North America Enhanced Index Fund G (AIF)

... equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual fund. The returns, such as dividends and interest, will be reinvested. The fund’s base currency is the euro. The fund is intended for institutional inve ...

... equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual fund. The returns, such as dividends and interest, will be reinvested. The fund’s base currency is the euro. The fund is intended for institutional inve ...

Should Financial Stability Be An Explicit Central Bank Objective?

... Thus, for the purposes of this paper, I’ll define financial instability as a situation characterized by these three basic criteria: (1) some important set of financial asset prices seem to have diverged sharply from fundamentals; and/or (2) market functioning and credit availability, domestically an ...

... Thus, for the purposes of this paper, I’ll define financial instability as a situation characterized by these three basic criteria: (1) some important set of financial asset prices seem to have diverged sharply from fundamentals; and/or (2) market functioning and credit availability, domestically an ...

PRINCIPLES OF INVESTMENT MAY 2012

... compared, and economists and investors can begin to decipher the business cycles, which are made up of the alternating periods between economic recessions (slumps) and expansions (booms) that have occurred over time. From there we can begin to look at the reasons why the cycles took place, which cou ...

... compared, and economists and investors can begin to decipher the business cycles, which are made up of the alternating periods between economic recessions (slumps) and expansions (booms) that have occurred over time. From there we can begin to look at the reasons why the cycles took place, which cou ...

A Framework for Assessing International Risk to the Financial System

... spillovers, combined with the increasing complexity of financial instruments and institutions, has sparked increased interest by central banks in financial stability. In particular, recent credit market turbulence associated with the deterioration of the U.S. subprime mortgage market reinforces the ...

... spillovers, combined with the increasing complexity of financial instruments and institutions, has sparked increased interest by central banks in financial stability. In particular, recent credit market turbulence associated with the deterioration of the U.S. subprime mortgage market reinforces the ...

The Relationship between Ownership Structure and the Probability

... firms’ financial performance. Financial institutions do not execute monitoring and promoting functions. Since the financial institutions are institutional investors, they just want to obtain a capital return rather than be involved in strategic investments. Therefore, financial institutions do not a ...

... firms’ financial performance. Financial institutions do not execute monitoring and promoting functions. Since the financial institutions are institutional investors, they just want to obtain a capital return rather than be involved in strategic investments. Therefore, financial institutions do not a ...

Explanations

... Explanations The survey covered all enterprises with a legal person right (except budget establishments) which are situated on the region's territory. to the table: Data are given without of taking into account the result of activity of banks. The financial result before taxation has used from 2009 ...

... Explanations The survey covered all enterprises with a legal person right (except budget establishments) which are situated on the region's territory. to the table: Data are given without of taking into account the result of activity of banks. The financial result before taxation has used from 2009 ...

Optimal credit flows - Lorenzo Bini Smaghi

... participants that the hypothesis is unrealistic and to stop the mounting speculative wave has ...

... participants that the hypothesis is unrealistic and to stop the mounting speculative wave has ...

Document

... considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Absent direction from Congress, there is no basis for the SEC to extend regulation to Internet portals. Under the Securities Exchange Act, a person is subject to broker-dealer regulation if t ...

... considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Absent direction from Congress, there is no basis for the SEC to extend regulation to Internet portals. Under the Securities Exchange Act, a person is subject to broker-dealer regulation if t ...

tripartite financing

... Triland (or any director or employee of Triland) may trade for its own account as principal, may have long or short positions in commodities or instruments or any related instrument mentioned in the Material. Brokerage or fees may be earned by Triland or persons associated with it in respect of any ...

... Triland (or any director or employee of Triland) may trade for its own account as principal, may have long or short positions in commodities or instruments or any related instrument mentioned in the Material. Brokerage or fees may be earned by Triland or persons associated with it in respect of any ...

Insecurities: How a Financial Innovation Led to the Great Recession

... system leading up to the crash and that recoveries from financial crises are slower and more painful than the recoveries from ordinary recessions. This result accords with conclusions of Reinhart and Rogoff (2014) though the Taylor paper also shows that not only are “financial crisis recessions” mor ...

