect to patterns of financial intermediation. Following the abandonment of the Convertibility Plan in December 2001, it suffered a huge financial and economic c ...

What have the Capital Markets ever done for us?

... as a result, taxpayers are rightly unwilling to provide this kind of blanket guarantee any longer and it is something we all need to recognise. It is for this reason, among others, that we must shift away from relying on traditional bank lending and instead broaden the means through which businesses ...

... as a result, taxpayers are rightly unwilling to provide this kind of blanket guarantee any longer and it is something we all need to recognise. It is for this reason, among others, that we must shift away from relying on traditional bank lending and instead broaden the means through which businesses ...

investment management of banks

... • When the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve”, it is valued at successively lower yields and higher prices. • Using this strategy, a bond is held for a period of time as it appreciates in price and is sold before maturity to realize the gain. As ...

... • When the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve”, it is valued at successively lower yields and higher prices. • Using this strategy, a bond is held for a period of time as it appreciates in price and is sold before maturity to realize the gain. As ...

(as for FX options).

... – An executory contract (to be executed or performed later by both parties), the value of which depends on the changes in another measure of value (often referred to as the “underlying” item). ...

... – An executory contract (to be executed or performed later by both parties), the value of which depends on the changes in another measure of value (often referred to as the “underlying” item). ...

Target Asset Allocation

... years of poor market performance. The purpose of this report is to provide investors with a sense of the historical volatility of a specific mix of asset classes over various time periods. A benchmark line representing the U.S. stock market and U.S. bond market is provided to demonstrate how the gen ...

... years of poor market performance. The purpose of this report is to provide investors with a sense of the historical volatility of a specific mix of asset classes over various time periods. A benchmark line representing the U.S. stock market and U.S. bond market is provided to demonstrate how the gen ...

Lecture Presentation to accompany Investment Analysis

... Political risk is the uncertainty of returns caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium when determining their required rate o ...

... Political risk is the uncertainty of returns caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium when determining their required rate o ...

10-3

... Marketability Sought for All Securities • The Goals Sought for its Investment Portfolio • The Degree of Portfolio Diversification the Institution Wishes to Achieve with its ...

... Marketability Sought for All Securities • The Goals Sought for its Investment Portfolio • The Degree of Portfolio Diversification the Institution Wishes to Achieve with its ...

PDF

... payment or a medium for assessing the value of goods. Different market actors use currencies for a wide range of diverse purposes such as, for instance, to hedge positions, diversify a portfolio or reap returns from investment oppor tunities and trends. Alongside central banks, business enterprise ...

... payment or a medium for assessing the value of goods. Different market actors use currencies for a wide range of diverse purposes such as, for instance, to hedge positions, diversify a portfolio or reap returns from investment oppor tunities and trends. Alongside central banks, business enterprise ...

Towards a Sustainable Banking Sector—Malaysia

... should be financed through the issuance of Government bonds. At a more fundamental level, free entry and firm exit policies are essential in solving these problems. Danaharta has to function independently without any Government interference. And it should not take an unduly long time to maximize the ...

... should be financed through the issuance of Government bonds. At a more fundamental level, free entry and firm exit policies are essential in solving these problems. Danaharta has to function independently without any Government interference. And it should not take an unduly long time to maximize the ...

1 Competition and Concentration in the New European Banking

... structure and conduct in the banking industry (Shaffer, 2004). These two tendencies (competition and concentration) seem to contrast each other, if we accept the theoretical proposition according to which a more concentrated market implies a lower degree of competition due to undesirable exercise o ...

... structure and conduct in the banking industry (Shaffer, 2004). These two tendencies (competition and concentration) seem to contrast each other, if we accept the theoretical proposition according to which a more concentrated market implies a lower degree of competition due to undesirable exercise o ...

The rooney Group - Edwards School of Business

... The Rooney group will hire primarily young professionals starting their career with the guidance of several board of directors with experience in commercial real estate development in both the Calgary and Vancouver areas. We will hire young professionals just starting their careers as well as those ...

... The Rooney group will hire primarily young professionals starting their career with the guidance of several board of directors with experience in commercial real estate development in both the Calgary and Vancouver areas. We will hire young professionals just starting their careers as well as those ...

REO Asset Management Guide

... prepares and executes a customized disposition plan for each individual property via a rental or sale strategy in order to maximize the value of the asset. Carrington offers a comprehensive suite of flexible outsourced solutions to minimize risk for institutional owners of real estate who are lookin ...

... prepares and executes a customized disposition plan for each individual property via a rental or sale strategy in order to maximize the value of the asset. Carrington offers a comprehensive suite of flexible outsourced solutions to minimize risk for institutional owners of real estate who are lookin ...

Chapter 5 Understanding Risk

... A risk-averse investor will always prefer an investment with a certain return to one with the same expected return, but any amount of uncertainty. ...

... A risk-averse investor will always prefer an investment with a certain return to one with the same expected return, but any amount of uncertainty. ...

