Britain`s banks: a bargain for value hunters

... good times, it’s hard to be conservative – shareholders demand their capital is worked harder and an aggressive bank that makes profits on a low capital base will make higher returns on capital. So, after 2008, UK banks had to become conservative fast. They cut lending and devoted any profits they m ...

... good times, it’s hard to be conservative – shareholders demand their capital is worked harder and an aggressive bank that makes profits on a low capital base will make higher returns on capital. So, after 2008, UK banks had to become conservative fast. They cut lending and devoted any profits they m ...

invest in syndicate mortgages

... the dates are estimates where fluctuations in the order of months can occur. Especially during approvals processes, when dealing with municipalities, the public, city councils, and the many other stakeholders, many aspects of the schedule are outside the control of the development manager. During th ...

... the dates are estimates where fluctuations in the order of months can occur. Especially during approvals processes, when dealing with municipalities, the public, city councils, and the many other stakeholders, many aspects of the schedule are outside the control of the development manager. During th ...

Hockey is Nothing Like Investing

... with today is that many stocks are hanging around our reasonable sense of fair value and are not coming down to levels we think represent a margin of safety. And we are sick and tired of it, dammit. To rehash some prior frustration, a policy of suppressing interest rates enables a thought process th ...

... with today is that many stocks are hanging around our reasonable sense of fair value and are not coming down to levels we think represent a margin of safety. And we are sick and tired of it, dammit. To rehash some prior frustration, a policy of suppressing interest rates enables a thought process th ...

STATE BANK KEEPS POLICY RATE UNCHANGED AT 12 PERCENT

... Further, the problems in the euro zone have increased uncertainty in the global economy,’ Monetary Policy Decision said and added that being a safe haven for investors, the US dollar has strengthened significantly in the past few weeks against almost all currencies, especially the euro, and Pakistan ...

... Further, the problems in the euro zone have increased uncertainty in the global economy,’ Monetary Policy Decision said and added that being a safe haven for investors, the US dollar has strengthened significantly in the past few weeks against almost all currencies, especially the euro, and Pakistan ...

Printable edition

... So, angels invested US$25.4B in a year in North America. Wow. That’s a 1:0.95 ratio angel investment to total VC funding and a 1:0.55 ratio of angel to early stage VC funding in a given year across North America. Of course they invested in many more companies (roughly 50,000 for angels vs. 3,000 for ...

... So, angels invested US$25.4B in a year in North America. Wow. That’s a 1:0.95 ratio angel investment to total VC funding and a 1:0.55 ratio of angel to early stage VC funding in a given year across North America. Of course they invested in many more companies (roughly 50,000 for angels vs. 3,000 for ...

Bank System Stabilisations - Corporate Restructuring Summit

... Make risk management as robust as possible; ...

... Make risk management as robust as possible; ...

Opalesque Exclusive: Coherence Capital sees central bank actions

... The recent backdrop of central bank actions has set the stage for stability and improvement in risk assets broadly. The majority of spread compression and/or price improvements could occur before the ECB actually buys much in the way of "non-financial" assets which we expect in the third quarter. Wi ...

... The recent backdrop of central bank actions has set the stage for stability and improvement in risk assets broadly. The majority of spread compression and/or price improvements could occur before the ECB actually buys much in the way of "non-financial" assets which we expect in the third quarter. Wi ...

Brief Profile of Coralbay Advisory Private Limited We are a young

... We work closely with some of the most significant Private Equity funds in the world (the likes of TPG, Bain Capital, Warburg Pincus, Carlyle, etc.), and in addition have very close relationships within the Indian banking system. In terms of background, Coralbay is a young boutique firm which was fou ...

... We work closely with some of the most significant Private Equity funds in the world (the likes of TPG, Bain Capital, Warburg Pincus, Carlyle, etc.), and in addition have very close relationships within the Indian banking system. In terms of background, Coralbay is a young boutique firm which was fou ...

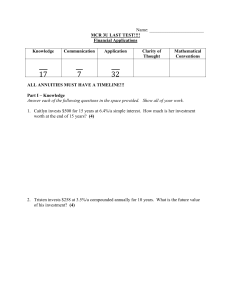

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

the full document

... should not be relied upon. This communication is provided for general information only and for distribution only in South Africa. It is not an invitation to make an investment nor does it constitute an offer for sale. The full documentation that should be considered before making an investment, incl ...

