ASX Clear Schedule 01 - Risk Based Capital Requirements

... amount from the amount of Liquid Capital. “Market Spot Exchange Rate” means the closing rate of exchange for foreign currencies against Australian dollars on each Business Day, having a settlement period of 2 days. “Non-Standard Risk Requirement” means the amount calculated in accordance with Rule S ...

... amount from the amount of Liquid Capital. “Market Spot Exchange Rate” means the closing rate of exchange for foreign currencies against Australian dollars on each Business Day, having a settlement period of 2 days. “Non-Standard Risk Requirement” means the amount calculated in accordance with Rule S ...

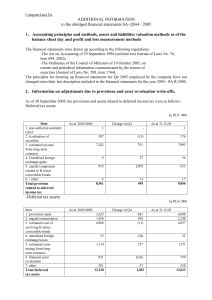

notes to - Sygnity

... profitability yet again. Sales amounted to PLN 112 million. This can be attributed largely to cooperation with Telekomunikacja Polska in realising the following projects: Geomarketing.CL, OSS and the financial-bookkeeping system. The public sector achieved sales of almost PLN 200 million, almost 50% ...

... profitability yet again. Sales amounted to PLN 112 million. This can be attributed largely to cooperation with Telekomunikacja Polska in realising the following projects: Geomarketing.CL, OSS and the financial-bookkeeping system. The public sector achieved sales of almost PLN 200 million, almost 50% ...

19.1 Financing Your Business

... Most start-up funds come from an entrepreneur’s personal resources; however, there are other common sources of funding. ...

... Most start-up funds come from an entrepreneur’s personal resources; however, there are other common sources of funding. ...

Evidence about Bubble Mechanisms: Precipitating Event

... Shiller’s extensive writings about speculative asset price bubbles discuss how three components combine to create and reinforce bubbles (see for example, Shiller 1995, 2008, 2015).1 First, a precipitating event causes an increase in prices. This precipitating event need not be related to the assets’ ...

... Shiller’s extensive writings about speculative asset price bubbles discuss how three components combine to create and reinforce bubbles (see for example, Shiller 1995, 2008, 2015).1 First, a precipitating event causes an increase in prices. This precipitating event need not be related to the assets’ ...

collective investment schemes in emerging markets

... The CIS sector is characterized by a lot of risk to the investors which include inter alia conflict of interest, weak regulators, theft, misappropriation of assets, and deliberate abuse of the law by market players. Many investors have suffered significant financial loss while they trusted their adv ...

... The CIS sector is characterized by a lot of risk to the investors which include inter alia conflict of interest, weak regulators, theft, misappropriation of assets, and deliberate abuse of the law by market players. Many investors have suffered significant financial loss while they trusted their adv ...

Do Shareholder Preferences Affect Corporate

... Institutional investors can have heterogeneous preferences regarding the investment and financial policies of the firms they include in their portfolios for a variety of reasons. For example, investors can have different opinions on the potential growth opportunities in the economy. This can affect ...

... Institutional investors can have heterogeneous preferences regarding the investment and financial policies of the firms they include in their portfolios for a variety of reasons. For example, investors can have different opinions on the potential growth opportunities in the economy. This can affect ...

Regulation of CrowdFunding in Germany, the UK, Spain and Italy

... able to benefit from organic growth and profitability, others will be able to smooth income fluctuations - which are normal in seasonal businesses - through supplier credits or factoring, for example. As a result, a very large number of SMEs, maybe as many as 10 million, rely on their own wealth, th ...

... able to benefit from organic growth and profitability, others will be able to smooth income fluctuations - which are normal in seasonal businesses - through supplier credits or factoring, for example. As a result, a very large number of SMEs, maybe as many as 10 million, rely on their own wealth, th ...

The Role of Operating Leverage in Asset Pricing

... Berk, Green, and Naik (1999) are among the first in this line of research. Through a dynamic model they develop, the authors show that optimal investment decisions account for a predictable change in firm’s assets-in-place and growth opportunities and thus impacts the systematic risk and expected re ...

... Berk, Green, and Naik (1999) are among the first in this line of research. Through a dynamic model they develop, the authors show that optimal investment decisions account for a predictable change in firm’s assets-in-place and growth opportunities and thus impacts the systematic risk and expected re ...

SME Exchanges in Emerging Market Economies

... Before applying these actions, an intensive diagnostic would be needed to assess whether the broader context is conducive. Taking the measures discussed in this paper alone will not spark a successful SME exchange. It does not propose a specific model to follow. Each exchange would need to consider ...

... Before applying these actions, an intensive diagnostic would be needed to assess whether the broader context is conducive. Taking the measures discussed in this paper alone will not spark a successful SME exchange. It does not propose a specific model to follow. Each exchange would need to consider ...

Good news-Bad news: Information revelation

... In this paper, we consider whether the introduction of ambiguity may reproduce some of the anomalies that have been documented regarding asset price reaction to news. In this respect our research fits with the argument that a possible account for financial anomalies can be the existence of un-model ...

... In this paper, we consider whether the introduction of ambiguity may reproduce some of the anomalies that have been documented regarding asset price reaction to news. In this respect our research fits with the argument that a possible account for financial anomalies can be the existence of un-model ...

ECONOMICO 2013 ENG.indd

... on the entities included in the consolidation scope. The Group companies hold interests of less than 20% in other entities over which they have no significant influence. The Group’s main activities and sales are carried on and made in Spain, Latin America, Asia, Africa and North America. On 17 Decem ...

