The Environment of Financial Reporting

... Committee on Accounting Procedure (CAP) In 1938, the AICPA formed the Committee on Accounting Procedure. This group issued pronouncements known as Accounting Research Bulletins (ARB), but the CAP did not have authority to enforce its pronouncements and application was optional. The CAP was criticize ...

... Committee on Accounting Procedure (CAP) In 1938, the AICPA formed the Committee on Accounting Procedure. This group issued pronouncements known as Accounting Research Bulletins (ARB), but the CAP did not have authority to enforce its pronouncements and application was optional. The CAP was criticize ...

FREE Sample Here

... A. To get the best possible price for their securities. B. To market the issues to the public at the lowest cost. C. To issue fairly simple securities requiring little incremental analysis. D. All of these are true. E. None of these is true. ...

... A. To get the best possible price for their securities. B. To market the issues to the public at the lowest cost. C. To issue fairly simple securities requiring little incremental analysis. D. All of these are true. E. None of these is true. ...

chapter one - McGraw Hill Higher Education

... markets alone from mid-2000 to mid-2001, the experience of many new equity investors was not very successful. And stock returns since 2000 have not been disappointing: The return for U.S. stocks from 2000-2010 was only 0.4% per year, on average. Here’s a question: is the growing equity culture match ...

... markets alone from mid-2000 to mid-2001, the experience of many new equity investors was not very successful. And stock returns since 2000 have not been disappointing: The return for U.S. stocks from 2000-2010 was only 0.4% per year, on average. Here’s a question: is the growing equity culture match ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... Develop the complete markets : It is observed that derivative trading develop the market towards “complete markets” complete market concept refers to that situation where no particular investors be better of than others, or patterns of returns of all additional securities are spanned by the already ...

... Develop the complete markets : It is observed that derivative trading develop the market towards “complete markets” complete market concept refers to that situation where no particular investors be better of than others, or patterns of returns of all additional securities are spanned by the already ...

CH06 - Class Index

... Define “return” and state its two components. Explain the relationship between return and risk. Identify the sources of risk. Describe the different methods of measuring returns. • Describe the different methods of measuring risk. • Discuss the returns and risks from investing in major financial ass ...

... Define “return” and state its two components. Explain the relationship between return and risk. Identify the sources of risk. Describe the different methods of measuring returns. • Describe the different methods of measuring risk. • Discuss the returns and risks from investing in major financial ass ...

LPL Financial Security Site

... Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. Because of their narrow focus, spec ...

... Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. Because of their narrow focus, spec ...

Outlook 2017 > Gauging Market Milestones

... Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. Because of their narrow focus, spec ...

... Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. Because of their narrow focus, spec ...

Market Penetration and Investment Pattern: A Study

... marketing. For, they may be able to attract additional buyers and bigger market share. In this pursuit, they endeavor to look at the potential of their products in the existing and new markets. These strategies are technically labeled as ‗market penetration‘ (Armstrong & Kotler, 2009). This strategy ...

... marketing. For, they may be able to attract additional buyers and bigger market share. In this pursuit, they endeavor to look at the potential of their products in the existing and new markets. These strategies are technically labeled as ‗market penetration‘ (Armstrong & Kotler, 2009). This strategy ...

FRONT STREET TACTICAL BOND FUND Interim Management

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

Introduction to Volatility

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

Chap021-Investors and the Investment Process

... • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk default investment scheme. • ...

... • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk default investment scheme. • ...

2015 tech growth equity

... 21 new companies joined the “Unicorn” club with valuations in excess of $1,000,000,000 Uber raised capital at a $41B valuation, a value that would rank it 32nd among NASDAQ listed companies ...

... 21 new companies joined the “Unicorn” club with valuations in excess of $1,000,000,000 Uber raised capital at a $41B valuation, a value that would rank it 32nd among NASDAQ listed companies ...

CHAPTER THIRTEEN

... Beware of growth that comes from financial leverage. Firms can generate earnings growth by borrowing, and Chapter 14 makes the point. The analysis in the chapter is designed to prevent you from making the mistake of giving a firm a higher P/E ratio because it has generated earnings growth through bo ...

... Beware of growth that comes from financial leverage. Firms can generate earnings growth by borrowing, and Chapter 14 makes the point. The analysis in the chapter is designed to prevent you from making the mistake of giving a firm a higher P/E ratio because it has generated earnings growth through bo ...

financial system in russia as compared to other transition

... economies is not a matter of conscious choice of policy makers based on advantages and disadvantages of respective models. Rather, it is a result of path dependent development with an outcome determined primarily by two factors: the chosen model of privatisation and the degree of concentration of th ...