Northrop Grumman Financial Security and Savings - corporate

... changes in the values of investment securities may occur in the near term, and those changes could materially affect the amounts reported in the financial statements. Fair Value of Financial Instruments The Plan utilizes fair value measurement guidelines prescribed by GAAP to value financial instrum ...

... changes in the values of investment securities may occur in the near term, and those changes could materially affect the amounts reported in the financial statements. Fair Value of Financial Instruments The Plan utilizes fair value measurement guidelines prescribed by GAAP to value financial instrum ...

Growth in Agricultural Loan Market Share for

... Mac) and other secondary markets, Thus, a rural bank may not have sufficient local funds to meet its goals in agricultural lcndmg, but funds can be made available from other sources, Loan participations are quite common among banks. In fact, Arkansas Bankers Bank was chartered in 1990 for the sole p ...

... Mac) and other secondary markets, Thus, a rural bank may not have sufficient local funds to meet its goals in agricultural lcndmg, but funds can be made available from other sources, Loan participations are quite common among banks. In fact, Arkansas Bankers Bank was chartered in 1990 for the sole p ...

Dissecting the `MAC` Universe Multi-Asset Credit

... With the new generation of products/styles of investing, it is prudent to do your due diligence when selecting a product or manager. Products such as Absolute Return Bond, Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a pa ...

... With the new generation of products/styles of investing, it is prudent to do your due diligence when selecting a product or manager. Products such as Absolute Return Bond, Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a pa ...

Optimising Risk-adjusted Returns

... For the untrained eye the ensuing topic might appear highly theoretical, academic and even intimidating, yet it contains a very powerful message of how index investing can fit into an overall investment strategy, which I shall endeavor to convey in the simplest terms possible. The active manager inv ...

... For the untrained eye the ensuing topic might appear highly theoretical, academic and even intimidating, yet it contains a very powerful message of how index investing can fit into an overall investment strategy, which I shall endeavor to convey in the simplest terms possible. The active manager inv ...

A Quantitative Look at the Italian Banking System

... growth of the ratio of loans to deposits occurred during the economic boom of 1958-1963, when the ratio rose above one (in 1944 it was equal to 0.6). 10 Overall from the 1950s to the mid-1970s − in the period of the greatest development of the Italian economy − bank loans and deposits increased cons ...

... growth of the ratio of loans to deposits occurred during the economic boom of 1958-1963, when the ratio rose above one (in 1944 it was equal to 0.6). 10 Overall from the 1950s to the mid-1970s − in the period of the greatest development of the Italian economy − bank loans and deposits increased cons ...

What Happened in Cyprus?

... independence would be safeguarded at all costs since it was the last lever of independent economic policy in the country. That is, it should have been the case that the fiscal authorities should have become a lot more careful in maintaining their ability to finance a downturn. Instead, the governme ...

... independence would be safeguarded at all costs since it was the last lever of independent economic policy in the country. That is, it should have been the case that the fiscal authorities should have become a lot more careful in maintaining their ability to finance a downturn. Instead, the governme ...

Some Recent Trends in Commercial Banking

... also decreased during the eighties, but the creation of new banks went back up to historical levels during the second half of the nineties. Finally, the number of bank failures increased significantly during the second half of the eighties but again went back to normal levels (or even lower) after 1 ...

... also decreased during the eighties, but the creation of new banks went back up to historical levels during the second half of the nineties. Finally, the number of bank failures increased significantly during the second half of the eighties but again went back to normal levels (or even lower) after 1 ...

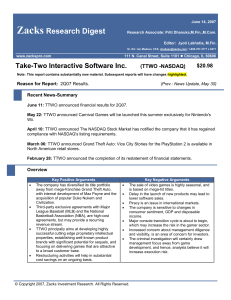

TTWO -NASDAQ

... The company’s fundamentals remain unchanged. Despite the release of GTA IV in October and strong profits expected from major rivals, Take-Two has guided for only breakeven results for FY07. The new management indicated the focus of the new Board is to improve margins. A potential way to accomplish t ...

... The company’s fundamentals remain unchanged. Despite the release of GTA IV in October and strong profits expected from major rivals, Take-Two has guided for only breakeven results for FY07. The new management indicated the focus of the new Board is to improve margins. A potential way to accomplish t ...

Financial Instruments

... On the other hand, as they are joint owners, shareholders have the following rights: Rights attached to shares - dividend right: if the company has made a profit and the general meeting resolves to allocate such profit, either wholly or in part (and not to reinvest it or to appropriate it to reserve ...

... On the other hand, as they are joint owners, shareholders have the following rights: Rights attached to shares - dividend right: if the company has made a profit and the general meeting resolves to allocate such profit, either wholly or in part (and not to reinvest it or to appropriate it to reserve ...

MLC Wholesale Australian Share Value Style Fund

... company specific issues liquidity (the ability to buy or sell investments when you want to), and changes in the value of the Australian dollar. ...

... company specific issues liquidity (the ability to buy or sell investments when you want to), and changes in the value of the Australian dollar. ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.