The importance of being separated

... similar nature attempts to split trading activities will result in complications. For example, attempts to split proprietary trading from other trading under the so-called Volcker rule in the U.S. have led to extremely complex legal code and reports of easy evasion and regulatory arbitrage. To provi ...

... similar nature attempts to split trading activities will result in complications. For example, attempts to split proprietary trading from other trading under the so-called Volcker rule in the U.S. have led to extremely complex legal code and reports of easy evasion and regulatory arbitrage. To provi ...

FDI in Russia in difficult times - Columbia Center on Sustainable

... The 1999 Federal Law No. 160 on foreign investment (the most important law), together with the 1991 Investment Code, guarantee that foreign investors have rights equal to Russian investors. The Russian constitution allows for nationalization only under very limited conditions. In addition, 54 bilate ...

... The 1999 Federal Law No. 160 on foreign investment (the most important law), together with the 1991 Investment Code, guarantee that foreign investors have rights equal to Russian investors. The Russian constitution allows for nationalization only under very limited conditions. In addition, 54 bilate ...

Mth - Prudential Jennison Small Company Fund

... Russell 2500 Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index. Russell 2000 Index measures the performance of the small-cap segment of t ...

... Russell 2500 Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index. Russell 2000 Index measures the performance of the small-cap segment of t ...

The data refer to the Hong Kong Special Administrative Region

... Source S index, weights reference period: September 1992. Data are based on the Labor Earnings Survey and refer to nominal wage indices for September of each year. Data cover a similar range of remuneration as the payroll per person index but only for normal work time. Manufacturing Production: Sour ...

... Source S index, weights reference period: September 1992. Data are based on the Labor Earnings Survey and refer to nominal wage indices for September of each year. Data cover a similar range of remuneration as the payroll per person index but only for normal work time. Manufacturing Production: Sour ...

A CASE White Paper

... Mr. Russell is a Manager of the Emerald Banking & Finance Fund and a Senior Research Analyst for Emerald Advisers, Inc. Prior to joining Emerald in 2005, Mr. Russell founded Greenwood Advisers, LLC, a registered investment adviser. Previously, he served as Managing Director of iNetworks, LLC a priva ...

... Mr. Russell is a Manager of the Emerald Banking & Finance Fund and a Senior Research Analyst for Emerald Advisers, Inc. Prior to joining Emerald in 2005, Mr. Russell founded Greenwood Advisers, LLC, a registered investment adviser. Previously, he served as Managing Director of iNetworks, LLC a priva ...

Don`t states have the right to regulate banks?

... blocked states from enforcing their anti-predatory lending laws against national banks. Second, the OCC asserted its “exclusive authority to supervise, examine, and regulate the national banking system”, including exclusive enforcement authority for consumer protection laws.[5] The 2004 rules were t ...

... blocked states from enforcing their anti-predatory lending laws against national banks. Second, the OCC asserted its “exclusive authority to supervise, examine, and regulate the national banking system”, including exclusive enforcement authority for consumer protection laws.[5] The 2004 rules were t ...

Charles Bean: Sustaining the recovery

... to shoot straight back up to pre-crisis levels. It is now five years since we cut Bank Rate to its historic low of 0.5% and launched our asset purchase programme (QE). Those five years have been tough for both businesses and households. But they surely would have been even tougher had we not taken t ...

... to shoot straight back up to pre-crisis levels. It is now five years since we cut Bank Rate to its historic low of 0.5% and launched our asset purchase programme (QE). Those five years have been tough for both businesses and households. But they surely would have been even tougher had we not taken t ...

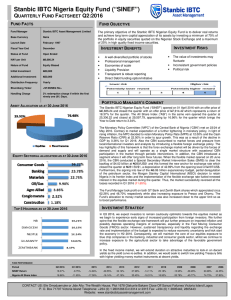

Nigerian Equity Fund - Stanbic IBTC Asset Management

... Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this f ...

... Reserve Ratio (CRR) at 22.50% in order to spur growth. This was as a result of the decline in GDP by 0.36% for Q1 2016. Also the CBN succumbed to market forces and pressure from local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this f ...

Analysts foresee boost in market activities this week

... At the close of trading activities last Friday, the NSE All-Share Index appreciated by 227.46 points or 1.1 per cent to close at 20,592.02 points, up from 20,364.56 at the beginning of the week. Similarly, the market capitalisation of the 187 First-Tier equities rose by N72bn or 1.1 per cent from 20 ...

... At the close of trading activities last Friday, the NSE All-Share Index appreciated by 227.46 points or 1.1 per cent to close at 20,592.02 points, up from 20,364.56 at the beginning of the week. Similarly, the market capitalisation of the 187 First-Tier equities rose by N72bn or 1.1 per cent from 20 ...

Investment risk, return and volatility

... While the MVP can reduce the impact of downside risk, it can also reduce the height of upside results. All investments carry a degree of risk, and risk can never be completely eliminated without giving up some potential return. It’s important to note that the MVP is not expected to address cyclical ...

... While the MVP can reduce the impact of downside risk, it can also reduce the height of upside results. All investments carry a degree of risk, and risk can never be completely eliminated without giving up some potential return. It’s important to note that the MVP is not expected to address cyclical ...

FAQ Structured Investment

... principal to give a balance between risk and potential higher return – these are usually termed as “Partially Principal Guaranteed” by HSBC Malaysia Berhad (“HSBC”). ...

... principal to give a balance between risk and potential higher return – these are usually termed as “Partially Principal Guaranteed” by HSBC Malaysia Berhad (“HSBC”). ...