... economies is not a matter of conscious choice of policy makers based on advantages and disadvantages of respective models. Rather, it is a result of path dependent development with an outcome determined primarily by two factors: the chosen model of privatisation and the degree of concentration of th ...

Discovery Fund - Wells Fargo Funds

... evident from many U.S. companies provided key catalysts for solid equitymarket gains in the second quarter. Companies with strong, sustainable growth prospects continued to lead the market after many of these stocks declined following the U.S. election in late 2016. At the outset of 2017, investors ...

... evident from many U.S. companies provided key catalysts for solid equitymarket gains in the second quarter. Companies with strong, sustainable growth prospects continued to lead the market after many of these stocks declined following the U.S. election in late 2016. At the outset of 2017, investors ...

New York Stock Exchange

... The Board of directors Kenneth Lay was the chairman of the Board of Directors. The Board periodically reviewed Enron’s operations, financial results, proposed transactions and executive compensation. Lay and Skilling also attended meetings of the Board’s Commitees, including the Finance Committee s ...

... The Board of directors Kenneth Lay was the chairman of the Board of Directors. The Board periodically reviewed Enron’s operations, financial results, proposed transactions and executive compensation. Lay and Skilling also attended meetings of the Board’s Commitees, including the Finance Committee s ...

Product Innovations, Advertising and Stock Returns

... identified in the accounting and finance literature (Fama and French 1992; Kothari 2001). Thus, our central research question is: To what extent do marketing actions improve stock returns, over and above the typical finance and accounting benchmark measures? Our empirical research focuses on one in ...

... identified in the accounting and finance literature (Fama and French 1992; Kothari 2001). Thus, our central research question is: To what extent do marketing actions improve stock returns, over and above the typical finance and accounting benchmark measures? Our empirical research focuses on one in ...

Decimalization and market liquidity

... the same dealer may have decided not to post limit orders of the same size at the new prices of 50.51–50.53. This is because the profitability of committing to be willing to both buy and sell a given stock, as measured by the bid–ask spread, has declined. Thus, the dealer might only be willing to of ...

... the same dealer may have decided not to post limit orders of the same size at the new prices of 50.51–50.53. This is because the profitability of committing to be willing to both buy and sell a given stock, as measured by the bid–ask spread, has declined. Thus, the dealer might only be willing to of ...

Bendigo Socially Responsible Growth Fund

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...

History Sheet Information entered by [ ]

... 1630 in Holland: Tulips are considered an investment by the population 1636: “Tulipomania” Tulips are traded with a rage that spreads to all classes of the society 1637: Speculation begins… Bulbs are sold faster than they can grow In March, Francois Koster pays DFL 6650 for a few dozen tulips ...

... 1630 in Holland: Tulips are considered an investment by the population 1636: “Tulipomania” Tulips are traded with a rage that spreads to all classes of the society 1637: Speculation begins… Bulbs are sold faster than they can grow In March, Francois Koster pays DFL 6650 for a few dozen tulips ...

Report of the Committee to suggest steps for fulfilling the objectives

... Forward Markets Commission were transferred to the Ministry of Finance in September, 2013, this Committee was set up to examine whether the commodity futures markets has been able to perform its role after a decade of liberalization. There is a vast literature on price-discovery and hedging efficien ...

... Forward Markets Commission were transferred to the Ministry of Finance in September, 2013, this Committee was set up to examine whether the commodity futures markets has been able to perform its role after a decade of liberalization. There is a vast literature on price-discovery and hedging efficien ...

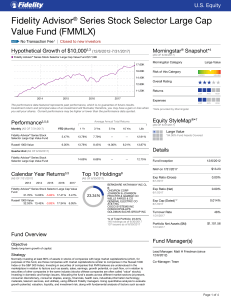

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

980-eng-Azioni_PGB_ing

... Estate S.p.A. board in May 2002 at the time of the IPO process, equal to n. 855,000 options of which n. 427,500 already exercisable, has also agreed with Banca Caboto S.p.A. not to sell (in case of options exercise) Pirelli & C. Real Estate shares for a period of 180 days. After the two transactions ...

... Estate S.p.A. board in May 2002 at the time of the IPO process, equal to n. 855,000 options of which n. 427,500 already exercisable, has also agreed with Banca Caboto S.p.A. not to sell (in case of options exercise) Pirelli & C. Real Estate shares for a period of 180 days. After the two transactions ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.

![History Sheet Information entered by [ ]](http://s1.studyres.com/store/data/008202941_1-745098000e8c3b4ca6ac471bb8585e75-300x300.png)