Asian Bonds Still Sitting Pretty - March 2013

... Philippines. I think this will offer investors more opportunities to derive value in the corporate bond space. Danny : 2012 was a record year for new issuance in the Singapore dollar bond segment. The market witnessed robust participation by both new and existing issuers. Foreign issuers also booste ...

... Philippines. I think this will offer investors more opportunities to derive value in the corporate bond space. Danny : 2012 was a record year for new issuance in the Singapore dollar bond segment. The market witnessed robust participation by both new and existing issuers. Foreign issuers also booste ...

a chapter in the history of central banking

... to pay for a war. First, Congress passed an act in July 1861 that authorized Secretary of the Treasury Salmon P. Chase to borrow money on behalf of the federal government and to issue Treasury notes as collateral for any such loans. So Chase arranged for an initial loan of $50,000,000 from several d ...

... to pay for a war. First, Congress passed an act in July 1861 that authorized Secretary of the Treasury Salmon P. Chase to borrow money on behalf of the federal government and to issue Treasury notes as collateral for any such loans. So Chase arranged for an initial loan of $50,000,000 from several d ...

what is finance

... difficulty accessing finance due to the perceived lack of creditworthiness. This perception could be avoided if reliable data and information are available. While banks have their own risk management and credit assessment units, they also rely on specialized services, which provide credit informatio ...

... difficulty accessing finance due to the perceived lack of creditworthiness. This perception could be avoided if reliable data and information are available. While banks have their own risk management and credit assessment units, they also rely on specialized services, which provide credit informatio ...

Slide 1

... 2. Deep research is the only reliable way to identify exceptional investment managers. Brand and past performance are unreliable predictors of future performance 3. Diversification leads to more consistent investment outcomes ...

... 2. Deep research is the only reliable way to identify exceptional investment managers. Brand and past performance are unreliable predictors of future performance 3. Diversification leads to more consistent investment outcomes ...

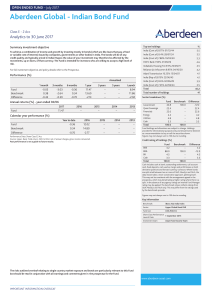

Aberdeen Global - Indian Bond Fund

... jurisdictions and private placement exemptions may be available in others. It is not intended for distribution or use by any person or entity that is a citizen or resident of or located in any jurisdiction where such distribution, publication or use would be prohibited. Aberdeen Global is not regist ...

... jurisdictions and private placement exemptions may be available in others. It is not intended for distribution or use by any person or entity that is a citizen or resident of or located in any jurisdiction where such distribution, publication or use would be prohibited. Aberdeen Global is not regist ...

Doll commentary - MidWestOne Investment Services

... The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not co ...

... The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not co ...

Handling Market Volatility

... • Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult ...

... • Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult ...

Will Indonesia`s new stimulus hit the right note?

... investment cycle, boosting industrial competitiveness, and improving governance standards. A two-pronged focus: Broadly, Indonesia’s latest economic package encompasses a two-pronged strategy - 1) Aiding consumer purchasing power and 2) Rekindling a flagging investment cycle (See Table – 1). While t ...

... investment cycle, boosting industrial competitiveness, and improving governance standards. A two-pronged focus: Broadly, Indonesia’s latest economic package encompasses a two-pronged strategy - 1) Aiding consumer purchasing power and 2) Rekindling a flagging investment cycle (See Table – 1). While t ...

Best Payment Value Market Share Growth

... Standard Chartered – leading the way in Ghana Standard Chartered Bank is a market - leading financial services brand in Ghana, listed on the Ghana Stock Exchange. It has operated for 115 years in the country and is currently the highest priced stock on the exchange. It ranks among the top 15 compani ...

... Standard Chartered – leading the way in Ghana Standard Chartered Bank is a market - leading financial services brand in Ghana, listed on the Ghana Stock Exchange. It has operated for 115 years in the country and is currently the highest priced stock on the exchange. It ranks among the top 15 compani ...

Introduction to Investments (Chapter 1)

... Meaning of Investments • Commitment of money that is expected to generate additional money • Current commitment of dollars for a period of time to desire future payments that will compensate the investor for – The time the funds are committed – The expected rate of inflation, and – The uncertainty ...

... Meaning of Investments • Commitment of money that is expected to generate additional money • Current commitment of dollars for a period of time to desire future payments that will compensate the investor for – The time the funds are committed – The expected rate of inflation, and – The uncertainty ...

Market discipline, disclosure and moral hazard in banking

... to the proportion of uninsured liabilities in the bank’s balance sheet. Using panel data techniques, we test whether these factors provide incentives for banks to hold larger capital buffers against adverse outcomes in portfolio risk. Our results suggest that government safety nets result in lower c ...

... to the proportion of uninsured liabilities in the bank’s balance sheet. Using panel data techniques, we test whether these factors provide incentives for banks to hold larger capital buffers against adverse outcomes in portfolio risk. Our results suggest that government safety nets result in lower c ...

Deconstructing the time in the market mantra

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

Foreign Direct Investment (FDI)

... • Sri Lanka is one of the safest countries in the world to invest in, due to a number of mechanisms in place to protect investors. The Article 157 of the island's constitution guarantees the safety of investment protection treaties and agreements approved by parliament by a two thirds majority. • Sr ...

