Empirical Analysis of Interaction between Securities Market,

... of money and other financial asset to gross domestic product. The increase of this proportion means that social exchange and investment works through money or financial asset. In the past 20 years, the Chinese gross financial asset increased rapidly, from 3417.5 billion in 1978 to 512523.6 billion i ...

... of money and other financial asset to gross domestic product. The increase of this proportion means that social exchange and investment works through money or financial asset. In the past 20 years, the Chinese gross financial asset increased rapidly, from 3417.5 billion in 1978 to 512523.6 billion i ...

Document

... “the greater fool” theory. Likewise, it may be rational not to buy a stock that is trading below its optimal value if it was believed that market psychology was such that the stock’s price could go down further. Other economists suspect that financial market prices may overreact before reaching equi ...

... “the greater fool” theory. Likewise, it may be rational not to buy a stock that is trading below its optimal value if it was believed that market psychology was such that the stock’s price could go down further. Other economists suspect that financial market prices may overreact before reaching equi ...

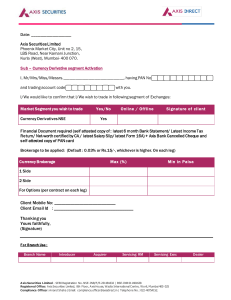

Client Email Id : Thanking you Yours faithfu

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

Does Japanese Government Increase Its Role in Financial Crisis?

... in which some financial institutions or assets suddenly lose a large part of their value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include ...

... in which some financial institutions or assets suddenly lose a large part of their value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include ...

41% - Bank Of India

... (UID) coupled with new technologies will expedite the process of financial inclusion in the country ...

... (UID) coupled with new technologies will expedite the process of financial inclusion in the country ...

The Meanings of Financial Services Integration

... Consolidated regulation suitable in a market where: Similar products/services are offered by different types of intermediaries in the same market segments. Institutions in competing sectors have similar strategies for growth and development in the domestic and/or the international market. Institutio ...

... Consolidated regulation suitable in a market where: Similar products/services are offered by different types of intermediaries in the same market segments. Institutions in competing sectors have similar strategies for growth and development in the domestic and/or the international market. Institutio ...

New financial instruments for global challenges

... rates are no longer determined by the economic fundamentals, i.e. productive investment performance trends, but by the expectations of short-term capital earnings by private players on the financial markets (especially banks, insurance companies and investment trusts). Their transactions cause unpre ...

... rates are no longer determined by the economic fundamentals, i.e. productive investment performance trends, but by the expectations of short-term capital earnings by private players on the financial markets (especially banks, insurance companies and investment trusts). Their transactions cause unpre ...

The causes of the Great Recession:

... Thus there is the famous (infamous) efficient market hypothesis (EMH). Financial markets always get prices right given the available information. Eugene Fama from University of Chicago first promulgated the EMT. According to Fama, there was no bubble in housing markets because consumers had all the ...

... Thus there is the famous (infamous) efficient market hypothesis (EMH). Financial markets always get prices right given the available information. Eugene Fama from University of Chicago first promulgated the EMT. According to Fama, there was no bubble in housing markets because consumers had all the ...

PDF - EMM Wealth Management

... rebounding slightly. Likewise, Brazilian local bonds not only depreciated along with the Real but also lost significant value as investors demanded much higher interest rates to carry Brazilian debt (rates jumped from around 11-12% in late 2014 to 16% at one point in late 2015). ...

... rebounding slightly. Likewise, Brazilian local bonds not only depreciated along with the Real but also lost significant value as investors demanded much higher interest rates to carry Brazilian debt (rates jumped from around 11-12% in late 2014 to 16% at one point in late 2015). ...

external employment Role of financial inclusion in meeting the SDGs

... costs or benefits relative to immediate costs or benefits. ...

... costs or benefits relative to immediate costs or benefits. ...

The stock-flow consistent approach: background, features and

... In post-Keynesian economics, markets clear either because quantities supplied are assumed to adjust to demand within the period or because of buffers. The price mechanism in our models only plays a clearing role for ...

... In post-Keynesian economics, markets clear either because quantities supplied are assumed to adjust to demand within the period or because of buffers. The price mechanism in our models only plays a clearing role for ...

