Financial Innovation, Macroeconomic Stability and Systemic Crises

... features of intermediation through hedge funds, private equity rms, and other non-bank institutions in the modern nancial system. The analysis points to a range of possible outcomes. Since expected future returns in productive sectors are high, these are all associated with strong initial investment ...

... features of intermediation through hedge funds, private equity rms, and other non-bank institutions in the modern nancial system. The analysis points to a range of possible outcomes. Since expected future returns in productive sectors are high, these are all associated with strong initial investment ...

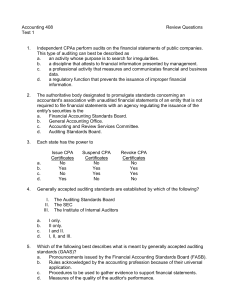

Test 1, Review Questions

... financial position, results of operations, and cash flows without the expertise of an independent auditor. b. It is management's responsibility to seek available independent aid in the appraisal of the financial information shown in its financial statements. c. The opinion of an independent party is ...

... financial position, results of operations, and cash flows without the expertise of an independent auditor. b. It is management's responsibility to seek available independent aid in the appraisal of the financial information shown in its financial statements. c. The opinion of an independent party is ...

JPM Europe Strategic Value X (acc) - EUR

... may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a ...

... may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Prospectus. JPMorgan Funds consists of separate Sub-Funds, each of which issues one or more Share Classes. This document is prepared for a ...

Financial System Classification

... disseminate information necessary for decision taking. Market systems are characterized by less concentrated structure of information, and diluted ownership gives a vast number of agents an incentive to conduct monitoring. These classic arguments should in ideal world imply that market systems are m ...

... disseminate information necessary for decision taking. Market systems are characterized by less concentrated structure of information, and diluted ownership gives a vast number of agents an incentive to conduct monitoring. These classic arguments should in ideal world imply that market systems are m ...

MTA – ELTE CRISES HISTORY RESEARCH GROUP

... The question remains, however, whether or not the two episodes are comparable. Aiginger (2010) contrasts several indicators and arrives at the conclusion that the Great Depression was significantly more severe than the recent crisis in all but one respect (the stock market decline). Romer (2009) eve ...

... The question remains, however, whether or not the two episodes are comparable. Aiginger (2010) contrasts several indicators and arrives at the conclusion that the Great Depression was significantly more severe than the recent crisis in all but one respect (the stock market decline). Romer (2009) eve ...

Banking crises yesterday and today

... panics. The US also experienced an unusually high frequency of severe waves of bank failures: in the s, s and s. Great Britain also suffered an unusually high propensity for banking panics in the first half of the nineteenth century, but experienced a dramatic change in its propensity fo ...

... panics. The US also experienced an unusually high frequency of severe waves of bank failures: in the s, s and s. Great Britain also suffered an unusually high propensity for banking panics in the first half of the nineteenth century, but experienced a dramatic change in its propensity fo ...

chapter 1

... Tear out this page for quick and easy reference. “Terms and Concepts You Need to Know, Continued” are on the reverse side. ...

... Tear out this page for quick and easy reference. “Terms and Concepts You Need to Know, Continued” are on the reverse side. ...

Asset allocation - Foresters Financial

... conservative investor. But how do you know what type of investor you are? Deciding how much risk you are willing to accept, while taking into account such factors as your age, income level and financial objectives, is a key factor in developing your investment philosophy. For example, young people l ...

... conservative investor. But how do you know what type of investor you are? Deciding how much risk you are willing to accept, while taking into account such factors as your age, income level and financial objectives, is a key factor in developing your investment philosophy. For example, young people l ...

2.3 - United Nations Statistics Division

... Financial Services - Intermediation Compilation issues A single reference rate should be used. Different reference rates should be used for transactions in other currencies The rate prevailing for inter-bank borrowing and lending may be a suitable choice as a reference rate. However, differ ...