... system leading up to the crash and that recoveries from financial crises are slower and more painful than the recoveries from ordinary recessions. This result accords with conclusions of Reinhart and Rogoff (2014) though the Taylor paper also shows that not only are “financial crisis recessions” mor ...

financial liberalization

... most N-sector firms are financially constrained and depend on domestic banks for their financing. Trade liberalization promotes faster productivity growth in the Tsector, but is of little direct help to the N-sector. By allowing banks to borrow on international capital markets, FL leads to an increa ...

... most N-sector firms are financially constrained and depend on domestic banks for their financing. Trade liberalization promotes faster productivity growth in the Tsector, but is of little direct help to the N-sector. By allowing banks to borrow on international capital markets, FL leads to an increa ...

Bubbles: Some Perspectives (and Loose Talk) from

... was doomed from the start. I knew the cause of this foreboding. Several years ago, I organized the AFA meetings and had the privilege of putting together what turned out to be the last Proceedings issue. Among the papers I included in the issue was an analysis by Jay Ritter and Ivo Welch of IPO beha ...

... was doomed from the start. I knew the cause of this foreboding. Several years ago, I organized the AFA meetings and had the privilege of putting together what turned out to be the last Proceedings issue. Among the papers I included in the issue was an analysis by Jay Ritter and Ivo Welch of IPO beha ...

financial regulations and the basel accords.

... to be paid the return on the joint value. This makes MBS a derivative since its value is derived from its assets. The risk is that in many cases, the borrower may default thereby depriving the investor of his initial investment. These complex security products created the ‘asset bubble’ which burst ...

... to be paid the return on the joint value. This makes MBS a derivative since its value is derived from its assets. The risk is that in many cases, the borrower may default thereby depriving the investor of his initial investment. These complex security products created the ‘asset bubble’ which burst ...

September 2016 - Bernzott Capital Advisors

... there are 2 involved, and the individual with a threshold with 2 jumps in. The scenario repeats itself until the entire crowd has joined the madness. The point of this exercise is to note that other than the instigator, not one of the insurgents by himself thought it was a good idea to riot. But as ...

... there are 2 involved, and the individual with a threshold with 2 jumps in. The scenario repeats itself until the entire crowd has joined the madness. The point of this exercise is to note that other than the instigator, not one of the insurgents by himself thought it was a good idea to riot. But as ...

31 December 2008

... Opinions and comments contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Therefore, making decisions with respect to th ...

... Opinions and comments contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Therefore, making decisions with respect to th ...

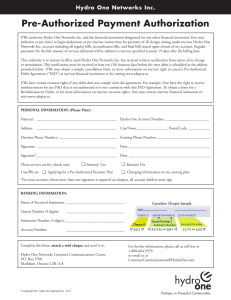

Pre-Authorized form En

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

FSPIO11 – SQA Unit Code H5GX 04 Process corporate actions on

... The regulatory framework for processing corporate actions and impact on your own work role The structure of the investment market, including the role of your own organisation and external parties and organisations in the processing of corporate actions The type and impact of corporate actions on inv ...

... The regulatory framework for processing corporate actions and impact on your own work role The structure of the investment market, including the role of your own organisation and external parties and organisations in the processing of corporate actions The type and impact of corporate actions on inv ...

SilverArrow Supports Highest Possible Value For Rofin

... statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “future,” “continue,” “anticipate,” “believe,” “estimate,” “expect,” “strategy,” “likely, ...

... statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “future,” “continue,” “anticipate,” “believe,” “estimate,” “expect,” “strategy,” “likely, ...

Asia Investment Grade Bond Fund

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

- City Research Online

... infinitely for a number of reasons: first, they normally require collateral against lending – and these collaterals reflect market value of assets and hence by definition set a limit on credit lines. Second, banks assess the riskiness of default on credit lines and naturally, the higher the leverage ...

... infinitely for a number of reasons: first, they normally require collateral against lending – and these collaterals reflect market value of assets and hence by definition set a limit on credit lines. Second, banks assess the riskiness of default on credit lines and naturally, the higher the leverage ...