Actuarial and Financial Models

... Furthermore, a profound knowledge of the standard models and techniques of actuarial science and financial mathematics is required. ...

... Furthermore, a profound knowledge of the standard models and techniques of actuarial science and financial mathematics is required. ...

A23 Anonymous_Redacted

... global market, unfortunately do not reap the optimum benefits of their Superannuation. The total asset value of Superannuation of any country, like Australia is a very heavy untapped resource we may leverage to this end. If the above is considered and a strong government incentive is to gear the peo ...

... global market, unfortunately do not reap the optimum benefits of their Superannuation. The total asset value of Superannuation of any country, like Australia is a very heavy untapped resource we may leverage to this end. If the above is considered and a strong government incentive is to gear the peo ...

Interpreting the Causes of the Great Recession of 2008

... regulatory stance that he, and many other regulators, took: it was not robust. It was predicated on a particular behavioral model. If that model was wrong—as it proved to be—the economy could be exposed to great risks. A good “Bayesian” should recognize that our knowledge is limited, our models inco ...

... regulatory stance that he, and many other regulators, took: it was not robust. It was predicated on a particular behavioral model. If that model was wrong—as it proved to be—the economy could be exposed to great risks. A good “Bayesian” should recognize that our knowledge is limited, our models inco ...

Risk Allocation, Debt Fueled Expansion and Financial Crisis Paul Beaudry Amartya Lahiri

... If so, the mechanism needs to be able explain both the expansion between 2001-07 and the collapse ...

... If so, the mechanism needs to be able explain both the expansion between 2001-07 and the collapse ...

CIO Investment spotlight

... due to the hangover of the GFC’s deflationary and deleveraging headwinds. We don’t expect this to change any time soon. So, with the economic cycle extended, we continue to prefer shares over bond markets at present. We’re on the lookout for signs the Fed may need to slow growth due to abovetarget a ...

... due to the hangover of the GFC’s deflationary and deleveraging headwinds. We don’t expect this to change any time soon. So, with the economic cycle extended, we continue to prefer shares over bond markets at present. We’re on the lookout for signs the Fed may need to slow growth due to abovetarget a ...

Letter of Representation

... for Independent Reports of Factual Findings on costs claimed under a Grant Agreements financed under the Seventh Research Framework Programme (FP7)” in connection with your engagement to perform agreed-upon procedures regarding Financial Statements (Form C) and in particular covering the period from ...

... for Independent Reports of Factual Findings on costs claimed under a Grant Agreements financed under the Seventh Research Framework Programme (FP7)” in connection with your engagement to perform agreed-upon procedures regarding Financial Statements (Form C) and in particular covering the period from ...

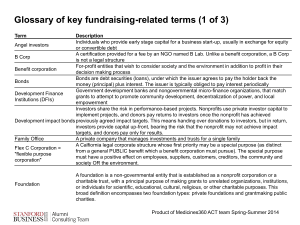

Glossary of Key Fundraising

... High impact philanthropy begins with a philanthropist’s personal commitment to making a change in the world and caring enough about a particular issue to remain engaged in the long-term and focused on best practices that make a difference Investment in for-profit companies that have social impact po ...

... High impact philanthropy begins with a philanthropist’s personal commitment to making a change in the world and caring enough about a particular issue to remain engaged in the long-term and focused on best practices that make a difference Investment in for-profit companies that have social impact po ...

Global investing: Understanding currency risk and

... read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained in this sales tool is designed to provide you with general information related to investment alternatives and strategies and is no ...

... read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained in this sales tool is designed to provide you with general information related to investment alternatives and strategies and is no ...

Employer Sponsored Retirement Plans

... How are we paid for our services? We use external mutual fund companies and insurance providers to manage our clients and their employees’ company retirement plans. You are charged transaction fees when you buy or sell investments within your plan account. We receive a portion of your front-end or d ...

... How are we paid for our services? We use external mutual fund companies and insurance providers to manage our clients and their employees’ company retirement plans. You are charged transaction fees when you buy or sell investments within your plan account. We receive a portion of your front-end or d ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... • Annuities markets around the world are small • They have been growing with the increase of DC pension schemes • Some previous research shows that MWRs are high in most countries (James, 2001; Mitchell, Mc Carthy 2003) but quite often insurance companies cover their costs through up front pricing a ...

... • Annuities markets around the world are small • They have been growing with the increase of DC pension schemes • Some previous research shows that MWRs are high in most countries (James, 2001; Mitchell, Mc Carthy 2003) but quite often insurance companies cover their costs through up front pricing a ...

Read more.

... categories on a global basis. Bernie leads the group’s efforts to integrate top‐down research, local market fundamental analysis, relative value considerations, and specialized portfolio modeling to implement allocations that are tailored to investor objectives and preferences. Leveraging the Gl ...

... categories on a global basis. Bernie leads the group’s efforts to integrate top‐down research, local market fundamental analysis, relative value considerations, and specialized portfolio modeling to implement allocations that are tailored to investor objectives and preferences. Leveraging the Gl ...

D-3205 FINANCIAL AND ECONOMIC CRISIS

... the financial markets and the economy consequences never seen before. This unavoidably had a strong negative influence on global economy and on trade exchanges. It is evident that shipping – being the main transporter of global trade – could not escape this strong slow down. Also shipping was carryi ...

... the financial markets and the economy consequences never seen before. This unavoidably had a strong negative influence on global economy and on trade exchanges. It is evident that shipping – being the main transporter of global trade – could not escape this strong slow down. Also shipping was carryi ...

ICPAK-Impairment of Assets

... instruments cont’d Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They arise when the Society provides money, goods or services directly to a customer with no intention of trading the receivable Available for ...

... instruments cont’d Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They arise when the Society provides money, goods or services directly to a customer with no intention of trading the receivable Available for ...

Full Text [PDF 67KB]

... The list of achievements regarding the reform of the international financial system since the Crisis is quite long. Basel III was introduced. The over-the-counter (OTC) derivatives market was reformed. Risk management at central counterparties (CCPs) was strengthened. The process of resolving financ ...

... The list of achievements regarding the reform of the international financial system since the Crisis is quite long. Basel III was introduced. The over-the-counter (OTC) derivatives market was reformed. Risk management at central counterparties (CCPs) was strengthened. The process of resolving financ ...

Resilience is Difficult to Define (But Easy to Spot)!

... Certain economists are predicting outright economic collapse. Others are much rosier with their predictions. I don’t have a crystal ball (and am too smart to fall into the trap of Babe Ruth‐like predictions “calling a shot” regarding factors so far beyond one’s control) but, I do believe in capi ...

... Certain economists are predicting outright economic collapse. Others are much rosier with their predictions. I don’t have a crystal ball (and am too smart to fall into the trap of Babe Ruth‐like predictions “calling a shot” regarding factors so far beyond one’s control) but, I do believe in capi ...

FINANCIAL KEYNESIANISM AND MARKET INSTABILITY

... allocated by rules, regulations, and tradition to banks. The growth of competition on both sides of banking business—checkable deposits at non-bank financial institutions that could pay market interest rates; and rise of the commercial paper market that allowed firms to bypass commercial banks—squee ...

... allocated by rules, regulations, and tradition to banks. The growth of competition on both sides of banking business—checkable deposits at non-bank financial institutions that could pay market interest rates; and rise of the commercial paper market that allowed firms to bypass commercial banks—squee ...

![Full Text [PDF 67KB]](http://s1.studyres.com/store/data/017928079_1-9c531ce11d4ce380303c6a2d80a8e5ce-300x300.png)