The land of the rising sun

... economy back on track. There is a chance that corporate Japan may respond if the Government ...

... economy back on track. There is a chance that corporate Japan may respond if the Government ...

Third, it explores the evolution of market power in MENA countries

... competition in banking markets ( Carbo et al 2009) use five indicators of competition- net interest margin, Lerner index, return on assets, H-statistic, and HHI market concentration. The authors show that “the comparison of the five indicators gives conflicting predictions of competitive behavior ac ...

... competition in banking markets ( Carbo et al 2009) use five indicators of competition- net interest margin, Lerner index, return on assets, H-statistic, and HHI market concentration. The authors show that “the comparison of the five indicators gives conflicting predictions of competitive behavior ac ...

When Valuing a Manufacturing Business, Work With a Pro

... Boulay provides the information in this article for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consult ...

... Boulay provides the information in this article for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consult ...

How do you assess multi-asset funds?

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

Market Efficiency, Housing Affordability and the Real Estate “Bubble”

... and household income to see how those variables have swayed. Interest rates adjust to record lows Household income and inflation were modest Possible drivers for housing affordability ...

... and household income to see how those variables have swayed. Interest rates adjust to record lows Household income and inflation were modest Possible drivers for housing affordability ...

Defining the new core of a bank

... choice for customers. Instead, they have been left bewildered by an array of products with a variety of terms and conditions, few of which are suited to them individually. Although many banks have started talking about a customer-centric (rather than productcentric) approach, few have achieved it. T ...

... choice for customers. Instead, they have been left bewildered by an array of products with a variety of terms and conditions, few of which are suited to them individually. Although many banks have started talking about a customer-centric (rather than productcentric) approach, few have achieved it. T ...

Investor empowerment - a survival essential

... capital markets. Investment is the key to economic development, Income in an economy flows from one part to another whenever a transaction takes place. Fresh spending generates new income which generates further spending and additional new income and so on. Spending and income continue to circulate ...

... capital markets. Investment is the key to economic development, Income in an economy flows from one part to another whenever a transaction takes place. Fresh spending generates new income which generates further spending and additional new income and so on. Spending and income continue to circulate ...

Tax Havens and Illicit Financial Flows

... persons” and private operators. Support, ratify and implement specific international conventions against fraud, corruption, and money laundering. Provide technical assistance in tax administration and governance reforms ...

... persons” and private operators. Support, ratify and implement specific international conventions against fraud, corruption, and money laundering. Provide technical assistance in tax administration and governance reforms ...

Document

... financial inclusion? If not, which mode do you think is more appropriate? Please support your viewpoint with reasons. RESPONSE: Yes USSD can become most appropriate mode, but telecom industry should give low priority to incoming voice call when a USSD transaction is in process. ...

... financial inclusion? If not, which mode do you think is more appropriate? Please support your viewpoint with reasons. RESPONSE: Yes USSD can become most appropriate mode, but telecom industry should give low priority to incoming voice call when a USSD transaction is in process. ...

The Need for High Quality Data on Direct Investment in

... As can be seen, value of DI transactions grown substantially Discrepancies between inward and outward financial transactions and between income credits and debits ...

... As can be seen, value of DI transactions grown substantially Discrepancies between inward and outward financial transactions and between income credits and debits ...

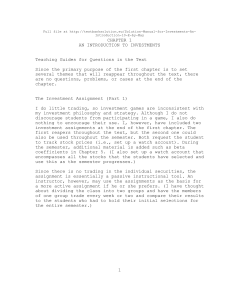

FREE Sample Here - We can offer most test bank and

... the students why they would buy a stock. The answers should revolve around dividends and price appreciation. Use these answers to stress future dividends and future price appreciation (capital gains), all properly discounted at the appropriate risk-adjusted rate. While Chapter 1 is too early in the ...

... the students why they would buy a stock. The answers should revolve around dividends and price appreciation. Use these answers to stress future dividends and future price appreciation (capital gains), all properly discounted at the appropriate risk-adjusted rate. While Chapter 1 is too early in the ...

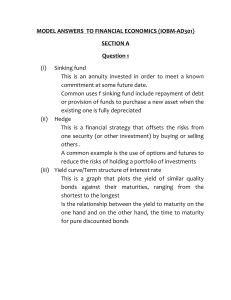

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... To enhance strategic focus: a firm may divest/sell business that are not part of its core business so that it can focus on what it does best To raise funding: by selling one of its businesses in exchange for cash, divestitures help generate funds for a firm. ...

... To enhance strategic focus: a firm may divest/sell business that are not part of its core business so that it can focus on what it does best To raise funding: by selling one of its businesses in exchange for cash, divestitures help generate funds for a firm. ...

end of the golden age? - Virtus Investment Partners

... without harming performance when they do. However, the last group looks to exploit opportunities arising from market inefficiencies created by non-profit seekers such as global central banks. This focus on diversifying risk means a multi-strategy approach can produce smoother returns to deliver cons ...