It is nowadays generally accepted that Greece has

... through the central banks. Money market spreads that stood in the US at 10 basis points during the 1999-2000 market euphoria years and that in more normal times would be 20 to 40 basis points have increased to more than 400 basis points. This is a huge increase in the cost of funding, if funding can ...

... through the central banks. Money market spreads that stood in the US at 10 basis points during the 1999-2000 market euphoria years and that in more normal times would be 20 to 40 basis points have increased to more than 400 basis points. This is a huge increase in the cost of funding, if funding can ...

2 - Dnb

... of deregulation. This allowed greater risk sharing and supported exuberance in the financial sector. “Shadow banking” (the English insurance companies and international investors) played a pivotal role. As liquidity stress morphed into solvency problems, the bubble burst with a dramatic internationa ...

... of deregulation. This allowed greater risk sharing and supported exuberance in the financial sector. “Shadow banking” (the English insurance companies and international investors) played a pivotal role. As liquidity stress morphed into solvency problems, the bubble burst with a dramatic internationa ...

The Antecedents and Aftermath of Financial Crises as Told by

... Carlos F. Díaz-Alejandro started in Yale in 1961 as an assistant professor in the department of economics immediately after completing his graduate training at the Massachusetts Institute of Technology. He took a brief detour to the University of Minnesota, but, by 1969, he returned to Yale to becom ...

... Carlos F. Díaz-Alejandro started in Yale in 1961 as an assistant professor in the department of economics immediately after completing his graduate training at the Massachusetts Institute of Technology. He took a brief detour to the University of Minnesota, but, by 1969, he returned to Yale to becom ...

Sovereign debt crisis and banking system stress Financial Stability

... Financial Stability Implications of safe assets • Considerable upward pressures on the demand for safe assets at a time of declining supply entails sizable risks for global financial stability. • The unmet demand drives up the price of safety, with the safest assets affected first. • In their search ...

... Financial Stability Implications of safe assets • Considerable upward pressures on the demand for safe assets at a time of declining supply entails sizable risks for global financial stability. • The unmet demand drives up the price of safety, with the safest assets affected first. • In their search ...

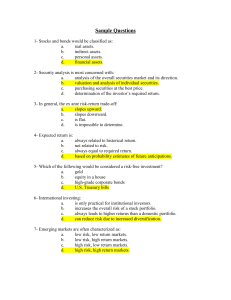

Sample Questions - U of L Class Index

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

Panel_2_-_Leslie_Seidman

... Investors routinely add operating leases to lessee balance sheets using incomplete disclosures Possible new approach: What are the assets and liabilities relating to the lease contract? Present value of expected lease payments? Implications for lessors (revenue recognition) – Is there a point where ...

... Investors routinely add operating leases to lessee balance sheets using incomplete disclosures Possible new approach: What are the assets and liabilities relating to the lease contract? Present value of expected lease payments? Implications for lessors (revenue recognition) – Is there a point where ...

Weekly Commentary 04-27-15 PAA

... the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance potential. In other words, they wouldn’t take the risk necessary to earn such a high potential return. It’s important to set realistic expectations for portfolio returns; expe ...

... the vast majority of investors surveyed said, if they had to choose, they would opt for safety of principal over performance potential. In other words, they wouldn’t take the risk necessary to earn such a high potential return. It’s important to set realistic expectations for portfolio returns; expe ...

Personal Finance

... • Explain the rationale for financial literacy. • Explain how sound financial decisions can increase a person’s standard of living and wealth. • Identify goals for the future. • Recognize that choices made today will affect goal attainment. • Apply steps in a problem-solving process and economic rea ...

... • Explain the rationale for financial literacy. • Explain how sound financial decisions can increase a person’s standard of living and wealth. • Identify goals for the future. • Recognize that choices made today will affect goal attainment. • Apply steps in a problem-solving process and economic rea ...

6, 2009, Abuja. The Global Financial System And National Economies

... trade, and deregulation of capital markets and foreign direct investments. These doctrines, since the mid 1980s, have shaped and motivated policy prescriptions emanating from developed nations, and have served as the primary force behind the drive towards global integration of national economies. Th ...

... trade, and deregulation of capital markets and foreign direct investments. These doctrines, since the mid 1980s, have shaped and motivated policy prescriptions emanating from developed nations, and have served as the primary force behind the drive towards global integration of national economies. Th ...