Policy in the Wake of the Banking Crisis: Taking Pluralism

... incentivise rational behaviour, with respect for example to inflation targeting and addressing moral hazard, and/or remove market imperfections Very limited use of psychology Mathematical method applied to establishing one best model Presumes culture and behaviour are homogenised by financial incent ...

... incentivise rational behaviour, with respect for example to inflation targeting and addressing moral hazard, and/or remove market imperfections Very limited use of psychology Mathematical method applied to establishing one best model Presumes culture and behaviour are homogenised by financial incent ...

Quick Market Update. Six Possible Surprises for 2014

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

EU single market in banking

... TAIEX Conference, EU single market in banking, Ankara, 1 March 2005 ...

... TAIEX Conference, EU single market in banking, Ankara, 1 March 2005 ...

2010 Article IV Consultation, Concluding Statement, 9

... Despite these successes, Lebanon’s underlying vulnerabilities remain very high and key reforms are still stalled. At 148 percent of GDP as of end-2009, the government’s debt remains among the highest in the world and generates large recurring borrowing needs. The large banking system is highly expos ...

... Despite these successes, Lebanon’s underlying vulnerabilities remain very high and key reforms are still stalled. At 148 percent of GDP as of end-2009, the government’s debt remains among the highest in the world and generates large recurring borrowing needs. The large banking system is highly expos ...

Indonesia - Bernardo Villegas

... Although the sovereign credit rating is still 1-2 notches below investment grade, the country has been receiving upgrades by major ratings agencies in recognition of its strong prospects. Many observers expect Indonesia soon to reach investment grade. ...

... Although the sovereign credit rating is still 1-2 notches below investment grade, the country has been receiving upgrades by major ratings agencies in recognition of its strong prospects. Many observers expect Indonesia soon to reach investment grade. ...

Competition Policy in Banking and Financial Services

... small banks) are consistent with this. There is less solid evidence for the existence of economies of scope (lower costs from delivery of a range of products by one organization than when delivered separately by multiple organizations. Constantly changing technology for the manufacture, delivery, an ...

... small banks) are consistent with this. There is less solid evidence for the existence of economies of scope (lower costs from delivery of a range of products by one organization than when delivered separately by multiple organizations. Constantly changing technology for the manufacture, delivery, an ...

The RAM Opportunistic Value Portfolio

... company’s assets. This asset assessment step is the most critical for our “price per pound” investment process. The flexibility of our process allows us to define an asset in the following ways: real estate, oil/gas reserves, sticky/recurring software contracts, research and development investments, ...

... company’s assets. This asset assessment step is the most critical for our “price per pound” investment process. The flexibility of our process allows us to define an asset in the following ways: real estate, oil/gas reserves, sticky/recurring software contracts, research and development investments, ...

Mr Chairman, there is already a year and a half since

... U.S. How do you see the situation evolving? I believe the recovery will come from the same place that the crisis began. For the time being though, I don’t see a great deal of optimism in the market, particularly judging by the way Wall Street reacted to the recent statements made by the Treasury Sec ...

... U.S. How do you see the situation evolving? I believe the recovery will come from the same place that the crisis began. For the time being though, I don’t see a great deal of optimism in the market, particularly judging by the way Wall Street reacted to the recent statements made by the Treasury Sec ...

The Risk and Term Structure of Interest Rates

... the risk premium is itself a gauge of another more important factor. The risk premium essentially measures the risk of default. The greater the chance of default, the larger is the risk premium that a bond must pay to attract investors. ...

... the risk premium is itself a gauge of another more important factor. The risk premium essentially measures the risk of default. The greater the chance of default, the larger is the risk premium that a bond must pay to attract investors. ...

Investment Outlook

... More laughter, but PIMCO and a few others it turns out had the last hoo-hah. The housing bubble and the Fed’s neglect of it was recognized early on by PIMCO’s Paul McCulley, an economist/investor who should belong in someone’s Hall of Fame. McCulley introduced me and PIMCO to Hyman Minsky and his pe ...

... More laughter, but PIMCO and a few others it turns out had the last hoo-hah. The housing bubble and the Fed’s neglect of it was recognized early on by PIMCO’s Paul McCulley, an economist/investor who should belong in someone’s Hall of Fame. McCulley introduced me and PIMCO to Hyman Minsky and his pe ...

A Conservative, Value-Oriented Investment

... $10 because it has a high expected return, because my clients, and it was buying back their stock at this high cash flow yield or investing truth is me personally, can’t bear the one that goes to zero, even if in building up their hospital base in areas where they are already some percentage of them ...

... $10 because it has a high expected return, because my clients, and it was buying back their stock at this high cash flow yield or investing truth is me personally, can’t bear the one that goes to zero, even if in building up their hospital base in areas where they are already some percentage of them ...

commercial banks

... Some banks (called Banks of issue) issue banknotes as legal tender. Many banks offer ancillary financial services to make additional profit; for example, most banks also rent safe deposit boxes in their branches. Central banks are non-commercial bodies or government agencies often charged with contr ...

... Some banks (called Banks of issue) issue banknotes as legal tender. Many banks offer ancillary financial services to make additional profit; for example, most banks also rent safe deposit boxes in their branches. Central banks are non-commercial bodies or government agencies often charged with contr ...

Download attachment

... Islamic banks utilize Islamic modes of financing on two sides: 1. The side of liabilities or resource mobilization 2. The side of assets or resource utilization. On the resource mobilization side, the mudārabah mode, either general or restricted to a certain business line, is the mode most frequentl ...

... Islamic banks utilize Islamic modes of financing on two sides: 1. The side of liabilities or resource mobilization 2. The side of assets or resource utilization. On the resource mobilization side, the mudārabah mode, either general or restricted to a certain business line, is the mode most frequentl ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.