Working Paper No. 427 Liquidity Preference Theory Revisited—To

... 2000a, 2001, Davidson 1965, Foley 1975, Johnson 1951-2, Kahn 1954, Kregel 1986, Leijonhufvud 1968, Terzi 1986a,b, Trevithick 1994, Tsiang 1956, Wray 1992, in particular. ...

... 2000a, 2001, Davidson 1965, Foley 1975, Johnson 1951-2, Kahn 1954, Kregel 1986, Leijonhufvud 1968, Terzi 1986a,b, Trevithick 1994, Tsiang 1956, Wray 1992, in particular. ...

What makes a great value investor?

... The third step consists of detailed research. The type of research is unconstrained and can include reading annual reports and talking to the company’s management team, customers, competitors and suppliers. Based on the assumption that Kennox is likely to hold a portfolio of 20-30 stocks with an an ...

... The third step consists of detailed research. The type of research is unconstrained and can include reading annual reports and talking to the company’s management team, customers, competitors and suppliers. Based on the assumption that Kennox is likely to hold a portfolio of 20-30 stocks with an an ...

Tax Deduction at Source 2015-2016

... Final Settlement of Income Tax Income from some specified businesses activities by a company is treated as final settlement of tax as per provision of Section 82C of the IT Ordinance 1984. Final settlement means company's tax obligation for these sources of income is limited to the tax that has bee ...

... Final Settlement of Income Tax Income from some specified businesses activities by a company is treated as final settlement of tax as per provision of Section 82C of the IT Ordinance 1984. Final settlement means company's tax obligation for these sources of income is limited to the tax that has bee ...

NEW YORK CITY’S HOUSING BUBBLE

... Reduced Consumer Spending Cooler NYC housing market implies a moderate reduction in spending. Growth in NYC housing prices, 77% in five years, less rapid than in Santa Barbara, 122%; San ...

... Reduced Consumer Spending Cooler NYC housing market implies a moderate reduction in spending. Growth in NYC housing prices, 77% in five years, less rapid than in Santa Barbara, 122%; San ...

VALUE -OR iE NTED iN VESTMENTMANAGEMENT Fox Asset

... and Boston Management and Research (“BMR”) are also wholly owned subsidiaries of Eaton Vance Corp. EVM and BMR are each registered as an investment adviser with the SEC. Eaton Vance and BMR are each registered with the Commodity Futures Trading Commission (“CFTC”) as a commodity pool operator and a ...

... and Boston Management and Research (“BMR”) are also wholly owned subsidiaries of Eaton Vance Corp. EVM and BMR are each registered as an investment adviser with the SEC. Eaton Vance and BMR are each registered with the Commodity Futures Trading Commission (“CFTC”) as a commodity pool operator and a ...

Moulton

... Time cost of money (the returns that the investment could have earned, had it been invested in another asset, such as a bond – or used to repay money borrowed). ...

... Time cost of money (the returns that the investment could have earned, had it been invested in another asset, such as a bond – or used to repay money borrowed). ...

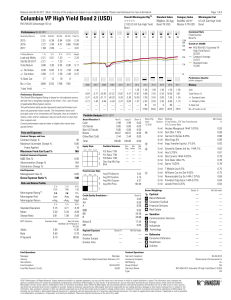

Columbia VP High Yield Bond 2 (USD)

... falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and yo ...

... falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and yo ...

Unit four

... consider whether or not you really will be able to repay and what kind of security you can offer against the possibility that you do not repay. In the case of a business the manager may well want to see well prepared, relevant documents such as profit and loss accounts and balance sheets for the mos ...

... consider whether or not you really will be able to repay and what kind of security you can offer against the possibility that you do not repay. In the case of a business the manager may well want to see well prepared, relevant documents such as profit and loss accounts and balance sheets for the mos ...

Fair Value Measurement after Financial Crunch

... make any new transfers of assets or changes to its accounts, a different market environment would deem its financial situation different. The closest indicator of fair value estimate is the current market price for the similar asset, in the similar location, condition and under similar lease arrange ...

