Losing the Future: The Decline of US Saving and

... ·· American private saving barely keeps pace with total government deficits. On the whole, the country saves very little. ·· American investment barely keeps pace with depreciation; U.S. private and public capital stock and infrastructure deteriorates almost as quickly as it can be repaired or repla ...

... ·· American private saving barely keeps pace with total government deficits. On the whole, the country saves very little. ·· American investment barely keeps pace with depreciation; U.S. private and public capital stock and infrastructure deteriorates almost as quickly as it can be repaired or repla ...

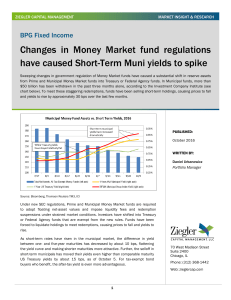

Changes In Money Market Fund Regulations

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

Chapter 12

... The present value—the value today—of a given payment in the future is the maximum amount a person is willing to pay today for that payment. As the interest rate increases, the opportunity cost of your funds also increases, so the present value of a given payment in the future falls. In other words, ...

... The present value—the value today—of a given payment in the future is the maximum amount a person is willing to pay today for that payment. As the interest rate increases, the opportunity cost of your funds also increases, so the present value of a given payment in the future falls. In other words, ...

November

... This paper solves for the equilibrium of a standard real business cycle model with money under model ambiguity. It first shows that monetary certainty is a sufficient condition for an interest rate smoothing rule to be optimal even under preferences for model robustness on the part of private agents ...

... This paper solves for the equilibrium of a standard real business cycle model with money under model ambiguity. It first shows that monetary certainty is a sufficient condition for an interest rate smoothing rule to be optimal even under preferences for model robustness on the part of private agents ...

Ex ante - David Flacher

... What about the free rider behavior (Skype; Google): a Schumpeterian view more destructive than creative? ...

... What about the free rider behavior (Skype; Google): a Schumpeterian view more destructive than creative? ...

Yankee bonds – a British invasion?

... analysts and fund managers have developed a strong set of credit skills that allows them to establish relative value between different names and to price those credits accordingly. As a result, US investors are willing to commit the resources to do this credit work as long as they get paid for it. T ...

... analysts and fund managers have developed a strong set of credit skills that allows them to establish relative value between different names and to price those credits accordingly. As a result, US investors are willing to commit the resources to do this credit work as long as they get paid for it. T ...

2016: The year in review

... The weakness of the UK pound post-Brexit will benefit many UK companies, particularly those in the Health Care, Energy, Materials and Information Technology sectors which make most of their earnings from operations outside the UK. The election in November of Donald Trump as the next US President was ...

... The weakness of the UK pound post-Brexit will benefit many UK companies, particularly those in the Health Care, Energy, Materials and Information Technology sectors which make most of their earnings from operations outside the UK. The election in November of Donald Trump as the next US President was ...

Fast-growing Ghana and Cote d`Ivoire: Similarities and Differences

... Founded in 2006, Frontier Market Asset Management holds more than 35 years worth of investment experience including work in Emerging and Frontier Markets since 1987. For more information, please contact us at (858) 4561440. This is not an offering. An offering will be made only by means of a final o ...

... Founded in 2006, Frontier Market Asset Management holds more than 35 years worth of investment experience including work in Emerging and Frontier Markets since 1987. For more information, please contact us at (858) 4561440. This is not an offering. An offering will be made only by means of a final o ...

Northern Rock - Bruce Packard

... staff as securitisation volumes dry up. Lehmans buys Northern Rock’s subprime mortgages, however its shares are now down 31% since mid June and up until last week had only just outperformed Northern Rock! ...

... staff as securitisation volumes dry up. Lehmans buys Northern Rock’s subprime mortgages, however its shares are now down 31% since mid June and up until last week had only just outperformed Northern Rock! ...

Data Management: Does changing - Federal Reserve Bank of Atlanta

... • In the model, financial intermediaries can issue equity at no cost – Any discrepancy between assets and the value of existing equity, shadow- money and money is always made up by issuing new equity ...

... • In the model, financial intermediaries can issue equity at no cost – Any discrepancy between assets and the value of existing equity, shadow- money and money is always made up by issuing new equity ...

Prospect Theory as an explanation of risky choice by professional

... result has also been found for professional decision makers in other domains (Slovic, 1987). Therefore, the first survey was conducted to focus more closely on potential risk attributes. Table 1 presents the results of this survey. In this survey, respondents were requested to rate each mentioned ri ...