... without harming performance when they do. However, the last group looks to exploit opportunities arising from market inefficiencies created by non-profit seekers such as global central banks. This focus on diversifying risk means a multi-strategy approach can produce smoother returns to deliver cons ...

Special Interview : Hideo Shiozumi [PDF 134KB]

... the stock market and for companies having to meet pension liabilities next year? HS: The problem is not as exacerbated as in other developed economies. And actually one of the biggest forces for consumer spending is from the elderly. They are getting a huge lump sum on retirement and they are buying ...

... the stock market and for companies having to meet pension liabilities next year? HS: The problem is not as exacerbated as in other developed economies. And actually one of the biggest forces for consumer spending is from the elderly. They are getting a huge lump sum on retirement and they are buying ...

Impact of number of mobile operators on investments

... competent authorities should carefully evaluate this balance in their assessment methods, before they encourage market entry or block consolidations. A recent study from Genakos et al. (2015) on 33 OECD countries over 2002-2014 concludes that 4-3 mobile mergers led to increases in prices but to more ...

... competent authorities should carefully evaluate this balance in their assessment methods, before they encourage market entry or block consolidations. A recent study from Genakos et al. (2015) on 33 OECD countries over 2002-2014 concludes that 4-3 mobile mergers led to increases in prices but to more ...

Kagiso-Tiso-Holdings-invests-in-Ghana1

... subsidiary, KTH announced its ambition to diversify its portfolio into fast growing markets, particularly in West and East Africa and has set aside substantial funds to pursue this strategy. The Fidelity transaction represents a significant milestone for KTH and is its first direct investment outsid ...

... subsidiary, KTH announced its ambition to diversify its portfolio into fast growing markets, particularly in West and East Africa and has set aside substantial funds to pursue this strategy. The Fidelity transaction represents a significant milestone for KTH and is its first direct investment outsid ...

The Dynamics of Business Investment Following Banking Crises

... I start by estimating equation (1), which does not differentiate between normal recessions and banking crises, and find that there is evidence that growth in business investments in recoveries is moderately stronger the deeper the previous recession was. The parameter estima ...

... I start by estimating equation (1), which does not differentiate between normal recessions and banking crises, and find that there is evidence that growth in business investments in recoveries is moderately stronger the deeper the previous recession was. The parameter estima ...

The eurozone banking system: a sector undergoing

... The change with respect to the previous situation, which has seen the creation of the SSM and the SRM, has been enormous and it is no exaggeration to say that this is the most important regulatory change of the last thirty years. However, it is also clear that some things need to be improved. The ex ...

... The change with respect to the previous situation, which has seen the creation of the SSM and the SRM, has been enormous and it is no exaggeration to say that this is the most important regulatory change of the last thirty years. However, it is also clear that some things need to be improved. The ex ...

20170504 CACEIS partner in the initiative to develop apost

... Jean-François Abadie, CEO of CACEIS, remarked, “We are very pleased to participate in this collective innovation process. This promising project combines a wide range of experience and expertise that is appropriate to its ambition to help drive the process of transforming the postmarket environment. ...

... Jean-François Abadie, CEO of CACEIS, remarked, “We are very pleased to participate in this collective innovation process. This promising project combines a wide range of experience and expertise that is appropriate to its ambition to help drive the process of transforming the postmarket environment. ...

issues to correctly assess the investment climate and its risks.

... that credit markets lend based on cash flow and asset values, one can rightly assume that lenders around the world are very nervous as they see commodity prices collapse by 50–70%. The situation is similar to 2007, when we knew that housing prices were falling, but did not know the extent of the deb ...

... that credit markets lend based on cash flow and asset values, one can rightly assume that lenders around the world are very nervous as they see commodity prices collapse by 50–70%. The situation is similar to 2007, when we knew that housing prices were falling, but did not know the extent of the deb ...

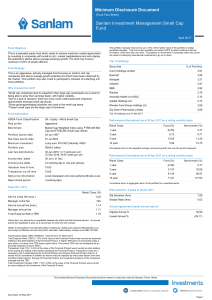

Sanlam Investment Management Small Cap Fund

... investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved Manager in Collective Investment Schemes in Securities. Additional information of t ...

... investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is available from the Manager, Sanlam Collective Investments (RF) Pty Ltd, a registered and approved Manager in Collective Investment Schemes in Securities. Additional information of t ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.

![Special Interview : Hideo Shiozumi [PDF 134KB]](http://s1.studyres.com/store/data/016787266_1-72016ef51958c0d1f7fbc9dd7e05b59e-300x300.png)