... Financial Services - Intermediation Compilation issues A single reference rate should be used. Different reference rates should be used for transactions in other currencies The rate prevailing for inter-bank borrowing and lending may be a suitable choice as a reference rate. However, differ ...

l. sau evolution of china`s financial system and its impact on

... Naughton, 1992). Shock therapy was the results of the Washington Consensus: the consensus achieved in Washington among the United States Treasury, the IMF, and the World Bank (cf. Williamson, 2000). As a matter of fact, this approach emphasised that the best modus operandi for developing and transit ...

... Naughton, 1992). Shock therapy was the results of the Washington Consensus: the consensus achieved in Washington among the United States Treasury, the IMF, and the World Bank (cf. Williamson, 2000). As a matter of fact, this approach emphasised that the best modus operandi for developing and transit ...

LionGlobal Asia Bond Fund

... distributors, before deciding whether to subscribe for or purchase units of the Fund. Investments in the Fund are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. T ...

... distributors, before deciding whether to subscribe for or purchase units of the Fund. Investments in the Fund are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. T ...

Bubbles, Financial Crises, and Systemic Risk

... bubble is forming. For example, if there has never been a nationwide decline in nominal house prices, agents may extrapolate that house prices will also not decline in the future (extrapolative expectations). Market participants are especially prone to such extrapolative expectations if there is a l ...

... bubble is forming. For example, if there has never been a nationwide decline in nominal house prices, agents may extrapolate that house prices will also not decline in the future (extrapolative expectations). Market participants are especially prone to such extrapolative expectations if there is a l ...

M. Singer: The economic and financial crisis from the point of view of

... • In response to rising risks, the domestic banking sector is continuing to reduce the rate of financing of the economy and to tighten the non-interest conditions in many segments of the credit market • However, banks are not the cause of the slowing economic growth; the main cause is the worsening ...

... • In response to rising risks, the domestic banking sector is continuing to reduce the rate of financing of the economy and to tighten the non-interest conditions in many segments of the credit market • However, banks are not the cause of the slowing economic growth; the main cause is the worsening ...

Speculation-led growth and fragility in Turkey: Does EU make a

... speculate, investors invent new forms of credit and ‘kinds of money’ (e.g. junk bonds, growth of derivatives, swaps …). Thus it is hard to prevent speculation, because the means of financing speculation will change, and money is endogenously generated. This makes the firms vulnerable to credit avail ...

... speculate, investors invent new forms of credit and ‘kinds of money’ (e.g. junk bonds, growth of derivatives, swaps …). Thus it is hard to prevent speculation, because the means of financing speculation will change, and money is endogenously generated. This makes the firms vulnerable to credit avail ...

4. definitions/terminologies

... Securities other than shares are negotiable instruments serving as evidence that units have obligations to settle by means of providing cash, a financial instrument, or some other item of economic value. Financial assets that are normally traded in the financial markets and that give holders the unc ...

... Securities other than shares are negotiable instruments serving as evidence that units have obligations to settle by means of providing cash, a financial instrument, or some other item of economic value. Financial assets that are normally traded in the financial markets and that give holders the unc ...

Enterprise Capital Funds

... British Business Bank plc is the holding company of the group operating under the trading name of British Business Bank. It is a development bank wholly owned by HM Government which is not authorised or regulated by the Prudential Regulation Authority (“PRA”) or the Financial Conduct Authority (“FCA ...

... British Business Bank plc is the holding company of the group operating under the trading name of British Business Bank. It is a development bank wholly owned by HM Government which is not authorised or regulated by the Prudential Regulation Authority (“PRA”) or the Financial Conduct Authority (“FCA ...

A Tale of Two Crises: Korea`s Experience with External Debt

... global financial markets declined and the yen began its long period of appreciation against the US dollar. The second was the decline in real wages in both 1980 and 81 due in part to an increase in the flexibility of the labor market. The third development was depreciation of the real exchange rate, ...

... global financial markets declined and the yen began its long period of appreciation against the US dollar. The second was the decline in real wages in both 1980 and 81 due in part to an increase in the flexibility of the labor market. The third development was depreciation of the real exchange rate, ...