... on the entities included in the consolidation scope. The Group companies hold interests of less than 20% in other entities over which they have no significant influence. The Group’s main activities and sales are carried on and made in Spain, Latin America, Asia, Africa and North America. On 17 Decem ...

building today, for tomorrow - EZRA HOLDINGS LIMITED

... Through proactive marketing and leasing efforts, MLT continued to report a high portfolio occupancy of 96.7% with positive rental reversion of 8%, which was contributed mainly by leases in Hong Kong and Singapore. As compared to last year, the Singapore portfolio registered a lower occupancy rate of ...

... Through proactive marketing and leasing efforts, MLT continued to report a high portfolio occupancy of 96.7% with positive rental reversion of 8%, which was contributed mainly by leases in Hong Kong and Singapore. As compared to last year, the Singapore portfolio registered a lower occupancy rate of ...

Atento SA (Form: 6-K, Received: 08/02/2016 16:55:59)

... exchange impacts and their tax effects. Adjusted Earnings is not a measure defined by IFRS. The most directly comparable IFRS measure to Adjusted Earnings is profit/(loss) for the period from continuing operations. We believe Adjusted Earnings is a useful metric for investors and is used by our mana ...

... exchange impacts and their tax effects. Adjusted Earnings is not a measure defined by IFRS. The most directly comparable IFRS measure to Adjusted Earnings is profit/(loss) for the period from continuing operations. We believe Adjusted Earnings is a useful metric for investors and is used by our mana ...

China National Materials Company Limited

... Ltd. and other promoters. The Company was incorporated on 31 July 2007 and was listed on the Main Board of the Hong Kong Stock Exchange on 20 December 2007. The Company is mainly engaged in cement equipment and engineering services, cement and high-tech materials businesses. The Company possesses se ...

... Ltd. and other promoters. The Company was incorporated on 31 July 2007 and was listed on the Main Board of the Hong Kong Stock Exchange on 20 December 2007. The Company is mainly engaged in cement equipment and engineering services, cement and high-tech materials businesses. The Company possesses se ...

annual report 2016 - Asseco Central Europe

... Asseco Group, one of the leading software houses in Europe. Company is listed on the Warsaw Stock Exchange since 10 October 2006. At that time it was the first Slovak company directly listed on a foreign stock exchange. On 28 November 2016 the Extraordinary General Meeting of Shareholders of the Par ...

... Asseco Group, one of the leading software houses in Europe. Company is listed on the Warsaw Stock Exchange since 10 October 2006. At that time it was the first Slovak company directly listed on a foreign stock exchange. On 28 November 2016 the Extraordinary General Meeting of Shareholders of the Par ...

Personal Finance Knowlegde and Practice: An Opinion Survey with

... used credit cards or some form of credit facility, while another 4 (14.28%) employed and 8(28.57) self employed had turned to installment schemes. Negligible 2 (7.14%) of employed respondents were response other pattern of purchase. Monitoring Expenditure: When asked how they monitored their spendin ...

... used credit cards or some form of credit facility, while another 4 (14.28%) employed and 8(28.57) self employed had turned to installment schemes. Negligible 2 (7.14%) of employed respondents were response other pattern of purchase. Monitoring Expenditure: When asked how they monitored their spendin ...

Proceedings of 7th Annual American Business Research Conference

... shareholders of to-be-delisted firms have a strong incentive to use their private information at the expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in the U.S. market, which document that the delisting decision has a significant negative eff ...

... shareholders of to-be-delisted firms have a strong incentive to use their private information at the expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in the U.S. market, which document that the delisting decision has a significant negative eff ...

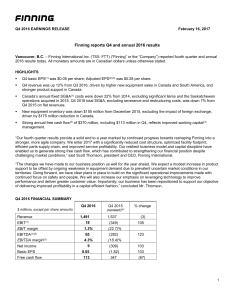

Q4 and Annual 2016 Results

... statements that are not historical facts. A statement Finning makes is forward-looking when it uses what the Company knows and expects today to make a statement about the future. Forward-looking statements may include words such as aim, anticipate, assumption, believe, could, expect, goal, guidance, ...

... statements that are not historical facts. A statement Finning makes is forward-looking when it uses what the Company knows and expects today to make a statement about the future. Forward-looking statements may include words such as aim, anticipate, assumption, believe, could, expect, goal, guidance, ...

What Causes Herding: Information Cascade or Search Cost ?

... investors. Herding of individuals is worth studying in these markets not only that it interacts with institutional herding, as suggested in Barber, B. M., Odean, T. and Zhu (2003) and Dorn, Huberman Sengmueller (2008). Individual herding is also an important issue, as indicated by Nofsinger and Sias ...

... investors. Herding of individuals is worth studying in these markets not only that it interacts with institutional herding, as suggested in Barber, B. M., Odean, T. and Zhu (2003) and Dorn, Huberman Sengmueller (2008). Individual herding is also an important issue, as indicated by Nofsinger and Sias ...

Earnings Release

... In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interpreted by the market as the fact that the company takes time to hide bad corporate earning ...

... In fact, markets anticipate the delay between the end of the fiscal year and the announcement date because it generally remains constant. According to Trueman (1990), a longer delay in the announcement is interpreted by the market as the fact that the company takes time to hide bad corporate earning ...