... result has also been found for professional decision makers in other domains (Slovic, 1987). Therefore, the first survey was conducted to focus more closely on potential risk attributes. Table 1 presents the results of this survey. In this survey, respondents were requested to rate each mentioned ri ...

The UK and multi-level financial regulation

... provides a brief overview of the UK’s negotiating position and current implementation of key EU financial services regulations. ...

... provides a brief overview of the UK’s negotiating position and current implementation of key EU financial services regulations. ...

Bond Yields Underpinning Equities

... if bond yields had not declined then equities all else equal would today be trading at significantly lower values. We estimate that global equities would be down by around 11% for the year instead of up 1% if bond yields had not declined over this period (Exhibit 2). In short, the weakening of econo ...

... if bond yields had not declined then equities all else equal would today be trading at significantly lower values. We estimate that global equities would be down by around 11% for the year instead of up 1% if bond yields had not declined over this period (Exhibit 2). In short, the weakening of econo ...

North Americans go bargain hunting in UK listed sector

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

Active Management: Andrew Slimmon Shares His

... inherit the fund’s cost basis in the underlying securities — some of which could have been purchased years before at low prices. The result: An investor could wind up paying capital gains taxes on securities that have lost value since they bought the fund (Display 1). But when an investor holds a se ...

... inherit the fund’s cost basis in the underlying securities — some of which could have been purchased years before at low prices. The result: An investor could wind up paying capital gains taxes on securities that have lost value since they bought the fund (Display 1). But when an investor holds a se ...

Strong Demand for Muni Bonds Yields Pros, Cons

... demand, which is bidding up prices. Not only is the domestic desire for munis running hot, the presence of negative interest rates in developed Europe and Asia has escalated the amount of money flowing in from overseas banks, pension funds and other institutions. The not-so-good news? Bond issuance ...

... demand, which is bidding up prices. Not only is the domestic desire for munis running hot, the presence of negative interest rates in developed Europe and Asia has escalated the amount of money flowing in from overseas banks, pension funds and other institutions. The not-so-good news? Bond issuance ...

Implications of Energy Price Weakness

... after the fourth quarter of this year, noted Glasebrook. In addition to cutbacks, many exploration and production companies will likely emphasize drilling in their more productive areas to generate more cash flows per dollar spent. This high-grading of acreage also has the potential to lower the cos ...

... after the fourth quarter of this year, noted Glasebrook. In addition to cutbacks, many exploration and production companies will likely emphasize drilling in their more productive areas to generate more cash flows per dollar spent. This high-grading of acreage also has the potential to lower the cos ...

Lesson 13 key - Bakersfield College

... Net asset value = Net asset value = 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this i ...

... Net asset value = Net asset value = 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this i ...

in South Asia - South Solidarity Initiative

... Chevron v. Ecuador (Amazonian oil pollution, evading court rulings) 2009, pending Chevron case against Ecuador under the U.S.-Ecuador BIT to evade payment of a multi-billion dollar court ruling against the company for widespread pollution of the Amazon rainforest. 26 Years of Texaco – acquired b ...

... Chevron v. Ecuador (Amazonian oil pollution, evading court rulings) 2009, pending Chevron case against Ecuador under the U.S.-Ecuador BIT to evade payment of a multi-billion dollar court ruling against the company for widespread pollution of the Amazon rainforest. 26 Years of Texaco – acquired b ...

Africa Is there economic hope

... No country or region ever developed thanks to aid alone. The best way to eradicate poverty is to deal with the poorest people in the world in terms of a market Innovation to deliver products and services to poorest people • Primarily in cost structures ...

... No country or region ever developed thanks to aid alone. The best way to eradicate poverty is to deal with the poorest people in the world in terms of a market Innovation to deliver products and services to poorest people • Primarily in cost structures ...

Asian Credit Daily

... This publication is solely for information purposes only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or s ...

... This publication is solely for information purposes only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or s ...

speech - Europa.eu

... investment banks and sophisticated traders. Enormous amounts of risk were accumulated and the links between financial institutions grew so tight that practically every large entity became vital for the whole system. Let me add in passing that public authorities have their share of responsibility her ...

... investment banks and sophisticated traders. Enormous amounts of risk were accumulated and the links between financial institutions grew so tight that practically every large entity became vital for the whole system. Let me add in passing that public authorities have their share of responsibility her ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.