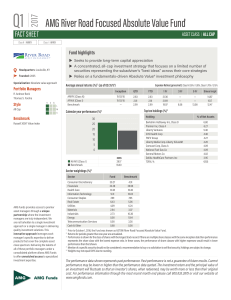

AMG River Road Focused Absolute Value Fund1

... The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. The Fund invests in value stock ...

... The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. The Fund invests in value stock ...

Training - NYU Stern

... where CFt is the expected cash flow in period t, r is the discount rate appropriate given the riskiness of the cash flow and n is the life of the asset. Proposition 1: For an asset to have value, the expected cash flows have to be positive some time over the life of the asset. Proposition 2: Assets ...

... where CFt is the expected cash flow in period t, r is the discount rate appropriate given the riskiness of the cash flow and n is the life of the asset. Proposition 1: For an asset to have value, the expected cash flows have to be positive some time over the life of the asset. Proposition 2: Assets ...

Case Study #2 – Software Co.

... medal” fishing stream where the Helericks had been able to supplement their income through fishing leases that now amounted to $50,000+ per year. The offer for the ranch was $21 million by a group of West coast real estate developers who wanted to build a golf course. ...

... medal” fishing stream where the Helericks had been able to supplement their income through fishing leases that now amounted to $50,000+ per year. The offer for the ranch was $21 million by a group of West coast real estate developers who wanted to build a golf course. ...

Chapter Ten

... The option has intrinsic value if the underlying spot price (S) is greater than X. In this case the option is said to be ‘in the money.’ If at expiration S > X, the option will be exercised, if not the option expires worthless. In either case, the initial call price C is a sunk cost. Call options w ...

... The option has intrinsic value if the underlying spot price (S) is greater than X. In this case the option is said to be ‘in the money.’ If at expiration S > X, the option will be exercised, if not the option expires worthless. In either case, the initial call price C is a sunk cost. Call options w ...

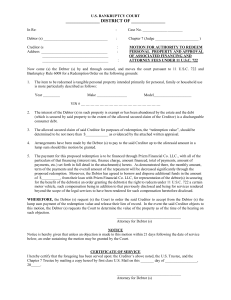

Chapter 7 Redemption Sample Motion

... The payment for this proposed redemption is to be financed through Prizm Financial Co. LLC., with all of the particulars of that financing (interest rate, finance charge, amount financed, total of payments, amount of payments, etc.) set forth in full detail in the attachment(s) hereto. As demonstrat ...

... The payment for this proposed redemption is to be financed through Prizm Financial Co. LLC., with all of the particulars of that financing (interest rate, finance charge, amount financed, total of payments, amount of payments, etc.) set forth in full detail in the attachment(s) hereto. As demonstrat ...

We analyze the business-cycle dynamics of commercial bank

... and the deposit rate. We analyze spreads for 3 kinds of deposits, savings deposits, time deposits and eurodeposits (the deposits nominated in the foreign currency). Motivation for this analysis is twofold. First, the amplitude of business cycle fluctuations depends on spreads. Output dynamics likely ...

... and the deposit rate. We analyze spreads for 3 kinds of deposits, savings deposits, time deposits and eurodeposits (the deposits nominated in the foreign currency). Motivation for this analysis is twofold. First, the amplitude of business cycle fluctuations depends on spreads. Output dynamics likely ...

MR0159 - Loan Value granted to Significant Security Positions Held

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

course

... *Preferred-paid first, fixed earnings, low risk Type of company? *Blue chip-from big companies, less risk *Growth-from growing companies, more risk *Penny-from high-risk ...

... *Preferred-paid first, fixed earnings, low risk Type of company? *Blue chip-from big companies, less risk *Growth-from growing companies, more risk *Penny-from high-risk ...

E procurement Workshop

... E procurement Workshop E-procurement system is an online system, through which companies will be connected directly to their suppliers and vice versa in the procuring of goods and services. Through this e-procurement, Kenya’s Public Service seeks to embrace transparency, accountability and prudent u ...

... E procurement Workshop E-procurement system is an online system, through which companies will be connected directly to their suppliers and vice versa in the procuring of goods and services. Through this e-procurement, Kenya’s Public Service seeks to embrace transparency, accountability and prudent u ...

summary sheet

... Most mutual funds can be started with a low minimum payment and historically mutual funds have far outperformed more conservative investments (like GIC’s or savings accounts at a bank). Earnings can be paid out to you quarterly or monthly OR the best strategy is to just reinvest the dividend reinves ...

... Most mutual funds can be started with a low minimum payment and historically mutual funds have far outperformed more conservative investments (like GIC’s or savings accounts at a bank). Earnings can be paid out to you quarterly or monthly OR the best strategy is to just reinvest the dividend reinves ...

Finance Notes 2008 Size: 351.5kb Last modified

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate u ...

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate u ...

FRBSF L CONOMIC

... percentage points, as shown in Figure 3, and the recommended period of a near-zero funds rate would end at the beginning of 2012. Returning the Fed’s balance sheet to normal An important part of the Fed’s exit strategy involves returning the level and composition of its balance sheet to pre-crisis n ...

... percentage points, as shown in Figure 3, and the recommended period of a near-zero funds rate would end at the beginning of 2012. Returning the Fed’s balance sheet to normal An important part of the Fed’s exit strategy involves returning the level and composition of its balance sheet to pre-crisis n ...

Solutions to Chapter 4

... Tips: The Monday issue of the Globe and Mail has the most complete list of corporate bond prices and yields. Warn students that not all bonds have ratings at both DBRS and S&P. They might have to check both sources for a bond rating. An alternative approach would be to start with the bond rating ser ...

... Tips: The Monday issue of the Globe and Mail has the most complete list of corporate bond prices and yields. Warn students that not all bonds have ratings at both DBRS and S&P. They might have to check both sources for a bond rating. An alternative approach would be to start with the bond rating ser ...