... make any new transfers of assets or changes to its accounts, a different market environment would deem its financial situation different. The closest indicator of fair value estimate is the current market price for the similar asset, in the similar location, condition and under similar lease arrange ...

The ABC of Housing Growth and Infrastructure

... development costs in situations where there is an increasing demand for housing, workspace, or public facilities. The measure is financed from the uplift in land values following development. The municipality buys land at existing use value, and then sells the land when it has been planned and servi ...

... development costs in situations where there is an increasing demand for housing, workspace, or public facilities. The measure is financed from the uplift in land values following development. The municipality buys land at existing use value, and then sells the land when it has been planned and servi ...

Draft report on the proposal for a regulation of the

... illiquid nature of most investments in longterm projects precludes an ELTIF from offering regular redemptions to its investors. The commitment of the individual investor to an investment in such assets is by its nature made to the full term of the investment. ELTIFs should, consequently, be structur ...

... illiquid nature of most investments in longterm projects precludes an ELTIF from offering regular redemptions to its investors. The commitment of the individual investor to an investment in such assets is by its nature made to the full term of the investment. ELTIFs should, consequently, be structur ...

I_Ch05

... ※ It is common to use the HPR of T-bills to be the risk-free interest rate rf ※ For the risk premium: there is no expectation for rf because the HPR of Tbills is known at the beginning of the holding period, but we cannot know the HPR of the risky portfolio rP until the end of the holding period ※ T ...

... ※ It is common to use the HPR of T-bills to be the risk-free interest rate rf ※ For the risk premium: there is no expectation for rf because the HPR of Tbills is known at the beginning of the holding period, but we cannot know the HPR of the risky portfolio rP until the end of the holding period ※ T ...

Personal Bankruptcy and Credit Market Competition

... and Tyagi 2003). Domovitz and Sartain (1999) also find that medical debt due to health problems is the most important bankruptcy factor, though the largest contributor at the margin is credit card debt. Research has also found that consumers are more likely to be turned down for credit and pay high ...

... and Tyagi 2003). Domovitz and Sartain (1999) also find that medical debt due to health problems is the most important bankruptcy factor, though the largest contributor at the margin is credit card debt. Research has also found that consumers are more likely to be turned down for credit and pay high ...

SIFMA AMG Submits Comments to the Basel Committee on Banking

... the client itself or CCP.3 As a matter of practice, in the event of an end-user’s default a CCP will look to all of the client’s segregated margin for payment before seeking to obtain additional funds from the clearing firm based on its guarantee to the extent needed. Client segregated margin reduce ...

... the client itself or CCP.3 As a matter of practice, in the event of an end-user’s default a CCP will look to all of the client’s segregated margin for payment before seeking to obtain additional funds from the clearing firm based on its guarantee to the extent needed. Client segregated margin reduce ...

The Impact of Post- Financial Crisis Regulations

... determine the maximum number of investors, size of the fund, geography and sector(s) in which to invest in. Furthermore, a specific team is assembled by the managers too asses potential investments and/or to provide portfolio companies with business support. They will look for investment opportuniti ...

... determine the maximum number of investors, size of the fund, geography and sector(s) in which to invest in. Furthermore, a specific team is assembled by the managers too asses potential investments and/or to provide portfolio companies with business support. They will look for investment opportuniti ...

Denarius Capital Advisors Inc. d/b/a Money Intelligence

... • Development of Investment Policy Statement (IPS) – DCA will assist the Plan Sponsor in developing a written investment policy statement that defines the plan's purpose and provides a clear understanding concerning the investment policies and advice regarding the selection, monitoring, and replace ...

... • Development of Investment Policy Statement (IPS) – DCA will assist the Plan Sponsor in developing a written investment policy statement that defines the plan's purpose and provides a clear understanding concerning the investment policies and advice regarding the selection, monitoring, and replace ...

Financial Markets, Banks` Cost of Funding, and Firms` Decisions

... insignificant, after controlling for the market-based cost-of-funding measures. Among the bank cost-of-funding measures used in our empirical work, the banks’ CDS spread dominate Tobin’s Q, suggesting that debt, rather than equity, is the marginal source of funding for the banks in our sample, and t ...

