Valuation of Money Market Securities

... After the auction, investor receives check from the Treasury covering the difference between par and the actual price Copyright© 2002 Thomson Publishing. All rights reserved. ...

... After the auction, investor receives check from the Treasury covering the difference between par and the actual price Copyright© 2002 Thomson Publishing. All rights reserved. ...

Wells Real Estate Investment Trust, Inc.

... We are pleased to announce that Wells REIT's real estate portfolio was recently appraised, and after taking into account its other assets and liabilities, third-party experts calculated a new estimated net asset value (NAV) per share of our common stock. Based on their findings, the estimated NAV pe ...

... We are pleased to announce that Wells REIT's real estate portfolio was recently appraised, and after taking into account its other assets and liabilities, third-party experts calculated a new estimated net asset value (NAV) per share of our common stock. Based on their findings, the estimated NAV pe ...

Superneutrality of Money under Open Market Operations

... interest rates and hold lower real cash balances. As is usual in frictionless models, a more expansionary policy increases the nominal interest rate through the Fisher effect (or expected inflation effect). It should be emphasized that prices and interest rates increase in period t*, although the mo ...

... interest rates and hold lower real cash balances. As is usual in frictionless models, a more expansionary policy increases the nominal interest rate through the Fisher effect (or expected inflation effect). It should be emphasized that prices and interest rates increase in period t*, although the mo ...

Captive Insurance Companies Insurance 230

... Could be designed as “forward starting,” i.e., option feature would be activated 5 or 10 years in the future based on index at that time Could be designed as a “tontine” Payoff = % of remaining principal rather than original principal Bond would terminate at some specified future date rather than ...

... Could be designed as “forward starting,” i.e., option feature would be activated 5 or 10 years in the future based on index at that time Could be designed as a “tontine” Payoff = % of remaining principal rather than original principal Bond would terminate at some specified future date rather than ...

Week 6 Slides

... Corporation Interest Rate Risk Management and identify issues in the case you have ...

... Corporation Interest Rate Risk Management and identify issues in the case you have ...

During August 2012, company produced and sold 3000 boxes of

... approving investment proposals, and implementing, monitoring and reviewing investments. Identifying investment opportunities Investment opportunities or proposals could arise from analysis of strategic choices, analysis of the business environment, research and development, or legal requirements. Th ...

... approving investment proposals, and implementing, monitoring and reviewing investments. Identifying investment opportunities Investment opportunities or proposals could arise from analysis of strategic choices, analysis of the business environment, research and development, or legal requirements. Th ...

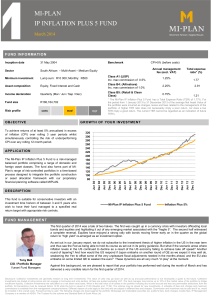

mi-plan ip inflation plus 5 fund

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

FIN 331 in a Nutshell

... N = number of periods Future value interest factor = (1 + I)N • Note: “yx” key on your calculator 331NS-39 ...

... N = number of periods Future value interest factor = (1 + I)N • Note: “yx” key on your calculator 331NS-39 ...

FIN507 Bank Management Solutions to Recommended Problems

... township will yield an annual expected return of 12 percent with an estimated standard deviation of 10 percent. The bank’s marketing department estimates that cash flows from the proposed Washington branch will be mildly positively correlated (with a correlation coefficient of + 0.15) with the bank’ ...

... township will yield an annual expected return of 12 percent with an estimated standard deviation of 10 percent. The bank’s marketing department estimates that cash flows from the proposed Washington branch will be mildly positively correlated (with a correlation coefficient of + 0.15) with the bank’ ...

Investor Relations Communications Plan

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

Advanced Accounting by Hoyle et al, 6th Edition

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...

Deutsche Invest I Top Asia - Deutsche Asset Management

... Current interest yield The current interest yield differs from the nominal interest rate because securities are bought at a price that can be higher or lower than their nominal value. Since interest is always paid on the nominal value, the following calculation is used: (interest rate x 100)/price = ...

... Current interest yield The current interest yield differs from the nominal interest rate because securities are bought at a price that can be higher or lower than their nominal value. Since interest is always paid on the nominal value, the following calculation is used: (interest rate x 100)/price = ...

12CHAPTER Money, Banking, and the Financial System

... used for a particular purpose (e.g., paying for university). It might require the borrower to provide regular information on and evidence of how the borrowed funds are being used, giving out the loan in installments (Tk. 10,000 this month, Tk. 10,000 next month), and so on. ...

... used for a particular purpose (e.g., paying for university). It might require the borrower to provide regular information on and evidence of how the borrowed funds are being used, giving out the loan in installments (Tk. 10,000 this month, Tk. 10,000 next month), and so on. ...

PDF - Allen Tate Mortgage

... ARM will change over time. No one can be sure when an index rate will go up or down. Some index rates tend to be higher than others, and some more volatile. (But if a lender bases interest rate adjustments on the average value of an index over time, your interest rate would not be as volatile.) You ...

... ARM will change over time. No one can be sure when an index rate will go up or down. Some index rates tend to be higher than others, and some more volatile. (But if a lender bases interest rate adjustments on the average value of an index over time, your interest rate would not be as volatile.) You ...