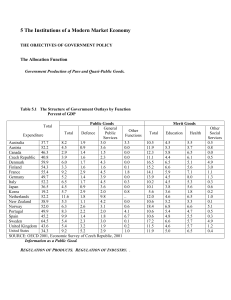

In chapter 1 we discussed in broad outline some of the institutions

... firms, which seemed to be a willing tool of the companies rather than an independent arbiter of a firm’s financial condition. The US government’s response has been to change the regulating framework. In the short-term chief executive officers are to be required to swear, under penalty of law, for th ...

... firms, which seemed to be a willing tool of the companies rather than an independent arbiter of a firm’s financial condition. The US government’s response has been to change the regulating framework. In the short-term chief executive officers are to be required to swear, under penalty of law, for th ...

How to avoid the next crash Financial Times 30-Jan

... The likelihood of a credit crunch, though not its exact form, was in fact well forecast by the regulatory community. The Bank for International Settlements had been predicting it for years and most other authorities had been warning about the underpricing of risk and the probability of a sharp rever ...

... The likelihood of a credit crunch, though not its exact form, was in fact well forecast by the regulatory community. The Bank for International Settlements had been predicting it for years and most other authorities had been warning about the underpricing of risk and the probability of a sharp rever ...

Mah Hui Lim

... Much of mainstream macroeconomic theory in the past three decades have been “useless at best and harmful at worst” ...

... Much of mainstream macroeconomic theory in the past three decades have been “useless at best and harmful at worst” ...

R - Heterodox Economics Newsletter

... are those investors who now get out of debt and reef their sails.” But as the Times also pointed out, a year earlier, the same Babson had said that “the election of Hoover and a Republican Congress should result in continued prosperity in 1929.” Why were the experts so wrong? They were wrong mostly ...

... are those investors who now get out of debt and reef their sails.” But as the Times also pointed out, a year earlier, the same Babson had said that “the election of Hoover and a Republican Congress should result in continued prosperity in 1929.” Why were the experts so wrong? They were wrong mostly ...

Accounting 350 Financial Statement Project Fall 2006

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

Financialization and the crisis

... banks and bond investors against loan defaults represents another effort to stretch the safety net. Now it can be presumed, the authorities will have to intervene to interdict a cascading of defaults only if to save the insurance industry” (Wojnilower 1985, p. 356). ...

... banks and bond investors against loan defaults represents another effort to stretch the safety net. Now it can be presumed, the authorities will have to intervene to interdict a cascading of defaults only if to save the insurance industry” (Wojnilower 1985, p. 356). ...

increases the asymmetric information

... Assume the economy is initially at point 2. Suppose we have a disruption that causes a fall in the NW of the firm → supply shifts to the left (arrow A, point 3). Disruptions in the financial market may also imply that the slope increases (banks perceive higher risk for any given NW), i.e., the ...

... Assume the economy is initially at point 2. Suppose we have a disruption that causes a fall in the NW of the firm → supply shifts to the left (arrow A, point 3). Disruptions in the financial market may also imply that the slope increases (banks perceive higher risk for any given NW), i.e., the ...

Diapositive 1 - University of Ottawa

... long-term bond markets, also leading to overly low long-term rates. • There would be no crises if government was small and interest rates were always set at their natural levels, or even better, if there was no central bank. • The fiscal stimulus will make things worse! ...

... long-term bond markets, also leading to overly low long-term rates. • There would be no crises if government was small and interest rates were always set at their natural levels, or even better, if there was no central bank. • The fiscal stimulus will make things worse! ...

Ch 12: 1.1-4

... or below the equilibrium rate that would prevail in the absence of the peg. Pegged exchange rates substantially above the equilibrium rate pose a particularly acute threat of a currency crisis because the country may have insufficient foreign exchange reserves to maintain the pegged exchange rate. S ...

... or below the equilibrium rate that would prevail in the absence of the peg. Pegged exchange rates substantially above the equilibrium rate pose a particularly acute threat of a currency crisis because the country may have insufficient foreign exchange reserves to maintain the pegged exchange rate. S ...

Press release- Bank Performance and Reporting Value

... that continues to affect developed world economies. This report focuses on the relationship between market-based indicators of value and risk and bank financial statement information, to reveal fault lines within the reporting framework. When signals from the economic environment do not correspond w ...

... that continues to affect developed world economies. This report focuses on the relationship between market-based indicators of value and risk and bank financial statement information, to reveal fault lines within the reporting framework. When signals from the economic environment do not correspond w ...

Financial crises_ Lessons from history

... about their income. But now as interest rates have risen, so have repossessions. The US housing market has collapsed and the banks find themselves saddled with a lot of bad debts. However, it is not just a problem for US banks. Globalisation has meant that much of this mortgage debt has been sliced ...

... about their income. But now as interest rates have risen, so have repossessions. The US housing market has collapsed and the banks find themselves saddled with a lot of bad debts. However, it is not just a problem for US banks. Globalisation has meant that much of this mortgage debt has been sliced ...

The Bursting Bubble

... Declining yields combined with an excess of capital, lack of regulation, and political corruption are the breeding grounds for Bubbles. Innovation, either financial, technical, or both also needed to create a major Bubble. Bubbles have circular feed-back mechanisms, where growth continually creates ...

... Declining yields combined with an excess of capital, lack of regulation, and political corruption are the breeding grounds for Bubbles. Innovation, either financial, technical, or both also needed to create a major Bubble. Bubbles have circular feed-back mechanisms, where growth continually creates ...

Mankiw 6e PowerPoints

... Asset price declines involving stocks, real estate, or other assets may trigger the crisis often interpreted as the ends of bubbles Financial institution insolvencies a wave of loan defaults may cause bank failures hedge funds may fail when assets bought with borrowed funds lose value ...

... Asset price declines involving stocks, real estate, or other assets may trigger the crisis often interpreted as the ends of bubbles Financial institution insolvencies a wave of loan defaults may cause bank failures hedge funds may fail when assets bought with borrowed funds lose value ...

the global recession and casino capitalism

... impossible to predict how these packages would perform. Their basic reaction was to simply hoard their assets as a protection against defaulting packages and refuse to lend out any money to anyone, thus sending the economy into its worst recession since the 1930s. This recessionary situation has bee ...

... impossible to predict how these packages would perform. Their basic reaction was to simply hoard their assets as a protection against defaulting packages and refuse to lend out any money to anyone, thus sending the economy into its worst recession since the 1930s. This recessionary situation has bee ...

A global perspective on the great financial insurance run: Causes

... An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. Unemployment rises and housing price declines extend out for five and six years, respectively. Even recessions sparked by financial crises do eventually end, albeit almos ...

... An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. Unemployment rises and housing price declines extend out for five and six years, respectively. Even recessions sparked by financial crises do eventually end, albeit almos ...