... insignificant, after controlling for the market-based cost-of-funding measures. Among the bank cost-of-funding measures used in our empirical work, the banks’ CDS spread dominate Tobin’s Q, suggesting that debt, rather than equity, is the marginal source of funding for the banks in our sample, and t ...

Revenue-generating projects

... the residual value of infrastructure does not need to be considered. For example, an investment in a new road, which is not subject to tolls or other user charge revenue, would not become revenuegenerating only due to residual value of the road at the end of the reference period. However, where it i ...

... the residual value of infrastructure does not need to be considered. For example, an investment in a new road, which is not subject to tolls or other user charge revenue, would not become revenuegenerating only due to residual value of the road at the end of the reference period. However, where it i ...

Introduction to High-Yield Bond Covenants

... bondholder without using the proceeds to either: a) reinvest in the business or b) offer to pay back bondholders at par (a “Net Proceeds Offer”). Asset sales are usually defined as a transaction of material size to the company; proceeds need to represent “fair market value” of the assets being sold ...

... bondholder without using the proceeds to either: a) reinvest in the business or b) offer to pay back bondholders at par (a “Net Proceeds Offer”). Asset sales are usually defined as a transaction of material size to the company; proceeds need to represent “fair market value” of the assets being sold ...

Abstract - The Institutional and Social Dynamics of Growth and

... increasingly come to recognize that strong interrelationships exist between macro policies and micro foundations. For example, corporate governance is considered in this context as a key element affecting countries’ and firms’ economic performance. Economists (La Porta, 1998, Kogut, 2003) and intern ...

... increasingly come to recognize that strong interrelationships exist between macro policies and micro foundations. For example, corporate governance is considered in this context as a key element affecting countries’ and firms’ economic performance. Economists (La Porta, 1998, Kogut, 2003) and intern ...

Uninsured Idiosyncratic Production Risk with Borrowing Constraints

... This paper investigates the importance of uninsured idiosyncratic production risk by the firm owned by the entrepreneur, and the importance of borrowing constraints for aggregate capital accumulation. It is interesting to analyze the implications of incomplete markets in this setting, for the follow ...

... This paper investigates the importance of uninsured idiosyncratic production risk by the firm owned by the entrepreneur, and the importance of borrowing constraints for aggregate capital accumulation. It is interesting to analyze the implications of incomplete markets in this setting, for the follow ...

Banking Relationships and REIT Capital Structure - DataPro

... debt that is secured, and thus firms with lower secured debt would have lower leverage due to the concerns related to asset substitution. The characteristics associated with secured lending underwritten to a single property and the ability to more readily assess the value of real estate collateral a ...

... debt that is secured, and thus firms with lower secured debt would have lower leverage due to the concerns related to asset substitution. The characteristics associated with secured lending underwritten to a single property and the ability to more readily assess the value of real estate collateral a ...

1 Foreign Market Entry Strategies

... complementary assets, typically lying downstream from production expertise. It has been true in large agricultural chemical, seed, grain and biotechnology companies that have been involved in a myriad of strategic alliances. Caves (1998) also agrees that technology assets seem often to provide an im ...

... complementary assets, typically lying downstream from production expertise. It has been true in large agricultural chemical, seed, grain and biotechnology companies that have been involved in a myriad of strategic alliances. Caves (1998) also agrees that technology assets seem often to provide an im ...

global property crash stress test scenario

... The historical record shows that multiple market catastrophes tend to occur at the same time and impacts cascade from one crisis to the next. The recent Great Financial Crisis (GFC) is one example of this. The financial crisis started in the US as a sub-prime asset bubble but quickly spread to the b ...

... The historical record shows that multiple market catastrophes tend to occur at the same time and impacts cascade from one crisis to the next. The recent Great Financial Crisis (GFC) is one example of this. The financial crisis started in the US as a sub-prime asset bubble but quickly spread to the b ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.