... • Sri Lanka is one of the safest countries in the world to invest in, due to a number of mechanisms in place to protect investors. The Article 157 of the island's constitution guarantees the safety of investment protection treaties and agreements approved by parliament by a two thirds majority. • Sr ...

Miron_Bailout - Harvard University

... mid-2004 through mid-2006 is plausibly one factor that slowed the economy starting in 2007.7 To summarize, the U.S. economy had overinvested in housing as of early 2006, and housing and stock prices were high relative to historical norms. Thus, the economy was misaligned, and a major adjustment—such ...

... mid-2004 through mid-2006 is plausibly one factor that slowed the economy starting in 2007.7 To summarize, the U.S. economy had overinvested in housing as of early 2006, and housing and stock prices were high relative to historical norms. Thus, the economy was misaligned, and a major adjustment—such ...

Foreign competition in US banking markets

... United Kingdom, the United States, and West Germany. Banks from France and Italy are excluded because their ownership by a national government makes it difficult to measure their true capital. Figure 6 suggests that the success of Japanese banks is only the most dramatic example of a more general p ...

... United Kingdom, the United States, and West Germany. Banks from France and Italy are excluded because their ownership by a national government makes it difficult to measure their true capital. Figure 6 suggests that the success of Japanese banks is only the most dramatic example of a more general p ...

Beyond Libor: The Evolution of `Risk-Free` Benchmarks

... has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. PIMCO provid ...

... has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. PIMCO provid ...

Gloom, Doom and the Hidden Rays of Hope

... markets index of developing nations fell 22.88%. Even the assets that are supposed to zig when the stock market zags were down comparably for the quarter. The Wilshire REIT index of real estate investment trusts was down 12.10% for the third quarter; moving it down 2.54% for the year. Commodities to ...

... markets index of developing nations fell 22.88%. Even the assets that are supposed to zig when the stock market zags were down comparably for the quarter. The Wilshire REIT index of real estate investment trusts was down 12.10% for the third quarter; moving it down 2.54% for the year. Commodities to ...

Newsletter April 2010 - PNM Financial Management

... Over the last six months Giles Hargreave has been finding an increasing number of opportunities in the market. This is reflected in the fund; the number of holdings increasing from 162 to 199 as a direct result, many of which are smaller companies. Companies have cut costs and improved their finance ...

... Over the last six months Giles Hargreave has been finding an increasing number of opportunities in the market. This is reflected in the fund; the number of holdings increasing from 162 to 199 as a direct result, many of which are smaller companies. Companies have cut costs and improved their finance ...

Lesson 2 Are Commodities Back?

... Strongin: Commodities and financial assets like stocks and bonds tend to offset each other (to balance / compensate each other) . By combining them (commodities investment and financial assets investment ) in an investment portfolio (investment mix, 投资总额, 投资 组合, See Note 6), you reduce risk in diffi ...

... Strongin: Commodities and financial assets like stocks and bonds tend to offset each other (to balance / compensate each other) . By combining them (commodities investment and financial assets investment ) in an investment portfolio (investment mix, 投资总额, 投资 组合, See Note 6), you reduce risk in diffi ...

34b debt, $20b reserves, debt forgiveness and slavery

... decades, and the industry’s expansion has been supported, aided and abetted by lenient government monetary and economic policies. Analysts have observed that the lucrative forex market and the financial malfeasance of round-tripping provided the foundation for the sustenance and growth of banks. The ...

... decades, and the industry’s expansion has been supported, aided and abetted by lenient government monetary and economic policies. Analysts have observed that the lucrative forex market and the financial malfeasance of round-tripping provided the foundation for the sustenance and growth of banks. The ...

March 2007 - NB must open doors

... Building a self-sufficient New Brunswick is a bit of a do-it-yourself project. For a variety of reasons - history, geography, a small population and the political and financial pull of central Canada - the Atlantic provinces have always struggled to attract the attention of investors willing to take ...

... Building a self-sufficient New Brunswick is a bit of a do-it-yourself project. For a variety of reasons - history, geography, a small population and the political and financial pull of central Canada - the Atlantic provinces have always struggled to attract the attention of investors willing to take ...

Handling Market Volatility

... asset will be balanced out by a gain in another, though diversification can't eliminate the possibility of market loss. One way to diversify your portfolio is through asset allocation. Asset allocation involves identifying the asset classes that are appropriate for you and allocating a certain perce ...

... asset will be balanced out by a gain in another, though diversification can't eliminate the possibility of market loss. One way to diversify your portfolio is through asset allocation. Asset allocation involves identifying the asset classes that are appropriate for you and allocating a certain perce ...

Lower Returns Likely in the Years Ahead

... are unsustainably high. We don’t believe that we are near either of these extremes today, but we will be wary if stock market optimism grows excessive and valuations continue to increase. Our primary message is that you should expect lower returns over the next five years compared to those experienc ...

... are unsustainably high. We don’t believe that we are near either of these extremes today, but we will be wary if stock market optimism grows excessive and valuations continue to increase. Our primary message is that you should expect lower returns over the next five years compared to those experienc ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.