... should not be relied upon. This communication is provided for general information only and for distribution only in South Africa. It is not an invitation to make an investment nor does it constitute an offer for sale. The full documentation that should be considered before making an investment, incl ...

hoenigs

... U.S. banks have more capital, liquidity and lower loan-‐to-‐deposit ratios. Our system is also less concentrated with the top 5 U.S. banks having less bank assets as a percentage of home country GDP ...

... U.S. banks have more capital, liquidity and lower loan-‐to-‐deposit ratios. Our system is also less concentrated with the top 5 U.S. banks having less bank assets as a percentage of home country GDP ...

commentary_economic_..

... There is a time for everything, and a season for every activity. Ecclesiastes 3:1. In a recent issue of Investment News, it said financial advisors report that a growing number of formerly wary clients are becoming dangerously aggressive. These advisors worry about their clients making more ill-time ...

... There is a time for everything, and a season for every activity. Ecclesiastes 3:1. In a recent issue of Investment News, it said financial advisors report that a growing number of formerly wary clients are becoming dangerously aggressive. These advisors worry about their clients making more ill-time ...

Why alternative asset classes offer attractive returns

... structure to make private equity an investable asset class for non-institutional investors. “The flexible structure facilitates investment in less liquid and often longer term asset classes. This opens up these asset classes and their attractive historic return profile to investors that may previous ...

... structure to make private equity an investable asset class for non-institutional investors. “The flexible structure facilitates investment in less liquid and often longer term asset classes. This opens up these asset classes and their attractive historic return profile to investors that may previous ...

Energy

... 0% corporate tax in areas with above average unemployment Depreciation rates – 2 years for computers and related equipment and 3 1/3 years for manufacturing equipment 2-year VAT exemption for imports of equipment, consumables and components related to investment projects valued over € 5 millio ...

... 0% corporate tax in areas with above average unemployment Depreciation rates – 2 years for computers and related equipment and 3 1/3 years for manufacturing equipment 2-year VAT exemption for imports of equipment, consumables and components related to investment projects valued over € 5 millio ...

How_Much_International

... about ½ of the world's markets. So, it follows that about ½ of your equity portfolio should be in foreign assets. Anything less actually increases risk! Investors must have a very strong reason to deviate from this policy. However, some investors are shocked when introduced to an appropriately weigh ...

... about ½ of the world's markets. So, it follows that about ½ of your equity portfolio should be in foreign assets. Anything less actually increases risk! Investors must have a very strong reason to deviate from this policy. However, some investors are shocked when introduced to an appropriately weigh ...

Updating Accounting Standards

... In accordance with this announcement, the government is proposing to update section 76 of the General Regulation of the Pension Benefits Act (PBA) to reflect updates to the Chartered Professional Accountant (CPA) Canada Handbook, previously referred to as the Canadian Institute of Chartered Accounta ...

... In accordance with this announcement, the government is proposing to update section 76 of the General Regulation of the Pension Benefits Act (PBA) to reflect updates to the Chartered Professional Accountant (CPA) Canada Handbook, previously referred to as the Canadian Institute of Chartered Accounta ...

20 June 2017 Swanson: Stocks and Bonds: Two Markets Telling

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

Chapter 2 Macroeconomic Considerations

... Analysis of local units and VAT/PAYE based enterprises by ...

... Analysis of local units and VAT/PAYE based enterprises by ...

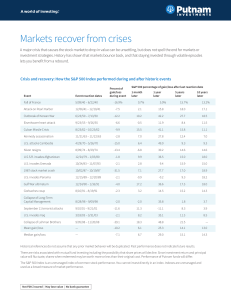

Markets recover from crises

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

Dr. John*s Products, Ltd. Case Study

... SpinBrush sales were 7/day per store while typical toothbrushes sell 1/week per store – In 2000 they were selling 6,000 units per day ...

... SpinBrush sales were 7/day per store while typical toothbrushes sell 1/week per store – In 2000 they were selling 6,000 units per day ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.